Journal of Financial Planning: May 2022

Ryann Marotta, CFP®, CFA, is a senior portfolio manager at Northern Trust Corporation. In her role, she develops relationships with clients to understand their unique situations and structures investment plans to support their needs.

NOTE: Please click on the below image for a PDF version.

Inflation currently sits at 7.9 percent,1 having soared to heights not seen since the early 1980s on the heels of loose monetary policy, logistical logjams, a global pandemic, and geopolitical crisis in Europe. After 20 years of relatively moderate inflation averaging 2.0 percent,2 this critical investment risk is emerging as a top priority for investors.

As inflation continued to surprise to the upside throughout 2021, this deviation from the longer-term trend left many market participants perplexed. At the start of 2022, the inflation outlook suggested a retreat in the second half of the year.3 Instead, months later, a geopolitical crisis now unfolds on Europe’s eastern front, further intensifying inflationary concerns, and investors are reminded of the importance to protect investment portfolios against unexpected inflation.

Plan for the Unexpected

For investors, the continued uncertainty can feel crushing as they look to their portfolios to fund their lifestyle and near-term financial goals. This presents an opportunity for advisers to reassess portfolios to ensure they are properly protected against unexpected inflation.

Yet effective inflation mitigation remains not just crucial for advisers, but also challenging to identify and implement. Advisers construct portfolios to balance the tradeoffs between risk and return, but this well-documented relationship is far from straightforward.

The real return to an investor is not simply the return of their portfolio, but the return net of fees, taxes, and inflation. Fees and taxes are explicit costs and thereby straightforward to mitigate. However, inflation mitigation within a portfolio requires added due diligence.

When considering risk in the scope of investment portfolios, advisers must plan for the unexpected. Many are quick to focus on market risk that broadly affects equity market participants via price volatility. However, investment risk takes many different forms that include—but are certainly not limited to—market risk, concentration risk, liquidity risk, interest rate risk, and inflation risk. This is vital because if the scope of risk is too narrow, investors may be left exposed.

How Real Are Real Assets?

Every asset class plays a role in a portfolio, and the role of real assets is to improve diversification and protect against unexpected inflation. But, are they doing the job? Here, we look at typical real assets and their performance.

When considering the ability of an asset class to mitigate inflation, Treasury Inflation-Protected Securities (TIPS) are often included alongside real assets.

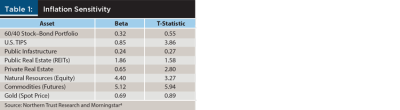

To evaluate the effectiveness of real assets to mitigate inflation, we compare their respective inflation betas—the sensitivity to changes in inflation (Table 1). Like market beta, the higher an asset’s inflation beta, the stronger the sensitivity, which means the more the asset return moves with inflation. A beta greater than one indicates that the asset class is more sensitive to inflation than inflation itself, thereby mitigating inflation risk beyond its weight in a portfolio. To ensure the inflation sensitivity is reliable, or statistically significant, the t-statistic must be greater than two.

With this context, the results reveal the four real asset classes that are reliably sensitive to inflation—TIPS, equity-based natural resources, commodities futures contracts, and private real estate. However, do these asset classes adequately contribute to a diversified portfolio?

While financial markets account for expected inflation over time, the small insignificant inflation beta for a standard 60/40 stock–bond portfolio indicates its poor ability to mitigate unexpected inflation, suggesting the potential benefit of an allocation to real assets.

TIPS Do the Job, but How?

Treasury Inflation-Protected Securities (TIPS) are Treasury bonds issued by the U.S. government. Just like other Treasury bonds, they are regularly auctioned at various maturities with a fixed coupon rate commensurate with market interest rates.

If the rate is fixed, how do TIPS hedge inflation? TIPS are structurally indexed to inflation. The principal value of a TIPS bond adjusts semiannually for inflation, as measured by the Consumer Price Index (CPI). The fixed coupon rate is applied to the fluctuating principal value, which results in a coupon payment indexed to inflation. Therefore, should inflation increase, even in a relatively muted inflationary environment, the coupon payment would increase accordingly. Conversely, a period of deflation would decrease the principal value of the bond and thereby the payment; however, TIPS mature at the greater of their inflation-adjusted principal or their issue value, creating a safeguard for investors that limits downside deflationary adjustments.

The inflation adjustment effectively guarantees that TIPS are an inflation hedge for investors who align TIPS to fund multiyear financial goals like lifetime consumption. From this multiyear, asset-liability perspective, TIPS serve as a true inflation hedge, while other inflation-sensitive real assets only mitigate inflation.

In theory, TIPS sound great! However, implementation requires additional consideration. TIPS are only issued in limited maturities and make interim interest payments, complicating the precise alignment of cash flows with goals.

Additionally, circumstances often change as time passes. New goals emerge while old goals are modified or eliminated, and the portfolio should be able to adapt efficiently to new liability profiles. Therefore, TIPS allocations are often implemented utilizing fund structures.

In addition, like traditional fixed income securities, TIPS prices are sensitive to changes in yields. Just as conventional bond values decrease with unanticipated increases in yields, TIPS values decrease with unanticipated increases in real yields. Lastly, let’s not forget that TIPS interest is taxed as ordinary income. Thereby, asset location matters, and the preferred account for implementation would be a tax-favored structure.

Natural Resources

Should unexpected inflation strike, the data clearly indicates that natural resources spring to action helping investors mitigate their inflationary risk. Natural resources are not just reliably sensitive to inflation: their large beta implies leveraged exposure to inflation, whereby a small allocation can provide broad inflation protection across the portfolio.

In addition to mitigating inflation, exposure to natural resources via equities provide an expected return driven by the equity premium to help fund long-term goals even in periods of low inflation. This means investors not only benefit from increasing supply costs, but also the returns from those companies that drive the industries—rather than owning copper, an investor would own shares in a mining company, for instance.

During the period of Great Inflation in the 1970s, natural resource equities generated positive real returns, exceeding the greatest cumulative increase in U.S. consumer prices—119 percent (9.5 percent per year). Meanwhile, the broad equity market lost ground to inflation, generating negative real returns.5 However, as advisers, we know that the past results do not guarantee future performance, and without a structural inflation adjustment like TIPS, there is no guarantee the degree to which natural resource equities may mitigate future inflation.

Commodities and Private Real Estate

Portfolio construction requires the delicate balance among all investment risks and return. While commodities and private real estate also indicate strong and reliable inflation sensitivity, at what point is their ability to mitigate inflation offset by other factors?

Commodities are accessed through futures contracts, and while this may lend to their outsized inflation sensitivity, it does not advance the multifaceted objectives of a well-constructed investment portfolio. Investors in diversified, long-only commodity futures earn a collateral return from Treasury bills while enduring excessive uncompensated volatility. While certainly helpful to mitigate inflation, commodities-based futures otherwise only serve to increase risk with no clear expected return.

Private real estate and publicly traded REITs derive their value from the same underlying assets. Yet, the results indicate that private real estate is a reliable asset class to mitigate inflation while REITs are not. This distinction may be attributed to appraisal-based valuations associated with private real estate investment as opposed to REITs. In addition to the challenges posed by private real estate investment including costs, liquidity, and concentration risk, this ambiguity further undermines an allocation to private real estate in a diversified investment portfolio.

What About I-Bonds?

Similar to TIPS, Series I savings bonds are issued by the U.S. government and provide a structural inflation adjustment that preserves purchasing power.

Otherwise, I-bonds are quite distinct financial instruments with unique limitations. I-bonds are non-marketable, meaning they do not trade on exchanges. To buy an I-bond, an investor may purchase up to $10,000 directly from Treasury Direct and an additional $5,000 through tax refunds in a given calendar year per Social Security number. Upon purchase, the I-bond must be held for at least one year, and if held less than five years, then three months interest is forfeited.

Currently, I-bonds are paying an annualized rate of 7.12 percent comprising a fixed rate (0.00 percent) and a variable inflation rate (3.56 percent) adjusted with CPI semiannually, at which point interest compounds and credits.6 The next period of interest is earned on the adjusted principal. During a deflationary period, an I-bond will not lose value, but rather continue to earn the fixed rate, which may be nothing like it is today. This accrual continues for 30 years unless redeemed sooner, at which point the interest is paid in full with principal. Tax payments on interest can be deferred or claimed annually, though like TIPS, the interest income is taxed as ordinary income at the federal level.

Given their ability to hedge unexpected inflation, I-bonds can certainly offer investors protection, helping preserve their purchasing power, though the degree to which can be limited. Therefore, an investment strategy that includes I-bonds could span multiple years while complementing other forms of mitigation depending on the size and immediacy of financial goals.

When Is the Right Time to Hedge?

To properly manage risk, advisers must construct portfolios that plan for the unexpected. Ideally, a level of inflation protection was built into investor portfolios prior to this recent inflationary bout, and investors have reaped the benefit. While insurance always costs more after the risk manifests, unexpected inflation remains a significant risk for forward-looking investors who can still benefit from risk mitigation with appropriately sized allocation to TIPS and natural resources.

Disclosures: This document is a general communication being provided for informational and educational purposes only and is not meant to be taken as investment advice or a recommendation for any specific investment product or strategy. The information contained herein does not take your financial situation, investment objective, or risk tolerance into consideration. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal, accounting, or tax advice from their own counsel. Any examples are hypothetical and for illustration purposes only. All investments involve risk and can lose value, the market value and income from investments may fluctuate in amounts greater than the market. All information discussed herein is current only as of the date of publication and is subject to change at any time without notice. Forecasts may not be realized due to a multitude of factors, including but not limited to, changes in economic conditions, corporate profitability, geopolitical conditions, or inflation. This material has been obtained from sources believed to be reliable, but its accuracy, completeness, and interpretation cannot be guaranteed. Northern Trust and its affiliates may have positions in, and may affect transactions in, the markets, contracts, and related investments described herein, which positions and transactions may be in addition to, or different from, those taken in connection with the investments described herein.

Legal, Investment, and Tax Notice. This information is not intended to be and should not be treated as legal, investment, accounting, or tax advice.

Past Performance is No Guarantee of Future Results. Periods greater than one year are annualized except where indicated. Returns of the indexes also do not typically reflect the deduction of investment management fees, trading costs, or other expenses. It is not possible to invest directly in an index. Indexes are the property of their respective owners, all rights reserved.

Endnotes

- FactSet; As of March 10, 2022

- Morningstar; IA SBBI US Inflation Index from 1/1/2001–12/31/2020

- FactSet; Nominal Treasury yields minus TIPS yields

- Northern Trust Research and Morningstar. Analysis based on quarterly returns from 06/1999 through 09/2021. Standard 60/40 stock–bond portfolio is 60 percent Russell 3000 and 40 percent Bloomberg U.S. Aggregate Bond indices. Asset classes are represented by MSCI USA Infrastructure, FTSE NAREIT Equity REITs, Bloomberg U.S. Treasury Inflation Note 1-10Y, S&P GSCI Gold Spot, NCREIF Property Index (private real estate), S&P North American Natural Resources, and Bloomberg Commodity indices. Table updated from quarterly research article, “How Real Are Real Assets” by Mladina and Bates, Northern Trust Research (2018).

- Northern Trust defines the Great Inflation from February 1973 to September 1981.

- Treasurydirect.gov for bonds issued from November 2021 through April 2022.