Journal of Financial Planning: December 2021

Executive Summary

- Financial professionals face client resistance to professional recommendations that can result in long-term effects on the outcomes of financial plans.

- Scaffolding Learning Theory is an effective method of teaching in various educational settings, from elementary school through college. However, financial professionals have rarely applied this theory to financial planning and literacy education.

- This article presents the principles of Scaffolding Learning Theory and, through a case vignette, provides an illustration of its application in both working with clients to assist in financial education, and in promoting a collaborative relationship with financial planning clients.

- Moreover, the case vignette elucidates differences between what clients can do with and without help, and provides a robust discussion of the benefits to financial professionals when implementing the Zone of Proximal Development concept when working with clients.

Elizabeth Sterbenz, LMFT, has a private practice in Los Angeles providing psychotherapy to individuals and couples, with a focus on trauma and anxiety. She has a graduate certificate in financial therapy from Kansas State University.

Dylan L. Ross, CFP®, AFC, is a financial coach with the Department of Defense and a graduate student at Kansas State University, working toward a master of science in personal financial planning. He has been advising clients about money since 2000.

Raylee Melton is an entrepreneurial consumer experience professional and digital marketing expert. Marketing automation, demand generation, and data insights are at the core of her work. She is a marketing director at a global financial investment management firm.

Jed Smith is a retired Navy pilot currently working as a civilian in the Department of Defense. Smith is pursuing an MA in personal financial planning with a focus on financial therapy at Kansas State University.

Megan McCoy, Ph.D., LMFT, CFT-I, is a professor of practice at Kansas State University and the director of the personal financial planning master’s program. She is the associate editor of Profiles and Book Reviews for the Journal of Financial Therapy.

Blain Pearson, Ph.D., CFP®, is the undergraduate program director of the Department of Personal Financial Planning at Kansas State University, where he teaches a variety of personal finance and financial planning courses.

NOTE: Please click on the images below for PDF versions.

When working with clients, financial professionals are tasked with developing plans that will meet their clients’ stated financial goals based on the initial information provided paired with the agreed-upon next steps of implementation and execution (Keown 2016). Yet, in order for any of these goals to come to fruition—from debt repayment to home purchasing to retirement—it is up to the client to follow through on the recommended steps of the plan. Client follow-through may not occur within the financial professional’s imposed timelines, or it may not occur at all. Many financial professionals are left asking themselves if there could be another way to approach these planning sessions to garner a stronger buy-in from their clients so they will take the needed steps to meet their goals (Klontz, Horwitz, and Klontz 2015).

There have been previous attempts at aiding financial planners to avoid client resistance in plan implementation and follow-through. Klontz et al. (2015) addressed this issue of client resistance to professional recommendations through the lens of Prochaska and DiClemente’s (1983) Six Stages of Change, with the first three stages being composed of the preparatory process before a client will be ready to take action with a financial planner. Another frequently cited view of financial education is the “just-in-time” method (Lerman and Bell 2006), where an individual is able to receive and process financial information through programs in the workplace or the community as they reach various milestones, such as meeting eligibility for a 401(k) plan or applying for a mortgage. The just-in-time method focuses on the client’s interest and emotional readiness, thus is not as necessarily focused on reaching milestones at a specific time. In both of these instances, there could be substantial time lost for a client before action toward their financial goals can happen, as the practitioner is encouraged to wait for the client to be ready, which can be a frustrating experience for the practitioner.

We posit an alternative approach to conducting financial planning sessions to enhance the client’s educational experience and increase the likelihood that they will implement the recommendations in a more timely manner. Scaffolding Learning Theory (Vygotsky 1978; Wood, Bruner, and Ross 1976) can be utilized as a practical framework for financial professionals. This article examines Scaffolding Learning Theory (Vygotsky 1978; Wood, Bruner, and Ross 1976) and the different areas of its application (e.g., Cowen, Blair, and Taylor 2011; Green, Jones, and Bean 2015; Nordlof 2014) before providing a case vignette to illustrate its application to financial professionals who work with clients from a scaffolding learning framework.

Scaffolding Learning Theory and the Zone of Proximal Development

Scaffolding Learning Theory developed from a combination of independent works studying learning and childhood development in two different countries (e.g., Vygotsky 1978; Wood et al. 1976). The first was Lev Vygotsky, a Soviet psychologist working in the 1920s and 1930s, whose work was not widely known in the Western world until being translated and republished in the 1970s (Pea 2004). Vygotsky (1978) developed the idea of the Zone of Proximal Development (ZPD) as a way to describe the tutor-student relationship. ZPD is “the zone of activity in which a person can produce with assistance what they cannot produce alone (or can only produce with difficulty)” (Pea 2004). In the United Kingdom, Wood et al. (1976) defined a similar concept as scaffolding. Scaffolding was defined as a process where a child learned to accomplish a task or solve a problem with the assistance of a tutor (Wood et al. 1976 as cited in Cull and Davis 2013). Wood et al. (1976) noted that the scaffolding during problem solving was informal and was intended to be temporary assistance until the child was able to perform the task on their own. This concept of removing the temporary assistance when the child became competent would later become known as fading (Pea 2004).

Verenikina (2008) pointed out that Vygotsky never used the term scaffolding in his work, and that Wood et al. (1976) used the idea of scaffolding to “operationalize” the ZPD. Verenikina noted that there have been authors who have opposed the use of the term scaffolding in association with Vygotsky’s work, as they see the metaphor as too limiting and possibly imposing a one-way communication process, due to the imagery of the word. Verenikina (2008) concluded that “scaffolding has the potential to be interpreted as any kind of help in general or even as a variation of direct instruction” and that the teacher must acquire a deeper understanding of Vygotsky’s concept of the two-way process involved in the ZPD in order to enable students to become independent and life-long learners. This is a paramount concept when considering the dynamics of financial education and financial planning. Financial education and financial planning are multifaceted, and both require continual and consistent development to successfully master.

Scaffolding theory found a home in education theory quickly (Rosenshine and Meister 1992). For example, scaffolds such as cue cards, visual aids, graphic organizers, modeling, prompting, coaching—anything that the teacher or tutor determines can help the student toward the lesson and are intended to “bridge the gap between their current abilities and the intended goal”—were integrated into the classroom (Rosenshine and Meister 1992). Nordlof (2014) expanded this integration of scaffolding in education by identifying the key features of the theory as intersubjectivity, ongoing diagnosis, dialogic and interactive, and fading. The intersubjectivity echoes Vygotsky’s original idea of co-collaboration as it reflects that the teacher and learner have an understanding of a shared goal, and both are vested and motivated in the outcome. The ongoing diagnosis implies an assessment of the learner’s ZPD and the teacher’s use of appropriate scaffolds to adjust for those changes. The dialogic and interactive concepts harken directly back to Verenikina’s (2008) description of Vygotsky’s original theory of a two-way sociocultural process, where the teacher and learner are in a dialogue and exchanging information. Finally, fading is the signature scaffolding concept, where once a student has fully internalized the task, the teacher can withdraw the scaffold and the student can move toward independent action (Nordlof 2014).

Scaffolding Learning Theory has been applied successfully in such varied areas as adult literacy programs (Taylor, King, Pinsent-Johnson, and Lothian 2003), online nursing education (Salyers, Carter, Cairns, and Durrer 2014), and accounting (Subagya and Susiati 2017). Two examples of usage in classrooms show particular potential for application within the financial adviser-client relationship. First, Green, Jones, and Bean (2015) illustrate the necessity financial advisers have to educate their clients in learning how to navigate situations with multiple options. Second, a study looking at the use of scaffolding in a financial planning classroom (Cowen, Blair, and Taylor 2011) shows how scaffolding can not only enrich the educational experience of their clients but can deepen the financial adviser’s own understanding of the teaching process and help them identify the areas where their clients may need additional help.

Green, Jones, and Bean (2015) outlined the process of developing new coursework in a business program. When they first approached the course, they assigned a research paper and received less than stellar results. They turned to Scaffolding Learning Theory and recognized where they had made their error. “The initial lengthy research paper assignment was too difficult for novice statisticians in that it violated Vygotsky’s (1978) zone of proximal development. Students needed intermediate help before they could succeed at top-of-the-wall assignments” (Green, Jones, and Bean 2015). The faculty backward designed the course, knowing where they wanted to end up, and developed earlier assignments that could help the students gain the needed skills. Similarly, Cowen, Blair, and Taylor (2011) looked at an Australian university’s financial planning programming coursework. At the start of a semester, students were presented with a case and given 11 weeks to come up with a full financial plan, using all available research and resources, and addressing the many interrelated concepts including budgeting, saving, investing planning, debt and credit management, estate planning, and retirement issues, among others. Students and faculty found the course demanding, and no one was happy with the results of the projects. The faculty decided to redesign this course based on Scaffolding Learning Theory. Faculty adopted a new textbook with systematic construction of a financial plan, realigned the lectures to match the text, and instituted weekly checks to track progress and give feedback on the financial plans (Cowen, Blair, and Taylor 2011). Each of these three steps can be linked to Vygotsky’s theorizing as they illustrate the two-way process that he valued in the teacher-student relationship (Verenikina 2008). The key concepts identified by Nordlof (2014) of intersubjectivity, ongoing diagnosis, and dialogic and interactive are also seen in these steps. The result was seen in pass percentages of students and faculty appreciation of the program.

Finally, Cull and Davis (2013) provided an empirical look at student feedback at the same Australian university several years after the scaffolding approach had been adopted in the financial planning program throughout several other courses in addition to the initial study. Students again found the scaffolding effective. However, one interesting development in this study was the inclusion of demographic data. While Cull and Davis (2013) found that all the demographic groups found the assignments helpful, they did see some notable differences in how strongly some of the groups felt about the learning experience. While all the age groups reported positive perceptions, the 46-plus age group had the lowest perceptions, causing the authors to speculate, “this more mature age group may find that due to both their life experiences and different life stage, they do not rely as heavily on scaffolded instruction from their tutor as younger students” (Cull and Davis 2013). They went on to conclude that while scaffolding has been shown to be an effective teaching method, “age, gender, first language, cultural background, study mode, and work experience are influential in the learning experience” (Cull and Davis 2013). The aforementioned factors are similarly relevant when applied to how financial advisers work with clients from varying demographic backgrounds. As noted by Pearson (2020), heterogeneity among a financial adviser’s client base can play a role in both the type of financial advice provided by the financial adviser and in the way the financial advice is received by clients. Consequently, financial advisers who utilize scaffolding must be aware of clients’ life experiences and have the ability to provide contextual relevance.

Case Study

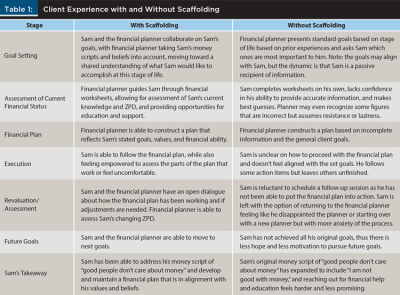

To illustrate how Scaffolding Learning Theory (Vygotsky 1978; Wood et al. 1976) can be applied to financial planning, this case study is based on an amalgam of the authors’ experiences with clients and not meant to reflect any one person’s experience. The case study focused on Sam, age 30, who is meeting with a financial planner. Sam is single, a school psychologist, and four years out of graduate school. He has been working for the same school district since graduating and earns a good income. Sam wants to pay off debt so he can save to buy a home and still be able to save for retirement. He has student loans, a car loan, and some credit card debt. He is able to make his payments but has struggled to build any savings. Sam shares that he was hesitant to seek help because, from a young age, he was raised to believe “good people should not care about money.” This belief has also discouraged him from paying attention to his spending. Sam would like a plan to pay off the debt but does not know where to begin.

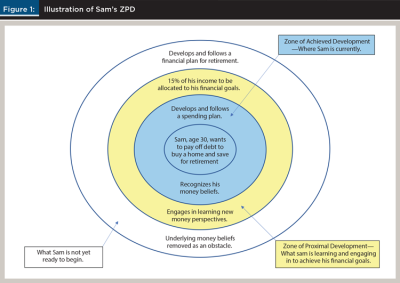

In determining what to help Sam with first, his financial planner considers each of Sam’s goals and agrees with the order in which he presented them: paying off debt before saving for a house and retirement. The planner spends significant time exploring the goals and the order of importance. The reason for this focus is to establish intersubjectivity between the client and the planner in order to arrive at a shared definition of the endpoint of Sam’s goals. Using scaffolding to help Sam with a plan to pay off the debt means determining his current Zone of Proximal Development (ZPD) and continually assessing his ZPD. This re-evaluation of ZPD is key to the theory, as Vygotsky (1978) encouraged an ongoing diagnostic process to ensure that scaffolding continues to allow for growth.

Sam says he is unsure how much of his income, if any, is available to repay his debts. Before Sam can be helped with debt management, he needs help developing a spending plan. As the discussion shifts toward the development of a spending plan and his ZPD surrounding that process, it becomes apparent that Sam is unsure how much disposable income he has. He tried using the worksheets on Form W-4, but his results left him owing $2,000 in taxes last year and receiving a $2,000 refund the year before. This is Sam’s ZPD. With some help, he could calculate proper withholding and his disposable income, which would then allow him to be guided through the creation of a spending plan to determine how much of his income could be used to make extra debt payments.

Before addressing Sam’s income and withholding elections, his underlying belief should be addressed to remove it as an obstacle. As Sam’s “good people shouldn’t care about money” belief is explored, he admits that he is unsure if it is true and that he likely picked up the money belief both overtly and covertly from his parents when growing up. Sam would like to know how to appreciate his money and still be a good person. This is Sam’s ZPD around dealing with this money belief. The financial planner engages in conversations with Sam, which allows Sam to evaluate and overcome the belief that “good people should not care about money.” Again, intersubjectivity arises, as it becomes essential for the planner to have a dialogue with the client to create shared meaning of what money means to Sam (Berk and Winsler 1995). Once this happens, the scaffolding can be removed, and the discussion about cognitive distortions ends. Sam is now eager to determine his withholdings.

Sam has copies of his most recent earnings statement and his prior-year tax return. He has a solid understanding of the basics of income taxation and the purpose of employer withholding. Determining the number of federal allowances or additional withholdings to include on Sam’s W-4 is within his ZPD. Scaffolding is created by showing Sam how to find and use the withholding calculator on the IRS website. The IRS withholding calculator provides Sam with the added piece of help he needed to make withholding elections on the W-4 for his employer. Using the results from the calculator, Sam is able to determine his disposable income and is now ready to create a spending plan with it.

A list of typical monthly expenses prepared by Sam includes bills, debt payments, groceries, dining out, fuel, and auto insurance. He also has clothing and vacation expenses. Sam knows there are additional expenses because his expenses total to less than his take-home income, yet he typically does not have any money left over. He feels like he is living paycheck-to-paycheck. Sam is unsure how to plan for or control this other spending. Recognizing that this is where Sam’s ZPD is, his financial planner shares a spending plan template, and they go through it together. Sam and his planner brainstorm to identify potential expenses within the categories of irregular, non-monthly spending needs and how much income to allocate for them. They determine Sam has some cyclical expenses he has not considered, such as car maintenance, concerts and events, gifts, and replacing personal property when it breaks or wears out. His financial planner shared some tips for deciding how much to plan for these expenses, and Sam internalizes this to create his own spending plan that allows for 15 percent of his income to be allocated to his financial goals, such as establishing an emergency fund and paying off debt. Although at times this case study is presented as the planner “doing” or “presenting” the information, the goal is for the relationship to go both ways, with Sam being empowered to participate in the process. This is the underlying goal of the dialogic and interactive aspect of scaffolding, as the client can teach the planner, too (Nordlof 2014).

Now that Sam is aware of how much income is available, he knows how much to apply toward his debts. He lists his creditors, balances, interest rates, and minimum payments. Knowing that extra payments retire the debt faster, he is unsure when, where, or how much to pay to each debt, or whether to save for emergencies or pay off debt first. This is now Sam’s ZPD for debt repayment, and with some guidance from his planner, Sam organizes his debts on www.powerpay.org, a debt repayment calculation and planning website. Together, Sam and his financial planner prioritize the debts to be repaid first, look at different repayment strategies, and discuss what would happen in the event of an emergency. Sam decides to build a small emergency fund with the surplus before making additional debt payments to his highest priority debt. Sam is surprised to see that he could pay off all of his debts in 30 months, provided he can stick to his spending plan. As you can see from the narrative now featuring Sam predominantly, fading is beginning to take place. Fading in scaffolding theory is the gradual removal of the primary role of the educator, in this case, the planner (Nordlof 2014).

With the debt repayment plan hinging on the success of his spending plan, Sam communicates concern about his ability to stick to the plan for 30 months. He shares that self-discipline, or lack thereof, has prevented him from successfully following plans in the past. In exploring what Sam has done to successfully overcome this in his past, he mentions strategies that remove the need to rely on self-discipline but needs help applying them to personal finances. This is his ZPD. Sam always pays his bills on time, and most are set up to automatically draft from his checking account. His financial planner leads Sam to the idea of turning the irregular expenses into regular monthly bills. Further brainstorming leads them to drawing a cash flow map with a few new savings accounts to hold non-monthly spending, such as an account for vehicle maintenance and another for vacations. On the map, they write arrows with the amounts to be automatically transferred each month from his checking to the different savings accounts. Sam will also give himself a cash allowance each week to help manage how much he spends on food and traveling. Sam is excited to try these new measures and asks how saving for retirement or buying a home fit in once the debt is paid off.

The financial planner asks Sam about his timeframe for wanting to buy a home. He responds that he is unsure of exactly when but wants to have savings ready for whenever he decides. However, he tells the financial planner he also wants to make sure he is saving for retirement. To establish Sam’s ZPD, his planner asks if he knows how much he will need to save for the home or for retirement, and Sam is able to estimate how much he needs for the down payment, closing, and nesting costs to buy and move into a home. However, he does not know how much he needs to save for retirement. The planner draws a timeline and asks Sam to fill in his goals. Sam writes in the emergency fund and debt repayment goals at 30 months. He estimates that his spending surplus after the debt is paid off would take another 30 months to get to the amount needed to buy a home. Even if he does not buy one at that time, he will be prepared to do so. Sam then realizes that in five years he can use the surplus to increase his retirement plan contributions. The financial planner shows Sam some retirement calculators, and they plug in the current retirement contributions and the matching projected increase in five years. Both Sam and his planner agree that it is a reasonable plan at this stage of Sam’s life.

Without Scaffolding Learning Theory

This section of the case demonstrates Sam’s experience without the use of Scaffolding Learning Theory. Sam is 30, single, a school psychologist, and earns a good income. Sam is meeting with a financial planner to review how he can pay off debt, buy a home, and save for retirement. He has student loans, a car loan, and some credit card debt, is struggling to build any savings, and believes that “good people should not care about money.”

In hearing Sam’s goals, his financial planner suggests that he completes a financial plan. His financial planner sends Sam home with a data-gathering workbook and tells Sam to email him the data workbook when it is completed. He also directs Sam to schedule a follow-up appointment with his receptionist after he completes the data workbook. That evening, Sam eagerly begins completing the data workbook. The data workbook directs Sam to provide account values for 401(k)s, SEP IRAs, ESOPs, and other retirement plan accounts. The workbook also directs Sam to list existing life insurance policies, gather copies of tax returns, gather a copy of his estate planning documents, and complete a risk tolerance questionnaire. Sam feels overwhelmed, discouraged, and ultimately does not complete the data workbook.

Several weeks have passed, and the financial adviser Sam originally met with calls Sam to check in. Sam states that he feels overwhelmed and has no idea where to begin. The financial adviser insists that Sam “do his best.” While on the phone, the financial adviser forwards Sam to his receptionist to schedule an appointment to review the document. Sam sets the appointment and emails the data workbook to the financial adviser. The financial adviser receives the workbook and develops Sam’s financial plan.

The day of Sam’s meeting with the financial adviser has arrived. Sam enters the financial adviser’s office and is directed to a conference room. Sam is handed a hard copy of his financial plan, and the adviser begins explaining the plan to Sam. Sam is told that he will have to follow the budgeting plan that the adviser has constructed, open and fund a retirement account, and hire an attorney to update his estate planning documents. The financial adviser continues with the list of items that he will have to complete, however, Sam has zoned out. The adviser ends the meeting by stating that if Sam follows his plan, he will retire with well over $2 million in assets. Sam’s belief that “good people should not care about money” causes him great reservation. Sam leaves the office, enters his car, and places his financial plan in the back seat, where it lies today.

Conclusion

The implementation of a financial plan can be a significant challenge. Typical roadblocks that prevent clients from reaching their goals are compartmentalizing money, lack of financial literacy, money beliefs, and cognitive and emotional biases. Failing to reach goals rarely stems from the lack of trying. Clients may try to meet their savings goals, but an errant understanding of their expenses prevents them from doing so. When this happens, it is because the comprehensive plan ignores the importance of building solid foundations first, which can take time. Scaffolding allows for an approach to meet clients where they are today by building off of previous guidance and working collaboratively to reinforce its usefulness and importance to guide a client to become an independent in his or her money decisions. In conjunction with continued support and guidance through life stages, the scaffolding theory is a lens that allows for necessary interventions, support, tools, aids, maps, handouts, and prompts, which are determined based on the two-way process of education through this lens.

Despite the strengths, the metaphor of scaffolding as a visual construct often creates an unfortunate multitude of operational definitions as mentioned above (Pea 2004). This can be controlled by using the previously defined ZPD in a consistent manner, as it applies to the evolution of a client across financial planning events, literacy, and cognitive and emotional states. Scaffolding must focus consistently on whether the diagnosis is focused on the individual learner, the task, or the studying context/tools (Azevedo and Hadwin 2005).

An additional challenge in the application of Scaffolding Learning Theory is the breadth of the financial planning continuum. A client will likely be endlessly mastering certain elements of financial planning and its related psychological impacts as well as entering a new financial planning ZPD. This will require a financial planner to continuously tailor the scaffolding concept of fading with the identification of the new ZPD for the next major planning event. Future studies can combine the identification of a core group of key financial planning events or situations that are causing client distress.

References

Azevedo, Roger, and Allyson F. Hadwin. 2005. “Scaffolding Self-regulated Learning and Metacognition–Implications for the Design of Computer-based Scaffolds.” Instructional Science 33 (5/6): 367–379.

Berk, Laura E., and Adam Winsler. 1995. Scaffolding Children’s Learning: Vygotsky and Early Childhood Education. NAEYC Research into Practice Series. Volume 7. Washington, DC: National Association for the Education of Young Children. 20036-1426 (NAEYC catalog #146).

Cowen, Janet, William Blair, and Sharon Taylor. 2011. “The Use of Scaffolding in the Financial Planning Classroom: An Australian Case Study.” Australasian Accounting, Business, and Finance Journal 5 (3): 3–16.

Cull, Michelle, and Glenda Davis. 2013. “Students’ Perceptions of a Scaffolded Approach to Learning Financial Planning: An Empirical Study.” Accounting Education 22 (2): 125–146.

Green, Gareth P., Stacey Jones, and John C. Bean. 2015. “Teaching Real-World Applications of Business Statistics Using Communication to Scaffold Learning.” Business and Professional Communication Quarterly 78 (3): 314–335.

Keown, Arthur J. 2016. Personal Finance: Turning Money into Wealth. 7th ed. New York, NY: Pearson.

Klontz, Brad T., Edward J. Horwitz, and Ted P. Klontz. 2015. “Stages of Change and Motivational Interviewing in Financial Therapy.” In Financial Therapy: Theory, Research, and Practice. Edited by Bradley T. Klontz, Sonya L. Britt, and Kristy L. Archuleta. New York, NY: Springer International Publishing: 347–362.

Lerman, Robert I., and Elizabeth Bell. 2006. “Financial Literacy Strategies: Where Do We Go From Here?” Networks Financial Institute Policy Brief 2006-PB: 10.

Nordlof, John. 2014. “Vygotsky, Scaffolding, and the Role of Theory in Writing Center Work.” The Writing Center Journal 34 (1): 45–64.

Pea, Roy D. 2004. “The Social and Technological Dimensions of Scaffolding and Related Theoretical Concepts for Learning, Education, and Human Activity.” The Journal of the Learning Sciences 13 (3): 423–451.

Pearson, Blain. 2020. “Demographic Variations in the Perception of the Investment Services Offered by Financial Advisors.” Journal of Accounting and Finance 20 (3): 127–139.

Prochaska, James O., and Carlo C. DiClemente. 1983. “Stages and Processes of Self-Change of Smoking: Toward an Integrative Model of Change.” Journal of Consulting and Clinical Psychology 51 (3): 390.

Rosenshine, Barak, and Carla Meister. 1992. “The Use of Scaffolds for Teaching Higher-Level Cognitive Strategies.” Educational Leadership 49 (7): 26–33.

Salyers, Vince, Lorraine Carter, Steve Cairns, and Luke Durrer. 2014. “The Use of Scaffolding and Interactive Learning Strategies in Online Courses for Working Nurses: Implications for Adult and Online Education.” Canadian Journal of University Continuing Education 40 (1): 1–19.

Susiati and Subagya. 2017. “Application of Accounting Scaffolding Learning Using Fingertips to Increase Learning Result.” Dinamika Pendidikan 12 (1): 1–12.

Taylor, M., J. King, C. Pinsent-Johnson, and T. Lothian. 2003. “Collaborative Practices in Adult Literacy Programs.” Adult Basic Education 13 (2): 81.

Verenikina, Irina. 2008. “Scaffolding and Learning: Its Role in Nurturing New Learners.” In Learning and the Learner: Exploring Learning for New Times. Edited by P. Kell, W. Vialle, D. Konsa, and G. Vogl. Australia: University of Wollongong: 161–180.

Vygotsky, Lev S. 1978. Mind in Society: The Development of Higher Mental Processes. Cambridge, MA: Harvard University Press.

Wood, David, Jerome S. Bruner, and Gail Ross. 1976. “The Role of Tutoring in Problem Solving.” Journal of Child Psychology and Psychiatry 17 (2): 89–100.