Journal of Financial Planning: December 2020

Bill Van Law, CEO and founder of WVL Group, specializes in business and succession planning for independent advisers. He spent over 15 years in senior leadership positions at Raymond James and 18 years at Merrill Lynch. He also served on the adjunct faculty for the College of Financial Planning.

NOTE: Please click on the Table below to open a PDF version of the image.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

What are the potential benefits and drawbacks of the various business models within the wealth planning space? I have been asked this question countless times over the years by advisers exploring which model was “right” for their business.

During my career, I spent more than 15 years with a firm that had multiple affiliation models ranging from employee to independent registered investment advister (RIA) and it was not uncommon for advisers to explore two or more options before determining the best solution. As the only senior executive to have worked in each model, this was a topic to which I have given considerable thought, as it was a primary concern for many advisers.

It’s important to reinforce that there is no “right” model for every practice—there are pros and cons of each. My goal with this analysis is to provide a context that will allow you to evaluate the attributes of the various alternatives, so you can determine which best fits the needs of your business and clients.

It is also worth noting that the business model that fits your needs can—and often does—change over time as you and your business move through the stages of your career. As you contemplate the evolving needs of your clients and business, it’s important to understand that what was the best fit a decade ago may not be the ideal solution today. In addition, the business itself has evolved. Technology has played a key role and innovation has allowed independent models to match and, in some cases, surpass the resources available at the large national firms.

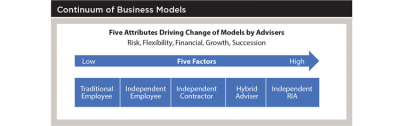

It is often helpful to think about business risk and responsibility (time), flexibility, and income (and the other attributes) on a continuum. I will also drill down into the five drivers that are frequently cited by advisers as they are evaluating business models:

- Risk and responsibility

- Freedom and control

- Financial implications

- Growth opportunities

- Succession options

Continuum of Business Models

The business models listed in the continuum are in the order of where they fall (either high or low) regarding each of these attributes. For example, Independent RIA is at the right end of the continuum and has greater risk while also offering higher potential financial rewards. On the left end is Traditional Employee, which has lower risk. Since the firm is assuming much of the regulatory, compliance, and business risk, the adviser may be able to focus more of their time and energy on their business and clients.

As you move further to the right, each model moves progressively higher on the five attributes. It is important to note, however, that these attributes do not move at the same rate as you move across the spectrum. For example, compliance and regulatory risk would be the same for both Independent Employee and Traditional Employee, though the other attributes would move higher. While there are certainly other areas that may impact an individual adviser’s decision to change business models, most will fall into one of these five categories.

Risk and Responsibility

While there are many types of risk, the two broad categories are regulatory/compliance and business risk. With regulatory/compliance risk, the firm is absorbing much of the responsibility, including developing the rules and guidelines for each of the categories that involve broker-dealers. This includes the Traditional Employee, Independent Employee, and Independent Contractor. For the Hybrid model, the responsibility is split with the adviser assuming responsibility for the advisory business, while the broker-dealer maintains responsibility for the brokerage business, although the broker-dealer also must supervise outside business activities, which includes the advisory business. This last element is important as there is typically a supervisory fee charged by the broker-dealer and the firm may also place limits on activities that are “approved” per their compliance guidelines. Independent RIAs assume full responsibility for compliance and regulatory risk. To meet this obligation, most firms will engage an outside consulting or law firm specializing in the RIA space to assist in developing, implementing, and managing the compliance process for the advisory firm.

Business risk moves at a different pace across the continuum than the regulatory/compliance category as each of the independent models includes increased levels of business risk. Responsibility (and the corresponding time commitment) also moves progressively higher with each model. For example, while all independent models have financial leverage (which we will address in a later section), in most independent employee models the broker-dealer handles payroll, including all benefit programs as well as accounts payable, reducing the time required as well as business risk.

Over the years, I found that advisers would often focus on the many benefits of the more independent business models, and not spend as much energy considering the potential risks and responsibilities. As an adviser at an employee firm, you have one primary role: to serve clients. As you progress along the continuum to higher levels of independence, the level of responsibility and time required increase. Fortunately, you are paid for the additional responsibility and risk, but it is important to acknowledge that the two go hand in hand and additional financial opportunities move in lockstep with the increased responsibility, time commitment, and risk as a business owner.

Freedom and Control

The freedom and control element moves progressively higher as you move from left to right across the continuum. While financial issues are certainly important, in my experience, the ability to control the important decisions impacting their business is the primary factor driving the migration of advisers to more independent business models. This has been particularly important for many CFP® professionals as greater latitude in how they serve clients fits well in the context of their role as a fiduciary.

Of course, this has many implications for the business, impacting decisions regarding staffing levels, the selection of technology solutions, marketing, branding, and the use of social media. Investment decisions are also impacted as some firms limit investment options, including share class selection, which has implications for clients and overall expense ratio for investment portfolios.

Financial Implications

Higher levels of independence provide additional financial rewards as the adviser potentially benefits from being a business owner in addition to receiving direct compensation as an adviser. The potential rewards and risk, as previously noted, increase as the adviser moves across the continuum. The primary driver of the increased rewards is the business leverage that occurs with margin expansion when revenues rise faster than expenses.

The long bull market has added to the trend and allowed many business owners to benefit in recent years. Of course, the reverse is also true; this factor impacted many firms during the current health pandemic as decreased revenues cause margins to contract much more quickly, resulting in rapid declines in net income. For those advisers/firms experiencing high levels of organic growth, this can be particularly impactful over time and has been a major contributor to the impressive growth in net income and valuation in recent years. It should be noted, however, that maintaining adequate capital reserves is important, so that the business is well positioned to navigate through market cycles.

Growth Opportunities

Successful advisers with thriving practices exist in each of the business models. High levels of organic growth can also be found across the continuum. There are significant differences, however, as each model has different attributes impacting potential growth strategies. For example, the employee models may include an opportunity to receive referrals from the firm (for example, investment banking leads or departing advisers).

Independent models, on the other hand, allow for more active marketing strategies as well as the potential for inorganic growth through the acquisition of other advisory firms. This has become a primary driver of growth in recent years and has also attracted significant growth capital from private equity (PE) firms and other outside investors. Specialty lenders have expanded their offerings in recent years, creating another source of growth capital for independent advisers. This has created tremendous growth potential for those who are interested in acquisitions. While activity levels have risen significantly in recent years, the market remains highly fragmented and consolidation is still in the early stages relative to many other industries.

Succession Options

Succession options also vary across the continuum. For employee models, valuation and structure is largely determined by the firm. In addition, the payouts to the departing adviser are typically taxed as ordinary income as the adviser does not have legal ownership of the business. Valuation for independent models is largely driven by market forces and set independently by the buyer/seller in each transaction. In addition, as they are typically structured as an asset sale, they qualify for long-term capital gains treatment, reducing the potential tax burden. As the adviser moves from left to right along the continuum, valuations generally increase as the cash flows are often higher and more predictable. In addition, there are larger numbers of potential buyers for independent firms as the adviser is not limited by the firm they are using for custody/clearing due to the multi-custodial nature of the independent space. Succession options and valuation have expanded in recent years, providing a plethora of options for advisers approaching retirement or considering succession alternatives.

Conclusion

Selecting the “right” business model requires both a thorough understanding of the alternatives as well a thoughtful evaluation of the adviser’s business, including their vision and goals going forward. The business evaluation should include a review of historical growth, an analysis of the current business (client demographics, staffing review, profitability, etc.), and realistic expectations for future growth. This process will allow the adviser to determine where their current/future business best fits along the continuum of business models. Remember, there is no single “right” model for everyone and the best model for a particular adviser/firm is the one with the right balance of the five attributes as they relate to the business and their goals and aspirations for the future.