Journal of Financial Planning: February 2011

Randy Gardner, J.D., CPA, CFP® (gardnerjr@umkc.edu), is a professor of tax and financial planning at the University of Missouri-Kansas City. He is also co-author (with Julie Welch) of the book 101 Tax Saving Ideas, and co-editor (with Leslie Daff) of the book WealthCounsel® Estate Planning Strategies.

Leslie Daff, J.D. (ldaff@estateplaninc.com), is a Certified Legal Specialist in estate planning, probate, and trust law and the founder of Estate Plan Inc., an estate planning law firm with offices in Orange County, California, and Overland Park, Kansas.

Julie Welch, CPA, CFP® (julie@meara.com), is the director of tax and a shareholder with Meara Welch Brown PC in Kansas City, Missouri.

Post-mortem planning includes passing wealth to our descendants in a manner that protects the wealth for generations to come. In our litigious society, asset protection has emerged as one of the greatest concerns of clients. Parents are not only concerned about threats to their own wealth while they are alive, they are concerned about protecting the wealth passing to their descendants. With divorce and bankruptcy rates as high as they are, it is easy to understand why parents are concerned about the risk of their assets passing to their children’s spouses, creditors, and predators.

Parents are limited in terms of what they can do to protect their own property. They can establish limited liability companies and create asset protection trusts offshore or in states (such as Nevada and Delaware) with favorable law, but these measures are usually not effective if judicial proceedings against the parents have already been initiated. Irrevocable trusts set up by parents for their descendants, however, do provide asset protection for the children because the children did not set up the trusts for themselves.

A Sample Problem

At her death, grandma’s trust left her property outright to her son, Sean. Grandma expected that any remainder would eventually pass to Brandon—Sean’s only child from his first marriage. At the time of grandma’s death, Sean had recently married his second wife, Wilma. What happens?

If Sean comingles the property with Wilma and they divorce, half of the assets could go to Wilma instead of to Brandon. If Sean dies without an estate plan, the state’s intestate succession provisions control. By operation of law, the inheritance could be split equally between his new wife and Brandon, with Brandon receiving his inheritance outright at age 18. If Sean inherits outright and has creditor problems, the entire inheritance could be lost to creditors.

However, if grandma had designed her trust estate to go to her descendants in beneficiary-controlled trusts, the assets could be protected from immature beneficiaries, predators, spouses, and creditors.

Four Levels of Protection

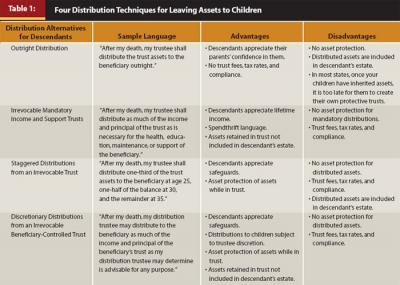

Below are the four most common distribution techniques parents use to leave assets to their children. See Table 1 for a comparison of advantages and disadvantages.

Outright Distribution is a technique favored by parents with mature, financially astute children. In short, the assets pass directly to the child at the parent’s death. Although valued for its simplicity, this technique provides no asset protection for the child’s inheritance. Once the child receives the inheritance, it is exposed to predators and the child’s spouse and creditors. The child must take proactive measures to keep it separate from his or her spouse to prevent it from being claimed as marital or community property in a divorce. In many instances, beneficiaries find it difficult to keep the assets separate and also “keep the peace” with their spouses.

Mandatory Income and Support Trusts require the trustee to make distributions according to the terms of the trust. Mandatory income trusts require the trustee to distribute income to the beneficiaries. Support trusts direct the trustee to distribute the trust’s principal and/or income for the health, education, maintenance, or support (HEMS) of the beneficiaries. Trusts established for descendants do not need to have mandatory distribution provisions. If they do, the beneficiaries have a demand right, and consequently creditors who “step into the shoes” of the beneficiary can demand distributions from the trust. The trust usually contains spendthrift language that does not permit the beneficiary to assign future income of the trust, but the mandatory distributions are not protected.

Staggered Distribution Trusts, where assets are held in trust for a child and distributed in intervals or when the child attains certain ages (such as 25, 30, and 35), are used to prevent the child from squandering the inheritance all at once. Moreover, the child may gain financial maturity as he or she manages successive distributions. Until the triggering ages are reached, a trustee other than the child typically makes distributions for the child’s health, education, maintenance, or support. Similar to the mandatory income and support trust described above, if a child is able to demand a distribution, a creditor may have the same demand right. Furthermore, once the child receives the distributions of income or principal, the distributed assets have no protection.

Lifetime Beneficiary-Controlled Trusts are the newer, preferred way to leave assets to a child. The child has access to the parents’ assets almost as if the parents had left them to the child outright, but the assets are protected from the child’s spouse and creditors and not included in the child’s estate.

Beneficiary-controlled trusts are created by the parents when they create their own trusts. The parents’ trust provides that, after the death of the second parent, the child serves as a co-trustee along with an “independent” distribution trustee. In other words, the parents’ trust leaves assets to the child’s trust, naming the child as co-trustee to handle the investment of the assets and naming a second, independent co-trustee who has complete discretion to make distributions to the child. According to IRC Section 672, an independent trustee is someone other than a spouse, parent, grandparent, sibling, issue, or employee of the beneficiary. Possible candidates for independent trustee include: friends; more distant relatives, such as an aunt, uncle, or cousin; professional fiduciaries; or financial institutions.

The child is the beneficiary of his or her own separate trust. The trust assets are retitled directly from the parents’ trust to the child’s trust. If the child becomes a party to a lawsuit, such as a divorce or creditor action, the trust assets are protected because the child does not have the authority and cannot compel the distribution trustee to make distributions from the trust.

A variation on this type of beneficiary-controlled trust allows the child to serve as sole trustee of his or her separate trust. However, if the child resigns as trustee, he or she must appoint an independent trustee who has complete discretion to make distributions. The theory is that once the independent trustee is in place, the assets will not be vulnerable because the parent, not the child, established the trust, and the child who is no longer trustee does not have the discretion to distribute income or principal.

Other Considerations

Consider the following factors when establishing a beneficiary-controlled trust.

Potentially higher tax rates and tax filings apply with any irrevocable trust. When the trust is established, the trustee needs to obtain a taxpayer identification number and file annual Form 1041 tax returns. The tax rates that apply to income accumulated in a trust are significantly higher at a lower level of income than the rates that apply to individuals. If the trust income is totally distributed to the beneficiaries, then the income will be reported on the beneficiaries’ tax returns and taxed at the beneficiaries’ rates. Distributions of principal are usually nontaxable.

Waiving the prudent person standard in the trust document allows a child who is serving as trustee to behave almost as though he or she had received an outright distribution from the parent. There are virtually no restrictions on what the child can own in the trust, making it possible to buy a home, securities, collectibles, cars, and boats, instead of diversifying the assets.

Generation skipping to the extent of the exemption amount ($5 million per parent in 2011) is possible with beneficiary-controlled trusts. When the child dies, the assets will pass to the grandchildren estate-tax free because the child possessed only an income interest and a limited (not general) power of appointment. The grandchildren, similar to the children, can serve as trustees of their own trusts. If a child dies leaving no children of his or her own, the assets of that child’s trust could go to the trusts created for other siblings.

Parents who plan to leave assets outright to their children should consider leaving their children’s inheritances to them in beneficiary-controlled trusts. The parents will rest easier, and the children will appreciate the safeguards that have been put in place for themselves and their children.