Journal of Financial Planning: April 2015

Kevin R. Keller, CAE, is CEO of Certified Financial Planner Board of Standards Inc.

CFP Board’s public awareness campaign is now in its fifth year and has not only generated significant increases in consumer awareness of CFP® certification, but it is building upon the work of many—especially at the Financial Planning Association—as we work together to grow and support the financial planning profession.

The idea of the campaign came from CFP® professionals themselves. They worked hard to earn the certification and are passionate about helping people with their finances and plan for a financially secure future, but were not getting the recognition they deserved for being CERTIFIED FINANCIAL PLANNER™ professionals. Our initial research confirmed that most consumers were not familiar with CFP® certification. To make matters worse, the public had a negative perception of “financial planners.” With that impetus, CFP Board did additional consumer and stakeholder research in 2010 to launch the public awareness campaign in 2011 with a primary goal to increase awareness of the CFP® certification.

This year, in addition to our successful “DJ” TV ad, which debuted in 2014, we are adding new print and online ads featuring “extreme” situations, graphically illustrating why it’s important for consumers to choose a CFP® professional when seeking a financial adviser. The ads highlight that CFP® certification is the highest standard in personal financial advice. The TV ads will continue to air on networks such as MSNBC, Golf, and Fox News; we will be in national publications like Kiplinger’s, Financial Times, and Travel and Leisure; and on websites such as The Atlantic, NBC Sports, and Food & Wine, among others.

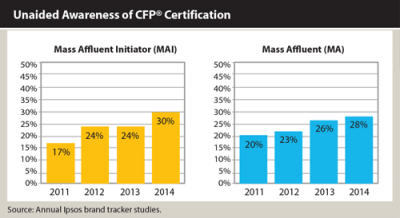

Launched in the spring of 2011, the campaign’s primary target audience is the mass affluent initiator, consumers between the ages of 35 and 64 with $100,000 to $1 million in investible assets and who are willing to seek out expert advice. Since we started advertising, we have raised unaided awareness of the certification among our target audience by 13 percentage points—nearly doubling it from 17 percent to 30 percent and with a jump of 6 percentage points in the last year alone, based on annual Ipsos brand tracker studies.

We have also differentiated CFP® certification from other financial designations. While we have seen gains in our brand awareness and unaided awareness, many of the other designations such as CFA, CLU, ChFC, and PFS have either remained flat or declined over the last four years. Only the CFP® brand has made any significant increases in awareness, though CPA still has very strong brand awareness.

Aside from the awareness of the certification, the campaign has increased awareness of several positive attributes that consumers associate with professionals in the financial industry.

Our research shows statistically significant increases in qualities such as trust, popularity, relevance, and willingness to recommend a CFP® professional. In addition, the campaign has helped promote that a CFP® professional acts in their clients’ best interest, with an increase of 11 percentage points since the beginning of the campaign. These qualities indicate that consumers are more likely to seek out a CFP® professional—not only if they’re aware of them, but also if they feel more positive about financial planners and the profession overall.

This likelihood to seek out a CFP® professional is especially important as CFP Board focuses its efforts on growing the number of CFP® professionals. We believe more Americans are in need of competent and ethical financial planning advice. With this goal in mind, creating consumer awareness of CFP® certification has never been more important. If consumers are aware of the certification, they will likely seek out a CFP® professional when looking for a financial planner. This demand for a CFP® professional should also inspire more firms to require their advisers to be certified and more individual advisers to pursue CFP® certification.

The public awareness campaign is slated to continue with periodic reviews by the board of directors. As it goes forward this year, we are making a more concerted effort with our business partners to integrate our consumer-focused earned media with our consumer-focused paid advertising to support each other and strengthen our message of working with “the highest standard."

With the help of our consumer advocate and FPA member Eleanor Blayney, CFP®, CFP Board ambassadors from across the country and our more than 71,000 CFP® professionals, we are continuing to provide consumers with financial planning information on our consumer website, LetsMakeAPlan.org. We are also increasing the resources in our marketing toolkit so CFP® professionals can use the public awareness campaign for their own marketing purposes and become ambassadors of the brand to help their business as well as the overall CFP® brand.

We are extremely pleased with the success of the public awareness campaign. We are proud to represent the CFP® brand, support our CFP® professionals and elevate the financial planning profession. Looking back, we have come a long way in the campaign’s first five years and look forward to continued success going forward.