Journal of Financial Planning: June 2017

The rise of behavioral finance and related behavioral therapy has given rise to the popularity of tools such as mind-mapping to gain a better sense of where one’s client is “coming from.” That approach is laudatory, but does it go far enough?

An underlying premise of behavioral finance is the recognition that decision-making involves both System 1 and System 2 mental processes. The former is intuitive and emotional, and the latter more cognitive and rational. Are the two equal? Probably not, as neurobiology studies suggest that 70 percent of a person’s decision-making process is emotionally driven. Our default—because it’s easier and more natural—is to be more like Homer Simpson than Mr. Spock of Star Trek fame.

A limitation with using mind-mapping or like-minded exercises to uncover a client’s true emotional state is that, to the extent they explore emotions, they may actually traffic in feelings. Psychologists distinguish between emotions and feelings—emotions subconsciously and spontaneously occur; feelings are cognitively filtered instances of self-reporting. In other words, people don’t think their emotions, they experience them. Therefore, facial coding could be another tool to use to get more accurate insights into your clients.

Importance of Facial Expressions

None other than Charles Darwin first recognized the importance of emotions as a matter of evolutionary survival. That’s because emotions matter. The emotional part of the brain came into existence before the more rational part of the brain, and that fact colors our “rational” reflection.

As Darwin came to realize, we best reflect and communicate our emotions in our faces. Not only are facial expressions universal, they’re spontaneous. The face is the only place in the body where the muscles attach right to the skin, ensuring real-time reactions that a client might try to suppress or hide with a camouflaging social smile. As Yogi Berra notes: “You can observe a lot by watching.” Facial coding has been codified into the Facial Action Coding System by psychologists including Paul Ekman, who in 2009 was named one of Time’s 100 most influential people.

You’ll be hearing a lot more about facial coding in the future. Big tech firms including Google, Microsoft, Intel, and Facebook are working on automating facial coding. Current first-wave facial coding software from small tech firms performs in the range of 50 percent accuracy, far less than the 90 percent accuracy an experienced manual facial coder can achieve. But with greater resources at hand, more reliable versions of facial coding software will likely be available in the future.

Someday, your advisory practice could have software that enables you to read the emotions of clients in real-time (and clients, in turn, will be able to read your emotions if the software is priced reasonably enough). Until then, here are some practical ways to use facial coding in your practice today:

What Resonates with Clients?

Even an amateur facial coding read of a client can help you understand what’s most pertinent to that client. One’s emotions “turn on” when something is relevant or novel. If the facial muscles around a client’s eyes and mouth rarely, if ever, move as you’re talking, odds are that you are failing to connect.

Watch for signs of anger and contempt. Anger can reflect either confusion or resistance. Confusion can be signaled by eyebrows that knit together firmly, and resistance can be signaled by lips pressed tightly together. Contempt is the emotion that is the opposite of trust. Look for what you may take as a smile but is actually a smirk, with enough tightness at the corner of the mouth to indicate the client isn’t actually on board (no matter what he or she says).

Lessons from a Beta Test

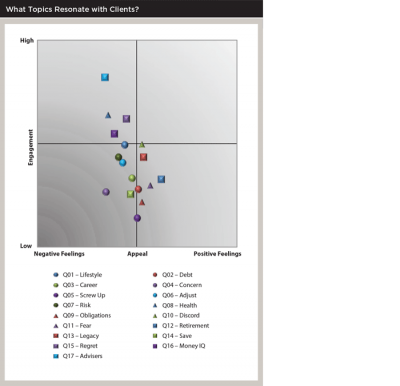

My company ran a beta test involving 10 wealthy investors ranging in age from their 30s to 80s—four couples and two (divorced) individuals with reported assets ranging from about $1.5 million to more than $10 million. For this beta test, a 17-question interview was developed with input from a successful financial adviser running his own practice. The interviews were conducted in person and captured on video using a flip cam. Answers ranged from under a minute to three minutes. Using the Facial Action Coding System, I facially coded the investors’ responses manually to learn the participants’ emotional responses. Results are shown in the scatter plot on this page.

Despite the very small sample size, the chart may indicate the topics that emotionally resonate most with your clients of similar demographics. From top to bottom, the “engagement” axis runs from high to low. And from left to right, the “appeal” axis moves from negative to positive feelings.

In this chart, “engagement” reflects the amount of emoting—in other words, how often the facial muscles move in ways that indicate an emotional response. The question: “What are your feelings about financial advisers?” (“Q17–Advisers” on the chart) elicited the greatest interest to the wealthy investors interviewed in this beta test. Interest is a euphemism for what is actually concern. That’s because “appeal” as a research measure captures the balance between positive versus negative emoting, and no topic got a more negative reception from the wealthy investors in this test than their adverse reactions to advisers, due to the issue of potentially self-serving adviser recommendations.

The adverse appeal result shown in the chart suggests that advisers are at risk of losing clients if they can’t get more aligned with them and earn their trust. What is in effect distrust outweighed all other topics. The question: “How’s your health?” qualified as the second-most engaging, meaningful topic based on the amount of emoting elicited during the interviews (“Q08– Health” on the chart).

The third-most engaging topic was: “What one previous financial choice that you made on your own do you now most regret?” (Q15–Regret), and the fourth was: “What’s your degree of financial/investment knowledge?” (Q16–Money IQ). Both of these topics confirm the opportunity for advisers to fill in knowledge gaps and help clients avoid future mistakes.

Connecting to Couples

The studies my firm has done analyzing adviser/client interactions have shown that more successful advisers have been able to position themselves emotionally as a bridge or equal connection to both the wife and the husband, as opposed to tilting more to the latter. In contrast, newer or lower revenue-generating advisers have generally shown a bias for connecting more to the husband alone.

Facial coding provides the ability to serve like an emotional radar, to understand where the two members of a couple may stand on a specific topic or issue. Because women are often more observant of social cues, facial coding insights may be of particular value to male financial advisers.

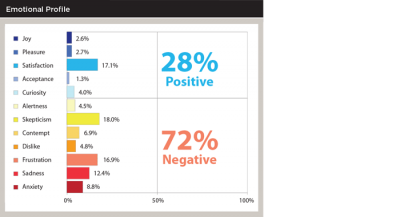

Facial coding can capture seven core emotions: happiness, surprise, sadness, fear, anger, disgust, and contempt (remember, contempt is the opposite of trust). The emotional profile chart on this page addresses how those seven core emotions can be refined to cover four descending levels of happiness from joy to mere acceptance, positive versus negative surprise (curiosity versus alertness), plus skepticism—social smiles linked to sardonic, negative, or deliberately ambivalent, non-committal verbal input from the wealthy investors in the beta test.

Note that the results in the emotional profile chart reflect the average type of emoting across all 17 questions in the interview sessions, held individually. The results cover both genders and clearly show the large amount of negative, concerned emotions that money topics create.

Gender Differences

If you look at the results by gender, things get even more interesting. Across the four couples coded in this beta test, the men were three times more likely to show joy (the top level of happiness), perhaps given career achievements that made the topic of money a welcome one. The women were admittedly less knowledgeable of money matters and showed four times more surprise (curiosity and alertness), much of it negative in nature. The women were also twice as likely to show anxiety related to financial planning topics. Frustration was one-third more common for men than it was for the women interviewed and facially coded in this beta test.

Gender differences also emerged across specific topics during the beta test interviews. For the wives, the question: “What’s the most crucial area of continuing disagreement between you and your spouse or significant other when it comes to money management?” garnered the largest amount of emotional engagement. In contrast, the men didn’t perceive this question as a matter of great concern. That money matters might lead to threats to the current lifestyle being enjoyed was the second-most engaging, and negative, topic for the wives. The other negatively received topics for the wives were money IQ, what kind of legacy their wealth might create, and the topic of handling or avoiding debt.

The husbands were most engaged in these cases of disparate gender responses to a given topic when it came to their money IQ (a source of pride, as their reactions were positive, not negative as they were for the women). They were second-most engaged by the topic of creating a legacy, again positively so. But they were negative in contrast to their wives when it came to obligations and to past screw-ups with their investments (again, probably a result of pride).

These results are anecdotal of how wealthy investors may respond to various topics and the potential gender differences among couples’ responses. Nevertheless, the goal here is to get financial advisers to be alert to emotions. Advisers may need to become more emotionally literate, paying more attention to facial expressions, then begin to divine the emotions experienced by their clients and respond accordingly.

Dan Hill, Ph.D., is president of Sensory Logic Inc., a research and training firm specializing in using facial coding to capture and quantify emotional response. His frequent media appearances include CNN, Fox, MSNBC, Reuters, and Fast Company, and his forthcoming book is Faces: Reading Others Without Them Knowing.