Journal of Financial Planning: August 2014

Randy Gardner is a tax, retirement, and estate planning attorney. He is co-author of 101 Tax Saving Ideas and The Closing Wealth Transfer Window. Email author HERE.

Leslie Daff is a state bar certified specialist in estate planning, probate, and trust law and the founder of Estate Plan Inc., a professional law corporation. Email author HERE.

Effective May 9, 2014, for estates (and starting in 2015 for most irrevocable trusts), the deductibility of many fiduciary expenses, including the investment advice portion of bundled fiduciary fees, is reduced by the 2 percent floor on miscellaneous itemized deductions.

Recently issued Treasury Department regulations (IRS Reg. 1.67-4 or T.D. 9226) respond to years of comments and provide guidance to fiduciaries and advisers with regard to a variety of fiduciary expenses addressed in the Supreme Court decision in Michael J. Knight, Trustee of William L. Rudkin Testamentary Trust, 2008-1 USTC ¶50,132 (the Knight case). These changes promise to be a source of contention between the IRS and fiduciaries for years to come.

Note: These regulations apply to billions of dollars of assets under management in non-grantor trusts, but they do not apply to all trusts. Our clients’ revocable living trusts and defective grantor trusts are not immediately affected by these changes. However, when trusts become irrevocable after a grantor’s death, as they might if the estate plan calls for a bypass trust, qualified terminable interest property (QTIP) trust, retirement trust, irrevocable life insurance trust (ILIT), beneficiary-controlled asset-protection trust, and numerous other irrevocable trusts, the changes do apply.

Background

In 2008, the Knight case resolved a split in the Circuit Courts of Appeal regarding whether payments for investment advice by a trust are unique to the administration of a trust and would not have been incurred if the property was not held in a trust. Contrary to the arguments of fiduciaries that state laws across the country impose a fiduciary duty on trustees to seek expert advice on investments, in Knight the Supreme Court unanimously agreed that the proper inquiry was whether a hypothetical individual would commonly or customarily incur the same expenses. If the answer is “yes,” then the expenses are subject to the 2 percent floor on miscellaneous itemized deductions that apply to fiduciary income tax returns. Although trustees’ fees are unique to trusts, the “investment advice” portion of these fees is customarily incurred by individuals; thus, the investment advice portion of the trustees’ fees plus numerous other expenses paid by fiduciaries must be identified, unbundled, and subjected to the 2 percent floor.

Following this victory, the IRS issued preliminary guidance on the matter of bundled fees in Notice 2008-32. In September 2011, the Treasury Department issued proposed regulations and sought public comment. On May 9, 2014, the Treasury finalized the regulations requiring taxpayer compliance.

Because most trusts use the calendar year, individuals and entities serving as trustees, trust companies, and the beneficiaries of trusts will be affected in 2015. Executors and beneficiaries of estates could be affected sooner if they have tax years starting in 2014 due to the death of a loved one.

Tax Impact of the Change

The tax bills of trusts and estates will increase for two reasons. First, the 2 percent floor will decrease the amount of expenses that are deductible in full. The new regulations state: “In analyzing a cost to determine whether it commonly or customarily would be incurred by a hypothetical individual owning the same property, it is the type of product or service rendered to the estate or non-grantor trust in exchange for the cost, rather than the description of the cost of that product or service, that is determinative.”

Trusts and estates are subject to the maximum marginal income tax rates (39.6 percent on ordinary income and 20 percent on capital gains) at low levels of income ($12,150 in 2014). Decreasing the deductible expenses automatically increases the taxes of estates and trusts by the marginal tax rate of the estate or trust.

The second impact is more subtle. The 3.8 percent net investment income surtax is imposed on a trust or estate on the lesser of the entity’s undistributed net investment income or the entity’s adjusted gross income in excess of the level at which a trust or estate’s taxable income is taxed at the maximum rate. For this reason, more fiduciaries are allocating capital gain income to trust income rather than principal, thereby escaping taxation at the trust level and allowing the capital gains to be distributed to the beneficiaries with their more desirable marginal tax rates.

For the trusts and estates that cannot use this strategy, the new regulations will restrict the fiduciaries’ discretion to classify expenses as deductible for adjusted gross income. Many trusts have only investment income. If the amounts of expenses that are deductible in computing the trust’s adjusted gross income decreases, the trust will end up paying an additional 3.8 percent tax on the amount of expenses no longer deductible for adjusted gross income.

The instructions for Form 1041 (income tax return for trusts and estates) include a complex discussion of how to calculate the adjusted gross income of a trust or estate. In short, the entity’s total income is reduced by the “income distribution to the beneficiaries” deduction, the amount of the entity’s exemption, and the “administration costs of the estate or trust that would not have been incurred if the property were not held by the estate or trust.”

Under the new regulations, more of the administration costs will be considered commonly or customarily incurred by a hypothetical individual, increasing the amount of trust income that is subject to the full 3.8 percent surtax and the income tax caused by the 2 percent reduction of the itemized deductions.

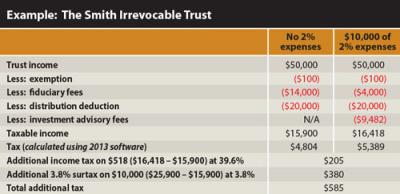

Example: The Smith irrevocable trust has $1 million of assets, $50,000 of investment income, and one beneficiary. The trust has $14,000 of fiduciary’s fees allocable to corpus, $10,000 of which are for investment advice.

In this example, the total tax the trust will owe is based on 2013 rates and is approximate. The additional income tax is from the 2 percent floor, disallowing $518 (2 percent of $25,900) in deductions. The additional surtax comes about because the $10,000 of investment advice fees is treated as an itemized deduction rather than as a deduction for adjusted gross income.

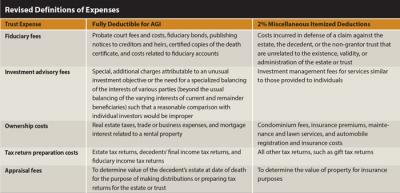

The Revised Definitions of Expenses

One of the thrusts of the new regulations is to provide guidance regarding which expenses are deductible in full and which are restricted.

Often these expenses are aggregated into a single fee. According to the final regulations: “If an estate or a non-grantor trust pays a single fee, commission, or other expense (such as a fiduciary’s commission, attorney’s fee, or accountant’s fee) for both costs that are subject to the 2 percent floor and costs (in more than a de minimis amount) that are not, then … the single fee, commission, or other expense (bundled fee) must be allocated, for purposes of computing the adjusted gross income of the estate or non-grantor trust in compliance with section 67(e), between the costs that are subject to the 2 percent floor and those that are not.”

Expenses not computed on an hourly basis, out-of-pocket expenses, and disbursements to third parties also must be scrutinized for fees related to investment advice.

In performing this allocation, the regulations provide that any reasonable method may be used, including “the percentage of the value of the corpus subject to investment advice, whether a third party adviser would have charged a comparable fee for similar advisory services, and the amount of the fiduciary’s attention to the trust or estate that is devoted to investment advice as compared to dealings with beneficiaries and distribution decisions and other fiduciary functions.”

In the end, taxes on trusts, estates, and their beneficiaries will increase, but the compliance rules and recordkeeping burden for fiduciaries will increase significantly.