Journal of Financial Planning: December 2012

Randy Gardner, J.D., LL.M., CPA, CFP®, is a professor of tax and estate planning at the University of Missouri–Kansas City; education director for the WealthCounsel Companies; and an estate planning attorney. He is co-author (with Leslie Daff) of the recently published book, The Closing Wealth Transfer Window, available at www.estateplanning.com), and co-editor (with Leslie Daff) of WealthCounsel® Estate Planning Strategies. (randy.gardner@wealthcounsel.com)

Leslie Daff, J.D., is a State Bar Certified Specialist in estate planning, probate, and trust law, member of WealthCounsel, and the founder of Estate Plan Inc., a professional law corporation with offices in Orange County, California, and Johnson County, Kansas. (ldaff@estateplaninc.com)

With the re-election of President Barack Obama and a divided Congress, it is vitally important for us to review clients’ estate plans and take steps to take advantage of the opportunities available.

At the time of this writing, there are two potentially closing windows to watch. Unless Congress acts soon, the first window closes automatically December 31, 2012. The main estate planning changes that occur then include:

- The $5.12 million exemptions for gift, estate, and generation-skipping transfer taxes revert to $1 million; and

- The maximum 35 percent rate on transfers in excess of the exemption amount increases to 55 percent.

The second window concerns proposed restrictions on the following estate planning techniques that planners have used for decades:

- All grantor trusts, including intentionally defective grantor trusts (IDGTs) and irrevocable life insurance trusts (ILITs), will be subject to estate tax when the grantor dies.

- Discounts claimed on the transfer of non-business interests or for transfers of minority interests, the backbone of planning with family limited partnerships and limited liability companies, will not be allowed.

- Grantor retained annuity trusts (GRATs) can no longer be zeroed out or have terms less than 10 years, eliminating the commonly used two-year rolling GRAT strategy.

- Dynasty trusts, powered by the allocation of the generation-skipping exemption, will be limited to 90 years, significantly changing their mathematical benefits.

President Obama supported these proposals during his first term. Working with a compromising Congress, he could succeed in legislation related to some or all of them in his second term. When these windows close depends on Congress. If your clients have been contemplating these strategies, now may be the time to implement them.

The 12/31/2012 Wealth Transfer Opportunity

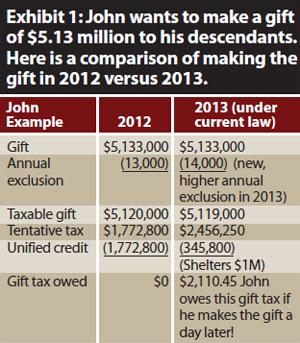

The following example illustrates the opportunity that exists through the end of the year (see Exhibit 1).

Clients can take advantage of this opportunity by making 2012 gifts, including gifts of cash, securities, real estate, and forgiven loans. Many clients are reluctant to make such gifts, however, because of the threat of clawback, loss of stepped-up income tax basis, and loss of control over the property.

- Clawback is real. The law currently requires it, but its occurrence, in the opinion of many estate planning attorneys, is not likely because it was not intended and Congress has already proposed reasonable fixes. If it does occur, the client is paying the same tax as if he or she did nothing in 2012 while probably removing appreciating property from their estate.

- Loss of stepped-up basis does occur because the client transferred the property by gift with its carryover basis rather than holding it to death with its stepped-up or down basis. If the property is appreciating, the client is trading the estate tax rate of possibly 55 percent for the capital gains income tax rate of 20 percent. Unless the client is terminally ill, this tradeoff favors gifting the property.

- Loss of control occurs if the client makes outright gifts. It is wiser to make gifts using irrevocable trusts because many of the benefits of ownership can be retained while the client gains the benefits of making a current gift.

Client Goals and the Use of Trusts

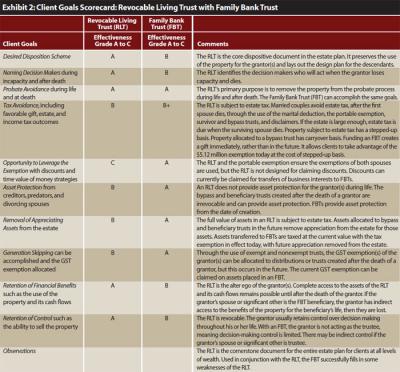

Similar to financial planning, all effective estate planning starts with an inventory of the client’s goals. The goals most commonly identified by clients and how they are met by using a revocable trust in conjunction with a Lifetime Bypass Trust, sometimes called a Family Bank Trust or Spousal Lifetime Access Trust (SLAT), are shown in the Client Goals Scorecard (see Exhibit 2).

The Family Bank Trust is the most versatile tool in the estate planner’s toolbox during the window that ends December 31, 2012. It is easily used in combination with other strategies, such as irrevocable life insurance trusts (ILITs) and qualified personal residence trusts (QPRTs), to transfer property up to the $5.12 million ($10.24 million for a couple) level.

With the federal government and 50 states enacting new laws every year and the courts and executive branch of government changing the legal landscape every day, it is difficult to stay on top of new developments, opportunities, and strategies in the estate planning area. The website www.estateplanning.com is a treasure chest of estate planning information and resources. Check it for the most current developments about these closing windows. In our fast-paced society, it is easy to procrastinate, but taking steps to secure your clients’ families’ futures is worth your immediate attention.