Journal of Financial Planning: May 2016

Jerry A. Miccolis, CFP®, CFA, FCAS, MAAA, CERA, is a founding principal and the chief investment officer of Giralda Advisors (part of Montage Investments). He has more than 40 years of experience in the actuarial, risk management, and investment management fields, and is co-author of Asset Allocation For Dummies®.

Gladys Chow, CIMA®, is managing director and a portfolio manager of Giralda Advisors. She has spent more than two decades managing money for regulated investment companies, foundations, trusts, family partnerships, and institutional, corporate, and individual clients.

At the time of this writing, the S&P 500 had dallied with a correction (generally defined as a decline of –10 percent or worse from a recent peak) four times since the beginning of 2014. In none of those four cases did the decline dip into bear market territory (a drawdown of –20 percent or worse).

The first of these phenomena—the repeated corrections and near corrections—has frayed the nerves of many investors. The second—the avoidance of deeper declines—has caused even greater apprehension among those investors by reminding them that we have not seen a bear market downturn in more than seven years now, implying that one is well overdue by historical standards. Combined, these two phenomena have left many investors battered, weary, and wary of the equity market’s volatility, and they are looking to escape it, at least partially, by “de-risking” their portfolios.

De-risking usually takes the form of reducing the portfolio’s allocation to equities below the level that would be typical of the investor’s financial situation. There are certain risks associated with this tactic, some long known, and some new and unique to today’s market conditions.

To begin with, de-risking may take the equity allocation below a level that would be considered prudent for a given investor’s long-term financial well-being. If, for example, a well-thought-out financial plan indicates that a moderately aggressive portfolio—a “60/40” mix, say—is optimal for a client, then materially reducing the equity allocation below 60 percent may impair, perhaps forever, the client’s ability to meet his or her financial obligations over the length of the planning horizon. Equities are the workhorse, the growth engine, of the portfolio. They are arguably the best bet to keep the purchasing power of the portfolio from being eroded by inflation over the long term. In our view, spanning the investment horizon of a typical investor, no other asset class has provided inflation protection as reliably as equities.

If an investor were to de-risk, to which asset class(es) would he or she reallocate the funds released by the trimming of the equity share? The choices of the typical non-institutional investor are cash, fixed income, and/or liquid alternatives. Let’s review each of these choices in turn, and examine the risks that they may introduce.

Moving to Cash

Cash is the probably the single-worst asset class one could choose if the goal is to protect the economic value (the purchasing power) of the portfolio. The returns on cash have been near zero for several years now. Moreover, cash returns have historically lagged the prevailing inflation rate by a considerable degree.

The portion of the portfolio kept in cash will almost certainly be able to buy progressively fewer goods and services as time goes on. Many traditional portfolio managers do not consider cash an asset class for this reason. Their view is that the only reason to hold cash is to meet very short-term (one year or less) financial obligations. In other words, cash serves liquidity needs, not investment needs. We share this view.

An alternative to moving into cash as a long-term holding is to use it as a temporary repository for funds that are freed up by periodically taking down large swaths of risk assets (for example, by investors who follow a “risk-on/risk-off” approach). In our opinion, this sort of market timing is a dangerous and unreliable path to building wealth.

De-risking into cash can be self-destructive and therefore, we believe, a risk not worth taking.

Moving to Fixed Income

What about fixed income? Looking back over the past few decades, fixed-income investments have actually outperformed equities during some intermediate-term stretches. What this retrospective fails to appreciate, however, is that fixed income has enjoyed a robust bull market for the last 30 years, as interest rates have steadily fallen. It is a virtual mathematical impossibility for the asset class to repeat that performance over the next decade or so, as interest rates, for all practical purposes, have nowhere to go but up from here. Rising interest rates are anathema to the total return of fixed-income investments, and can even turn them negative, as the market value of bonds moves in the opposite direction from rates. Thus, fixed income may actually be a riskier choice than cash going forward.

This dismal prospect may lead some investors to seek higher returns from their fixed-income investments by sacrificing their credit quality, but this introduces risks of another sort, and in two dimensions.

First, a review of the junk bond component in the Barclays Aggregate Bond Index reveals that junk bond spreads have more than doubled over the last 18 months. At the same time, the trailing 12-month default rate of junk bonds has increased by 60 percent. Second, as fixed-income investments slide down the creditworthiness scale, their risk/return profile begins to look more and more like the profile of equities. This not only reintroduces the equity risk the investor was presumably looking to avoid, it also decreases the diversification benefit that fixed income is supposed to provide. Examining the rolling 60-month correlation of the U.S. High Yield Bond Index with the S&P 500 Stock Index shows that this correlation is high and has been in the neighborhood of 75 percent since the 2008–2009 financial crisis. Low risk and a high diversification benefit are the cornerstones of the rationale for having fixed income as an asset class. Reaching for yield erodes this foundation.

In short, no matter where we look in fixed income, we see increased risks relative to the last three decades.

Moving to Liquid Alts

Are liquid alternatives the answer? This asset class has seen a surge in popularity over the last 20 or so years, as sophisticated strategies, such as market neutral, long/short (hedged) equity, merger arbitrage, and global macro, once the domain of hedge funds, have become available in more accessible and liquid form. With growth, however, has come a disturbing trend toward mediocrity.

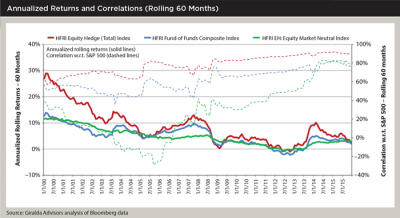

Given the diversity of strategies within this asset class, one must be careful not to paint its picture with too broad a brush; but, there is sufficient evidence based on the aggregate indexes that attempt to track performance of this class to give an investor pause. The solid lines in the chart plot the total return of three prominent indexes in the alt space compiled by Hedge Fund Research Inc. (HFRI): the Equity Hedge Index, the Equity Market Neutral Index, and the Fund of Funds Composite Index. The data series extend through December 31, 2015. The returns shown are the average annual returns calculated on a rolling 60-month basis to reduce short-term “noise,” smooth out the effects of bull/bear market cycles, and make clear the long-term trend.

This picture, while far from predictive of course, concerns us. An additional concern is that liquid alts appear to be losing whatever diversification benefit they may have had. The dotted lines in the chart plot the rolling 60-month correlations of each of these three indexes with the S&P 500. Here again, the picture is disturbing. The correlations have trended upward over time into the neighborhood of 80 to 90 percent. To the extent that portfolio managers are relying on liquid alts to buffer the risk of equities in client portfolios, it would appear from this evidence that the asset class has failed to deliver. This erosion of diversification benefit is even more concerning to us than the erosion of return, as it clearly points to increased portfolio risk.

Another Approach

Is there a solution to this dilemma—this “portfolio problem” as we have come to call it? We believe there may be. A growing number of investment approaches have come to market that attempt to mitigate equity risk at its source, within the equity investment itself. Methodologies include “low-vol” and “min-vol” index funds, tactical sector rotation strategies, and solutions that incorporate put options or other “tail-risk hedges” alongside their traditional equity exposure. We term this category of approaches “risk-managed investing,” or RMI, and we have written about it extensively, including documenting ways to gauge the cost-effectiveness of various solutions. (See “Quantifying the Risk of Downside Protection” in the January 2016 issue of the Journal.)

In our view, the best way to de-risk the portfolio in the current environment is to not decrease the equity allocation at all, but to replace a material portion of traditional equities with their risk-managed counterparts. In fact, we have seen some investors take this approach the next step and actually increase their allocation to equities, employing a sizeable dose of RMI-infused equities to do so. They claim that “80/20 is the new 60/40.” With the right RMI choices, that might be the most prudent and enlightened de-risking strategy of all.

This column is for informational use only and is not intended to constitute legal, tax, or investment advice. Investment involves risk including potential loss of principal.