Journal of Financial Planning: June 2015

Randy Gardner, J.D., LL.M., CPA, CFP®, is a professor of estate and financial planning at the University of Missouri and a practicing attorney with more than 30 years of experience.

Charles Daff, J.D., is a trust administrative officer at U.S. Trust, Bank of America Private Wealth Management in Kansas City, Missouri.

Frank and Mary both had children from prior marriages. When they married, they sought to protect their children by setting up a revocable living trust that divided into a revocable survivor’s trust to hold the survivor’s assets, and an irrevocable trust to hold the decedent’s assets (the subtrusts) after the first death. The subtrusts provided for the surviving spouse during his or her remaining lifetime, with the remainder going to their children in equal shares at his or her death.

They named Mary’s daughter, Dee, the successor trustee upon the surviving spouse’s incapacity or death. Mary died first. Frank was grief-stricken and never found the energy to divide assets between the subtrusts. After Frank’s death, Dee (a working spouse and mother) tried to sort out Frank’s and Mary’s estates while fielding weekly calls from her siblings and Frank’s children expressing urgency over when the money was going to be distributed.

After a year with little communication from Dee, the two sets of children each hired their own attorneys. Accusations flew against both Frank and Dee for failure to follow the plan, nondisclosure of investment choices, inadequate accounting, overspending, and disproportionate distributions. Legal fees mounted. The attorneys agreed it would have been better if Frank and Mary had named a corporate trustee to serve as successor trustee at Mary’s death.

Pros and Cons of Naming a Corporate Trustee

Most trust administrations do not turn out this way, but enough do that clients and their advisers should be alert to the situations when naming a corporate trustee is advisable. The main advantages of naming a corporate trustee are expertise, experience, resources, and impartiality. The oft-mentioned disadvantages are cost (approximately 1 percent of assets), insensitivity to or lack of familiarity with family circumstances, and bureaucracy.

An often overlooked advantage of naming a corporate trustee is the organization’s fiduciary responsibility. A corporate trustee is required to look out for the interests of all beneficiaries equally. Corporate trustees take this obligation very seriously; even the slightest favoritism may shatter its relationship with the other beneficiaries and open up the possibility of litigation.

In practice, this tension is best seen in the balancing of the interests of current income beneficiaries and remainder beneficiaries. While meeting the requirements of the various states’ Prudent Investor Acts, a trustee has a duty to simultaneously make trust property productive for any current income beneficiaries and preserve and grow the trust property for future remainder beneficiaries.

The current low interest rate environment is a good illustration of how this can play out. A standard balanced portfolio would pay significantly less in income in today’s low interest market, and as a result, a truly equitable portfolio would be underweight on fixed-income assets and overweight on dividend-producing stocks to supplement income for current income beneficiaries. Most corporate trustees manage and invest assets in a way that treats both classes of beneficiaries as equally as possible.

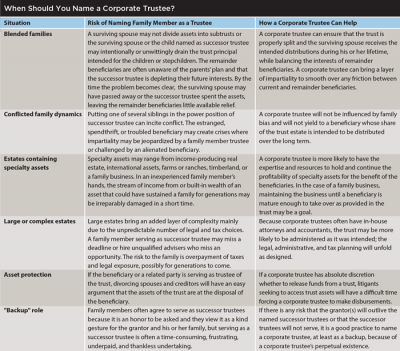

The table on above summarizes several situations when it could be advantageous to name a corporate trustee.

Will the Trustee Serve When the Time Comes?

It is important for the client and adviser to look into the corporate trustee’s requirements to ensure the trustee will accept the appointment before the client finalizes the documents. Often, the adviser names a financial institution with which he or she is affiliated, and the adviser is familiar with its rules. However, if the client or adviser is not familiar with the requirements of the institution, he or she should always contact the chosen institution before naming them to determine:

- The exact name of the institution as it should appear in the trust document, with a reference to successor institutions in the event the institution is acquired

- Account minimums

- Whether the corporate trustee requires any special language in or attachments to the trust document

- Whether the corporate trustee needs to review the trust document in advance

The adviser should also inquire whether there are any particular clauses or language that would cause the trustee to refuse to serve. For example, some corporate trustees will not serve if language in the trust includes special needs language, addiction language, conservatorship language, restrictions on fees, or restrictions on investments or other powers.

In certain circumstances, the best way to keep wealth in the family is to have someone outside the family manage the wealth. This reasoning leads clients to use financial advisers and corporate trustees.