Journal of Financial Planning: December 2014

Randy Gardner, J.D., LL.M., CFP®, CPA, is a professor of tax and estate planning at the University of Missouri and a practicing attorney. He is co-author of 101 Tax Saving Ideas and The Closing Wealth Transfer Window. Email author HERE.

Leslie Daff, J.D., is a state bar certified specialist in estate planning, trust, and probate law, founder of Estate Plan Inc. and OnlineEstatePlanning.com Inc., and co-author of The Closing Wealth Transfer Window. Email author HERE.

How can you and your clients benefit from estate planning law firms that are going online to deliver legal documents at reduced rates? Although non-attorney document service providers such as LegalZoom.com have been online for years, estate planning attorneys are only now making meaningful inroads on the Internet. Off-the-shelf computer programs such as Quicken Family Lawyer provide forms, and non-attorney document service providers check customer input for spelling errors, but neither of these approaches do—or can—provide legal advice.

As many financial advisers and estate planning attorneys know, do-it-yourself estate planning has resulted in documents that clients do not understand, documents that do not work as intended, and even estate plans that are missing necessary documents. Furthermore, many revocable living trusts that are created online or with do-it-yourself computer programs go unfunded, meaning financial assets and business interests are not re-titled in the name of the trust, and beneficiary designations on life insurance and retirement plans are not coordinated with the overall estate plan.

Attorneys have been slow to offer services online, primarily due to ethical considerations. However, by using limited scope agreements that clearly delineate the work the attorney will be doing and the work the client will be doing and when an engagement starts and ends, attorneys are able to offer more unbundled services. An engagement that ends after the attorney provides the documents and the client handles the execution of the documents is a perfect example of a limited scope engagement. By protecting client information on secure encrypted websites with secure client portals to transfer information, attorneys can now ethically gather client data and deliver confidential documents, such as wills and trusts, electronically.

Working with an Online Firm

Online estate planning law firms engage the client with a limited services agreement. Clients fill out an online questionnaire, which generates a first draft of the estate planning documents. Typically, the attorney then reviews the input with the client, provides legal advice as needed, and modifies the documents. The client, after downloading and reviewing the documents, executes them and funds the trust on his or her own with detailed instructions provided by the attorney. Some online estate planning attorneys offer an ongoing maintenance program to keep the client informed of estate planning developments and a way to amend documents if circumstances change.

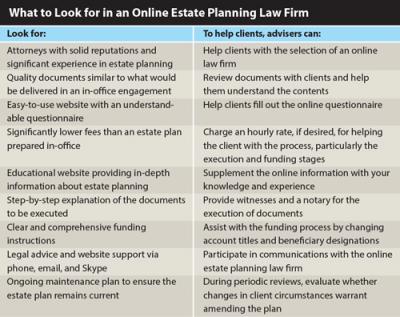

With this framework in mind, what should advisers and their clients look for in an online estate planning law firm?

Attorney experience. Behind every online law firm are real attorneys who are typically operating a traditional law firm as well. Be sure these attorneys have solid reputations and significant experience in estate planning. Online attorney rating sites such as Avvo.com and Martindale.com can help with this determination.

Quality documents. Online attorneys should deliver the same quality documents online as they do in their offices. Not all do.

Easy-to-use website. Some websites are so dense and offer so many documents that it may be unclear to the client which ones to select, and why. This may be why the do-it-yourself estate plans we review in our office are often missing documents.

Lower fees. Online engagements can save attorneys three to four hours or more of input, drafting, and face-to-face meeting time. With a $300 to $350 average hourly attorney billing rate, you can expect the fees for online estate plans to be significantly less than what would be charged in an in-office engagement.

Education. The website should educate clients about estate planning in general, estate planning documents, probate, transfer and income taxes, intestate laws, asset protection, and much more. The educational material may be in writing or in audio/video files.

An explanation of the documents. Online clients will be executing their documents without an attorney present, so the website or written documentation provided to clients should thoroughly explain the documents they are signing. This information should also be available in audio/video files so clients can follow the presentation while looking at their own documents.

Comprehensive, easy-to-understand funding instructions. Online estate planning law firms should provide detailed, understandable funding instructions with legal advice. Document service providers do not provide legal advice about trust funding, and as a result, many trusts go unfunded. An unfunded trust gives the client a false sense of security, because the trust will not accomplish its probate-avoidance purpose when the client passes away.

Legal advice and support. If necessary, clients of an online law firm must be able to communicate with online attorneys via email, phone, and Skype for legal advice. Some online law firms provide free legal advice, while others provide their online clients with legal advice at reduced rates.

A way to amend/maintain the plan. A significant problem with having an online estate plan is how to amend your low-cost estate plan at the same low cost if your circumstances change. Most attorneys do not want to amend plans drafted by others because they do not want to assume the liability of a poorly drafted plan, and they would have to read the entire document to ensure it meets their standards. It’s easier for an attorney to start from scratch using his or her own documents than to amend someone’s existing estate plan. Online estate planning law firms should provide a system that allows clients to change their plans without having to start over. Some online estate planning law firms offer maintenance programs that provide free or reduced-fee amendments in exchange for an annual fee. Although this sounds like a warranty similar to what you find at an electronics store, it usually provides a low-cost way for clients to maintain their plans if they think their circumstances will change.

Opportunity to Work Together

A collaboration with an online estate planning law firm enables advisers to offer the estate planning component of a one-stop shop for clients without having to have an in-house legal department. Advisers can help their clients obtain high-quality, attorney-drafted estate plans at significantly reduced rates while guiding clients every step of the way: selecting the online law firm, navigating the website, completing the questionnaire, reviewing the documents, executing the documents, funding the trust, and monitoring the need for changes. The adviser and client can also communicate with the attorney together. Throughout the process, the financial adviser can build a deeper relationship with the client or prospective client as the adviser learns more about the clients’ goals and resources.

Advisers and attorneys are facing a huge challenge, and a huge opportunity. Seventy percent of adults have no estate planning documents in place: no health care directives; no guardians named for minor children; no decision makers named in the event of incapacity or death; no plan for the distribution of property at death; and as a result, an estate heading toward probate court. Complex situations are best dealt with in an attorney’s office, but a full-service law firm model may be more than what much of the population needs. With affordable, high-quality estate plans now being offered by online law firms, attorneys and advisers can close the gap for individuals who need a basic estate plan at an affordable price while advisers address the other financial planning needs of clients.