Journal of Financial Planning: February 2013

It is more challenging today for financial planners to articulate our value proposition to clients, especially if what we base our relationships on primarily consists of investment returns. With the challenging economy, low financial returns, and employment uncertainty, clients question how we can justify our fees. Our current financial planning practice standard includes investment management, estate planning, risk management, income tax planning, retirement planning, and employee benefit planning. Not included in this standard is arguably our clients’ most valuable asset—their career or human capital equity and the service I call career asset management.

I first began advocating that our business model needed to include career asset management in 2005, well before the Great Recession. Today it is more relevant than ever as we transition to an economy based on human capital.

Career, the New Asset Class

When creating a truly holistic financial plan, planners should expand the traditional view of asset classes to include career as an emerging, vital element in the data gathering, analysis, and development phases of traditional financial planning. Like traditional cash, stocks, bonds, and real estate asset classes, the career asset class represents an opportunity for clients to acquire additional financial assets. It also offers planners the opportunity to add significant value to client relationships by increasing their clients’ potential income, optimizing work/life fit, and extending the life cycle of the career asset.

The broad definition of “career” I favor in my client planning engagements is the sum total of a client’s time, talent, and potential in three dimensions: employment, family, and community. This is in contrast to the often narrow view of career in the traditional planning process, which is somewhat fixed around either work or retirement, and lacks a systematic model for change I call the career asset management model.

When viewing career as an asset, financial planners need to explore the alternatives on the continuum from not working at all to working full time until retirement. These alternatives represent the opportunity to optimize the career and extend the life cycle of that asset.

Example: A client with peak annual wages of $150,000 abruptly retires at age 60 versus extending his career asset for an additional eight years—the first three years at 75 percent work time (and income), the next three years at 60 percent, and last two years at 40 percent. Assume an average income and employment tax rate of 40 percent, and a 6 percent discount rate, and the net present value of that increased income stream is $348,150.

The example is an over-simplification given that income is the only consideration taken into account. Other quantifiable measures of the value of the career asset, including employee benefits, increased pension, and Social Security benefit accruals also would need to be factored into the analysis. Additionally, there are many qualitative (non-financial) factors of the career asset, including job satisfaction, social interaction, and self actualization that also would be measured as part of calculating a client’s total career value.

Estimating the Value of the Career Asset

Career value has two components that are important in estimating the value of a career asset. Those components are the career financial value (quantitative) and the career qualitative value. The components should be viewed independently and holistically when calculating a metric for total career value.

The following career asset management formulas provide the metrics to estimate current total career value as a basis of comparison to that value after optimization.

Career Financial Value (CFV) = (PV of Wages + PV of Benefits)-(PV of Employment Costs)

- Wages = salary + bonuses + reimbursements

- Benefits = employee benefits (pension, health, and welfare, etc.) + government benefits (Social Security, Medicare, etc.)

- Employment costs = employment taxes + transportation + tools and supplies + education and training + business-related costs (clothing, meals, entertainment, etc.) + child care/family care + networking

The CFV formula measures the quantitative values of the career asset in financial terms and affects the financial side of career satisfaction. Wages and employee benefits have a positive value or correlation to satisfaction because as these increase, so does career satisfaction to a limit (diminishing returns). Employment costs have a negative value because they decrease wages or take-home pay.

Total Career Value (TCV) = CFV (Quantitative) + Career Qualitative Value

The total career value formula is applicable for both discrete and absolute time periods with minimal modification.

Career qualitative value is the sum of +/- career knowledge value +/-work/community connections +/- experience/maturity/wisdom +/- job satisfaction value +/- family value +/- self actualization.

Total career value reflects the sum of career financial value (quantitative) plus the career qualitative value (qualitative).

Managing Your Clients’ Career Asset

The significance in our planning with clients is not only recognizing career-related risks, but also compensating and effectively managing those risks by establishing a career asset working capital fund.

This is a reserve fund kept distinct from a client’s emergency cash reserves. While emergency cash reserves and working capital funds can be pooled, working capital funds need to be considered and calculated separately. Typically, emergency cash funds are based on three to six months of living expenses. By comparison, the amount of a working capital fund is based on effectively managing career risk factors, including funding skill set maintenance and development (lifelong learning), funding job changes, and funding career sabbaticals.

The costs of skill set maintenance and development should be reflected as an annual expense on the income statement or budget. The appropriate amount would be determined based on the nature of the client’s career. A credentialed career coach can assist in establishing the development/maintenance plan and estimating the required budget.

The second element of the working capital fund is funding job changes. According to a May 2011 report by the U.S. Department of Labor’s Bureau of Labor Statistics (www.bls.gov), the median number of weeks job seekers had been unemployed in the month prior to finding work was greater than 10 weeks. In contrast, prior to 2008 the median was five weeks. Another report by the Bureau of Labor Statistics predicts the average number of job changes for a young worker today to be nine. These findings help reinforce that during a career life cycle, reserves will be needed to fund inevitable job changes.

The last element of the career asset working capital fund is the cost associated with career sabbaticals. Career sabbaticals are growing in popularity and are often viewed as necessary for career rehabilitation and for family or personal transitions that can extend from three months to a few years.

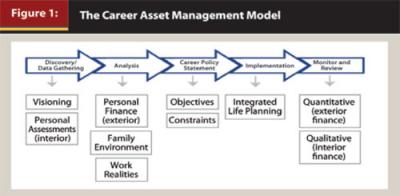

Applying the Career Asset Management Model

The career asset management model (CAMM) is modeled after the generally applied financial planning process. Just as with the financial planning model, CAMM repeats with another cycle over time as the client transitions over life.

As financial planners look for opportunities to add value to the client-planner relationship, along with creating greater client wealth and overall well-being, career asset management is a logical consideration.

Michael P. Haubrich, CFP®, is president of Financial Service Group, a fee-only financial planning firm based in Racine, Wisconsin.