Journal of Financial Planning: March 2018

C. Augusto Casas, Ph.D., CFP®, is an associate professor in residence at the University of Connecticut’s computer science and engineering department, and the chief financial planner of iFIT2 LLC, a technology and financial consultancy firm based in Mount Kisco, New York. He has worked in financial planning for 20 years and has been a full-time professor since 2002.

Financial planners rely on information technology for nearly all aspects of their work: to create financial plans, manage client relationships, store and protect client data, comply with regulations and policies, oversee their planning practices, and provide services to clients, such as access to their data and financial plans.

A financial planning information technology system is complex; it’s made up of multiple advanced technologies—and it’s dynamic, changing as information and computing technology evolves. A good understanding of various technologies and how they work together is essential for the success of a financial planning firm.

This article seeks to help provide that understanding. It explores the role information technology plays in the planning profession, presents the architecture of an updated personal financial planning information system, and offers an overview of what the future brings to information technology applied to financial planning.

First, a little background. In 2008, I proposed the establishment of a new field of knowledge: “financial planning informatics” (which I defined as the application of information and communication technologies and information management techniques to financial planning), and shared a basic model for a personal financial planning information system with Journal readers.1 Some technologies, such as cloud computing, document management, electronic signatures, mobile payments, and mobile applications (apps), have matured since 2008, and other technologies, including cryptocurrencies and robo-advisers, continue to evolve and impact the delivery of financial services. Therefore, an update to the 2008 model is warranted.

The Role of Information Technology

Information technology provides support in many professional fields. Physicians, accountants, attorneys, dentists, nurses, and law enforcement officers rely on technology to fulfill their duties and deliver services, just as financial planners do. While all information systems have common elements (explored in the next section), every field has unique characteristics and needs.

A specific financial planning information technology system can help planners comply with laws and regulations and support their fiduciary role, providing documentation that may be needed to demonstrate such compliance. It provides the computational power to achieve efficiency and accuracy in multiple types of financial analyses and complex calculations. And it includes the software planners use to develop financial plans for clients, manage client relationships, handle business financial and accounting affairs, and promote their practices.

As consumers become more financially and computer literate, they may be more likely to use financial planning software independently from financial planners. This, in turn, will increase the oversight of such software by regulatory agencies. A robust personal financial planning information system model can set the benchmarks for vendors, financial planners, and consumers.

Elements of an Information System

An information system—including a personal financial planning information system—consists of five elements: hardware, software, data, procedures, and users. It may seem common knowledge, but a review of the elements will lead to a better appreciation for the system model proposed here.

Hardware includes all physical devices, including computers, routers, modems, and peripherals (printers, scanners, keyboards, monitors, cameras, etc.). The hardware provides the computational power required to process input data. However, hardware requires software to use that computational power.

Software covers the operating system (Windows, iOS, or Linux). The most widely used operating system is Microsoft’s Windows. Until recently, most professional financial planning software ran under the Windows operating system.

In addition to the operating system, referred to as system software, an information system uses application software. Examples of application software used in financial planning are the financial planning software itself, customer relationship management software, office automation software (for example, Microsoft Office), document management software, and accounting/billing software.

Data, stored in a database, includes client data, market data, and product data. Often this data is proprietary or confidential, including client income, assets, and documents such as wills and trusts.

Procedures define policies to use the system and restrictions to access it. In small firms, procedures are created by the planner, while in larger firms they are often developed by teams of professionals in information technology, financial planning, marketing, sales, and the legal and compliance departments.

Because of the confidential nature of financial planning data, procedures must be in place to protect the data from theft and to maintain its integrity. These procedures involve the use of usernames and passwords, biometrics, and other screening techniques to restrict access to the data. Therefore, system security is a key priority in the implementation of a financial planning information system.

Users of financial planning information systems are primarily financial planning practitioners and staff members. However, clients may also need to access the system. In some instances, clients enter data directly into the system or request reports. They may also make payments or access general financial information through the system.

Information systems also interact with other systems. A financial planning information system may interact with payment systems, live market data systems, tax return preparation software, online banking systems, and online brokerage systems.

A note about cloud computing. Cloud computing is an evolving technology for which one, single definition has not been agreed. For this discussion, the “cloud” implies that the hardware and software are remotely located—the implications of which are huge for financial planning firms.

Software and data are not stored on a computer physically located at the firm’s premises, and the hardware that runs the applications can also be in the cloud. As a result, the planner’s computer doesn’t require much computational power, and the planner does not need to invest in expensive software and hardware; rather he or she can pay a fee for the use of both. This frees up the firm to operate with inexpensive computers or even tablets, likely a significant savings in operating costs. When the information systems’ servers are in the cloud, a cloud computing service provider manages these devices, relieving the financial planner from having to maintain and service computing equipment.

The offering of “hardware” from the cloud is known as infrastructure as a service (IaaS), an operating system in the cloud is known as platform as a service (PaaS), and application programs from the cloud are known as software as a service (SaaS).

An Updated Model

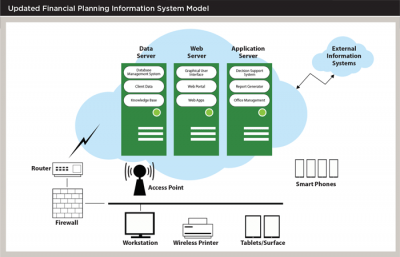

The original model for a personal financial planning information system proposed in 2008 incorporated the basic elements of an information system. The updated version for 2018 expands the model to incorporate customer relationship management, office automation, document management, and cloud computing. The updated model also provides additional details on the user interface, acknowledging the increased use of mobile devices by both planners and clients.

Cloud computing has become ubiquitous and is a fundamental element of a personal financial planning information system. Therefore, the updated model suggests a cloud-based architecture, although the three servers (data, web, and applications) could be physically located on the financial planning firm’s premises. Keep in mind that cloud computing offers significant advantages (as discussed earlier) and seems the preferred choice for an updated system.

The data server stores client data, historical market data, documents, and the knowledge base. It also hosts the database management system software, which manages the database, and provides access to the knowledge base.

The web server hosts the planner’s website, the graphical user interface, and any proprietary apps developed for the firm that can be accessed by planners and clients from mobile devices. The web server’s memory and storage must have a secure area that only the financial planning practitioner, the practitioner’s staff, and clients can access. The public area of the server stores the pages that promote the planner’s practice. The web server must support different types of devices, including desktop computers, laptops, tablets, and smart phones.

The application server contains the financial planning software, office automation software, customer relationship management, document management, and other types of support programs.

Now that we’ve defined the servers, here’s how the model flows:

At the planner’s physical office location, a router forwards and receives data traffic from and to the internet (the cloud). A firewall, commonly defined as a combination of hardware and software that screens network traffic and blocks unauthorized access to the network, protects the incoming data traffic. This is an essential device to protect the local component of the information system.

The router forwards the traffic to a wireless access point, which broadcasts the signals coming from the router as well as those coming from the individual computers. The updated model uses a wireless access point, because today, most local networks are wireless; they offer convenience and flexibility. However, they expose the system to significant risks. Because of this, wireless networks must adopt the highest levels of security and must encrypt all data traveling through the network.

A note about security. Wireless networks are identified with a “name” called the service set identifier (SSID). The SSID must be hidden. This will prevent outside parties from detecting the signal without knowing the network’s name. For a higher level of security, the access point will provide access only to devices whose media access control (MAC) addresses have been programmed into the access point. A MAC address is the physical interface between each computer and the network; a unique number assigned by its manufacturer.

The user interface in the updated model is web based to permit users to access the information system from the office and remotely. Just as the web server must support different types of devices, the user interface must also support different types of devices. For example, the full financial plan, which was likely printed and delivered to the client in the 2008 model, is now presented in a PDF or as a multimedia presentation on a laptop, tablet, or surface computer (not to be confused with Microsoft’s Surface computer). The report generator, which generates the financial plan, must also support all these different types of devices.

A financial planning information technology system needs to interface with external systems, most of which are accessible through the internet, including market databases or information providers such as Thomson Reuters, Morningstar, or Bloomberg. Other external databases may include the SEC’s EDGAR database, Compustat, or the many open databases provided by data.gov. The system may also need to interact with income tax software, financial institutions, and robo-advisers.

The Future of Information Technology for Financial Planning

The outlook for applications of information technology and computing power to personal financial planning are exciting and fascinating. As information technology evolves, so will financial planning information systems. The model presented here needs to update on a regular basis.

Mobile devices will acquire more computing power and wireless networks will support higher transmission speeds.

Public wireless networks will support more bandwidth and fast WiFi hot spots will be prevalent in cities and towns.

Cryptocurrencies such as bitcoin are gaining more acceptance, becoming universal and accepted in many countries. As a result, financial planning software will have to support currency conversions including conversions to cryptocurrencies.

Regulatory agencies will continue to scrutinize the financial planning profession. As a result, the financial planning information technology system will have to support more audits, store more data, and be more secure.

Financial planners will become popular targets of hackers and intruders, as income tax preparers are today. Understanding the strategies to protect the information systems—and particularly the data—will become more challenging.

New communications technologies will continue to have an impact on the planner-client relationship. Video calls and conferencing, instant messaging, and video messages will become preferred interaction methods, and financial planners will be able to more easily establish client relationships with individuals located remotely.

The cloud will be the predominant vehicle to access services for many years until a new, more effective technology emerges. Financial planning software will be primarily offered in the SaaS modality, and all data will be stored in the cloud with backup copies kept locally or on the servers of multiple cloud service providers. And the fact that computing is now done in the cloud will easily and smoothly provide planners with access to the capabilities of quantum computing.

The Internet of Things (IoT), also known as the Internet of Objects (IoO), is a network of physical devices, many of them wearable, accessed through the internet, in most cases wirelessly, and it will have an impact on the financial planning profession. Insurance companies are already using objects to track the driving patterns of drivers. Good drivers get more discounts; bad drivers higher premiums. Smart watches are used to make payments and monitor health signals. Financial planners can use data collected from these devices to warn clients when they are close to spending limits or even to change the client’s asset allocation when health conditions deteriorate.

3-D printing will be used to create visual representations of financial strategies and financial plans, and to create support material for sales presentations.

The user interface will move mainly to mobile devices such as smart phones, tablets, and surface computers, and possibly smart watches.

The financial plan will no longer be a static, printed document; it will be an interactive presentation running on a touch-sensitive screen. The client will simulate different scenarios, look at the data directly behind every chart, and access explanatory videos of the different parts of the plan.

Robo-advisers (defined here as automated investment management services) will continue to evolve and add services to their clients. Often backed by millions of dollars of private equity and other sources of funding, robo-advisers can invest in the most sophisticated information technology, and this access to technology will enable them to expand their services beyond investment management.

Advances in artificial intelligence and machine learning that are already used in algorithmic trading will find use by the independent planner.

Conclusion

Future financial planning information technology systems will be much more complex and will incorporate even more technologies and tools than they do today. Financial planners will need to understand those new technologies in order to adopt the most effective tools and services available.

The complexity of the systems, technology’s role in the financial planning profession, and the dependence of financial planners and their clients on technology justify the establishment of the financial planning informatics field first proposed 2008. The profession needs the development of reliable and robust systems that address the unique technology needs of the financial planner.

Endnote

- See “Informatics: Proposing a New Information Technology Discipline for Financial Planning,” in the April 2008 Journal, available in the Journal archives at FPAJournal.org.