Journal of Financial Planning: August 2018

Martha Fulk is a graduate student in the Department of Financial Planning, Housing, and Consumer Economics at the University of Georgia.

Kimberly Watkins is a Ph.D. candidate in the Department of Financial Planning, Housing, and Consumer Economics at the University of Georgia.

John Grable, Ph.D., CFP®, is an athletic association endowed professor in the Department of Financial Planning, Housing, and Consumer Economics at the University of Georgia.

Michelle Kruger is a graduate student in the Department of Financial Planning, Housing, and Consumer Economics at the University of Georgia.

Executive Summary

- A great wealth transfer of approximately $30 trillion in assets is expected to be passed down from baby boomers to those in younger generations over the next several years.

- Financial planners face the possibility that inheritors of those assets will change financial planners after assets are received.

- This study provides evidence that those who are more likely to change financial planners have high income and high net worth. They also tend to be remarried, widowed, or divorced.

- Those who are likely to change a financial planner also exhibit high financial acumen and confidence. They indicate being a savvy investor, and when asked how much they know about their own investment performance, they report the highest financial knowledge.

- Results from this study suggest that financial planners should strive to maintain a client-centered planning approach with high levels of communication and interpersonal attention to create client trust, retention, and commitment.

Although the use of financial planners among the general population continues to grow, there is a widely held perception that the market for financial planning services is limited to those who exhibit high socioeconomic status, and evidence supports this perception (Elmerick, Montalto, and Fox 2002). The economics associated with providing financial advice means that a client generally must have the financial resources to pay for services. Payment can be made directly through fees paid to a financial planner, or indirectly through fees based on assets under management and/or commissions generated from the sale of products. In any case, a client must have the financial wherewithal to fund recommendations.

This is one, but certainly not the only, reason that financial planners tend to work with individuals and households that have access to excess cash flow or investable assets. In addition to income and net worth, other factors known to be associated with the use of financial planning services include a household’s educational profile, the head of household’s age, marital status, financial knowledge, and financial need (Chang 2005).

For the purposes of this study, financial knowledge refers to a financial decision-maker’s understanding of their financial situation, whereas financial need is dependent on a household’s demand for products and services to meet lifetime financial goals.

Traditionally, the financial planning community has focused on identifying individuals and households as potential clients who need and can pay for financial services. Often, this has resulted in firms marketing to high-net-worth clientele. However, this strategy is coming under scrutiny.

According to Skinner (2015), over the next 30 years, $30 trillion will be passed down from baby boomers to Generation X and millennials. Rather than view this as an opportunity for financial planners, some market experts have expressed concern that planners will see their assets under management shrink as recipients of wealth transfers change existing financial planners in favor of new planners and/or web-based advisory services. If this happens, the value of existing firms could be reduced, potentially hampering the continued growth of financial planning as a profession.

What explains this potentiality? Skinner (2015) noted that financial planners seem ill-prepared to connect with the children and grandchildren of their current clients. Some of the difficulty may be attributed to a lack of technical ability and a dearth of intergenerational adaptability. The underlying premise of the reversal of assets under management argument is that future heirs of wealth expect a different service experience than their parents or grandparents do or did.

Data from an InvestmentNews survey showed, for example, that 66 percent of heirs terminate the relationship with their parents’ financial adviser after they inherit their parents’ assets (Skinner 2015). Hence, firms should carefully consider the cost of retaining clients versus the cost of acquiring new clients.

According to Ahmad and Buttle (2001), the cost of client retention is not only lower than the cost of marketing and acquisition of new clients, but it also has the potential for delivering substantial benefits to firms in terms of long-term profitability. This is especially true for financial planning firms and financial planners who operate using an AUM fee model where the loss of assets from accounts that have accumulated over extended periods of time can mean a substantial loss of revenue.

The purpose of this study was to identify characteristics of individuals who have previously terminated a relationship with a financial planner, paying attention to the receipt of an inheritance as a separation trigger. It was hypothesized that in addition to receiving an inheritance—which may free an heir to pursue financial planning services with another firm or a robo-adviser—other issues may consistently point to a breakage in the client-financial planner relationship.

As shown here, while it may not be possible for a financial planner to control the disposition of a client’s assets via an inheritance, it may be possible to identify triggers of relationship dissolution and address those elements when working with clients and their children and/or grandchildren.

Literature Review

Determinants of using a financial planner. A question often posed in the financial planning literature is who uses the services of financial planners (Heckman, Seay, Kim, and Ketkiewicz 2017)? The financial planning help-seeking literature is robust in examining determinants of those who seek help from financial planners. Gentile, Linciano, and Soccorso (2016), for example, noted that certain demographic factors could be used to differentiate those who seek professional services compared to those who do not. For example, due to the costs associated with the use of a financial planner, households with higher levels of income and wealth were more likely to seek help from a financial planner (Chang 2005). In addition to help-seeking tendencies, those with greater income and wealth were also more willing to pay for financial advice (Finke, Huston, and Winchester 2011; Miller and Montalto 2001).

Studies have shown factors such as net worth, income, age, gender, education, and marital status to be associated with financial help-seeking behavior (Auslander and Litwin 1990; Elmerick, Montalto, and Fox 2002; Fischer and Farina 1995; Kaskutas, Weisner, and Caetano 1997; Phillips and Murrell 1994; Robb, Babiarz, and Woodyard 2012; Salter, Harness, and Chatterjee 2010). For instance, given the increased financial complexities often encountered with aging, older individuals are known to be more likely to seek help from financial planners compared to younger individuals. Older individuals are also more likely to have accumulated greater wealth and have higher incomes, which allows them the means to afford the services of a financial planner.

Research shows that higher levels of education and financial knowledge are characteristics associated with the use of financial planners (Robb, Babiarz, and Woodyard 2012). Well-educated and financially knowledgeable individuals are more likely to use the services of a financial planner (Chatterjee and Zahirovic-Herbert 2010; Salter, Harness, and Chatterjee 2010). In addition to education and financial knowledge, Gentile, Linciano, and Soccorso (2016) noted that factors such as saving behavior, impulsivity, financial satisfaction, self-assessed financial knowledge, positive perceptions of one’s financial situation, level of engagement in a household’s financial affairs, and feelings of regret can be used to describe who is likely to seek financial advice from a professional.

A study by Grable and Joo (2001) summarized much of what is known about financial help-seeking behavior. Their profile of help-seekers showed that those who work with financial planners proactively plan and save for the future; create and adhere to a budget; possess higher levels of knowledge; identify as confident; and carry less regret or disappointment over past mistakes.

Inheritances and the usage of financial planners. Little is known about how the receipt of an inheritance shapes financial planning help-seeking behavior. A widely held belief by many planners appears to be that those who receive an inheritance will seek help from their financial planner instead of continuing to work with a family’s existing financial planner, especially if the relationship with the heir, prior to the family member’s death, is weak.

It is estimated that $30 trillion in assets will be passed down to heirs over the next few decades (Robaton 2016; Skinner 2015). Although some of these assets will be used to pay for health care and long-term care expenses, the amount of future transfers will be substantial. What is unknown is if heirs (particularly those from younger generations) will continue to use the services of the financial planner who helped create the transferred wealth.

One idea is that millennials will be more likely to continue the use of their parents’ or grandparents’ financial planner. Millennials tend to be cognizant of the need for help but less likely to search broadly for it (Bannon, Ford, and Meltzer 2011). On the other hand, those in the Gen-X cohort may be more likely to forego the use of a financial planner due to their general distrust of organized financial advice and counsel (Robaton 2016). Additionally, younger individuals are known to be more apt to adopt the use of robo-adviser services. Preliminary research on the use of robo-advisers suggests that primary adopters tend to be younger consumers who trust the use of online platforms (Cutler 2015; Pisani 2016).

Changing from one financial planner to another. An essential element embedded in the financial planning process is the relationship that a financial planner builds with his or her clients (Sharpe, Anderson, White, Galvan, and Siesta 2007). Clients use quantitative and qualitative evaluations to determine the quality of advice received from a financial planner (Cummings and James 2014). Given that sensitive feelings, attitudes, and beliefs are often related to money, clients frequently come to rely on the expertise and trustworthiness of financial planners for ongoing information and advice.

Clients who have terminated previous client-financial planner relationships cite several reasons for changing a financial planner, including lack of communication; lack of attention; low portfolio performance; failure to understand the client’s goals; and high fees (O’Connell, 2013). Grable and Goetz (2017) and Sharpe Anderson, White, Galvan, and Siesta (2007) noted that a financial planner could reduce the possibility of losing a client by developing meaningful relationships with clients. This can be enhanced by exhibiting empathy, listening, and attending to a client’s needs, goals, worries, and aspirations.

The death of a client can leave a financial planner in a precarious situation in relation to maintaining assets under management. This is particularly true if the financial planner has failed to build a strong relationship with the deceased’s heirs. Harris (2017) stated that financial planners may struggle to work with widows because those who have recently lost a partner are fearful of making financial mistakes and prone to switching financial planners. To Harris’s point, it has been estimated that nearly 70 percent of widows will switch financial planners at some point (Waymire 2017). Financial planners can potentially counter this possibility by helping their clients increase financial confidence. Korb (2010) found that widows often do not feel financially capable, but confidence can be created if attended to by a financial planner.

Few firms have a program in place to meet widows’ needs, although those that do often retain assets at a higher level than other firms (Korb 2010). Grable et al. (2017) indicated that financial planners who were more skilled at interpersonal skills and remained involved in their clients’ lives after their husbands had passed exhibited a lower likelihood of switching financial planners.

Methodology

Survey participants were recruited during fall 2015 using an online Mechanical Turk (MTurk) survey system. To be eligible to complete the questionnaire, participants needed to meet three criteria: (1) be primarily or jointly responsible for managing household finances; (2) have at least $25,000 of household income; and (3) correctly identify the definition of net worth. The survey generated 608 respondents, but after the application of delimitations, as described below, the final sample used in the analysis included 312 participants.

Outcome variable. The outcome variable was based on responses to the following question: “How many advisers (financial planners) have you fired?” Although the range was relatively large (zero to five), the mean was less than one (M = 0.80; SD = 0.95; Mdn = 1.00).

Given the way in which data were distributed (0 = 47 percent, 1 = 32 percent, 2 = 16 percent, 3 = 3 percent, 4 = 1 percent, and 5 = 1 percent), the variable was recoded into a three-point ordinal variable: those who had never changed a financial planner were coded 0; those who had changed one financial planner were coded 1; and those who had changed more than one financial planner were coded 2. Those who had never worked with a financial planner were excluded from the analysis.

Independent variables. The following independent variables were included in the analysis to determine which factors might be associated with changing a financial planner: gender, marital status, age, education, household income, household net worth, percent of wealth due to inheritance, percent of income saved, impulsivity, financial satisfaction, being a savvy investor, income sufficiency, financial numeracy, and financial regret.

Gender was measured as a dichotomous male/female variable. Marital status was measured nominally at six levels: (1) single, never married; (2) married, never divorced; (3) remarried; (4) widowed; (5) divorced; and (6) separated. Marital status was recoded into three distinct dichotomous variables: single, never married; married, never divorced; and “other,” which included those who were remarried, widowed, and divorced. Age was measured as a continuous variable.

Education was measured on an ordinal scale with eight categories: (1) high school graduate; (2) some college, no degree; (3) associate’s degree, occupational; (4) associate’s degree, academic; (5) bachelor’s degree; (6) master’s degree; (7) doctoral degree; and (8) professional degree.

Household income and net worth were measured in dollars. Due to the skewed distribution of three of the continuous variables (i.e., household income, household net worth, and percent of wealth due to inheritance), these variables were transformed using the two-step approach for transforming continuous variables as described by Templeton (2011).

An inheritance variable was included to account for the possibility that a large asset windfall in the past might have prompted someone to make a change in their financial help-seeking behavior. Participants were asked to indicate the percentage of their overall net worth that was a result of an inheritance. Saving behavior was measured by asking participants to indicate what percentage of their pretax income they saved each month.

Impulsivity was measured by asking: “How often have you ignored budgets or plans when making large-scale purchases?” A five-point Likert-type scale was used to record responses, which ranged from 1 = never, to 5 = very often/always.

Financial satisfaction was measured with the following item: “In general, how satisfied are you with your current financial situation?” A five-point Likert-type scale using 1 = very unsatisfied, and 5 = very satisfied was used to code answers.

Whether someone considered himself or herself to be a savvy investor was assessed by asking: “In the past, how often have you thought of yourself as a smart/savvy investor?” A five-point Likert-type scale was used to code responses, ranging from 1 = never to 5 = very often/always.

Whether a participant felt they earned enough money was measured by asking: “My family’s current income is sufficient for most needs and wants.” A five-point Likert-type agreement scale was used to code responses, with 1 = strongly disagree to 5 = strongly agree.

Financial and investment acumen was measured by asking the following question: “I often do not know how my investments are performing” with a five-point Likert-type agreement scale of 1 = strongly disagree, to 5 = strongly agree.

Regret and disappointment in financial decisions were assessed with the following item: “How often have you been disappointed by the financial decisions you have made?” A five-point Likert-type scale was used to record responses, ranging from 1 = never, to 5 = very often/always.

Statistical approaches. Three statistical approaches were used to determine the factors associated with changing a financial planner. First, chi-square tests were used to evaluate the association between gender and marital status across the three change categories. Second, ANOVA tests were used to evaluate associations for those items coded as ordinal or continuous variables. Third, a chi-squared automatic interaction detection (CHAID) model was built using the statistically significant variables from the chi-square and ANOVA tests. CHAID uses chi-square statistics to describe the outcome variable (categories of changing a financial planner in this paper) using optimal splits in the data. As exemplified in this study, decision trees can be a useful tool for those interested in applying statistical tests to applied situations.

Results

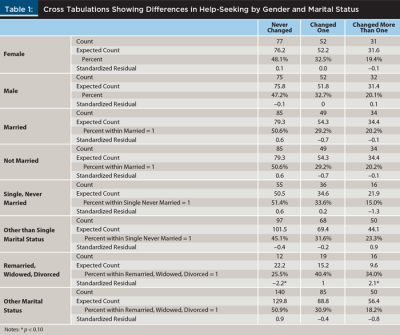

Table 1 shows how gender, categories of marital status, and changing a financial planner were related. No statistically significant associations were noted among those who were married or single, never married. A significant association (χ2 (2) = 11.528, p = 0.003) was found among those who were remarried, widowed, or divorced. These study participants were more likely to report changing two or more financial planners. They were also less likely to have never changed a financial planner.

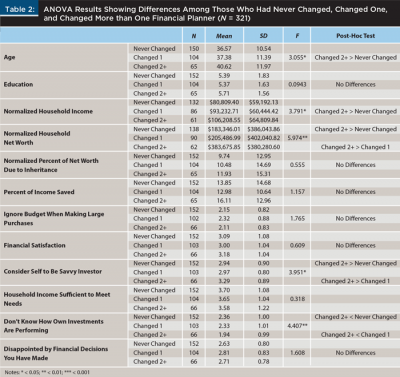

Other demographic results related to who had changed a financial planner were mixed. As shown in Table 2, no differences were noted between those who had changed one financial planner and those who had not changed a financial planner. In other words, those in these two groups were very similar along the variables used in the study.

However, several differences were noted between those who had changed more than one financial planner and those who not changed a financial planner. Those who had changed more than one financial planner:

- Were older (this may be an indicator that, given their age, they had more time to hire and change multiple financial planners)

- Had a higher level of household income

- Had a higher level of household net worth

- Considered themselves to be a savvy investor

- Were more likely to know how their own investments were performing

Additional differences were noted between those who had changed one financial planner and those who had changed more than one financial planner. Specifically, those who had changed multiple financial planners:

- Had a higher level of household income

- Considered themselves to be a savvy investor

- Were more likely to know how their own investments were performing

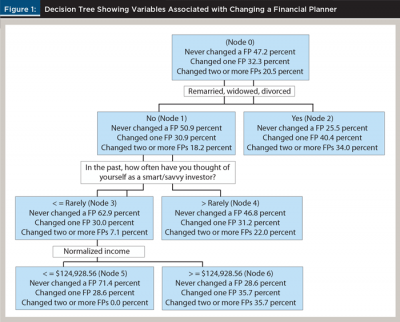

Figure 1 shows the decision tree that was developed using the CHAID model. For this decision tree, the statistically significant variables from Table 1 and Table 2 were used as descriptive variables in the model. The model was particularly good at categorizing those who had never changed a financial planner, with a 90 percent success rate. The model was weaker in predicting who had changed more than one financial planner.

The decision tree begins at Node 0. The percent and number figures represent the actual percentage and quantities for those in the changing categories. The data were then split using the remarried, widowed, or divorced variable. Those who fit this category were more likely to report changing at least one financial planner (74.4 percent), as shown at Node 2. Those with another marital status classification were less likely to have changed a financial planner (50.9 percent), as shown in Node 1.

Following Node 1, the data were then split with the variable asking how often the participant thought they were a smart/savvy investor. Those who responded more than rarely were placed into Node 4. More than 50 percent of those in Node 4 had changed at least one financial planner. In this model, anyone who failed to respond was classified as being similar to a participant who indicated “rarely” as their answer. Someone who indicated that they rarely or never thought of themselves as a smart/savvy investor were more likely to have never changed a financial planner (62.9 percent), as shown at Node 3.

Finally, the data were split based on household income. Those with annual income less than or equal to $124,928.56 (and those with missing income data) were very unlikely to have changed more than one financial planner. The majority of those with this level of income had never changed a financial planner. Survey participants with income greater than $124,928.56 were split almost evenly across changing categories, with more than 70 percent reporting changing at least one financial planner.

Discussion

A distinct profile of those who are more likely to change financial planners emerged from the analysis conducted in this study. Those most prone to changing financial planners were older, had more financial capacity (i.e., income and wealth), and tended to be remarried, widowed, or divorced. They also exhibited an elevated level of financial acumen and confidence; specifically, they indicated being a savvy investor, and when asked how much they knew about their own investment performance, they reported the highest scores among the three groups.

Interestingly, no evidence was found to support the common perceptions of those in the financial planning media, and among some financial planners, that receiving an inheritance might trigger someone to change their current financial planner. What did emerge from the analysis is that it is very difficult to describe, let alone predict, who is likely to change their financial planner compared to someone who has not changed their financial planner.

Two clear demographic characteristics did emerge from the analysis: income, and being remarried, widowed, or divorced. Those who fell into these marital status categories were significantly more likely to have changed two or more financial planners, and they were less likely to have never changed their financial planner. The same is true for study participants with high household income.

Two important practice management observations also emerged from this study. The first is that those financial planners who focus their practices on finding and working with high income, high net worth, and overtly confident and knowledgeable clients should expect to experience more client turnover throughout their careers. It may be that given their financial status, clients who exhibit these types of characteristics receive more solicitations from other financial planners. This could also increase the likelihood of a client shopping for advice when he or she might have otherwise not done so.

It is also possible that the type of client who changes more than one financial planner is focused on an objective financial performance rather than the subtle nuances associated with a strong client-financial planner relationship. That is, these clients may be more likely to change their financial planner if the financial planner’s recommendations lag some type of client-derived performance index. This observation stems from the finding that showed those who change financial planners see their own skills and capabilities related to money as quite strong. When coupled with the finding that they are more likely to know how their investments are doing, it is possible that when this type of client does evaluate the recommendations made by their financial planner, the client may conclude that their financial planner is underperforming expectations.

The second practice management observation looks at the flipside of the situation. While possibly not as lucrative given their lower income and net worth situation, it may pay in the long run for financial planners to reach out to the mass affluent (i.e., beyond the traditional high financial capacity marketplace) when building a practice. Those who were least likely to change their financial planner were younger, had less income, less wealth, less confidence in their own investing abilities, and were less knowledgeable about the performance of their investments. It is worth noting, however, that being remarried, widowed, or divorced increased the likelihood of changing a financial planner.

Both observations suggest a question that cannot be answered with the dataset used in this study. Specifically, how changeable are these observations? For example, is it possible that as people age and gain more wealth through higher incomes, they also gain the capacity to switch from one financial planner to another to obtain more complex and costly services? Anecdotal evidence based on asset minimums imposed by some financial planning firms suggests that prospective clients with less financial capacity are being priced out of the market for sophisticated financial planning services. This is a topic for additional study.

Rather than focus on income and net worth, findings from this study provide circumstantial evidence other client characteristics may be better predictors of client changing proclivities. The two non-demographic variables—being a savvy investor and knowing how one’s investments are performing—may be the key to who is likely to change a financial planner. Clients who track their investment performance, but at the same time do not feel that they are particularly investment savvy—appear to rarely change their financial planner. This topic is also something worth further study.

Some readers may appropriately ask what can be done today to help combat the possibility that a client and/or a client’s heirs will move to another financial planner. In many respects, the answer entails building a strong client-financial planner relationship. As noted by Sharpe Anderson, White, Galvan, and Siesta (2007), clients are constantly weighing the costs and benefits (both monetary and emotional) associated with maintaining a financial planner.

Rather than treat financial planning engagements as transactional moments, financial planners who attempt to honestly incorporate a client’s feelings, attitudes, and beliefs into financial planning recommendations tend to retain clients over long periods. One reason is that integration of qualitative factors into practice generally leads to perceptions of trustworthiness on the part of clients (Yeske 2010).

Based on the work of O’Connell (2013) and Grable and Goetz (2017), a reasonable path to client retention involves the use of empathetic listening and communication skills, paying attention to the verbal and non-verbal cues clients send, attending to clients, referencing recommendations to client goal achievement, and documenting performance in relation to measurable outcomes. This is akin to stating that a financial planner can reduce the possibility of being fired by focusing on developing meaningful client-financial planner relationships.

References

Ahmad, Rizal, and Francis Buttle. 2001. “Customer Retention: A Potentially Potent Marketing Management Strategy.” Journal of Strategic Marketing 9 (1): 29–45.

Auslander, Gail K., and Howard Litwin. 1990. “Social Support Networks and Formal Help Seeking: Differences Between Applicants to Social Services and a Nonapplicant Sample.” Journal of Gerontology 45 (3): S112–S119.

Bannon, Shele, Kelly Ford, and Linda Meltzer. 2011. “Understanding Millennials in the Workplace.” The CPA Journal 81 (11): 61–65.

Chang, Mariko L. 2005. “With a Little Help from My Friends (and My Financial Planner).” Social Forces 83 (4): 1,469–1,497.

Chatterjee, Swarn, and Velma Zahirovic-Herbert. 2010. “Retirement Planning of Younger Baby-Boomers: Who Wants Financial Advice?” Financial Decisions 22 (2): 1–12.

Cummings, Benjamin F., and Russell N. James III. 2014. “Factors Associated with Getting and Dropping Financial Advisors Among Older Adults: Evidence from Longitudinal Data.” Journal of Financial Counseling and Planning 25 (2): 129–147.

Cutler, Neal E. 2015. “Millennials and Finance: The ‘Amazon Generation.’” Journal of Financial Services Professionals 69 (6): 33–39.

Elmerick, Stephanie, A., Catherine P. Montalto, and Jonathan J. Fox. 2002. “Use of Financial Planners by U.S. Households.” Financial Services Review 11 (3): 217–231.

Finke, Michael S., Sandra J. Huston, and Danielle D. Winchester. 2011. “Financial Advice: Who Pays.” Journal of Financial Counseling and Planning 22 (1): 18–27.

Fischer, Edward H., and Amerigo Farina. 1995. “Attitudes Toward Seeking Professional Psychological Help: A Shortened Form and Considerations for Research.” Journal of College Student Development 36 (4): 368–373.

Gentile, Monica, Nadia N. Linciano, and Paola P. Soccorso. 2016. “Financial Advice Seeking, Financial Knowledge, and Overconfidence: Evidence from the Italian Market.” CONSOB Working Papers No. 82. Available at papers.ssrn.com/sol3/papers.cfm?abstract_id=2802589.

Grable, John E., and Joseph W. Goetz. 2017. Communication Essentials for Financial Planners: Strategies and Techniques. Hoboken, N.J.: John Wiley & Sons.

Grable, John E., and So-hyun Joo. 2001. “A Further Examination of Financial Help-Seeking Behavior.” Journal of Financial Counseling and Planning 12 (1): 55–74.

Grable, John E., Carrie L. West, Linda Y. Leitz, Kathleen K. Rehl, Carolyn C. Moor, Michele N. Hernandez, and Susan Bradley. 2017. “Enhancing Financial Confidence Among Widows: The Role of Financial Professionals.” Journal of Financial Planning 30 (12): 38–44.

Harris, Bill. 2017. “Preparing Clients for Widowhood.” Journal of Financial Planning 30 (4): 34–35.

Heckman, Stuart, J., Martin C. Seay, Kyoung T. Kim, and Jodi C. Ketkiewicz. 2017. “Household Use of Financial Planners: Measurement Considerations for Researchers.” Financial Services Review 25 (4): 427–446.

Kaskutas, Lee A., Constance Weisner, and Raul Caetano. 1997. “Predictors of Help-Seeking Among a Longitudinal Sample of the General Population, 1984–1992.” Journal of Studies on Alcohol 58 (2): 155–161.

Korb, Brian R. 2010. “Financial Planners: Educating Widows in Personal Financial Planning.” Journal of Financial Counseling and Planning 21 (2): 3–15.

Miller, Susan A., and Catherine P. Montalto. 2001. “Who Uses Financial Planners? Evidence from the 1998 Survey of Consumer Finances.” Consumer Interests Annual 47: 1–9.

O’Connell, Brian. 2013. “Why Clients Fire Financial Advisors.” Investopedia. Available at www.investopedia.com/articles/professionals/071113/why-clients-fire-financial-advisors.asp.

Phillips, Mark A., and Stanley A. Murrell. 1994. “Impact of Psychological and Physical Health, Stressful Events, and Social Support on Subsequent Mental Health Help-Seeking Among Older Adults.” Journal of Consulting and Clinical Psychology 62 (2): 270–275.

Pisani, Jeanette. 2016. “Robo-Advisors: A Disruptive Force in the Wealth Management Industry.” University of Malta dissertation. Available at www.um.edu.mt/library/oar/handle/123456789/13703.

Robaton, Anna. 2016. “Preparing for the $30 Trillion Great Wealth Transfer.” CNBC, posted November 30. Available at cnbc.com/2016/11/29/preparing-for-the-30-trillion-great-wealth-transfer.html.

Robb, Cliff, Patrick Babiarz, and Ann Woodyard. 2012. “The Demand for Financial Professionals’ Advice: The Role of Financial Knowledge, Satisfaction, and Confidence.” Financial Services Review 21 (4): 291–305.

Salter, John R., Nathan Harness, and Swarn Chatterjee. 2010. “Utilization of Financial Advisors by Affluent Retirees.” Financial Services Review 19 (3): 245–263.

Sharpe, Deanna L., Carol Anderson, Andrea White, Susan Galvan, and Martin Siesta. 2007. “Specific Elements of Communication that Affect Trust and Commitment in the Financial Planning Process.” Journal of Financial Counseling and Planning 18 (1): 2–17.

Skinner, Liz. 2015, July 13. “The Great Wealth Transfer Is Coming, Putting Advisers at Risk.” InvestmentNews, posted July 13. Available at investmentnews.com/article/20150713/FEATURE/150719999/the-great-wealth-transfer-is-coming-putting-advisers-at-risk.

Templeton, Gary F. 2011. “A Two-Step Approach for Transforming Continuous Variables to Normal: Implications and Recommendations for IS Research.” Communications of the Association for Information Systems 28 (4): 41–58.

Waymire. Jack. 2017. “5 Financial Planning Tips for Working with Recent Widows.” Seeking Alpha posted July 7. Available at: seekingalpha.com/article/4079384-5-financial-planning-tips-working-recent-widows.

Yeske, David. 2010. “Finding the Planning in Financial Planning.” Journal of Financial Planning 23 (9): 40–51.

Citation

Fulk, Martha, Kimberly Watkins, John Grable, and Michelle Kruger. 2018. “Who Changes Their Financial Planner?” Journal of Financial Planning 31 (8): 48–56.