Journal of Financial Planning: May 2017

Sonya L. Britt, Ph.D., CFP®, is an associate professor of personal financial planning at Kansas State University. She has devoted her research to the area of financial therapy using her educational background in marriage and family therapy (M.S.) and financial planning (Ph.D.).

E. Jeffrey Hill, Ph.D., is a professor of family life at Brigham Young University where he teaches classes in family finance and family processes. His research focuses on work and family, and family finance.

Ashley LeBaron is a graduate student in the Marriage, Family, and Human Development Program at Brigham Young University. Her research focuses on family finance.

Derek R. Lawson, CFP®, is a doctoral student in personal financial planning at Kansas State University where he serves as a graduate research assistant studying financial therapy, physiological stress, and financial psychology.

Roy A. Bean, Ph.D., is an associate professor of marriage and family therapy in the School of Family Life at Brigham Young University. He is a co-principal investigator on the Flourishing Families Project.

Editor’s note: This research was originally presented at the 2016 FPA Annual Conference in Baltimore as unpublished research, where it received feedback from academics and practitioners in attendance and was recognized as the Best Theoretical Research presented at the conference. To submit research to be presented at this year’s FPA Annual Conference, visit FPA-BE.org/Academics.

Executive Summary

- Financial problems are consistently reported as a top stressor for Americans, contributing to marital conflict and dissolution. The purpose of this paper was to determine how spending personalities contribute to financial conflict between partners.

- Data were obtained from husbands, wives, and their households from the Flourishing Families dataset. Respondents were on average 45 to 46 years old and had been married for 18 years.

- The top predictors of financial conflict for husbands included perceptions of a spendy wife, having financial worries, reporting a lower income, having three or more children, and having a wife who thinks he is too spendy.

- The top predictors of financial conflict for wives included having a husband who thinks she is too spendy, feeling a lack of communication with her husband, having financial worries, having a husband with low income, and having perceptions of a spendy husband.

- Planners should take note of the results and openly discuss perceptions of spending and saving behavior during the initial client meeting and subsequent interactions. Encouraging clients to complete a values assessment to help guide resource allocation decisions should yield happier clients.

The ability for a couple to successfully manage conflict while navigating their financial situation is important to the ultimate success of their relationship. Financial problems are consistently reported as a top stressor for Americans (APA 2015), and disagreement over money matters is a frequently cited source of conflict for couples (Dew 2007) and a contributor to relationship dissatisfaction and divorce (Britt and Huston 2012).

Evidence suggests that money arguments are less related to the amount of family income and more related to conflict about how decisions regarding the allocation of that family income are made (Rick, Small, and Finkel 2011). Part of the negotiation in resource allocation within the household is tied to spending preferences and personalities. Two of the most commonly recognized “money personality types” are spenders and tightwads (Rick, Small, and Finkel 2011). There is often an attraction to the opposite spending personality (Klohnen and Mendelsohn 1998; Rick, Small, and Finkel 2011), although the spender-tightwad match is generally associated with greater conflict over time (Luo and Klohnen 2005; Rick, Small, and Finkel 2011).

Conceptual Framework and Related Research

Traditional economic models suggest that consumers make decisions based on a utility-maximization approach (i.e., they seek outcomes that bring them the greatest personal satisfaction). To that extent, there should be no difference in the spending personalities of each partner in a couple within the household because they would each agree on decisions based on what maximizes household utility. Yet, consumers often do not make the satisfying consumption decision and may even view spending as very dissatisfying (Rick, Cryder, and Loewenstein 2008). Those who experience spending as painful are naturally more frugal and may be considered tightwads. On the other end of the spectrum are those who experience little or no pain when making purchases—these people are referred to as spenders (Rick, Cryder, and Loewenstein 2008). The lack of pain associated with spending decisions results in spending more than they would ideally like to spend.

Previous research has found that people are attracted to others who have different personalities than their own, but only when they are dissatisfied with themselves. Those who are satisfied with themselves tend to have partners who are similar to them (Klohnen and Mendelsohn 1998). Couples who marry based on dissimilar spending personalities (i.e., spender and tightwad) tend to have increased financial conflict (Rick et al. 2011), which is a predictor of marital dissatisfaction (Watson et al. 2004).

To better understand the influence of spending personality on marital outcomes, a theory of resource allocation is useful. Within the context of marriage, there are two important assumptions from a collective bargaining theoretical approach—spouses maintain their own preferences, and after consideration of power, one spouse cannot be made better off without making the other spouse worse off (Browning and Chiappori 1998). Economically, these assumptions can be represented with Equation 1, which shows that household utility/satisfaction (UHH) is a function of the individual utility functions of spouse A (UA), spouse B (UB), and the bargaining power (α) each spouse is able to use to allocate resources to their individual utility functions.

UHH = α* UA + (1 – α)* UB [1]

Bargaining power may be tied to differences in age, education, and income contribution with the older, more educated, and higher-paid partner being able to allocate more resources for personal consumption (Britt, Huston, and Durband 2010). Britt and associates demonstrated that wives (husband data was not available) who were unhappy with the resources being allocated to their individual utility functions were likely to report arguments about money.

The current study expands on previous research by exploring the influence of perceived spending personality on financial problems in a couple relationship.

Methods

The Flourishing Families Project (FFP) is a longitudinal study designed to show how family processes impact young people. It contains 10 waves of data gathered yearly from 2007 to 2016. Due to the project aim, families had to have a fifth grader to participate in the first wave of the survey. Because of this and the need to explore couple-level data, no respondent had a family size of fewer than three.

Families for FFP were randomly selected from targeted census tracts that mirrored the socio-economic and racial stratification of reports of local school districts in a northwestern city using a national telephone survey database (Polk Directories/InfoUSA). Of the 692 eligible families contacted, 423 agreed to participate, resulting in a 61 percent response rate.

Data for this study comes from Wave 2, which was collected in 2008 and contains information on perceptions of partner spending. Less than 4 percent of the sample were in same-sex relationships, so data were restricted to heterosexual couples. The mean age of respondents in 2008 was 44.61 (SD = 5.59) for females and 46.50 (SD = 6.12) for males.

Financial Conflict

The dependent variable measured perception of conflict about money in the relationship by responses to the question: “How often are financial matters a problem in your relationship?” Respondents were categorized as couples with conflict (i.e., reported conflict sometimes, often, or very often; coded 1), versus couples with no conflict (i.e., reported conflict never or rarely; coded 0). This resulted in a distribution of 56 percent of men who reported conflict about financial matters and 59 percent of women who reported conflict about financial matters.

Relationship Dynamics

Perception of partner’s power in the couple relationship was measured with a 15-item scale created by the Flourishing Families team based on their empirical work as a way to measure how spouses regulate one another and how power imbalance influences family functioning. Respondents were asked to indicate how strongly they agreed with items such as: “My partner tends to dominate our conversations,” and “When it comes to money, my partner’s opinion usually wins out.” Responses ranged from 1 = strongly disagree to 5 = strongly agree and were then summed where higher scores on the scale of 15 to 75 represented greater perceived power of the partner (Women α = 0.92; Men α = 0.92).

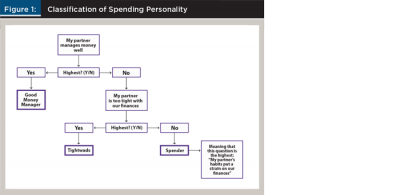

Respondents were classified as good money managers (i.e., “My partner manages money well”), spenders (i.e., “My partner’s spending habits put a strain on our finances”), or tightwads (i.e., “My partner is too tight with our finances”) based on their partner’s perception of them. Respondents were asked to indicate how strongly they agreed with each statement in parentheses above where 1 = very strongly disagree to 5 = very strongly agree for each item.

Because respondents could agree to more than one item, responses were ranked so that the highest-ranking item was the classifier. For instance, if respondents indicated a score of 4 for good money manager, 2 for spender, and 3 for tightwad, they were classified as a good money manager. If respondents reported the same score for good money managers as they did for spenders or tightwads, then they were coded as either a spender or tightwad (whichever score was higher). For example, if a respondent reported a score of 4 for good money manager, 4 for tightwad, and 2 for spender, they were classified as a tightwad. There were no instances of a tied score for tightwad and spender. For a visual illustration of spending classification, see Figure 1.

Positive financial communication between partners was measured with the summated score of the following five items developed by the Flourishing Families team: (1) My partner and I have good communication about household financial issues; (2) My partner and I are working toward the same financial goals; (3) My partner and I discuss major household purchases before spending the money; (4) My partner and I work together on the household financial budget; and (5) I enjoy talking to my partner about household financial matters. Response options ranged from 1 = very strongly disagree to 6 = very strongly agree where higher scores on the scale of 5 to 30 indicated more positive financial communication patterns (women α = 0.88; men α = 0.88).

Relationship duration was measured continuously as the number of years that respondents indicated they had been with their partner. Responses ranged from less than one year to 30 years.

Financial Resources and Constraints

Financial resources were measured by each respondent’s self-reported income, which was captured categorically where 1 = under $10,000 per year; 2 = at least $10,000 per year; 3 = at least $20,000 per year; 4 = at least $40,000 per year; 5 = at least $60,000 per year; 6 = at least $80,000 per year; 7 = at least $100,000 per year; 8 = at least $120,000 per year; 9 = at least $140,000; 10 = at least $160,000 per year; 11 = at least $180,000 per year; and 12 = $200,000 or more per year. Due to the categorical nature of the variable, it was difficult to accurately capture a measure of each partner’s contribution to household income.

Respondents who indicated they experienced financial worries related to insufficient income, excessive spending, heavy debt, or other reasons were coded 1 for financial worries, otherwise 0.

Household size was measured with three categories of (1) three members; (2) four members; or (3) five or more members. No households were smaller than three (i.e., couple plus one child) given the nature of the sampling procedure.

Descriptive Results

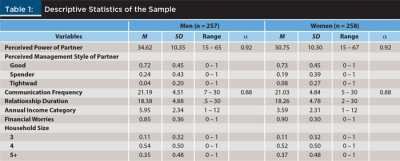

Descriptive statistics for all study variables are presented in Table 1. For the perceived power of partner scale (men α = 0.92; women α = 0.92), men indicated a higher mean power score for their wife (M = 34.62, SD = 10.35) than women indicated for their husband (M = 30.75, SD = 10.30).

For both men and women, good perceived management style of their partner was the most frequently reported (men M = 0.72, SD = 0.45; women M = 0.73, SD = 0.45), followed by spender (men M = 0.24, SD = 0.43; women M = 0.19, SD = 0.39), and then tightwad (men M = 0.04, SD = 0.20; women M = 0.08, SD = 0.27).

Financial communication (men α = 0.88; women α = 0.88) was rated about the same for men (M = 21.19, SD = 4.51) and women (M = 21.03, SD = 4.84).

Participants reported having been with their partner a range of six months to 30 years (men M = 18.38, SD = 4.88; women M = 18.26 SD = 4.78).

Although exact respondent income descriptive statistics were impossible to obtain due to the ordinal nature of the data, men’s self-reported income (M = 5.95, SD = 2.34) was higher than women’s (M = 3.59, SD = 2.31). Income for both men and women ranged from under $10,000 per year to $200,000 or more per year.

Ninety percent of women reported experiencing financial worries (M = 0.90, SD = 0.30), compared to 85 percent of men (M = 0.85, SD = 0.36).

Finally, the most common household size was four people or a couple with two children (men M = 0.54, SD = 0.50; women M = 0.52, SD = 0.50), followed by a household size of five or more (men M = 0.35, SD = 0.48; women M = 0.37, SD = 0.48), and then three members (men M = 0.11, SD = 0.32; women M = 0.11, SD = 0.32).

Relationship Dynamics

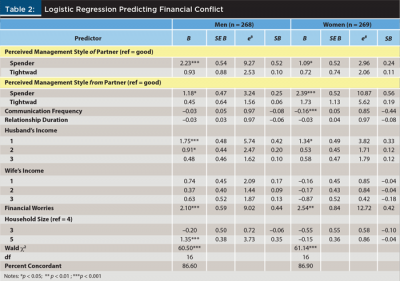

Results of the logistic regression predicting presence of financial conflict (coded 1) versus not (coded 0) are shown in Table 2. For husbands, having a wife who they saw as a spender was the highest contributor to financial conflict (B = 2.23, eB = 9.27, p < 0.001). Husbands who viewed their wife as a spender were nine times more likely to report financial conflict in the relationship.

For wives, having a husband who viewed them as a spender was the highest contributor to financial conflict (B = 2.39, eB = 10.87, p < 0.001), and wives were nearly 11 times more likely to report financial conflict when husbands viewed them as spenders.

Views of the husband’s spending personality were also predictive of financial conflict for husbands and wives at lower degrees. Husbands and wives were three times more likely to report financial conflict when the wife viewed the husband as a spender (Men B = 1.18, eB = 3.24, p < 0.05; Women B = 1.09, eB = 2.96, p < 0.05). Perceptions of husbands or wives as tightwads was not predictive of financial conflict.

Feeling a high degree of communication frequency was associated with a decreased likelihood of conflict for wives, but not for husbands, and was the second-largest predictor of financial conflict for wives (B = –0.16, eB = 0.85, p < 0.001). Relationship duration was not statistically significant in predicting financial conflict for husbands or wives.

Financial Resources and Constraints

Reporting financial worry was highly predictive of conflict for husbands and wives. Husbands with financial worries were nine times more likely to report financial conflict (B = 2.10, eB = 9.02, p < 0.001) and wives with financial worries were nearly 13 times more likely to report financial conflict (B = 2.54, eB = 12.72, p < 0.01).

Husband’s low income was predictive of financial conflict as reported by both husbands and wives. Husbands with the lowest quartile of income were nearly six times more likely to report financial conflict as compared to those with the highest quartile of income (B = 1.75, eB = 5.74, p < 0.001), and wives were four times more likely to report financial conflict with the same conditions (B = 1.34, eB = 3.82, p < 0.05). Husbands with income in the second quartile were also associated with a higher likelihood of financial conflict as reported by men (B = 0.91, eB = 2.47, p < 0.05). Wife’s income was not predictive of financial conflict in the model.

Having three or more children was associated with a higher likelihood of financial conflict for husbands, but not wives, and was the second-largest contributor to predicting financial conflict for men (B = 1.35, eB = 3.73, p < 0.001).

Limitations and Future Research

The data presents a number of limitations that should be considered in light of the results. First, the average marital duration of the sample was 18 years. There was an inherent survivorship bias to the couples included within the sample. Part of the survivorship bias is partially explained by the method in which the data were collected. All families within the dataset were selected for inclusion because they had a fifth grader as part of the larger goals of the Flourishing Families Project. Parents did not have to be married to be included within the dataset, but those who were had likely already survived relationship distress. Future studies would benefit by greater diversity in family composition, especially considering couples with no children and/or only adult children.

The fact that spending personality was based on spousal perceptions versus actual spending may be seen as a limitation. However, this could also be seen as a strength of the study. How individuals think they are behaving is not as relevant as spousal perceptions in evaluating spousal perception of relationship satisfaction and frequency of marital discord (Britt, Grable, Nelson Goff, and White 2008). Nevertheless, future studies would benefit from an exploration of how actual spending influences perceptions. It is possible that spouses have inaccurate perceptions of dollars being spent and saved.

It would also be advantageous to obtain qualitative perspectives of spending and saving within the household for richer understanding of the relationship between money personality and relationship outcomes.

Financial Planning Implications

The planner-client relationship. It is important that financial planners spend time establishing and building a strong relationship with clients. When planners greet their clients with a handshake, they should take note of the client’s hand temperature. Cold hands could indicate a high degree of physiological stress and perhaps the unwillingness or inability to focus on the planning session (Grable and Britt 2012).

Planners could start the meeting by asking, “What is it that brings you in today?” A simple question like this allows the financial planner to understand what is bothering the clients and helps build rapport.

Another question to ask to get a sense of expectations is: “At the end of our meeting today, how will you know that it has been successful?” (Archuleta, Grable, and Burr 2015). During this initial joining process, it may become apparent how clients perceive each other in regard to the discussion of spending and frugality.

Dissatisfaction with perceptions of spending and saving in the household can lead to anxiety and decision-making that is not aligned with the spouse’s or household’s best interest, leading to further financial anxiety (Sages, Griesdorn, Gudmunson, and Archuleta 2015). One assessment that financial planners can use with their clients is the Financial Anxiety Scale, FAS, (Archuleta, Dale, and Spann 2013), a seven-item assessment that can help the financial planner assess the degree to which clients are financially stressed.

Low-stress communication. Whether they are accurate representations of spending or not, results of this study show that perceptions of spousal spending is highly predictive of financial conflict. The first step in reducing financial conflict is low-stress communication. High physiological stress is associated with emotion-based and present-oriented decision-making (Pham 2007), and couples under high physiological stress will be less likely to make progress on their goals (Britt, Lawson, and Haselwood 2016). Taking a deep breath, mentally counting to five while inhaling and back down from five while exhaling will immediately reduce physiological stress.

If financial planners see signs of tension in their clients—crossed arms, daydreaming, leg shaking, finger tapping, clinched fists, cold hands, etc.—they should take a break. The planner could encourage everyone to get up and take a deep breath together or take a short walk to the other room to retrieve something.

Over time, negative perceptions may lead to further marital and financial stress, and ultimately, the dissolution of the client’s marital relationship (Britt et al. 2008). Finding ways to alleviate financial stressors, such as an overreliance on consumer debt instruments, will likely be associated with happier relationships.

Inclusivity. After reducing initial signs of stress, financial planners should open the communication door between partners by being overly inclusive. Traditionally, many financial planners have focused their conversation with the husbands as they were the “breadwinners,” often discounting the wife, or not requiring the wife to be present (O’Connor and Ettinger 2015). The current research posits that this may not go over well, because wives value communication; they want to be involved in household financial conversations.

Also, if something were to happen to one of the spouses, namely the husband (thinking along the lines of traditional financial planning), then it would have a profound impact on the other spouse and the rest of the family. This is why ensuring both spouses are present in the financial planning meeting is important. Incorporating communication strategies within the financial planning meeting to allow both partners to express their opinion and concerns could assist in reducing financial conflict.

Stress-relief strategy. A communication strategy that may help alleviate financial stress would be to have clients set a specific time and day on a weekly, bi-weekly, or monthly frequency where they discuss their finances as a couple. Additionally, the financial planner can assist in creating a balanced strategy with the couple so that each partner gets what they want.

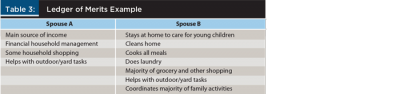

To help with this strategy, the use of the concept of ledger of merits (Ruzgyte 2011) may fit well, particularly given bargaining power as a variable in the empirical model used here. The ledger of merits stems from contextual family therapy, which uses it in terms of balance, and what is given or taken via each spouse (on a horizontal level). The ledger can be adapted to financial planning by giving meaning to the ledger via whatever the couple is presenting in terms of their financial and marital distress. For example, perhaps the husband and wife are fighting due to one providing income and the other providing household chores (i.e., bargaining power issue). The use of a ledger of merits might be able to help each client become more balanced, and therefore increase trustworthiness with each other.

Continuing with the example, the ledger of merits would need to be completed by drawing what is essentially a balance sheet with the clients and helping them walk through their valuable contributions to the relationship—financial and otherwise. For the wage earner, they contribute income but they may not play as large of a role in household chores such as cooking, cleaning, doing laundry, buying groceries, and caring for young children. The same applies for the non-wage earner (essentially a reciprocal of the wage earner). For a visual illustration of the ledger of merits, see Table 3.

A discussion would be warranted at this point, helping each spouse look at how they both contribute and how those contributions may be more balanced than they originally thought. Helping the family understand that there is financial value to a stay-at-home parent/spouse is a necessity, and this ledger of merits helps serve that purpose.

A study by insure.com tracked the average hours per week spent on various tasks for a stay-at-home parent, along with the number of weeks worked at said task, and then used the Bureau of Labor Statistics’ mean hourly wage of those tasks to estimate an annual salary, of which they calculated to be $59,862 (Woodruff 2013). This helps give some “numbers” to an otherwise one-sided financial argument, and helps the wage earner of the relationship better understand what the non-wage earner brings to the table within a financial context.

Mad money. A final strategy to potentially reduce couple financial conflict is to adopt the concept of “mad money.” The concept of mad money is for each spouse to agree on an amount of the monthly budget that can be allocated to each spouse to use in any way desired, without comment or even knowledge of the other spouse. It is effectively “off budget.” In this way, some small individual spending preferences that could have engendered arguments would be accommodated without conflict. The tightwad could find satisfaction in saving this money each month, while the spender could find satisfaction in making some small purchases each month.

References

APA. 2015. “American Psychological Association Survey Shows Money Stress Weighing on Americans’ Health Nationwide.” Retrieved April 24, 2016 from apa.org/news/press/releases/2015/02/money-stress.aspx.

Archuleta, Kristy L., Anita Dale, and Scott M. Spann. 2013. “College Students and Financial Distress: Exploring Debt, Financial Satisfaction, and Financial Anxiety.” Journal of Financial Counseling and Planning 24 (3): 50–62.

Archuleta, Kristy L., John E. Grable, and Emily Burr. 2015. “Solution-Focused Financial Therapy.” In B. T. Klontz, S. L. Britt, and K. L. Archuleta (Eds.), Financial Therapy: Theory, Research, and Practice (pp. 121–141). New York, N.Y.: Springer.

Britt, Sonya L., John E. Grable, Briana S. Nelson Goff, and Mark White. 2008. “The Influence of Perceived Spending Behaviors on Relationship Satisfaction.” Financial Counseling and Planning 19 (1): 31–43.

Britt, Sonya L., Sandra J. Huston, and Dorothy B. Durband. 2010. “The Determinants of Money Arguments between Spouses.” Journal of Financial Therapy 1 (1): 41–59.

Britt, Sonya L., and Sandra J. Huston. 2012. “The Role of Money Arguments in Marriage.” Journal of Family and Economic Issues 33 (4): 464–476.

Britt, Sonya L., Derek R. Lawson, and Camila A. Haselwood. 2016. “A Descriptive Analysis of Physiological Stress and Readiness to Change.” Journal of Financial Planning 29 (11): 45–51.

Browning, Martin, and Pierre A. Chiappori. 1998. “Efficient Intra-Household Allocations: A General Characterization and Empirical Tests.” Econometrica 66 (6): 1,241–1,278.

Dew, Jeff. 2007. “Two Sides of the Same Coin? The Differing Roles of Assets and Consumer Debt in Marriage.” Journal of Family and Economic Issues 28: 89–104.

Grable, John E., and Sonya L. Britt. 2012. “Assessing Client Stress and Why It Matters to Financial Advisors.” Journal of Financial Service Professionals 66 (2): 39–45.

Klohnen, Eva C., and Gerald A. Mendelsohn. 1998. “Partner Selection for Personality Characteristics: A Couple-Centered Approach.” Personality and Social Psychology Bulletin 24 (3): 268–278.

Luo, Shanhong, and Eva C. Klohnen. 2005. “Assortative Mating and Marital Quality in Newlyweds: A Couple-Centered Approach.” Journal of Personality and Social Psychology 88 (2): 304–326.

m stearnsfinancial.com/wpcontent/uploads/WomenofWealthBreadwinnerReport.pdf.

Pham, Michael Tuan. 2007. “Emotion and Rationality: A Critical Review and Interpretation of Empirical Evidence.” Review of General Psychology 11 (2): 155–178.

Rick, Scott, I., Cynthia E. Cryder, and George Loewenstein. 2008. “Tightwads and Spendthrifts.” Journal of Consumer Research 34 (6): 767–782.

Rick, Scott, Deborah A. Small, and Eli Finkel. 2011. “Fatal (Fiscal) Attraction: Spendthrifts and Tightwads in Marriage.” Journal of Marketing Research 48 (2): 228–237.

Ruzgyte, Edita. 2011. “Contextual Family Therapy.” In. L. Metcalf (Ed.), Marriage and Family Therapy: A Practice-Oriented Approach (pp. 65–90). New York, N.Y.: Springer.

Sages, Ronald A., Timothy S. Griesdorn, Clinton G. Gudmunson, and Kristy L. Archuleta. 2015. “Assessment in Financial Therapy.” In B. T. Klontz, S. L. Britt, and K. L. Archuleta (Eds.), Financial Therapy: Theory, Research, and Practice (pp. 69–85). New York, N.Y.: Springer.

Watson, David, Eva C. Klohnen, Alex Casillas, Ericka Nus Simms, Jeffrey Haig, and Diane S. Berry. 2004. “Match Makers and Deal Breakers: Analysis of Assortative Mating in Newlywed Couples.” Journal of Personality 72 (5): 1,029–1,068.

Woodruff, Mandi. 2013. “Here’s How Much It Would Cost to Replace Your Mom.” Business Insider. Retrieved April 4, 2107 from businessinsider.com/value-of-stay-at-home-moms-2013-5.

Citation

Britt, Sonya L., E. Jeffrey Hill, Ashley LeBaron, Derek R. Lawson, and Roy A. Bean. 2017. “Tightwads and Spenders: Predicting Financial Conflict in Couple Relationships.” Journal of Financial Planning 30 (5): 36–42.