Journal of Financial Planning: June 2025

Sarah Howes is the vice president of advisor marketing at Commonwealth (www.commonwealth.com). With the firm since August 2015, she develops and facilitates communication plans and marketing strategies and manages an assortment of Commonwealth’s existing suite of marketing programs.

JOIN IN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

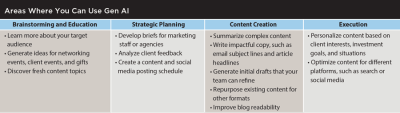

NOTE: Click on the chart below for a PDF version.

Imagine creating a compelling email campaign in minutes instead of hours, writing multiple social media posts with a simple prompt, or brainstorming new ideas for client content without doing a Google deep dive. These are just a few ways generative AI (gen AI) is changing marketing today.

Gen AI offers powerful tools you can leverage to enhance these efforts, helping you better understand your prospects’ needs and wants, create more compelling marketing materials, and offer a more personalized client experience. With gen AI tools, marketing teams have more time to focus on strategy rather than getting bogged down in execution. But how exactly does this work?

A Glimpse at Gen AI Impact

Here are a few examples of how gen AI can enhance the client experience.

1. Client Gifts

First, consider the task of choosing fun and meaningful gifts for your clients to celebrate an occasion or show appreciation. A client gift should be thoughtful while reflecting your firm’s values and strengthening client relationships. Curating the perfect gift, however, can be challenging. Gen AI can simplify this process by helping you develop meaningful ideas that resonate with your clients.

When using gen AI for this task, start with a “prompt” or instructions for your chosen tool and be specific about your goal. Here’s an example of a detailed, strategic prompt:

As a financial adviser, I want to give my clients thoughtful, memorable gifts that align with my profession and values. Suggest four unique gift ideas under $50 each that are finance-related, practical, and likely to be appreciated by a diverse client base. For each gift, provide a brief explanation of why it’s appropriate and how it ties into financial wellness or planning. Consider gifts that can be personalized and will remind clients of my services throughout the year.

Here are the ideas generated in this case by Claude AI:

- Personalized budget planner. Consider a high-quality, customized planner with sections for budget tracking, savings goals, and financial milestones. You can include your firm’s logo and contact information. This gift reinforces good financial habits and keeps your services top of mind.

- “Money plant” succulent in a piggy bank pot. A low-maintenance succulent in a small, decorative piggy bank pot symbolizes growth and saving, a daily reminder of financial nurturing. You can attach a card with care instructions and financial tips.

- Digital password manager subscription. A one-year subscription to a reputable password manager service is a practical gift that enhances clients’ digital security, which is crucial for protecting financial information. It shows that you care about their overall financial well-being.

- Charitable donation kit. This kit contains information about local charities, along with a small donation made in the client’s name. Include a guide on tax-efficient giving that aligns with philanthropic values and demonstrates tax-smart financial planning.

These AI-generated gift ideas give you a helpful starting point as you narrow down your options and choose gifts that will genuinely strengthen your connection with clients.

2. Thank-You Notes

I’ve written thank-you notes since I was a kid, and they are still as important as ever to write. They are an appreciated and expected component of excellent client service, but their effectiveness depends on personalization. While a template may be helpful for specific tasks, a one-size-fits-all approach for thank-you notes can make them feel impersonal and potentially undermine your client relationship. So, for this task, I’m asking Claude AI to write a thank-you note for me with this specific set of instructions:

Draft a professional, warm thank-you email to a new client who recently attended their first in-person meeting to discuss their financial plans. The email should:

- Express genuine appreciation for their time and trust

- Briefly recap one to two key points discussed in the meeting

- Outline the next steps in our financial planning process

- Encourage the client to reach out with any questions

- Close with a personalized touch that reflects our conversation

Keep the tone friendly yet professional, and limit the email to about 200 words. Include placeholders for the client’s name and any specific details to be filled in later.

By using this prompt instead of copying and pasting from a template, you will receive output that is more personalized to the situation. You can then edit the results to encompass your brand voice and include details that apply to the recipient. Here are the results:

Dear [Client Name],

I want to extend my sincere thanks for taking the time to meet with me yesterday. It was a pleasure to sit with you and discuss your financial goals and aspirations.

Our conversation about [specific topic, e.g., retirement planning] was particularly insightful. I appreciate your openness in sharing your concerns about [specific concern, e.g., balancing savings with current expenses]. Rest assured, we’ll work together to create a strategy that addresses these concerns while moving you toward your long-term objectives.

Next steps:

• I’ll be drafting a preliminary financial plan based on our discussion.

• My team will reach out next week to schedule a follow-up meeting where we’ll review this plan together.

Please don’t hesitate to contact me if you have any questions or additional thoughts in the meantime. I’m here to help.

[Personal touch, e.g., I hope you enjoy the book on personal finance I recommended. I look forward to hearing your thoughts on it!]

Thank you again for entrusting me with your financial future. I’m excited about the journey ahead.

Best regards,

[Your Name]

[Your Title/Company]

This approach lets you quickly create follow-up communications that resonate with clients and show the thoughtful approach that sets your firm apart. Once you’ve practiced effective prompting, selecting the right tool is key.

Now, let’s take a step back and explain the technology behind this innovative approach.

Understanding Gen AI

Gen AI refers to technologies that use large amounts of data to create original content across various formats, such as text, images, audio, video, and code. Unlike simple search tools, gen AI learns underlying patterns from multiple information sources. This process allows gen AI to generate new, relevant content in response to specific instructions, known as “prompts,” which will be covered later in this article.

When you provide a gen AI tool with clear instructions, it uses a vast dataset to produce content that matches your request. This allows the tool to help with tasks like brainstorming ideas, drafting client communications, or solving problems in ways that can be more creative and efficient than other methods.

There are many benefits to using gen AI, including:

• Boosted creativity. Use it to come up with new ideas you may not have thought of on your own.

• Improved efficiency. Automate tasks that would typically have taken up more of your time.

• Enhanced customer experiences. Create more personalized, engaging content and processes for your clients.

It’s crucial to understand how to communicate with these tools to create the most effective AI output, and effective communication happens with prompting.

Crafting Effective Prompts

When using gen AI, you provide it with a set of instructions, known as a prompt, to get the response you want. Think of a prompt like giving precise directions: the more explicit and detailed your instructions, the more accurately the AI tool can help you.

To create the most effective prompts, consider these elements:

- Voice. Who should the gen AI tool impersonate when creating the content?

- Target audience. Who are you trying to reach? What do you know about their characteristics, preferences, or needs that would help the tool write specifically for them?

- Copy style. What tone do you want your content to have? For example, should it be professional, conversational, technical, or inspirational?

- Content goal. What do you want your audience to do after seeing your content?

- Extras. Are there any additional formatting or stylistic elements you want to include, such as hashtags? Is there a specific length or number of words you aim to include? Should there be a call to action?

Pro tip: Build a “prompt library” within your firm. Keep a shared document of prompts that work well, allowing your team to learn and collaborate to improve AI interactions. This approach will help maintain consistency.

Choosing the Right Gen AI Tools

New gen AI tools are developed regularly, and existing tools are updated rapidly. Free tools, such as ChatGPT, Google Gemini, Perplexity AI, and Claude AI, are easy to access and great for simple tasks, but they may have limited features, accuracy, or processing power. They also do not offer data privacy, a key consideration for a financial firm.

Paid tools often provide more advanced capabilities, faster processing times, and higher accuracy. Most importantly, they offer better privacy protections.

When selecting a gen AI tool, consider your specific business requirements, budget, and data sensitivity level in your work.

Risks of Using Gen AI

While gen AI offers powerful capabilities, it’s essential to be aware of the risks, so you can take steps to mitigate them. Because these systems are trained using human-generated sources, they inherently come with data bias. A human must review the output to verify that it is accurate and objective.

Some risks to consider are:

- False information. Gen AI is still developing and may generate inaccurate output. It’s imperative to fact-check all AI-generated content and have a human review it.

- A lack of data security. Free gen AI tools do not offer data security. Do not use personal, client, or firm data in your queries.

- Limited math capabilities. Gen AI isn’t good at complex calculations, so don’t rely on it for any financial computation or analysis.

- Loss of brand identity. Overusing AI-generated content can make your marketing materials bland and forgettable. Adding your human touch and maintaining a consistent brand voice is required to ensure your readers trust your content.

Using Gen AI for Better Marketing and Client Experiences

Gen AI offers financial advisers an innovative tool for improving and streamlining marketing and client communications despite the risks. Consider the following areas where you can use gen AI:

Gen AI is a practical tool that can improve marketing effectiveness, increase process efficiency, build stronger client relationships, and drive business growth. If you embrace these tools today, you will lead the way and have a competitive edge.

Start experimenting and exploring its potential, and you will see firsthand how gen AI can transform how you market, connect, and grow your firm.

Please consult your member firm’s compliance policies and obtain prior approval for any ideas discussed in this article before moving forward.

Read Next: “The Compliance Risks of Using Generative AI in a Financial Planning Practice,” Emma Foulkes, May 2025