Journal of Financial Planning: June 2016

David M. Cordell, Ph.D., CFA, CFP®, CLU®, is director of finance programs at the University of Texas at Dallas.

Thomas P. Langdon, J.D., LL.M., CFA, CFP®, is professor of business law at Roger Williams University in Bristol, Rhode Island.

As more and more members of the largest population wave—the baby

boom—approach retirement, many are learning the hard way that failing to comply with the Medicare sign-up rules can be costly. One obvious item that should be on the checklist of everyone approaching age 65 is to sign up for Medicare to avoid the possibility of a lapse in insurance coverage or a permanent increase in premiums for Part B coverage.

From the financial adviser’s standpoint, those who have clients approaching age 65 must be conscious of the sign-up rules to provide proper service to clients and to retain them. Everyone who is a few months shy of their 65th birthday receives an onslaught of mail about Medicare, and many of those solicitors are capable of providing other advisory services—they are competition.

Brief Review of Medicare

Medicare provides government-sponsored health insurance for those age 65 and older, and for those who are on Social Security disability. Part A of Medicare provides hospital insurance coverage, and is provided free of charge to those who qualify for coverage. Part B, which provides physician and outpatient services; and Part D, which provides prescription drug coverage, are elective coverages that require a monthly premium from individuals choosing to sign up for them. Part C, the so-called Advantage Plan, is an option available through private insurers. Advantage Plans must offer at least the same benefits as original Medicare (those covered under Parts A and B) but they have different rules, costs, and coverage restrictions.

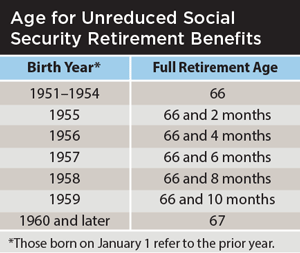

Originally, turning age 65 signaled eligibility for both Social Security and Medicare benefits. Current law, however, specifies age 66 as full retirement age (FRA)—the age at which one can begin receiving the full Social Security retirement benefits without a percentage reduction—for anyone retiring this year. The law phases in higher ages for full Social Security benefits, as shown in the above table, with the highest FRA at age 67 for those born in 1960 or later.

The differences in Social Security full retirement age and the Medicare eligibility age, combined with the reality that many individuals are working beyond age 65, has created confusion as well as a potential financial trap for those who do not strictly follow the Medicare sign-up rules.

Watch the Calendar

The initial enrollment period for Medicare begins three months before the 65th birthday, and ends three months after the 65th birthday. Those who do not sign up during that period must wait until the next open enrollment period to sign up for Medicare coverage. Typically, open enrollment periods are held in the fall, commonly between October and December, although the actual dates can vary from year to year.

Although failing to sign up for Medicare Part A upon attaining age 65 will not result in a premium penalty (because Part A is provided without cost to those who qualify), failing to sign up for Part B and Part D coverage during the initial open enrollment period can result in a permanent increase in premium payments for those coverages for the rest of the retiree’s life.

The premium penalty for Part B is a 10 percent increase in premiums per year of deferral after age 65. Missing the initial enrollment period or the subsequent open enrollment periods even by a month results in a full year premium penalty upon subsequent enrollment. The premium penalty for Medicare Part D prescription drug coverage is 1 percent for each month of deferral, or up to 12 percent per year.

A special exception to the premium penalty applies if an individual continues to work past age 65 and is covered by an employer group health insurance plan. In this circumstance, no premium penalties will be assessed, provided that the individual enrolls for Medicare within eight months of their retirement date. This eight-month period applies even if the employer provides retiree health insurance coverage and the individual is still receiving coverage under the employer’s plan.

Don’t Be Like Mike

The eight-month special enrollment period can be a trap for the unwary. For example, assume that Mike, age 66, has decided to retire. The health insurance plan provided by his employer is very comprehensive, and Mike would like to make sure he has access to the physicians he has been using for many years, some of whom do not accept Medicare insurance. Mike elects COBRA continuation coverage upon separation from service from his employer, and will be covered by his employer’s group medical insurance plan for an additional 18 months after his separation from service. Of course, Mike will have to pay the group insurance premium, plus up to a 2 percent administrative fee, to elect COBRA continuation coverage.

Even though Mike continues to be covered by his former employer’s medical insurance plan under COBRA, Mike has eight months from the date he separates from service to enroll for Medicare. If he waits until the end of the 18-month COBRA continuation period and then tries to enroll for Medicare, it is possible that his enrollment would be considered two or three years late (depending on the date of his retirement and the dates of the Medicare open enrollment period), generating a 20 percent to 30 percent Part B premium penalty for the rest of Mike’s life, and a potential 24 percent to 36 percent Part D premium penalty for the rest of his life. Even though Mike acted responsibly by maintaining medical insurance coverage and did not draw on Medicare resources during the COBRA continuation period, he will suffer the consequences of not enrolling for Medicare under the enrollment date rules.

Nothing in Medicare Is Simple

This example makes a simplifying assumption that may not apply to all employer group health insurance plans—that the employer plan will cover all of Mike’s medical expenses, even those that would have been covered by Medicare had Mike signed up for Medicare at age 65.

Many employer health plans are structured to pay for the medical expenses of employees over age 65, or those who have elected COBRA continuation coverage and are eligible for Medicare, if Medicare Part A and Part B will not cover those expenses. If structured in this way, these employer-sponsored health plans require employees and former employees electing COBRA continuation coverage to sign up for Medicare part A and part B at age 65, if the employee or former employee would like those medical costs covered.

In Mike’s case, even though he elected COBRA continuation coverage, he would still have to sign up for Medicare to have coverage for benefits provided for under Medicare Part A or Part B, because the employer plan will reject claims for payment for those services. Even though he opted for COBRA continuation coverage, Mike may find that his out-of-pocket expenses for medical care are much more costly if he does not also enroll for Medicare at age 65.

Another consequence of not complying with the enrollment date rules is that a coverage gap may result, triggering additional tax penalties under the Affordable Care Act. Continuing with our example, if Mike elected COBRA continuation coverage upon separation from employment, waited until the end of the 18-month COBRA continuation period to sign up for Medicare, and found out that he missed the open enrollment period for the year (and, by default, had also missed the eight-month special enrollment period upon separation from service), he will have to wait until the next Medicare open enrollment period to sign up for Medicare. Mike could, during this period, purchase private health insurance coverage (which would be very expensive given his age) until the next open enrollment period, or, alternatively, his health insurance coverage may lapse. If coverage lapses, Mike will not be meeting his obligation under the Affordable Care Act, and he may be subject to additional tax penalties.

Avoid the Consequences

Individuals approaching age 65 should consider their health insurance options and make informed choices about enrolling for Medicare. It is not enough to rely on general rules and exceptions to the Medicare rules when making this decision. Potential Medicare enrollees also need to know how Medicare coverage coordinates with their existing health coverage and the specific dates during which they can enroll in Medicare. Failure to consider these variables when making a decision to enroll in Medicare could subject the individual to premium penalties, claim rejections, and either high personal medical insurance costs or tax penalties.

If one of these unfortunate events befalls any of your clients, they may blame Medicare, the Affordable Care Act, the government, or the phase of the moon. But there is also a good chance that they will blame you. Be the adviser who is knowledgeable enough to help with Medicare decisions. Advisers wanting to avoid these unfortunate circumstances should stay on top of the timeline and ensure their clients know what to do in signing up for Medicare, and perhaps more importantly, when to do it.