Journal of Financial Planning: February 2013

Executive Summary

- Retaining client confidence during difficult market times is often a challenge for financial planners. Previous studies have found participants under risk tend to “offload” financial decision making to experts. This paper extends those studies, and the findings suggest that the presence of a Certified Financial PlannerTM (CFP®) certification brings more certainty to investors during times of market underperformance.

- The study uses functional magnetic resonance imaging (fMRI) to record the neural activations of participants during a stock market game. Employing four different investment strategies, the experiment compares participants’ brain activity in regions associated with continued decision making and error detection when employing an adviser who does not have CFP certification versus an adviser who is a CFP certificant.

- Greater brain activations were associated with the use of a non-certified adviser than when relying on CFP certificants during times the adviser is underperforming the market. In contrast, the experiment found no significant differences in brain activations between advisers with or without the certification during outperformance of the market.

- To the extent that maintaining a consistent investment strategy during inevitable market fluctuations is a desirable goal, the behavioral and neurological impact of a credential of expertise, such as the CFP marks, may benefit clients by engendering relatively greater confidence during temporary periods of underperformance.

Russell N. James III, J.D., Ph.D., CFP®, is associate professor and CH Foundation chair in personal financial planning at Texas Tech University. He conducts neuroimaging research related to financial decision making at the Texas Tech Neuroimaging Institute.

A core challenge in managing client investments is the ability to retain client confidence during periods of underperformance. Conceptually, it is easy to understand that no strategy, regardless of its long-term validity, will outperform the overall market every hour, every day, or every quarter. Similarly, the idea that greater returns can be obtained by those willing to accept greater variation in short-term outcomes is easy to grasp. However, the emotions associated with experiencing underperformance and relative loss can make the application of these simple ideas challenging for clients. It is at these critical times that trust in the expertise of a financial adviser can enhance the ability of clients to maintain a consistent investment strategy.

In general, people are more likely to accept advice from those perceived to be experts (Harvey and Fischer 1997), suggesting that designations of expertise may be particularly important. Although there are a wide variety of potential credentials that financial advisers may obtain, by far the most popular and recognized is the Certified Financial PlannerTM (CFP®) professional (Altfest 2004; Swan 2003).

Previous research has shown that clients prefer advisers to have the CFP certification. In a survey conducted by Bae and Sandager (1997), 92 percent of respondents preferred a financial planner to have the CFP certification. Hence, this study chose to use the CFP mark as a comparison. (Note: This study compares CFP certificant advisers with advisers who do not have the CFP certification. We might expect similar results where other respected designations are compared with non-credentialed advisers.)

This paper explores the impact of adviser CFP certification on client neurological activity in an adviser-intermediated stock-market game. Specifically, it explores whether clients are more likely to engage in mentally questioning or “second guessing” a non-certified adviser compared with a CFP professional. Investigating such an issue requires estimating what such second-guessing might look like from a neurological perspective. Here, “second guessing” describes a client who, after retaining an adviser, does not rest comfortably with that decision, but instead continues to reconsider, intently searching for (and perhaps finding) perceived adviser errors. When defined in this manner, more second guessing of an adviser may be associated with greater brain activation in regions associated with continued decision making and error-detection processing after the adviser has been retained. To the extent that this type of activity is greater when employing a non-certified adviser as contrasted with a CFP certificant adviser, it provides evidence to support the proposition that clients are more likely to engage in questioning or second-guessing a non-certified adviser.

Neuroimaging Research

A wide range of neuroimaging studies have explored the neural correlates of decision making. Deliberative decision making does not engage only one isolated region of the brain, but also implicates a widely distributed network of brain regions.

Krain et al. (2006) completed a meta-analysis of 27 neuroimaging studies exploring decision making. Using an activation-likelihood estimation to combine results from all of these neuroimaging studies, they found associated activations in several brain regions, including the superior/middle/medial/inferior/orbito frontal gyri, insula, superior/inferior parietal lobules, precuneus, postcentral gyrus, caudate, thalamus, cerebellum, middle occipital and temporal gyri, and fusiform gyrus. The authors made an additional meta-analysis of 14 neuroimaging studies that involved ambiguous decision making, where the probabilities of outcomes were not known in advance. Such ambiguous decision making is particularly relevant for selection of an investment adviser or investment strategy because such real-world decisions do not come with known probabilities of specific outcomes. The combined results of these 14 studies showed activation in the anterior cingulate cortex, cingulate cortex, superior/middle/inferior frontal gyrus, insula, precuneus, superior/inferior parietal lobule, angular gyrus, thalamus, caudate, and postcentral gyrus.

The anterior cingulate cortex, in addition to its involvement in the network for ambiguous decision making, also has been specifically implicated in error detection (sometimes referred to as “online monitoring”) (Carter et al. 1998). Particularly relevant for the context of employing an investment adviser, this error-detection function of the anterior cingulate cortex specifically includes detecting errors made by others (Kang et al. 2010; Newman-Norlund et al. 2009; de Bruijn et al. 2009).

For example, Apps, Balsters and Ramnani (2012) found evidence that this region is specifically involved in monitoring the outcome of others’ decisions, such as would be the case for one closely monitoring the performance of an investment adviser. Increased activation of the anterior cingulate cortex may specifically reflect the kind of careful monitoring that would be expected where a client is second-guessing the management of an adviser. Thus, in addition to its role in general decision making, this region is particularly relevant for the current hypothesis.

Little neuroimaging research exists on the impact of expertise in a financial context. Perhaps the most closely related experiment was conducted by Engelmann et al. (2009). In that experiment, participants chose between a certain payout and a gamble. The gamble had known payouts with known percentage chances of success. In some trials, either the certain payout or the gamble had an arrow pointing to it, indicating that it was recommended by an expert, and in other trials no arrow appeared. Engelmann et al. (2009) found value-calculating brain regions were more active in the absence of the advice. This supported “the hypothesis that one effect of expert advice is to ‘offload’ calculations” (p. 5)—that is, participants were less likely to mentally calculate the relative value of the different outcomes when there was a recommended option.

This “offloading” hypothesis is similar to that proposed in the current study. However, the current investigation differs in important ways. First, Engelmann et al. (2009) contrasted expert advice with no advice. This study contrasts two sources of professional investment advisement, one with a certification and one without. Second, Englemann et al. (2009) explored a decision involving risk (a gambling task with known risks). This study explores a decision involving ambiguity because the likelihood of different outcomes associated with each adviser is unknown. Accordingly, the task in Englemann et al. (2009) always had a right answer, in the sense of maximizing expected value, which could be determined by simple mathematical calculations. In this sense, the lack of mental calculations occurring in the presence of expert advice may be seen as a negative (or non-maximizing) consequence. Conversely, when investing, frequently focusing on short-term returns is likely to reduce overall success (Thaler et al. 1997), making such constant calculation a potentially negative (or non-maximizing) approach.

Methods

Participants: Nineteen female volunteers participated in this study. This number of participants is within the range commonly used in neuroimaging studies. For example, in an appendix focused on the issue of appropriate subject numbers for functional magnetic resonance imaging studies, Friston (2012) suggests “the optimal sample size for a study is between 16 and 32 subjects.”

It is common in neuroimaging studies to use a single gender for all participants where gender-related differences are not the primary focus of the research. This helps increase the images’ structural and functional similarity.

Participant ages ranged from 20 to 31, with a mean age of 24.1. None were in finance-related degree programs or had previous industry experience in financial services. Before entering the scanner, participants were provided with definitions of financial terms used in the experiment, including “stocks,” “return,” “market return,” “dividend,” and “financial planning firm.”1

Experiment: After being placed in the fMRI scanner and receiving an initial high-resolution brain scan, participants completed several unrelated tasks that familiarized them with observing the screen and using the response buttons. Participants had four response buttons, two in their left hand and two in their right hand. The adviser-intermediated stock-market game was then explained to the participants with the following instructions.

Next you will play a stock-market game. The participant who accumulates the most money in this game will be paid $250. Instead of picking stocks, you will select among four financial planning firms. These advisers will invest in stocks for you based on one of four strategies. You may change firms at any time, as many times as you like. There is no cost to change firms. The four financial planning firms are (A) The Able Firm, (B) The Baker Firm, (C) The Clark Firm, and (D) The Davis Firm.

The Able Firm follows a TRENDS strategy immediately selling stocks that are falling and buying stocks that are rising. The Baker Firm follows a GROWTH strategy buying stocks in companies that are growing. The Clark Firm follows a VALUE strategy buying “cheap” stocks in companies with a lot of assets but low stock price. All advisers in the Clark firm are Certified Financial Planners. A CFP [certificant] must have years of experience, a college degree with investment coursework, must pass a series of rigorous exams and continually complete ongoing education in investing. The Davis Firm follows an INCOME strategy buying stocks in companies that pay high dividends (income). All advisers in the Davis firm are Certified Financial Planners.

After each round you will see your percentage return (gain or loss) for that round and the overall market return for that round. You may change advisers at any point by clicking on the relevant button: left button/left hand for Able; right button/left hand for Baker; left button/right hand for Clark; right button/right hand for Davis .… Choose your initial adviser now. You may change at any point by pressing the appropriate button.

Participants controlled the advancement of the instruction text to ensure sufficient time for reading. They chose their initial adviser before the start of the game. During the presentation of instructions and throughout the game, photos of the four advisers were displayed below their name (Able; Baker; Clark, CFP®; Davis, CFP®) and above their strategy (TRENDS; GROWTH; VALUE; INCOME). During the game, market results were displayed on the top half of the screen with the text:

This round the market was up [down] x.x percent

Your investments were up [down] x.x percent

Each market result was displayed for four seconds, after which a new market result was displayed for four seconds. After six such market reports, subjects had an 11-second rest period, during which the screen text indicated:

You may change your adviser at any point by clicking the relevant button. The market will begin again in a moment.

After 36 market reports (six sets of six reports), subjects were introduced to a new set of financial advisers with the instructions:

For the second half of the game, the adviser firms are (A) The Adams Firm, (B) The Brown Firm, (C) The Cook Firm, and (D) the Dale Firm. All firm strategies are as described previously for TRENDS, GROWTH, VALUE, and INCOME. All advisers in the Adams Firm and the Brown Firm are Certified Financial Planners. Choose your initial adviser now.

The game was then played for an additional 36 market reports (six sets of six reports), for a total of 72 market reports. In addition to this division between the first and second half of the game, adviser images also were varied between group A (10 participants) and group B (nine participants), so that as a result, CFP certificants were balanced with non-certified advisers in terms of age (older, younger), dress (more formal, more casual), and investment strategies (trends, growth, value, and income).

All participants experienced market returns preset to be flat (0.5 percent to 3 percent) for the first 12 reports, high (10 percent to 20 percent) for the next 12 reports, and low (-10 percent to -20 percent) for the following 12 reports. For the second half of the game, after presentation with a new set of advisers, market returns were preset to be high (10 percent to 20 percent) for the first 12 reports, low (-10 percent to -20 percent) for the next 12 reports, and flat (0.5 percent to 3 percent) for the final 12 reports. Similarly, the adviser selected by each participant outperformed the market by 1 to 5 percentage points during market reports 1–6, 13–18, 31–36, 43–48, 55–60, and 67–72. During all other market reports, the adviser selected by each participant did worse than the market by 1 to 5 percentage points.

Participants were unaware that their selection of advisers did not actually affect their reported returns. (The winning player was determined by adherence to pre-determined market strategies.) Thus, in total, all participants experienced an equal number of market reports where advisers outperformed and underperformed the market, and an equal number of market reports in high, flat, and low markets.

Results

On average, participants employed CFP certificant advisers for 62.5 percent of each game, and non-certified advisers for 37.5 percent of each game. This ratio was similar during periods of both market underperformance and outperformance. Because of the very high proportion of CFP certificants selected to begin each half of the game (73 percent CFP certificants versus 27 percent non-certified advisers), switches made during the game were slightly more likely to be from a CFP certificant to a non-certified adviser (55 percent) than the reverse (45 percent). As expected, underperforming periods were associated with greater frequency of adviser switching. Nearly 75 percent of all adviser switches occurred during underperforming periods.

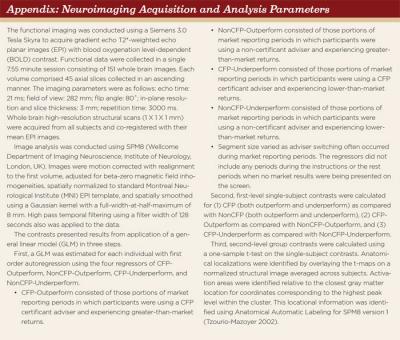

The fMRI analysis compared brain activations when participants were using CFP certificant advisers versus brain activations when participants were using non-certified advisers. Comparisons were made only during market-reporting periods and excluded rest times or times during the presentation of instructions. This comparison was made (1) overall, (2) during periods of outperforming the market, and (3) during periods of underperforming the market. Details of neuroimaging data collection and analysis are presented in the appendix on page 58.

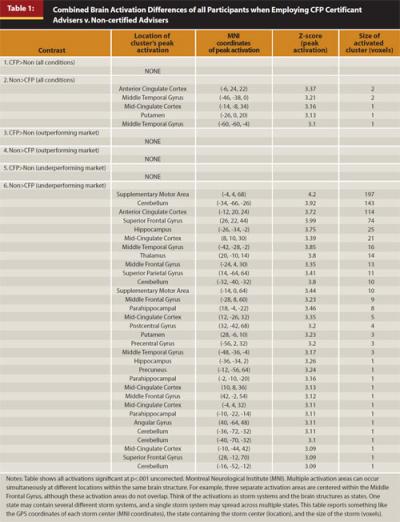

Table 1 displays results from the fMRI analysis combining the activations of all participants. The table shows only those activations significant at p<.001. Beyond this threshold level, greater relative strength of association is noted by a higher Z-score. (The activations shown here do not survive Bonferroni or family-wise error correction, although reporting findings using an uncorrected p<.001 threshold is not uncommon in neuroimaging research.)

The first column notes the two conditions being contrasted. There were no periods in which any region of brain activation was significantly greater when participants were employing a CFP certificant compared with a non-certified adviser (labeled as “CFP>Non” in). In contrast, there were several periods during which brain activation was significantly greater when participants were employing a non-certified adviser compared with a CFP certificant (labeled as “Non>CFP”).

When examining all market periods together, only very minute areas of increased activation occurred when participants employed non-certified advisers. These differences were relatively weak and quite small, comprising only seven voxels in total. (Here, each voxel represents a 3 millimeter cubed region of the brain).

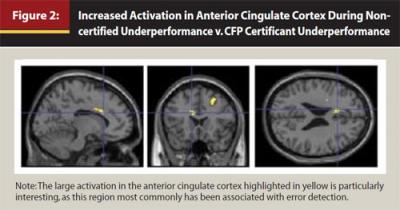

When examining only those market periods when advisers were outperforming the market, no significant differences in brain activation occurred when comparing CFP certificant advisers with non-certified advisers. However, when examining market periods in which advisers were underperforming the market, several large brain regions demonstrated significantly greater activation when participants were employing a non-certified adviser, labeled in Table 1 as “Non>CFP (underperforming market).” In total, 696 voxels showed greater activation with non-certified advisers. These differences are visually demonstrated in Figure 1, which displays all regions of significant activation (p<.001) resulting from combining activations from all 19 participants.

The following areas of increased activation occurred in brain structures that also were implicated in the meta-analysis of decision making or decision making under ambiguity by Krain et al. (2006): cerebellum, anterior cingulate cortex, superior/middle frontal gyrus, mid-cingulate cortex, middle temporal gyrus, thalamus, superior parietal gyrus, postcentral gyrus, middle temporal gyrus, precuneus, and angular gyrus.

The additional activations in the supplementary motor area and precentral gyrus may be explained by the button-pressing required to change advisers, as these regions are associated with finger movement (Sadato et al. 1997).

The hippocampus and parahippocampal activation were not common to decision-making studies, but are commonly related to memory recall (Henke et al. 1997). In this experiment, participants may have been attempting to consider the previous record of the adviser or the records of advisers previously selected, which would necessitate recalling past performance.

Thus, the current results support the idea that a greater level of continued decision-making activations occurred when participants employed an underperforming non-certified adviser compared with an underperforming CFP certificant adviser. Rather than comfortably resting with one’s selection of an adviser, this increased activation suggests a much higher level of mental questioning or second-guessing with the non-certified adviser.

The large activation in the anterior cingulate cortex highlighted in Figure 2 is particularly interesting, as this region most commonly has been associated with error detection, and even specifically with detecting errors made by another person (Kang, Hirsh, and Chasteen 2010). Conceptually, the idea of detecting an error made by another person is exactly what would occur when a client engages in second-guessing the choices of an investment adviser.

Discussion

Findings from Englemann et al. (2009) suggest that participants “offloaded” financial decision making under risk in the presence of expert financial advice as contrasted with no advice. The current results correspond with this general concept, but extend the findings.

First, instead of comparing expert advice to no advice, the current results compare more expert management (CFP certificant adviser) to less expert management (non-certified adviser).

Second, instead of examining a decision involving known risk, the current results explore a decision involving ambiguity. This second distinction is particularly important for understanding the implications of the two findings. In the context of a gamble with known outcome probabilities, expected returns can be maximized by completing the mathematical calculation allowed by such precise risk information. In this context, a reduction in effort associated with such mathematical calculations naturally would result in worse expected outcomes. As such, offloading may be seen as a negative outcome in such scenarios. This negativity was made extreme in popular media interpretations of the results (see, for example, headlines such as “Given ‘Expert’ Advice, Brains Shut Down” (Keim 2009).

However, the real world of investing in markets does not come with precisely known outcome probabilities. Even the best investment strategies will have periods of underperformance. Unfortunately, a focus on the experience of losses can lead investors to move away from better investments with greater long-term returns toward low variance investments with poorer returns as shown in Thaler et al. (1997).

In the current adviser-intermediated stock-market game, each adviser was associated with a specific market strategy. Thus, when presented with immediate negative results, participants not only changed advisers, but also changed investment strategies. The pain of temporary underperformance can lead to poor investment choices. Better choices result when the pain of temporary underperformance is reduced. As Read, Loewenstein and Rabin (1999) explained,

Over brief periods, stock prices are almost as likely to fall as to rise. For loss-averse investors, the falls will be extremely painful and the rises only mildly enjoyable, so the overall experience might not be worth undertaking. By this logic, if people could resist looking at their portfolios for longer periods—i.e., bracket their investment choices more broadly—the likelihood that they would see such losses would diminish, and the clear benefits of stocks would emerge. (p. 180)

Other studies have shown that training people to bracket results—that is, pay little attention to individual returns, but focus on the long-term strategy—can substantially improve choices and outcomes (Sokol-Hessner et al. 2009). Thus, where offloading of decision-making effort in a precisely known gambling context may reduce expected outcomes, in an ambiguous market investment scenario, offloading in the face of negative returns can produce much better outcomes.

Maintaining a consistent market strategy may require some form of offloading the decision making and error detection that naturally occurs when experiencing a loss. This ability to ignore short-term returns may come from choosing not to observe the portfolio, from thinking of returns in larger bracketed chunks, or from trusting in an investment adviser who pursues a consistent strategy.

The current fMRI results suggest that having certainty in a financial adviser during such periods of underperformance is influenced by the presence of CFP certification. (The degree to which these findings apply to non-experimental investment decisions is not certain.) This is not to suggest that CFP certificant advisers are inherently superior, but rather that participants reacted differently to advisers with the CFP certification. The absence of CFP certification in an underperforming adviser led to relatively more ongoing activation in participants’ decision making and error detection, suggesting less certainty and more second-guessing. The presence of the CFP certification may increase investor certainty during periods of adviser underperformance, and thus support investors’ ability to maintain a consistent investment approach during inevitable periods of underperformance.

This study examines brain activations during a financially incentivized, adviser-intermediated stock-market game. The degree to which these findings apply to non-experimental investment decisions is not certain. Further, this study compares CFP certificant advisers to advisers without the CFP marks, and thus casts no light on the value of any other form of professional credentialing or designations.

Acknowledgements: I am grateful for the invaluable assistance of Sandra Huston, Ph.D., Michael O’Boyle, Ph.D., and Ph.D. candidate Benjamin Cummings, all of Texas Tech University.

Endnote

- The Institutional Review Board of Texas Tech University reviewed and approved the experimental processes. All subjects provided written informed consent after the details of the study were explained to them.

References

Altfest, Lewis. 2004. “Personal Financial Planning: Origins, Developments, and a Plan for Future Direction.” The American Economist 48, 1: 53–60.

Apps, M. A., J. H., Balsters, and N. Ramnani. 2012. “The Anterior Cingulate Cortex: Monitoring the Outcomes of Others’ Decisions.” Social Neuroscience 7, 4: 424–435.

Bae, Sung C., and James P. Sandager. 1997. “What Consumers Look for in Financial Planners.” Financial Counseling and Planning 8, 2: 9–16.

Carter, Cameron S., et al. 1998. “Anterior Cingulate Cortex, Error Detection, and the Online Monitoring of Performance.” Science 280, 5364: 747–749.

de Bruijn, Ellen R. A., et al. 2009. “When Errors Are Rewarding.” The Journal of Neuroscience 29, 39: 12183–12186.

Engelmann, Jan B., et al. 2009. “Expert Financial Advice Neurobiologically ‘Offloads’ Financial Decision-Making Under Risk.” PLoS one, 4, 3: e4975.

Friston, Karl 2012. “Ten Ironic Rules for Non-Statistical Reviewers.” NeuroImage 61, 4: 1300–1310.

Harvey, Nigel, and Ilan Fischer. 1997. “Taking Advice: Accepting Help, Improving Judgment, and Sharing Responsibility.” Organizational Behavior and Human Decision Processes 70, 2: 117–133.

Henke, Katharina, et al. 1997. “Human Hippocampus Establishes Associations In Memory.” Hippocampus 7, 3: 249–256.

Kang, Sonia K., Jacob B. Hirsh, and Alison L. Chasteen. 2010. “Your Mistakes Are Mine: Self-Other Overlap Predicts Neural Response to Observed Errors.” Journal of Experimental Social Psychology 46, 1: 229–232.

Keim, Brandon 2009. “Given ‘Expert’ Advice, Brains Shut Down.” Wired, (March 25): www.wired.com/wiredscience/2009/03/financebrain/

Krain, Amy L., et al. 2006. “Distinct Neural Mechanisms of Risk and Ambiguity: A Meta-Analysis of Decision-Making.” NeuroImage 32, 1: 477–484.

Newman-Norlund, Roger D., et al. 2009. “Self-Identification and Empathy Modulate Error-Related Brain Activity During the Observation of Penalty Shots Between Friend and Foe.” Social Cognitive and Affective Neuroscience 4, 1: 10–22.

Read, Daniel, George Loewenstein, and Matthew Rabin. 1999. “Choice Bracketing.” Journal of Risk and Uncertainty 19, 1: 171–197.

Sadato, Norihiro, et al. 1997. “Role of the Supplementary Motor Area and the Right Premotor Cortex in the Coordination of Bimanual Finger Movements.” The Journal of Neuroscience 17, 24: 9667–9674.

Sokol-Hessner, Peter, et al. 2009. “Thinking Like a Trader Selectively Reduces Individuals’ Loss Aversion.” Proceedings of the National Academy of Sciences 106, 13: 5035–5040.

Swan, George. 2003. “A Multidisciplinary Bar and Financial Planners: The Recommendation of the District of Columbia Bar Special Committee on Multidisciplinary Practice.” Capital University Law Review 32: 369–405.

Thaler, Richard H., et al. 1997. “The Effect of Myopia and Loss Aversion on Risk Taking: An Experimental Test.” The Quarterly Journal of Economics 112, 2: 647–661.

Tzourio-Mazoyer, et al. 2002. “Automated Anatomical Labeling of Activations in SPM Using a Macroscopic Anatomical Parcellation of the MNI MRI Single-Subject Brain.” NeuroImage 15, 1: 273–289.