Journal of Financial Planning: January 2016

Greg Geisler, Ph.D., is an associate professor of accounting at the University of Missouri–St. Louis. He teaches a graduate course on taxes and investments. His work has been published in many journals, including the Journal of Financial Planning, Journal of Financial Service Professionals, State Tax Notes, and Tax Notes.

Executive Summary

- The tax savings on many employees’ contributions to a health savings account (HSA) increases wealth by more than an employer match on the same employees’ 401(k) contributions.

- In such cases, perhaps surprisingly, the maximum allowable HSA contribution should be made prior to the employee contributing any amount to his or her 401(k).

- The higher an employee’s combined tax rate, the larger the employer’s 401(k) match must be to beat contributing to an HSA first.

- The following is a proposed rank ordering of wealth-maximizing actions for investing and paying down debts: first, contribute the maximum to an HSA and contribute enough to a 401(k) to get the maximum employer match; if money is still available, next, pay down high-interest-rate debts; if money is still available, next, contribute to a 529 account if it produces state income tax savings and if funding future higher education costs of a loved one is important; and, if money is still available, contribute the maximum allowed for the year to unmatched retirement accounts.

Health Savings Accounts (HSAs), which require that an individual be enrolled in a high-deductible health plan (HDHP) to be set up, are quickly becoming very common. O’Brien (2015) reports that at the end of 2014, assets in all HSAs, both those provided by employers and those that are not, totaled $24.2 billion in almost 13 million accounts. Because they are taxed like a retirement account, HSAs should be compared to retirement accounts.

Financial planners should always find out if their clients are eligible to set up an HSA and, if they are, make appropriate recommendations about funding and taking distributions from it.

This article does not analyze whether an employee should choose a HDHP or a traditional health plan, if their employer offers both. Instead, this article provides financial planners with the tools needed to assess and perhaps recommend to individual clients HSAs as a wealth maximization option, where available. It also provides the tax-efficient rank ordering for contributing to HSAs, retirement accounts, 529 accounts, and for paying debts.

Overview of Health Savings Accounts

Assume an individual is enrolled in a HDHP and wants to contribute to his or her HSA. Such an individual cannot also be covered by a traditional health plan. For 2016, the maximum total contribution allowed from the employer and employee combined to an HSA is $3,350 for an employee with self-only health insurance coverage, and $6,750 for an employee with family coverage. These amounts are indexed for inflation. For an individual age 55 or over, an additional $1,000 contribution is allowed. Any employer contributions are tax free to the employee.

For a plan to be an HDHP, two requirements must be met. First, the annual deductible for 2016 can be no less than $1,300 for an individual employee’s self-only coverage and no less than $2,600 for family coverage. Second, the maximum annual deductible and other out-of-pocket expenses for 2016 can be no more than $6,550 for self-only coverage and no more than $13,100 for family coverage. These amounts are indexed for inflation.

An employee’s contributions to an HSA are not subject to federal income tax, state income tax (except in Alabama, California, and New Jersey), or FICA taxes if made through an employer’s HSA plan (in other words, out of pretax wages through a cafeteria plan). This is how most employees make their HSA contributions. Inside the HSA, the employee’s contributions are invested, and future earnings on such investments are also tax free.

Distributions from an HSA are tax free if used to either directly pay or get reimbursement for qualified medical expenses (QMEs) of the taxpayer, their spouse (if married), and any dependents claimed on the taxpayer’s federal income tax return.

QMEs are generally defined as out-of-pocket health care expenditures allowed as itemized deductions on an individual’s tax return. However, to be tax free, the distribution cannot be for QMEs that were taken as itemized deductions in any year, because “double-dipping” of tax benefits is not allowed (IRC Sec. 223(f)(6)). In most cases, this is not an issue, because each year QMEs up to 10 percent of adjusted gross income for taxpayers under age 65 (up to 7.5 percent of adjusted gross income for taxpayers 65 or older in 2016) do not increase total itemized deductions, so for any given year, most individuals do not include any of this category of expenses in total itemized deductions.

Generally, QMEs are out-of-pocket payments to health care, dental, and vision professionals, and for prescriptions. HDHP premiums are not considered QMEs and cannot be reimbursed from the HSA. Distributions cannot be for a QME from before the HSA was originally established, but otherwise, there is no time limit on a distribution from an HSA to reimburse a QME (IRS Notice 2004-50, Q&A No. 39).

For example, if an HSA was set up in 2010 and either the individual did not itemize deductions in 2013 or the individual did itemize deductions but the total did not include any medical expenses, QMEs for 2013 can be reimbursed tax free from an HSA in 2015. Alternatively, a conservative interpretation of the IRS guidance is that no QMEs from a prior year when medical expenses increased total itemized deductions can be reimbursed tax free from an HSA.

An individual in an HDHP is not allowed to contribute to a health care flexible spending account (FSA). Unlike an FSA, an HSA does not have a “use it or lose it rule,” and it is portable. If an individual leaves employment where enrolled in an HDHP and moves to an employer where they no longer have an HDHP, the employee can still use the HSA to reimburse QMEs tax free. Unlike from an FSA, the employee does not have to substantiate reimbursement of QMEs from an HSA. Instead, the individual simply puts receipts for QMEs in their tax file for the year of distribution in case the IRS ever audits the HSA distributions. Unlike an FSA, the HSA contribution amount does not have to be determined before the beginning of the year. In fact, HSA contributions by an employee can be changed monthly.

Before an individual is age 65, an HSA distribution that is not for QMEs is subject to both income tax and a 20 percent penalty tax. After an individual reaches age 65, such distribution is subject to income tax but not penalty tax. Distributions from an HSA, thus, should only be for QMEs.

Once an individual signs up for Medicare Part A, that individual can no longer contribute to an HSA, but he or she can continue to take distributions tax free from an HSA. Fidelity Benefits Consulting estimates that a 65-year-old couple retiring in 2015 with Medicare as their primary insurance will need $245,000 in today’s dollars for health care costs during retirement, excluding nursing home care. So the combination of reimbursement of old QMEs and the fact that the typical individual will have substantial amounts of QMEs after they can no longer contribute to an HSA means that building up an HSA while an employee and then taking tax-free distributions from it after retirement is a viable strategy.

Retirement Saving Options for an Employee

For an individual employee, typically the maximum they can contribute in 2016 to the combination of their 401(k) and Roth 401(k) retirement accounts is $18,000 ($24,000 if age 50 or over), and the maximum they can contribute in 2016 to the combination of their IRA and Roth IRA is $5,500 ($6,500 if age 50 or over). An HSA provides another opportunity for the typical employee to save for retirement. As Luebke (2012, p. 28) states, “HSAs can be funded even if the person has maxed out other tax-advantaged savings options.” These three types of retirement accounts will now be formally compared.

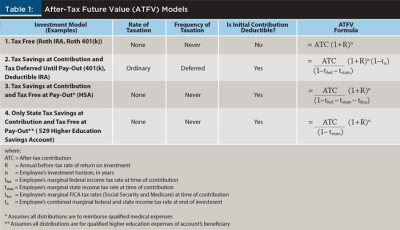

Table 1 contains formulas to calculate the after-tax future value of contributing to all three types of retirement accounts: (1) Roth; (2) tax deferred; and (3) HSA; as well as (4) 529 college savings account. For simplicity, the HSA formula and the remainder of this article assume the individual is an employee who has an HDHP and that he or she makes HSA contributions out of pretax wages through their employer’s HSA plan. Further assumptions are that the employee is a resident of a state with an income tax other than Alabama, California, and New Jersey. These assumptions result in the employee saving state income tax and FICA taxes on their HSA contributions.

Also for simplicity, and to focus on the employee’s tax savings, the remainder of this article ignores any employer contributions to the HSA and assumes all HSA distributions are for QMEs. Finally, formulas 2, 3, and 4 in Table 1 and the remainder of this article assume the individual does not itemize deductions on their federal income tax return.1

After-Tax Future Value (ATFV) Examples

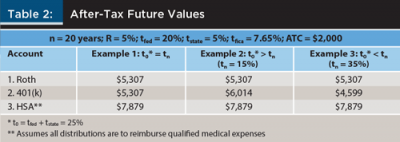

Reviewing Table 1, it is apparent that the HSA formula (3) will result in a higher after-tax future value (ATFV) than any of the other formulas given its substantial tax savings at contribution and no tax cost at distribution. How much wealthier does using an HSA to reimburse QMEs make an individual compared to an unmatched contribution to either a Roth retirement account (1), or a 401(k) (2)? Table 2 provides the answer for one set of facts. The fourth formula, a 529 account, is discussed later.

Reviewing Table 2, in the first example column, the Roth and 401(k) have equivalent ATFVs since t0 = tn. In the second example column, the 401(k) makes the employee wealthier than the Roth, because the tax rate at distribution is lower than the tax rate at contribution. In the third example column, the Roth makes the employee wealthier than the 401(k), because the tax rate at distribution is higher than the tax rate at contribution.

In all three examples, the HSA makes the individual much wealthier than contributing to either of the other two retirement accounts. This is true even if the contribution to the HSA is not left in the account for a long time.

For example, assume the same facts in Table 2 except that the contribution is withdrawn one year later instead of 20 years later. The ATFV for the HSA is $3,118. In contrast, if t0 = tn, the Roth and the 401(k) each have an ATFV of only $2,100. The HSA’s ATFV in both this example and in Table 2 is so much larger than either the Roth or the 401(k) that it raises the question of whether the HSA can increase wealth by more than a retirement account contribution that includes an employer’s matching contribution.

Next, HSAs will be compared to employer-matched 401(k)s. Adjusting the 401(k) formula (the second formula in Table 1) to incorporate the employer’s match on annual 401(k) contributions, the revised formula is:

[ATC / (1 – tfed − tstate)] (1 + m)(1 + R)n(1 – tn)

The only difference from the formula in Table 1 is multiplying the new term (1 + m), where m is the employer’s matching contribution percentage.2

Employer-Matched 401(k) versus HSA

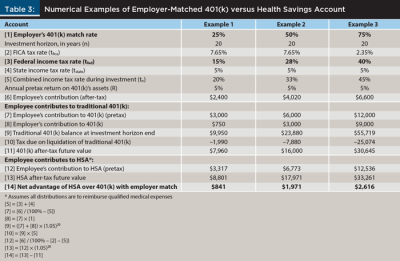

Three examples, summarized in Table 3, illustrate situations where an employee’s HSA contribution can increase wealth by more than an employer’s 401(k) match of 25, 50, and 75 percent, respectively. The first two examples assume salary does not exceed the Social Security tax base (and are subject to Social Security tax at a 6.2 percent rate, and Medicare tax at a 1.45 percent rate for a total FICA tax rate of 7.65 percent). The third example assumes the entire salary exceeds the Social Security tax base and is only subject to Medicare tax at a 2.35 percent rate (1.45 percent regular rate + 0.9 percent surtax rate).

Example 1 in Table 3 assumes an employee is subject to tax rates of 15 percent (federal), 5 percent (state), and 7.65 percent (FICA). Given these assumptions, the combined tax rate is the sum of the three rates (27.65 percent). Assume the employee’s salary is $50,000 and the employer 401(k) match is 25 cents per dollar contributed by the employee on the first 6 percent of salary. Finally, assume the employee contributes just enough to his or her 401(k) ($3,000) to get the maximum employer match ($750).

To summarize the 401(k), $3,000 is contributed before-tax ($2,400 / (1 − 0.15 − 0.05)) by the employee to his or her 401(k); this results in a $750 employer-matching contribution (25 percent). This all grows to $9,950 after 20 years (5 percent annual return); income taxes of $1,990 (20 percent) are paid and $7,960 remains. (The revised formula in the previous section was used to compute this ATFV.)

To summarize the HSA, $3,317 is contributed before-tax ($2,400 / (1 − 0.2765)). This grows to $8,801 (5 percent annual return) after 20 years. (The third formula in Table 1 was used to compute this ATFV.)

In conclusion for Example 1, contributing $2,400 after all taxes to an HSA increases wealth by more than contributing $2,400 after income taxes to a 401(k) with a 25 percent employer match, per dollar contributed by the employee.

Example 2 in Table 3 assumes an employee is subject to tax rates of 28 percent (federal), 5 percent (state), and 7.65 percent (FICA), respectively. The combined tax rate is the sum of the three rates (40.65 percent). Assume the employee’s salary is $100,000, and the employer’s 401(k) match is 50 cents per dollar contributed by the employee on the first 6 percent of salary. Finally, assume the employee contributes just enough to his or her 401(k) ($6,000) to get the maximum employer match ($3,000).

To summarize the 401(k), $6,000 is contributed before-tax ($4,020 / (1 − 0.28 − 0.05)) by the employee to his or her 401(k); this results in a $3,000 employer-matching contribution (50 percent). This grows to $23,880 after 20 years. Income taxes of $7,880 (33 percent) are paid, leaving $16,000 remaining.

To summarize the HSA, $6,773 is contributed before-tax ($4,020 / (1 − 0.4065)).3 This grows to $17,971 after 20 years.

In conclusion for Example 2, contributing $4,020 after taxes to an HSA increases wealth by more than contributing $4,020 after income taxes to a 401(k) with a 50 percent employer match.

Example 3 in Table 3 assumes an employee is subject to tax rates of 40 percent (federal), 5 percent (state), and 2.35 percent (FICA). The combined tax rate is the sum of the three rates (47.35 percent). Also, assume the employee’s salary is $200,000 and the employer 401(k) match is 75 cents per dollar contributed by the employee on the first 6 percent of salary. Finally, assume the employee contributes just enough to his or her 401(k) ($12,000) to get the maximum employer match ($9,000).

To summarize the 401(k), $12,000 is contributed before-tax ($6,600 / (1 − .45)) by the employee to his or her 401(k); this results in a $9,000 employer-matching contribution (75 percent). This grows to $55,719 after 20 years. Income taxes of $25,074 (45 percent) are paid, leaving $30,645 remaining.

To summarize the HSA, $12,536 is contributed before-tax ($6,600 / (1 − .4735)), and this grows to $33,261 after 20 years.4

In conclusion for Example 3, contributing $6,600 after taxes to an HSA increases wealth by more than contributing $6,600 after income taxes to a 401(k) plan with a 75 percent employer match.

Given the facts in these three examples, the employee would be wealthier contributing to their HSA compared to contributing to their employer-matched 401(k).

Break-Even Analysis

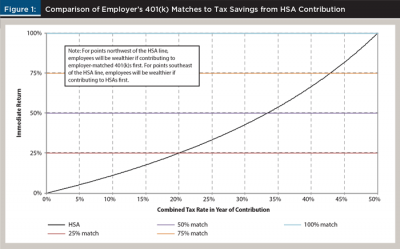

Figure 1 answers the question of whether employees should contribute first to their HSA or to their employer-matched 401(k). The parallel horizontal lines represent employer’s 401(k) matching percentages (25 percent, 50 percent, 75 percent, or 100 percent). The vertical axis is the immediate return from either the employer’s matching on a 401(k) or the tax savings percentage of an employee investing in an HSA. The horizontal axis is the combined tax rate (federal income, state income, Social Security, and Medicare) and runs from 0 percent to 50 percent. The curved line represents immediate tax savings (return) from investing in an HSA, given the combined tax rate. Because an HSA contribution is made with pretax dollars, immediate return is higher than the combined tax rate. A simple example illustrates this point. If $1 is the pretax contribution to the HSA and the employee’s combined tax rate is 20 percent, then the employee’s after-tax contribution is only 80 cents and the immediate tax savings of 20 cents represents a 25 percent immediate return (0.20 / 0.80).

The following summarizes Figure 1’s implications for wealth maximization:

- If an employee’s combined tax rate is greater than 20 percent, and his or her employer’s 401(k) match is 25 percent or less, contribute to the HSA before contributing anything to the 401(k).

- If an employee’s combined tax rate is greater than 33 1/3 percent, and his or her employer’s 401(k) match is 50 percent or less, contribute to the HSA before contributing anything to the 401(k).

- If an employee’s combined tax rate is greater than 42.86 percent, and his or her employer’s 401(k) match is 75 percent or less, contribute to the HSA before contributing anything to the 401(k).5

- If all three of the previous statements are false, then the wealth-maximizing order for the employee is to contribute enough to his or her 401(k) to get the maximum employer match before contributing to his or her HSA. In other words, for combinations of employer 401(k) match rate and combined tax rate that lie northwest of the HSA line, employees will be wealthier if contributing to an employer-matched 401(k) first, and for combinations that lie southeast of the HSA line, employees will be wealthier if contributing to HSA first.

Other Issues with Maximizing Contributions

Now that it has been established what to do first each year, how should the next most wealth-enhancing alternative be financed? At this point a financial planner might ask, “Why not tell the clients to contribute to both each year?” That may be appropriate advice for clients who do not spend too much of their annual cash inflow. However, many individuals do not contribute enough to their 401(k) to get the maximum employer match now, so even more individuals will be unable to make the maximum contribution allowable to their HSA and make a large enough contribution to their 401(k) to get the maximum employer match.

Fortunately, if the individual contributes to his or her HSA, there is a strategy to finance some or all of their 401(k) contributions that will receive the employer match. As Camp and Hulse (2008, p. 44) point out, “Even though it is preferred as a long-term investment, the HSA does present a short-term solution for those individuals with low or no liquid assets who have a current need to pay for medical expenses.”

The strategy is to take distributions from the HSA to reimburse all QMEs. The reimbursement from the HSA immediately increases after-tax cash flow by the amount of tax savings. The individual can use the tax savings as part of the QME reimbursement, leaving cash that was going to go to pay the QME available to finance other expenses and, thus, contribute more into the 401(k) than he or she would otherwise be able to. If despite following this strategy the employee still cannot contribute enough to his or her 401(k) to get the maximum employer match, refer to Geisler and Hulse (2014) for analysis of when a traditional 401(k) contribution increases wealth more than a Roth 401(k) contribution.

What to Do Next

Assume that financing the maximum contribution to the employee’s HSA and enough contribution to his or her 401(k) to get the maximum employer match is not an issue. What is the next most tax-efficient strategy for the employee with additional money available? The answer is to pay down high after-tax interest rate debts such as credit card balances.

For example, assume an individual has a $10,000 credit card balance with a 20 percent annual percentage rate. Further, assume the individual has a 25 percent combined tax rate and has an employer 401(k) match of 50 percent. Consistent with Figure 1, this individual should contribute enough to his or her 401(k) to get the maximum employer match of 50 percent first. Because the immediate return on the HSA contribution is 33.3 percent (see the HSA line in Figure 1 that shows a combined tax rate of 25 percent results in a 33.3 percent immediate return), contributing the maximum allowable to the HSA should be accomplished second. Third, any excess available money should go to paying down the credit card balance, since it results in immediate savings of 20 percent annual interest.

This rank ordering is based on relative returns: 50 percent match by the employer on the 401(k) contribution first; 33.3 percent tax savings from HSA contribution second; and 20 percent annual interest savings third. Note that there might be some non-tax reasons for using part of the available excess money for some purpose other than paying down the 20 percent credit card debt (for example, saving for the down payment on a home). Such reasons must be weighed against the additional interest costs of not paying down as much of the credit card debt as possible. In general, high interest rate debts should be rank-ordered by after-tax interest rate and paid off in order beginning with the one with the highest rate.

After paying off high-interest-rate debts, what is the next most tax-efficient savings vehicle? The answer is a 529 higher education savings account if the individual is a resident of a state that offers tax savings for contributions to such account. This is generally more wealth enhancing than unmatched investments in any retirement account, because such 529 contributions result in immediate state income tax savings yet no income tax payments upon distribution to pay qualified higher education expenses for the account’s beneficiary. Financial planners should keep in mind that not every client needs savings for future higher education costs. And even if there is such need, it is possible to save too much in 529s, but it is not possible to save too much for retirement. The former is possible when 529 savings exceed future qualified higher education expenses of the taxpayer’s beneficiaries.

After 529 contributions that result in state tax savings, the next most wealth-enhancing investment is to contribute to a retirement account that is unmatched by the individual’s employer. The issue is whether a contribution to a Roth 401(k), Roth IRA, (traditional) 401(k), or (traditional deductible) IRA is the most wealth enhancing.

Comparing Unmatched Retirement Account Contributions

First, a financial planner and their individual client should determine which of the four possibilities are available. Most commonly, a traditional 401(k) (or 403(b) or 457) is available. Far fewer employees can contribute to a Roth 401(k), although more 401(k) plans are adding this option each year. Roth IRAs are available to many individuals, but if their adjusted gross income (AGI) exceeds a threshold based on filing status, such opportunity phases out.

Specifically, for 2016, a married individual filing a joint tax return with their spouse can only make the maximum Roth IRA contribution of $5,500 for the year ($6,500 if age 50 or over) if AGI does not exceed $184,000. The threshold is $117,000 if filing status is single or head of household. Traditional IRAs where the individual can deduct his or her contribution are available to fewer individuals than Roth IRAs. If an employee is covered by a retirement plan through his or her employer and AGI does not exceed $98,000 if married filing jointly or does not exceed $61,000 if filing single or head of household, such individual can deduct up to $5,500 contributed to his or her IRA for the year ($6,500 if age 50 or over).

Once the financial planner determines which of the four options are available, the next step is to compare the individual client’s marginal income tax rate this year with their expected marginal income tax rate in the future (when taking distributions from the retirement account).

If t0 > tn, the traditional 401(k) dominates the Roth 401(k) and the traditional deductible IRA dominates the Roth IRA. If this is the case, the individual should contribute up to the maximum to the 401(k) and traditional deductible IRA, if eligible for the latter.

If both are available but the individual does not have enough money to contribute the maximum to both tax-deferred accounts, then the choice between an unmatched 401(k) contribution and an IRA contribution depends not on taxes, but on the investment choices inside the 401(k) and the annual investment fees on such choices. Typically, if the employer is large, the investment fees offered on some mutual fund choices inside the 401(k) are less than the individual could get buying the same mutual fund through his or her IRA. On the other hand, instead of a couple of dozen mutual funds offered by the typical 401(k), thousands of mutual funds, ETFs, and individual securities are available for investment inside an IRA.

If t0 < tn, the Roth 401(k) dominates the traditional 401(k), and the Roth IRA dominates the traditional deductible IRA. If this is the case, the individual should contribute up to the maximum to both the Roth 401(k) and Roth IRA, if the former is available and if eligible for the latter. If both are allowable but the individual does not have enough money to contribute the maximum to both Roth accounts, then, as in the preceding paragraph, the choice between an unmatched Roth 401(k) contribution and a Roth IRA contribution depends not on taxes, but on the investment choices inside the 401(k) plan and the annual investment fees on such choices.

If t0 = tn, then Roth and tax-deferred retirement account contributions are mathematically equivalent and the decision on which one(s) to invest in depends on three other factors. The first two favor Roths, but the third favors tax-deferred retirement accounts.

First, the maximum Roth and tax-deferred retirement account contribution amounts are the same. As stated earlier, if age is less than 50 at December 31, the maximum 2016 contributions into a combination of their 401(k) and Roth 401(k) are $18,000 ($24,000 if age 50 or over) and into a combination of their IRA and a Roth IRA are $5,500 ($6,500 if age 50 or over). However, Roth contributions are made with after-tax dollars, whereas tax-deferred contributions are made with pretax dollars, so effectively a greater amount of after-tax dollars can be contributed to a Roth account than to the corresponding tax-deferred account. This is relevant only when an individual has more than enough before-tax dollars to contribute the maximum to both a traditional 401(k) and, if eligible, a traditional deductible IRA. In such case, the individual will typically be wealthier contributing a higher amount of after-tax dollars into the Roth retirement account(s) compared to contributing a portion of the same amount of after-tax dollars (the maximum allowed) into a tax-deferred retirement account and the remaining portion into taxable investments.

The second factor is tax “diversification.” If an individual has no Roths or a small percentage of retirement assets in Roths, then contributing to a Roth might be wise, because it provides an additional option of where to take distributions from during retirement. This option to take distributions tax free can be valuable if in a future year the individual needs more cash to meet spending needs. But additional distributions from a tax-deferred retirement account would push them into a higher tax rate bracket.

The third factor is that tn is the “expected” tax rate in n years, which is uncertain. The tax benefits of a Roth are really unknown until the future year when distributions are being received and the taxpayer’s marginal tax rate becomes known. In contrast, t0 is the “actual” tax rate at contribution, so the exact amount of tax savings upon contribution to a tax-deferred retirement account can be determined. This favors contributing to a tax-deferred retirement account like a traditional 401(k) or, if eligible, a traditional deductible IRA.

Summary of Recommendations

The emergence of HSAs requires reexamining the traditional financial planning advice to first take advantage of the maximum employer-matching contribution to an employee’s 401(k) account. The proper rank-ordering of the annual wealth maximizing order to invest and pay down debts for an employee who is eligible to contribute to an HSA is the following:

First: if the return from the employee’s total tax savings on an HSA contribution is greater than the percentage of the employer’s 401(k) match (see Figure 1 to determine this), contribute the maximum allowed to an HSA.6 If not, reverse the first and second recommendations.

Second: contribute enough to the employee’s 401(k) account to get the maximum employer match.

If t0 < tn, contribute to a Roth 401(k), if available. If not available, contribute to a 401(k).

If t0 > tn, contribute to a (traditional) 401(k).

Third: pay off high-interest-rate debts. Pay off the one with the highest after-tax interest rate first.

Fourth: if paying for postsecondary education, contribute to a 529 higher education savings account (or accounts) if state income tax savings result.

Fifth: contribute to a retirement account (or accounts) unmatched by the employer.

If t0 < tn, contribute to a Roth 401(k) if available, and to a Roth IRA, if eligible.

If t0 > tn, contribute to a traditional 401(k) and to a traditional IRA if eligible and if it is deductible.7

For the second and fifth recommendations, if t0 = tn then Roth and tax-deferred retirement accounts result in the same ATFV if the same after-tax contribution is made to both. Given such tax rates, refer to the previous section to decide between contributing to a Roth or a tax-deferred retirement account.

When to Take Reimbursements from an HSA

Assume an individual contributing to an HSA has some QMEs this year. Should such QMEs be reimbursed from the HSA this year, or should they be financed from some other source and saved for reimbursement during the individual’s retirement years? Before answering this question, the most important issue for a financial planner is to have clients in HDHPs take advantage of their HSA by making significant contributions to it. The tables and figure in this article support this recommendation. To answer the question, the financial planner should determine where in the rank-ordering above the individual will finance the payment of the QME from. For example, if paying the QME (not out of the HSA) leads to a lower 401(k) contribution and reduces the employer 401(k) match or leads to more debt on a high interest rate credit card, then the individual should reimburse the QME from their HSA right away. In contrast, if the individual successfully completes the five recommendations in the rank-ordering, and paying the QME leads to less taxable (nonqualified) investing, then the individual would be wealthier if he or she leaves the money in the HSA where it can grow tax-free.

Conclusion

HSAs need to be incorporated into financial planners’ recommendations to individuals. The proper advice to some individual clients may be to maximize contributions to their HSA first and then contribute enough to their 401(k) to get the maximum employer match second—instead of the traditional advice to get the maximum employer 401(k) match first.

Endnotes

- Itemizing deductions would result in the following denominators for formulas 2, 3, and 4, respectively: (1 − tfed − tstate(1 − tfed)); (1 − tfed − tstate(1 − t) − tfica); (1 − tstate (1 − t)).

- Federal income tax law requires all employer-matching contributions on employees’ contributions to either a 401(k) or Roth 401(k) be made to employees’ (traditional) 401(k) account. For simplicity, an employer-matched Roth 401(k) contribution is ignored in the analysis

- The contribution to the HSA in this example is slightly larger than is allowed by law. The purpose of this example is to show it is realistic for an upper-middle-income individual to have a combined tax rate so high that contributing $1 after all taxes to their HSA results in a return higher than the 50 percent employer match on a $1 contribution after income taxes to their 401(k).

- The contribution to the HSA in this example is larger than is allowed by law. The purpose of this example is to show it is realistic for a high-income individual to have a combined tax rate so high that contributing $1 after all taxes to their HSA results in a return higher than the 75 percent employer match on a $1 contribution after income taxes to their 401(k).

- The graph ends when an employee’s combined tax rate is 50 percent. Such a combined tax rate, or higher tax rate, is rare. If an employee did have a tax rate above 50 percent, and his or her employer 401(k) match is 100 percent or less, contributing to the HSA before contributing anything to the 401(k) is the wealth-maximizing order.

- This assumes distributions from the HSA are for QMEs. If an HSA distribution is taken after reaching age 65 but it is not for reimbursement of QMEs, the entire distribution is subject to income tax. In such case, the ATFV formula becomes the same as investment model 2 in Table 1 (the tax deferred retirement account), and contributing to an HSA moves from the first or second recommendation to the fifth recommendation.

- Part of this hierarchy is adapted from Geisler (2006).

References

Camp, Julia M. Brennan, and David S. Hulse. 2008. “Using Health Savings Accounts as Long-Term Investment Vehicles.” Journal of Financial Service Professionals 62 (1): 36–45.

Geisler, Gregory G. 2006. “The Best Use of Spare Cash.” Journal of Accountancy 202 (3): 41–43.

Geisler, Greg, and David Hulse. 2014. “Traditional versus Roth 401(k) Contributions: The Effect of Employer Matches.” Journal of Financial Planning 27 (10): 54–60.

Luebke, Brittany R. 2012. “Create a Retirement Savings Strategy Using a Health Savings Account.” Journal of Financial Service Professionals 66 (1): 27–29.

O’Brien, Elizabeth. 2015. “Health Savings Accounts Gain Acceptance as Retirement Tool.” MarketWatch.com, May 28.

Citation

Geisler, Greg. 2016. “Could a Health Savings Account Be Better than an Employer-Matched 401(k)?” Journal of Financial Planning 29 (1): 40–48.