Journal of Financial Planning: July 2017

Julie A. Welch, CPA, PFP, CFP®, is the director of tax services and a shareholder with Meara Welch Browne P.C. in Leawood, Kansas.

Cara Smith, CPA, CFP®, is a senior tax manager with Meara Welch Browne P.C. in Leawood, Kansas.

The costs of nursing and assisted living facilities continue to rise each year. With more than a million seniors residing in some type of nursing or assisted living facility, the ability to take a tax deduction for medical costs can help offset the cost of the care.

Currently, taxpayers can deduct medical and dental expenses that are more than 10 percent of their adjusted gross income (of course, financial planners should keep an eye on legislation; a current proposal would eliminate medical expenses as an itemized deduction). Medical insurance reimbursements reduce the deductible amount. Self-employed taxpayers may be able to deduct 100 percent of their health insurance costs in arriving at adjusted gross income (AGI). Also, taxpayers using health savings accounts (HSAs) may be able to use amounts in the HSA account to pay for medical expenses.

Medical expenses are payments for the diagnosis, cure, mitigation, treatment, or prevention of disease. These expenses can be for the taxpayer, the taxpayer’s spouse, or relatives the taxpayer supports. However, expenses that are merely beneficial to a taxpayer’s general health, such as vacation costs and health club dues, do not qualify.

Medical expenses include items such as:

- Medical and dental insurance premiums including Medicare Part B and limited amounts for long-term-care insurance premiums

- Prescription medicines and insulin

- Fees for doctors, dentists, and other medical practitioners

- Fees for hospitals and medical centers providing psychiatric, drug, or alcohol treatment, including meals and lodging

- Fees for stop-smoking programs (including prescription drugs)

- Fees for physician-prescribed weight-loss programs to treat an existing disease

- Special equipment, such as wheelchairs, crutches, artificial limbs, eyeglasses (including contact lenses), hearing aids, and breast pumps

- Improvements to your home such as elevators, air filtration equipment, and swimming pools to the extent they exceed the increase in value of your home and are needed for medical purposes

- Transportation costs, including auto expenses at either 17 cents (down from 19 cents for 2016) per mile or your actual costs

- Cosmetic surgery if it corrects a deformity arising from a birth abnormality, a personal injury, or a disfiguring disease

- Special schools or homes for people with mental or physical disabilities

- Nursing homes and other costs for long-term care

Expenses for Continuing Care Facilities

Note that medical expenses include long-term-care expenses for chronically ill people. Long-term-care expenses are necessary diagnostic, preventive, therapeutic, curing, treating, mitigating, and rehabilitative services. Long-term-care expenses include nursing homes, other assisted living facilities, and in-home care.

The cost of residing in a nursing home can be deducted if the primary reason for the care is medical need. The cost of nursing home care is not deductible if the reason for living in the nursing home is personal and nonmedical.

The Federal Health Insurance Portability and Accountability Act (HIPPA) states the entire cost related to assisted living may be deductible. The entire cost includes not only the costs of the medical services, but also amounts incurred for rent, food, maintenance, and personal care services.

In order for the entire cost of an assisted living facility to be deductible, residents of such facilities must be “chronically ill,” and the services must be performed pursuant to a plan of care prescribed by a licensed health care practitioner. The determination of “chronically ill” is made by a licensed health care practitioner who must certify the resident as unable to perform at least two activities of daily living for at least 90 days due to a loss of functional capacity. The activities of daily living are bathing, eating, dressing, toileting, transferring (walking), and continence. Severely cognitively impaired individuals requiring substantial supervision, such as those with Alzheimer’s disease, also qualify as chronically ill.

If the taxpayer does not qualify as chronically ill by reason of being able to perform two or more of the activities of daily living, a portion of the cost of the stay at the assisted living facility is still deductible. The deductible amount is the portion that relates specifically to medical care. Typically, the facility will provide its residents with a letter outlining the percentages of their costs that relate to medical care that taxpayers can use to determine their deductible medical expenses.

In addition to HIPPA, there is even more authority to deduct 100 percent of the costs of assisted living facilities. Taxpayers can use an Internal Revenue Service information letter (INFO 2009-0252) and a 2011 Tax Court case. With the information letter, the IRS has confirmed that the full costs incurred for a stay at an Alzheimer’s medical facility are fully deductible in a situation in which the primary reason for being there is the availability of medical care to treat the Alzheimer’s disease.

In the 2011 tax court case, Estate of Lillian Baral (U.S. Tax Ct., No. 3618-00, July 5, 2011), the elderly Lillian Baral was diagnosed with dementia, and her physician determined that she required 24-hour care. Her brother hired unlicensed caregivers to provide the care prescribed by the physician, and medical expense deductions were taken for the amounts paid to the caregivers. The IRS argued the expenses did not qualify as deductible long-term care expenses. After her death, Baral’s estate appealed the decision to the Tax Court and came out victorious. The Tax Court agreed with the estate that the payments to the caregivers for assisting Baral were necessary services, provided pursuant to a plan of care prescribed by a medical practitioner, and therefore, tax-deductible medical expenses.

Lifetime Care Community Fees

A portion of the one-time entry fees and ongoing payments for independent living units and assisted living units that guarantee eventual access to a nursing home that is part of a lifetime care community are also tax-deductible medical expenses.

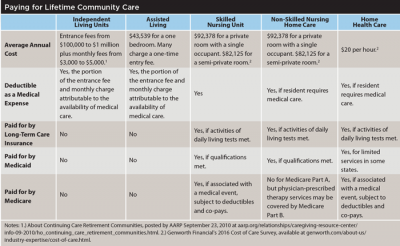

Although these advance payments can be expensive, a taxpayer might “buy in” to one of these communities before care is needed to ensure the ability to enter the community when the need for care is urgent. These fees are deductible based on the lifetime care community’s calculation of the portion related to medical care, even if it is possible for the fees to be refunded if the commitment can be cancelled. The table on page 35 gives an example of the various fees for lifetime community care.

Prior to 2006, entrance fees to continuing care retirement communities were considered loans and taxpayers were taxed on interest income imputed to them on the basis of their entrance fees. However, the 2006 Tax Relief and Health Care Act repealed this imputed interest requirement relating to entrance fees.

Long-Term-Care Insurance

Many people turn to insurance policies to help pay for some of the costs of long-term care. Premiums for long-term-care insurance can be deductible as medical expenses subject to the 10 percent of adjusted gross income limitations.

IRS Publication 502 dealing with medical expenses lists the following conditions that a long-term-care insurance contract must meet to secure a tax deduction:

- Be guaranteed renewable;

- Not provide for a cash surrender value or other money that can be paid, assigned, pledged, or borrowed;

- Provide that refunds, other than refunds on the death of the insured or complete surrender or cancellation of the contract, and dividends under the contract must be used only to reduce future premiums or increase future benefits; and

- Generally not pay or reimburse expenses incurred for services or items that would be reimbursed under Medicare, except where Medicare is a secondary payer, or the contract makes per diem or other periodic payments without regard to expenses.

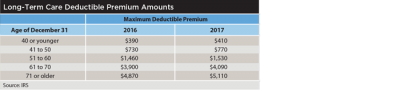

The deduction for the premiums is limited based on age of the insured as of December 31 of the year. The deductible premium amounts for each person are shown in this table:

These limits shown in the table may be adjusted for inflation annually, and the premiums allowed as a federal tax deduction are generally much less than the cost of a policy providing the $360 exclusion level allowed by the federal government.

Retired public safety officers can get special treatment for certain medical insurance premiums. If such person elects to pay the premiums with tax-free distributions from a qualified retirement plan directly to the insurance company, the distributions are excluded from his or her income. (Such person cannot get a double benefit by deducting long-term care insurance premiums.)

Self-employed taxpayers may be able to deduct 100 percent of long-term care insurance premiums, subject to the maximum deductible amounts shown in the table, in arriving at their adjusted gross income.

Those who are chronically ill and receiving benefits under a long-term-care insurance policy can exclude these benefits from income. Generally, the long-term-care policy must have been issued after December 31, 1996 to qualify to be excluded from income. However, a grandfather rule is available in some circumstances. The maximum amount that can be excluded from income in 2017 is the greater of $360 per day, or the amounts incurred for qualified long-term-care expenses. Only amounts that will be included in income are benefits received that exceed the beneficiary’s total qualified long-term-care expenses, or $360 per day, whichever is greater.

If you believe a client will incur long-term-care costs in the future, when discussing the various options available for care, explain the current tax benefits available. Such tax benefits can help reduce the costs associated with long-term-care expenses. The potential tax savings from deductions for assisted living facilities, nursing homes, and continuing care retirement communities can be significant. Long-term-care insurance policies should be considered to help protect your client’s wealth from the rapidly rising costs of such care.