Journal of Financial Planning: July 2020

Robert B. Mauterstock Jr., CFP®, CLU®, ChFC®, CLTC®, is partner and co-founder of Plan4Life LLC, the creator of The Elder Planning Specialist program, an extensive curriculum for financial planning professionals. He is a former Navy pilot and has written four books related to boomers, their aging parents, and their adult children. He was a practicing financial planner for over 30 years.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

An age wave is coming, and I don’t think most of us are prepared for what we’re about to experience. The over-85 age group is the fastest-growing age group in the United States. And that demographic is growing by a clip that will increase 79 percent over the next 10 years (Endnote 1). I don’t want to scare you, but the Alzheimer’s Association estimates that by 2050, 7 million people age 85 and older are projected to have Alzheimer’s dementia (Endnote 2).

Looking at what I call “the new retiree”—and I fit into this category—many of us are going to live 30 years in retirement; probably as many years as we lived working. We’re finding out that one in five of those people who are retiring are continuing to work (Endnote 3). In fact, there’s a lot of interest in changing and developing new careers. For example, Encore.org was started by Marc Freedman to help people in their 50s and 60s make a transition to a new career where they can make a difference with other people (see the Journal’s 10 Questions interview with Marc Freedman from the April 2016 issue). So, retirement is changing for most of us; it’s not what it was when our parents retired.

Retirees are changing, too. Retirees today are more educated than any previous generation. More than one-third of baby boomers have a college degree (Endnote 4). And they’re technology savvy. Sixty-eight percent of boomers are on Facebook; 24 percent are on LinkedIn (Endnote 5).

Family dynamics are also changing. You may notice that most boomers have fewer children than their parents did. How does that affect them? As we age, we’re going to have fewer caregivers to provide care for us. Many times, our children are disseminated all over the country, so it’s going to be difficult for those smaller families to take care of us aging boomers.

Concerns of the Aging Baby Boomer

Aging baby boomers are concerned with making the transition out of their career. The day you retire from that job, you think, what happens next? Where do I go; what do I do? I know it was difficult for me to make that transition.

Many of us in our 60s and 70s still have to care for parents. I’ve talked about this all over the country, and many times people will come up to me afterward and say, you know, my dad is 94 and still living alone and we’re not sure what we’re going to do and how we’re going to take care of him. That’s happening all the time, as our parents are living longer than the generations before them.

Aging baby boomers are also supporting their children. The clear majority of parents (82 percent) say they are willing to make a major financial sacrifice in order to help their adult child (Endnote 6). So you’ve got aging parents on one end and needy children on the other end. And at the same time, aging boomers have to manage their own health and well-being. They’ve also got to figure out where they’re going to live in retirement.

Lastly, they’ve got to manage the decumulation of their assets. Starting to use up your asset base for your minimum distributions each year is a scary process for many people, especially knowing that they may live 30 years during retirement.

The Longevity Planner

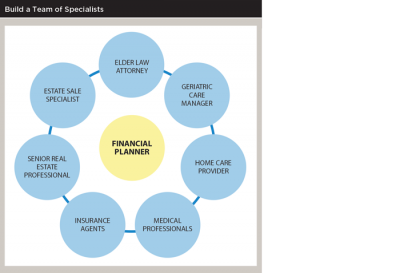

To best address the concerns of aging baby boomers, we as financial planners have to change from being asset managers to lifestyle managers. We have to learn the lifestyles of our aging boomer clients and how we can help them in that lifestyle process. We need to become familiar with different providers of various services and take a much more holistic approach to working with our clients and meeting all the needs they have. And we have to learn how to work with multiple generations to make the transition in wealth from one generation to the next.

The graphic above is an example of the types of services surrounding you that you need to work with, including elder law attorneys, long-term care specialists, and people in the medical field. Build this team of people to work with you to provide all these services, because you can’t do it yourself. Your job is to be the quarterback to manage that process and build that team for your clients.

What follows are some of the specific issues we need to work on. They may be things you were not too concerned about while you were helping to build clients’ assets, but they will become increasingly important issues as your clients age.

Long-Term Care Planning

I think we can simplify long-term care planning into three basic questions:

Will we be able to stay in our home? Ask your clients: Will you be able to stay in your home if one of you becomes disabled and not able to get around? Is your bedroom on the second floor? Can you provide wheelchair access to the bathrooms? Are the hallways narrow? Are there a lot of steps to get in and out of the garage? These are things many people have no idea about because they’ve never looked at it.

I discovered this for myself. About five years ago I had my left ankle replaced. I was supposed to use crutches, but I really don’t like crutches. When we came home from the hospital, I sat down on my rear end and slid up three steps from the garage into the kitchen. That worked. But then there I was, sitting on the kitchen floor. My wife was standing above me. She weighs about half of what I weigh. It was an elaborate process, and we had no idea this was going to happen. So, clients may not even know what situations they could face in their own home until they look at it closely. But they must consider this if, in fact, they can stay in their home if one of them becomes disabled.

Who will provide our care? This is also a question to ask clients directly. Is it going to be a family member? Will they hire an individual from an agency?

I remember sitting down with one couple and their adult son and his wife (their daughter-in-law). I asked, “Who is going to take care of you if one of you need care?” Without even hesitating, my client pointed to his daughter-in-law and said, “She’s going to take care of me.” You should have seen the look on her face. She said, “I have a full-time job. I’ve got two children of my own, and I’ve got to take care of your son, and that’s a full-time job!”

He had no idea who was really going to end up taking care of him, and his daughter-in-law didn’t understand that she was expected to do it. It’s important to think about these issues.

How will we pay for our care? For many people, their immediate response to this question is that Medicare will take care of it. If you’re recovering from an illness or an injury and you’re expected to get better, Medicare will cover you for up to 100 days with a co-payment. After that, it stops; so you can’t expect Medicare to cover you for the long term, especially if it’s custodial care. What are your other options? There’s Medicaid, but in most states, you have to spend down your assets until you have just $2,000 left before you qualify for Medicaid. Veterans have a program called Aid and Attendance Benefits that provides veterans $2,000 a month, or $1,000 a month for widows of veterans to put toward care.

For the rest of us, the money comes from our retirement funds and our savings. In my state of Massachusetts, it costs $8,000 to $10,000 a month to stay in an assisted-living facility. Clients can use up their retirement assets very quickly, so it’s important to help them determine what they will do and how they will take care of those expenses, because it’s a real shocker for most of us.

The Legal Issues

We always have to deal with the legal issues, and it’s important that our aging clients understand what they need to do to take care of themselves.

Who should hold the durable power of attorney? Clients should have a durable power of attorney—the ability to have someone act on their behalf. In most cases, the husband and wife have a durable power of attorney on each other. But what happens if neither one of them can handle their affairs? You need to have a third person that has that durable power. Oftentimes, it is one of their children, or an adviser, or an associate.

I recommend clients don’t give that power to two of their children. Rather, have one child have the durable power of attorney, and have the second child be a successor. And, be careful who you designate. Some of the biggest scams in this country are people taking advantage of elders, and it’s the people who have that durable power of attorney; oftentimes their own family member. If clients have durable powers with a person outside the family, get to know who that person is. That person can be very helpful, or he or she could be a real problem.

Who should be the healthcare proxy? The healthcare proxy makes decisions for your healthcare, supposedly in line with your wishes, if you’re not capable of making those decisions yourself. Each of your clients needs to have a healthcare proxy, and that person needs to understand what their job is.

Who should be the personal representative to manage the settlement of my estate? This area is often overlooked. The executor or executrix, also sometimes called the personal representative, needs to know what they are doing if they are going to settle your estate. You don’t want clients to haphazardly name one of their children to have that responsibility, unless they have complete confidence that they can handle it. And the children of your clients need to know who that person is, because they’re going to have work with them to make sure things are done properly handling their parents’ estate.

Are my beneficiaries up to date? I remember asking one of my clients to bring his life insurance policies into the office so we could review it and make sure everything was OK. He said, “What for? My life insurance is fine. It’s in place; it’s good.” I said, “Just bring it in.”

I sat down with him and his policies. “Who’s Jill?” I asked. “She’s my ex-wife who I divorced 12 years ago,” he answered.

“Did you know Jill is the beneficiary of a $100,000 life insurance policy that you own?”

It happens all the time.

I’ve seen situations where clients have their parents as beneficiaries, and their parents have been dead for 10 years. So, make sure your clients have their beneficiaries up to date, and that they have a contingency beneficiary, because if the primary beneficiary is gone and there’s no contingent, the benefit goes into the estate and goes through probate. You don’t want that to happen.

Legacy Planning

In his book How to Say It to Seniors, geriatric psychology expert David Solie mentioned that as people get older, two things become increasingly important to them. No. 1 is maintaining control of their lives—to be able to continue driving the car, to live where they want to live, to do what they want to do, and to be in control of everything that happens to them. But as they get older, some of that control starts to slip away, and something else becomes more important—who will remember me, and how will they remember me?

I suggest you have your clients create a “legacy letter.” In that letter, your clients specify what successes they had in life, what failures they had and what they learned from them, what their traditions are, and what they hope their children and grandchildren will continue. Some people call this an ethical will; a legacy letter sounds better to me, because it’s really not about ethics; it’s about, what do you want to happen?

One of the most interesting things, I think, is for clients to share with their children how they met.

My parents had been married for almost 60 years and I never knew how they met. When my mom was moving from her home in western Massachusetts to be closer to us on Cape Cod, I sat down with her and we went through the important papers she kept in this green metal box. In this box I found a brown envelope. Written in pencil was, “Bob sent this to me on his way overseas.” Bob was my dad. He was on his way to fight in World War II. On that trip across the Atlantic in 1944, he wrote this letter, and she had kept it in this box. It was in perfect condition, except for a spot that was cut out by the censors (the name of the ship he was on).

In perfect script, he wrote this letter in rhyme. It described their relationship—how they met at the lake on a Saturday afternoon, and how they dated, and so on. But the most interesting part to me was that first day they met. My dad got home from that day at the lake, and he was sitting at dinner when the phone rang. My grandmother picked it up and said, “Bob, it’s for you. It’s that girl that you met at the lake today.”

And the girl that he met at the lake that day asked him if he was going to the party that night. He said, “Yes.” And she said, “Well, can you pick me up?”

This was 1935, so that was a bit of a surprise for a woman to call a boy up and ask him to take her to a party. But I think even more amazing than that was she was born in 1920. She was 15 years old, asking this young man to take her to a party. And here my mom is sitting, and she’s 90 years old, and I said, “Mom, did you really do that?” She said, “Oh yeah, I did that all the time with all the boys.”

I was shocked. But I learned a lot about her and their experience together just from that letter. Those are the kinds of things you can share with your family that are really valuable.

End-of-Life Planning

This is one of the most difficult areas of longevity planning. Many clients want to avoid this entirely, but what I discovered doing the research is that families that don’t talk about end-of-life planning are families that have real problems when a parent dies. And it happens all the time.

The Five Wishes is an incredible tool that you can use to open up the conversation on end-of-life planning. It’s asking these five questions:

- Who do I want to make healthcare decisions for me?

- What kind of medical treatment do I want?

- How comfortable do I want to be?

- How do I want people to treat me?

- What do I want my loved ones to know?

You can go to agingwithdignity.org and download a document with these questions. Download it and fill it out yourself. It’s an eye-opener. It will give you real understanding of what people go through at the end of life, making those decisions when times are tough.

The Conversation Project is another great tool you can use with your clients and with your own family. Ellen Goodman developed it out of her experience dealing with her mother, who never spoke to her about her needs at the end of life. Her mother developed Alzheimer’s, and here was Ellen talking to her mother’s doctors, trying to answer their questions about her care, and she didn’t know what to do. It was a terrible experience.

She talked to her friends and to professionals and asked them, what’s the difference between a good death and a bad death? She discovered that when the family member discusses what their needs and concerns are before they die, that’s a good death. When they don’t ever talk about it and don’t share it, that’s a bad death.

The Conversation Project (theconversationproject.org) will illustrate the five steps you need to take to prepare for and discuss end-of-life planning with your family. It lays out the process in very simple terms.

I feel that the best way to open up the conversation regarding end-of-life planning with your parents, your spouse, or your clients is to fill out the Five Wishes form. Answer the five questions and then hand the form to the family member or client and say, “This is what I’ve decided to do. Let me know what you think about this.” It opens up a whole new conversation about the end of life that people weren’t willing to have. It’s an opportunity to do that in a way that’s not so scary, because it’s asking specific questions, and you’re giving specific answers.

Plan a Family Meeting

Once you get all this information together, and your clients have made all these decisions, then it’s time to pass the information on to the next generation.

I am a strong proponent of family meetings. I’ve seen relationships within families change dramatically after a family meeting, when they suddenly discover they’re all working together.

The first step in having a family meeting is to identify the alpha child. This is the child that the other children look up to; the one who is the family champion, who’s been successful in life, who gets along with his or her siblings, and gets along with mom and dad. When you work with a family, the alpha child will help you coordinate a meeting with the other children. They will act on their parents’ behalf and make sure that the meeting happens.

Be the facilitator. I strongly suggest you become the facilitator of that family meeting. One reason why is that it’s very valuable for you to develop a relationship with the children of your best clients.

I remember sitting next to an adviser from Merrill Lynch when I spoke at an event in New York a few years ago. He said, “You know, I had a pretty good year this year. I got five really big new clients. But three of my clients died, and within weeks the money was gone.”

The statistics say that up to 94 percent of your clients assets will moved when they die (Endnote 7). because their children have not developed a relationship with you. Do you know the first names of your five best clients’ children? And have you met them, and do you know them? The family meeting is the perfect opportunity to meet those children and get together with them to help plan for their parents. You will create a relationship with them, and they will look to you to become their financial planner in the future.

As the facilitator, make contact with each family member. I suggest you call each of them before the meeting to find out what they consider most important, what they think the family needs to talk about, and if they have things they don’t want to talk about.

I remember one situation where the alpha child said, “Listen, Bob. Whatever you do, don’t bring up the issue of money with my dad. If you start to talk about money, he’s going to shut down the meeting.”

So I said, “Okay, we won’t talk about money.”

The dad was a very successful business owner who grew his business over 40 years and was in the process of passing it on to his children.

We had our first meeting on a Friday night, and we got into some key issues that the dad discovered were really important. He thought his children were going to get together and tell him he had to move. But he discovered in that meeting that his children wanted to help him figure out what he needed to do to stay in his house. He discovered that they were there to support him not tell him what to do.

The next morning, we were getting together to continue the family meeting, and I noticed the dad putting a piece of paper on everyone’s chair. I went over and picked one up. He had created his balance sheet. He gave it to each one of his children and said, “If I’m going to be in this, I’m going to be in this 100 percent.” It changed the whole complexion of the meeting. And it made a huge difference to his family members.

Designate a scribe. You want someone to keep track of what is said, what is promised, and what needs to be done. It’s usually one of the children. After the meeting, the scribe follows up with a list of the things the family needs to do and the action items each person needs to take.

Everyone needs to be heard. Don’t have votes. You don’t want a situation where three of the children say dad needs to move to a condo, and two say he should stay where he is. Don’t do it that way. You’ll get a situation where one of the people who voted “no” when everyone else voted “yes” will undermine the whole decision-making process. Rather, everything needs to be done by consensus. What is the situation that all the family members can live with in the process? And I do mean all.

The family meeting can be a game-changer for your clients’ families. Start setting up these meetings today. You’ll be surprised how many clients will look forward to the opportunity, because many of them have been thinking about the things they need to share with their children, but they haven’t been able to do it, or they don’t know how to do it. You can show them a way to make that process happen so that they’re happy, and their children will be happy.

Endnotes

- According to the National Institute on Aging. See nia.nih.gov/living-long-well-21st-century-strategic-directions-research-aging/introduction.

- See the “2020 Alzheimer’s Disease Facts and Figures,” from the Alzheimer’s Association at alz.org/media/Documents/alzheimers-facts-and-figures.pdf.

- See “More Americans Working Past 65,” from AARP posted at aarp.org/work/employers/info-2019/americans-working-past-65.html.

- According to U.S. Census data, as reported by USA Today (usatoday30.usatoday.com/news/nation/census/2009-11-10-topblline10_ST_N.htm).

- According to Statista (statista.com/statistics/436417/us-baby-boomer-selected-social-networks).

- See the 2018 report “The Financial Journey of Modern Parenting,” by Merrill in partnership with Age Wave at ml.com/the-financial-journey-of-modern-parenting.html.

- See “The Great Wealth Transfer Is Coming, Putting Advisers at Risk,” from InvestmentNews at investmentnews.com/the-great-wealth-transfer-is-coming-putting-advisers-at-risk-63303.

Editor’s note: This article is adapted from the author’s 2019 FPA Annual Conference presentation. FPA members can access an on-demand recording of this and many other Annual Conference presentations HERE.

Sidebar: Tools to Use

Online tools. EverPlans (everplans.com) and Whealthcare Planning (whealthcareplan.com) both guide your clients through the entire process shared in this article, completing the tasks they need to and that you can help monitor. They create follow-up lists for you to use with clients, and they are excellent tools to automate the entire process of helping your clients get their financial situation in order.

Single-source reference. A simple tool you can create yourself using a three-ring binder is a single-source reference guide. It’s questionnaire you create for clients with things like: Who are your advisers? How do we reach them? Where are your investments? What is your insurance? Who are the beneficiaries? Where are your insurance policies? And, something that’s becoming increasingly important, what are your usernames and passwords? My partner, Annalee Kruger has created a binder with all the relevant questions called “The Grab and Go Binder.”

File of Life. Another real simple thing is the File of Life (folife.org). It’s a little plastic folder with a card and a magnet on the back. The card provides a fold-up listing of all your client’s medical requirements, medical situations, who their doctors are, what medicine they’re taking. It’s all in one place, and you put it on the refrigerator. If you’re ever in a situation where there’s an emergency and you have to dial 9-1-1, the first place EMTs will look for that kind of medical information when they come into the home is on the refrigerator. Some clients have a DNR, a do not resuscitate—that’s another important thing to have posted to the fridge. Get a stack of these; they cost about 50 cents each. Put your business card on the back and give them to your clients. —RBM

Learn More

Bob Mauterstock has teamed up with professional colleagues to offer a new Elder Planning Specialist Training. The training includes:

- 12 critical topics

- 8-week online course

- Expert guest lecturers

- Interactive case studies

The training starts in September. Learn more at www.plan4lifenow.com.