Journal of Financial Planning: February 2017

Who would have thought that a comedian’s video about 401(k) plans would go viral? Yet that’s what happened last spring when comedian John Oliver, host of HBO’s “Last Week Tonight,” riffed on the “rip-off” plan an adviser tried to sell his firm, ensuring that everyone knows how unwary 401(k) plan sponsors can find themselves—and their staffs—dramatically overpaying to save for retirement. He went on to share his take on how much of the financial services industry is fighting against the requirement to put savers’ interests ahead of our own, and most so-called financial advisers have little training and less regulation. As a result, we all have some reputational repair work to do.

Whether the Department of Labor (DOL) Conflict of Interest Final Rule (the fiduciary rule) actually takes effect in April—with a Trump presidency and Republican-led Congress—there’s no denying that a lot of change is already underway. In that sense, the fiduciary wave has hit the financial services industry in a similar manner to the way the Y2K wave hit computer technology back in the 90s. Although the entire computer world did not crash when the digital calendars shifted to the year 2000, most people considered the huge amount of time and money invested in updating their systems well spent. So it is worthwhile to take the new regulations seriously, along with the new guidance that the DOL published just prior to the election. Making sure that you are expertly and compliantly managing your clients’ hard-earned money, and communicating that fact to your clients, can’t hurt. There’s a trust gap, and many honorable advisers are working hard to bridge it.

Trust is no flash-in-the-pan issue. People’s concerns are real. Not because of you—because of them. The fastest-growing age group is centenarians, and your clients may figure they better prepare to join them. They need their retirement savings to last and last and last. Retirement in the age of longevity is still very much an economic experiment, and nobody knows how the mass affluent will fare.

For advisers, retirement planning for the “we’ll-live-longer generation” is a business adventure, and our best map is a well-developed process. But the transition to the new, DOL-sanctioned fiduciary process may lead you into unknown territory. Here is a brief introduction to the landscape.

What Does “Fiduciary” Really Mean?

In late 2016, the DOL published 24 pages of answers to frequently asked questions on the fiduciary rule and the document that exempts certain accounts, called the Best Interest Contract Exemption (visit dol.gov and search “Conflict of Interest Exemptions FAQs”). It starts by restating the basic concept that being a fiduciary means putting clients’ interests ahead of your own. But how? And when? Let’s get some detail.

As fiduciaries, you are responsible for demonstrating care, skill, prudence, and diligence in:

- Selecting and maintaining investment choices;

- Ensuring that retirement plan fees (including investment expenses) paid from participant accounts are reasonable; and

- Ensuring that the plan is properly administered in accordance with the plan document, and with ERISA and DOL mandates.

And the DOL’s fiduciary rule extends the fiduciary duty to Individual Retirement Accounts—in other words, the bulk of many clients’ investible assets.

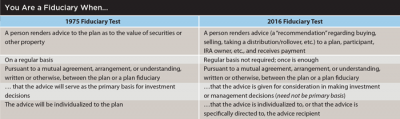

What’s new about being a fiduciary today is that when it comes to retirement plans, it’s nearly impossible to evade your responsibility. The table compares the definition of a fiduciary to a retirement plan based on the 1975 DOL rules to the rules scheduled to take effect this year. It’s interesting to note the 1975 test was a five-part test in which all five parts had to be met in order to be held to the fiduciary standard. With the new rules scheduled to take effect in April, almost any advice to the plan or a plan participant, even if it is not the primary basis for making investment decisions, must be fiduciary advice. According to the DOL, you escape the rule if you execute transactions solely at a customer’s direction, without offering advice; or if you receive no compensation, whether direct or indirect, as a result of providing advice (but this is not what most financial planners do).

What’s Changing?

The new DOL rule is about 1,000 pages long, and the government has published only its first phase of guidance for how the rule is to be followed. At my firm, we are watching the developments carefully. Here’s a brief synopsis of what we know:

A gradual transition. Several elements of the rule go into effect as of April 10, 2017—at the apex of tax season, of course! At that point you will be required to act impartially on behalf of your client, and to avoid most conflicted transactions. But there are some specific exceptions. In a few cases, institutions serving non-ERISA retirement plans and IRA holders may have a more flexible set of rules. For instance, under certain situations these institutions would not need affirmative consent for some transactions, and could rely on negative consent. And existing clients may be informed by negative consent until January 1, 2018. By January 1, 2018, however, all advisers and institutions will have to comply fully with the rule.

During the transition period, the DOL has stated that it will focus on “compliance assistance.” The DOL is also working on outreach to plan participants so they will understand the benefits of the fiduciary rule.

Fees on the level. One of the major changes is “level-fee” compensation. This means you can’t receive a different level of compensation for one product versus another in the same category. For example, if you’re selling mutual funds, you will no longer be able to accept higher payouts on your firm’s proprietary fund, trails on certain funds and not others, or other forms of variable payments. This also holds for annuities, alternative investments, managed accounts, or other products. All members of each product category must provide the same return—to the adviser. The DOL believes that this will eliminate biases toward higher-paying products, whether recommended consciously or unconsciously.

The DOL is looking to eliminate both prohibited transactions and conflicts of interest. Even fee-only advisers can create conflicts if they are moving a plan participant’s money from a plan to an individual IRA with ongoing fees, according to the DOL FAQ. How can an adviser deal? With a BICE that explains the rollover.

Roll the BICE. Advisers who do not comply with level fee or other DOL regulations, or who are suggesting rollovers from a plan that they advise, must provide clients with a “Best Interest Contract Exemption” or BICE. This exemption document —which clients must sign upon opening an account—may well be the most complex element of the new rule, and broker-dealers, custodians, and compliance experts are scrambling to put legal wording in place. The BICE contract must identify any potential conflicts the adviser faces, as well as whether he or she sells proprietary products or receives third-party payments tied to specific products. The BICE also has to affirm the client’s right to complete fee information and provide a web address where details on the adviser’s compensation can be found.

While this sounds burdensome, the way it will likely play out is fairly straightforward: if you are paid for advice, and not for products, you’re in the clear (provided the advice is up to the fiduciary standard). If you recommend that a client move money from a 401(k) to a rollover IRA that you will manage, you have to disclose the difference in cost to the client. And if you are paid for products, you will have to disclose it.

Outsourcing for Simplicity

As a plan adviser, you can outsource fiduciary responsibility for retirement accounts to an investment manager that is under one of two regulations ERISA 3(21) or ERISA 3(38). Of the two, ERISA 3(38) is the most complete. The table above looks at them side by side.

Advisers who outsource to an ERISA section 3(38) investment manager to provide an investment lineup for 401(k) plans or to manage individual clients’ retirement portfolios do not have to worry about running afoul of this particular element of the DOL fiduciary rule. Until you feel comfortable with the new fiduciary requirements for 401(k)s, outsourcing may be a route to comfort—especially if serving retirement plans is not the main focus of your practice.

The DOL rule’s requirements are causing tremendous change in the industry, with alterations to adviser compensation structures galore. Some firms are transitioning from commissions to fees; others are sticking to their “grid” but adding new forms and processes for retirement accounts. The most important thing for advisers is to prepare. Advisers may wish to upgrade their practices even if the new folks in Washington delay or abandon the rule. Just as with Y2K, when that calendar page turns, you want your business to keep on humming.

Nicole Newlin is president of Efficient Advisors (www.efficientadvisors.com), a Philadelphia-based fiduciary 3(38) investment manager and turnkey asset management firm that works with financial advisers to bring low-cost investing to their clients.