Journal of Financial Planning: October 2025

Christina Lynn, Ph.D., CFP®, AFC, CDFA, is a director and wealth strategist at Mariner (www.mariner.com). She specializes in applying motivational interviewing, an evidence-based communication method, to help advisers develop emotional intelligence and strengthen client relationships.

Scott Luhnau, J.D., CTFA, is an estate and tax planning attorney who leads the Advanced Planning Group at Mariner (www.mariner.com). Scott specializes in high-net-worth estate planning, charitable planning, and advising business owners.

NOTE: Click on the images below for PDF versions.

JOIN IN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Business succession planning is a coveted niche among emerging financial advisers. It makes sense; helping business owners maximize valuation, minimize taxes, and implement advanced estate planning techniques creates the opportunity for advisers to deliver asymmetrical value. It’s a mystery then, why more business owners are not seizing the opportunity to work with advisers who can assist them.

In reality, two-thirds of business owners defer succession planning until a crisis—such as death, disability, or divorce—forces their hand (Taylor and Taylor 2025). It can feel like a fisherman who has top-of-the-line gear, yet the fish don’t bite. If advisers have so much value to offer, why is it difficult to get business owners to engage in succession planning?

To entice business owners to participate meaningfully in planning, advisers must slow down and address the mental and emotional barriers that lie beneath the surface. Financial planners can learn to have better, more impactful conversations about exit planning by borrowing techniques from motivational interviewing (MI)—a proven, evidence-based communication style that helps clients move from ambivalence to action (Miller and Rollnick 2023). This article applies MI techniques to the unique psychology of business owners, helping planners bridge the gap between knowing and doing. All the communication techniques discussed herein draw upon 10 MI competencies adapted for financial planning contexts as outlined by Lynn (2025) in the financial planning emotional intelligence (FPEQ) Scorecard.

Why Logic Fails

The problem isn’t a matter of intelligence. Business owners are aware that succession planning would be in their best interest, yet they don’t take action. When surveyed, most business owners agreed that having a plan is important, yet 59 percent have no written transition plan, and 26 percent have done no planning at all (Exit Planning Institute 2023). On the surface, this inaction appears to stem from a gap in knowledge.

Thus, advisers often enter meetings armed with technical expertise, eager to showcase solutions. They arrive with presentations highlighting case studies and agendas designed to walk owners through business value assessment plans and planning frameworks. When advisers spot gaps in a client’s plan, it feels second nature to demonstrate value by offering education, customized recommendations, and step-by-step solutions.

MI provides critical insight into why this tactic often fails with business owners: the fixing reflex. The fixing reflex refers to the tendency of professionals to immediately propose solutions the moment they identify a problem (Miller and Rollnick 2023). In financial planning, this impulse is deeply ingrained; after all, it is what we are paid to do.

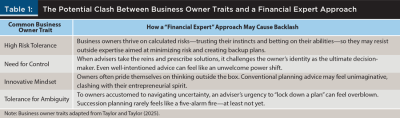

Here is the problem: the fixing reflex runs directly against the psychological grain of most business owners. The very traits that make them successful—an unusually high-risk tolerance, a need for control, an innovative mindset, and a tolerance for ambiguity (Taylor and Taylor 2025)—are the same traits that often clash with an adviser’s traditional “financial expert” approach. Table 1 outlines how these entrepreneurial characteristics can inadvertently trigger resistance when advisers lead with prescriptive solutions.

When advisers rush to “fix” without first exploring the owner’s internal push-and-pull, they do not merely miss the mark—they trigger active resistance to succession planning efforts.1

Motivational Interviewing as a Human-Centered Approach to Succession Planning

What’s really the hang-up here? Taking a step back to assess the situation from a broader perspective, the core issue underlying a business owner’s procrastination or resistance is ambivalence. Part of the owner wants to act logically—engaging in succession planning to protect and maximize their life’s work. Yet another part—the entrepreneurial, risk-taking part—actively resists it.

Ambivalence is a uniquely frustrating adversary for financial advisers because it runs counter to how we are trained to think. To advisers, the solution is obvious: build a plan, follow the plan, secure the outcome. However, logic alone is not enough when emotional undercurrents are at play. MI offers valuable lessons for navigating this internal conflict.

The Spirit of Motivational Interviewing

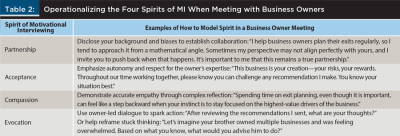

So how do we step back and meet business owners where they are? This is exactly the challenge MI was designed to address. In their seminal work, now in its fourth edition, Miller and Rollnick (2023) describe MI as a scientifically grounded conversation framework for resolving ambivalence. To begin, let’s explore the spirit of MI—captured in four key attitudes: partnership, acceptance, compassion, and evocation, which can be embedded in the succession planning process.

The first is partnership, which teaches professionals to convey an attitude of collaboration and recognizing the owner as an equal. This stands in contrast to the common practice of positioning ourselves as the expert. Instead, we may shift our paradigm from being a financial expert to a financial guide. Similarly, Langlois and Goudreau (2024) advocated for a shift from “health experts” to “health guides” in clinical practice. Just as physicians increasingly frame their advice as guidance rather than directives, the same approach applies to effective exit planning conversations. It is a nuanced, but critical, shift to accommodate the psychology of business owners.

The second spirit is acceptance, which centers on honoring the owner’s autonomy. Embedding acceptance into adviser–client conversations fosters an environment where owners feel valued and respected in their decision-making process (Pheasant and Lynn 2025). When owners perceive their motivation as self-directed rather than externally imposed, they are significantly more likely to engage. Advisers can model acceptance by acknowledging the owner’s experiences and emotions without judgment, thereby reducing resistance.

The third spirit is compassion—caring about what truly matters to the owner. This can be challenging, as advisers may not always naturally empathize with a client’s hesitation. Attempts at demonstrating compassion can sometimes come across as patronizing. MI emphasizes the importance of accurate empathy: making a genuine effort to see the world through the client’s eyes and reflecting that understanding back to them (Miller and Rollnick 2023). Accurate empathy not only fosters compassion but strengthens partnership, acceptance, and evocation as well.

The fourth spirit is evocation, or drawing out the owner’s own reasons for action.2 Several techniques support evocation, including eliciting change talk, helping the owner imagine solutions, enhancing self-efficacy by recalling past successes, and using scaling questions to assess readiness. A word of caution: evocation can easily drift into problem-solving or advice-giving, which should come later in the meeting. Even if owners’ ideas initially seem unrealistic, the early stages of dialogue must remain a judgment-free zone—a critical opportunity to build trust and collaboration.

Think of the four spirits of MI as attitudes that advisers embody. Capturing a spirit of partnership, acceptance, compassion, and evocation represents a subtle but powerful shift from leading as a financial expert to guiding as a trusted partner. Table 2 provides examples of how advisers might operationalize the four spirits in practice when meeting with a business owner.

A Realistic Timeline

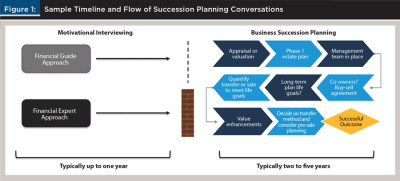

Specializing in business succession planning requires patience. Building the trust needed to initiate meaningful conversations can take years. Figure 1 illustrates that strategic planning rarely begins until a strong adviser–client relationship has been established. Notably, Figure 1 also highlights that advisers who adopt a financial guide approach are more likely to advance succession conversations. In contrast, advisers who lead with a financial expert posture often encounter resistance—owners deflect, delay, or claim they are “too busy,” signaling a lack of emotional readiness.

Once trust is built, conversations can progress through multiple layers—unfolding gradually, not in a single meeting. As shown in the timeline, a realistic succession planning process may span three to five years or more. Advisers should approach these conversations with that long view in mind, using the MI-informed techniques presented throughout this article to foster engagement and forward momentum.

Leveraging Business Owners’ Affinity for Innovation

Now that the planning phase is underway, it is critical not to lose sight of business owner psychology. Recall how owners are wired: they value autonomy, innovation, and control. Succession planning strategies are most effective when deployed proactively—before urgency forces the owner’s hand. However, reaching this point depends on laying the emotional groundwork first.

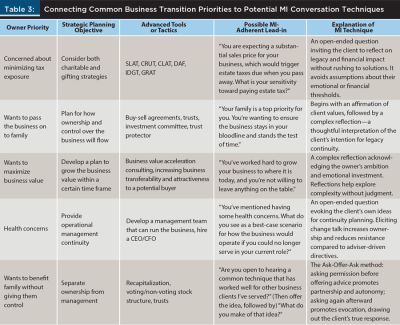

Table 3 outlines a sample framework that connects common business owner transition priorities to advanced planning strategies. It also illustrates how various succession strategies can be introduced through a MI-adherent conversation style. While countless variations are possible, this article offers a streamlined model to illustrate key applications without overwhelming the reader.

Integrating behavioral insights with technical planning strategies not only improves client outcomes but also strengthens the adviser–client relationship along the way. By honoring business owners’ natural inclinations toward innovation, autonomy, and creativity, advisers can create succession plans that are both technically sound and personally meaningful.

Conclusion

While technical expertise is essential in succession planning, it is rarely enough to prompt meaningful action. Logical, action-driven conversations may check all the technical boxes, but without addressing emotional undercurrents, they often fall flat. Too many business transitions are triggered by crisis—divorce, disability, or death—rather than by proactive, intentional planning.

This article proposes a shift from financial expert to financial guide. MI offers a proven, evidence-based framework for navigating ambivalence with empathy and respect. By resisting the urge to “fix” and embracing the MI spirits of partnership, acceptance, compassion, and evocation, advisers can foster deeper, more collaborative conversations. MI does not diminish technical expertise—it elevates it by aligning it with the owner’s perspective and motivation.

Building on Taylor and Taylor’s (2025) work, this article explains why a guiding approach better suits business owners with high risk tolerance, need for control, comfort with ambiguity, and an innovative mindset. It also introduces practical MI-based conversation techniques aligned with common succession goals and advanced planning strategies. Ultimately, advisers who adopt MI can help business owners take action—and strengthen client trust along the way. Difficult conversations become collaborative ones, turning succession planning into a guided, intentional process—a true win-win.

Endnotes

- A companion article was written for Trusts & Estates (Lynn and Luhnau forthcoming) that explores these same psychological dynamics through the lens of estate and tax planning, offering additional application to legal and fiduciary professionals.

- The 4th edition of Motivational Interviewing: Helping People Change and Grow (Miller and Rollnick 2023) renames “evocation” as “empowerment.” For clarity with financial planning practitioners, the original term is kept.

References

Exit Planning Institute. 2023. 2023 National State of Owner Readiness Report.

Langlois, S., and J. Goudreau. 2024. “‘From Health Experts to Health Guides’: Motivational Interviewing Learning Processes and Influencing Factors.” Health Education & Behavior 51 (2): 251–259.

Lynn, Christina. 2025. “Training Advisers to Build Superior Client Relationships with Motivational Interviewing and the FPEQ Scorecard.” Journal of Financial Planning 38 (2): 42–49.

Lynn, C. and S. Luhnau. Forthcoming. “When the Numbers Aren’t Enough: Addressing Psychological Resistance in Business Succession Planning.” Manuscript submitted for publication to Trusts & Estates.

Miller, W. R., and S. Rollnick. 2023. Motivational Interviewing: Helping People Change and Grow. Fourth edition. Guilford.

Pheasant, B. and Christina Lynn. 2025. “Harnessing Client Motivation: The Power of Autonomy Support.” Journal of Financial Planning 38 (5): 36–43.

Taylor, A. and A. Taylor. 2025. The Psychology of Transitions—Moving Owners to Action. Orange Kiwi LLC.