Journal of Financial Planning: July 2025

Chris Heye, Ph.D., is founder and CEO of Whealthcare Planning and Whealthcare Solutions.

NOTE: Click on the images below for PDF versions.

JOIN IN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Financial professionals talk frequently about risk—market risk, inflation risk, sometimes even longevity risk. After all, it’s their job to monitor and mitigate risks for their clients. These risks threaten both client investment portfolios and advisory firm’s AUM and profitability.

But there’s one risk that remains largely unaddressed, despite its power to quietly derail even the most carefully constructed portfolio: the declining health of the client. As chronic illness, cognitive impairment, and unexpected health events become more likely within an aging client population, they introduce a layer of volatility that is rarely fully captured in financial plans. Yet this volatility consistently reveals itself in declining levels of savings, impaired decision-making, and sudden losses in adviser AUM.

Financial professionals are trained to manage quantifiable, usually market- or macroeconomic-driven, risks to a client’s portfolio. These risks include bond and equity market volatility, inflation, interest rate fluctuations, sequence-of-returns risk, and the possibility of a person outliving their savings. These threats to client portfolios and firm AUM are measured by Sharpe ratios and volatility indices, estimated in Monte Carlo simulations, visualized in dashboards, and embedded in portfolio optimization tools.

While these “traditional” risks dominate the planning process for most advisers and clients, they tell only part of the story. Financial professionals acting in a fiduciary capacity are responsible for protecting clients from all financial risks, not just those posed by volatile financial markets or unpredictable bouts of inflation. And the greatest threat to a meticulously crafted financial plan or investment portfolio may not come from the markets—it may come from the client’s own health.

In this article I present my attempt to quantify the magnitude of the risks posed by client health events and costs, including diminished capacity, for wealth management firms.

One place to start is by assessing client perceptions of health-related risks. If clients are not concerned about health-related financial risks, financial advisers might be excused from largely ignoring them (even if they are in fact a significant threat). But if clients are concerned about health events and costs, then we have a starting point for measuring the risk of health-related factors for wealth managers. If clients are worried about the impacts of health-related factors on their financial security and they believe that their adviser is not addressing these concerns, that would constitute a potentially significant threat to the adviser’s AUM.

From a growing volume of survey research, we know that adults in the United States are extremely concerned about how health events and costs might affect financial and retirement security. Most people, including financial services firm clients, believe that healthcare costs and health events pose the number one risk to their retirement.

For example, a recent survey by the Retirement Coaches Association found that Generation X members view healthcare costs as far and away the greatest challenge to their financial and retirement security.1 Another survey conducted by Edward Jones and Age Wave reported that “healthcare costs, including long-term care” was the number one financial worry regarding retirement for both retirees and pre-retirees. The percentage reporting this as their top fear was between 52 percent and 66 percent, depending on the exact survey population. Concerns about the financial consequences of health events and costs far outstripped fears about inflation, taxes, or an economic downturn.2

Financial professionals might also be forgiven if these health-related fears are new and largely spurred by the COVID-19 pandemic. But they are not. Merril Lynch conducted a survey in 2013 asking its clients what they felt was their top financial worry in retirement. Fifty-two percent said healthcare expenses, again the number one response. (The number two response was “outliving my money,” which for many might be another way of saying they are concerned about the high costs of long-term care.)3

So now we can start to quantify the risk. For a typical wealth management firm, at least 50 percent of clients are more worried about the costs of healthcare than any other threat to their retirement security. Advisers who are not helping their clients plan for caregiving responsibilities, assisted living expenses, major medical procedures, or cognitive decline are arguably putting half of their AUM at risk.

Now let’s move from client perceptions of health risks to the actual state of clients’ health. There are several reasons why a client’s declining health poses a serious—and often underestimated—threat to an advisory firm’s long-term viability:

Health events have significant financial consequences: Major health events are not just medical episodes—they trigger some of the most financially consequential decisions a person will make. A diagnosis of cancer or heart disease might force early retirement, compel the liquidation of assets, or require a transition to a new living situation. These events often lead to unplanned changes in income, expenses, and the timing of asset withdrawals.

Chronic illnesses impact spending, risk tolerance, and liquidity needs: Chronic conditions tend to increase medical expenses and day-to-day living costs, while reducing tolerance for financial risk. Roughly 90 percent of all healthcare costs are tied to chronic conditions, which disproportionately affect adults over 60.4 Clients managing chronic illnesses may require greater liquidity and can become more conservative in their investment approach, often abruptly.

Cognitive impairment threatens decision-making: Financial decision-making is one of the first abilities to decline in the early stages of cognitive decline. Even before a diagnosis, clients may become more impulsive, less coherent, or overly deferential to others—including caregivers and scammers.

Health events increase emotional volatility: Declining health inevitably leads to behavioral changes, often including greater levels of stress, anxiety, and depression. These changes can have significant, and often quite adverse, effects on client spending and saving habits, even in the absence of a diagnosis of dementia.

Medications heighten both financial and behavioral risk: Prescription medications are a growing cost burden for older adults, often straining budgets and increasing the need for liquidity. Moreover, many medications, especially those used to treat chronic pain, anxiety, sleep disorders, or neurological conditions, come with cognitive and/or behavioral side effects. These often-unplanned consequences can impair decision-making, increase confusion, or heighten impulsivity, even in otherwise high-functioning adults.

To quantify the financial impact of client health on advisory firms, we will use population-level data on chronic illness and cognitive impairment. By applying national health statistics to a hypothetical wealth management firm, we can assess how health risks affect not just individual clients but the stability of AUM and the long-term viability of the business itself.

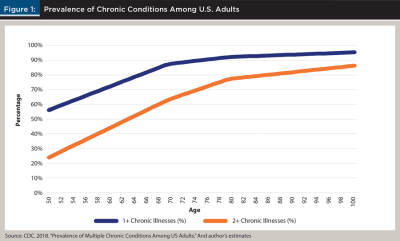

Figure 1 illustrates the prevalence of chronic illness by age in the United States. The likelihood of developing a condition such as diabetes, heart disease, asthma, or cancer increases sharply starting at age 50. By age 65, approximately 80 percent of adults have at least one chronic illness, and more than half live with two or more.5

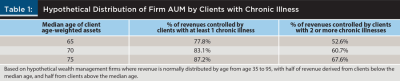

What does that mean for a typical wealth management firm? Table 1 provides estimates of the percentage of a firm’s assets that are controlled by clients suffering chronic illnesses. For example, let’s assume a hypothetical advisory firm where the median age of its age-weighted assets is 65—that is, half of the firm’s AUM are owned by clients over 65, and half by clients under age 65. In this example, 77.8 percent of its AUM are controlled by clients with at least one chronic illness, and over half of AUM by clients with two or more chronic illnesses.

Because the frequency of chronic illnesses increases with age, the percentage of assets owned by clients suffering from chronic illnesses grows as the median age of the client population rises. For an advisory firm with an age-weighted client asset base of 75, almost 90 percent of all AUM are controlled by clients with at least one chronic illness, and more than two-thirds of its AUM held by clients with two or more chronic illnesses.

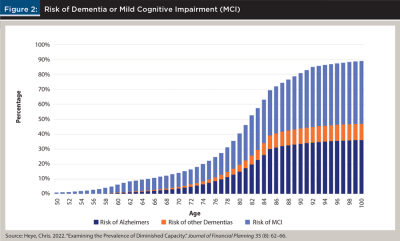

Now let’s use a similar estimation methodology for measuring the percentage of assets owned by clients suffering from cognitive decline. Previously I estimated the prevalence of Alzheimer’s, other dementias, and mild cognitive impairment (MCI) by age.6 The results of that analysis are shown in Figure 2. Like chronic illnesses, the prevalence of cognitive decline increases with age, and in most cases is not reversible.

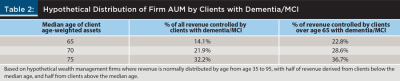

The percentage of assets controlled by clients with Alzheimer’s, another type of dementia, or MCI for three hypothetical wealth management firms is shown in Table 2. For example, for a firm with a median age of 65, about 14 percent of its assets are controlled by clients suffering from some form of cognitive impairment. If we look at only those assets held by clients over the age of 65 for this hypothetical firm, that percentage rises to 22.8 percent.

The likelihood of cognitive impairment increases with age, accelerating rapidly by the time a person reaches their mid-70s. So, for a firm with a client base with a median age of 75, almost one-third of its assets are held by clients suffering from cognitive impairment. This figure rises to 36.7 percent for its clients over the age of 65.

To summarize, we can estimate the health-related risks to a typical advisory firm in the following way:

- At least 50 percent of clients believe that health events and costs constitute the number one risk to their financial and retirement security

- Between 77.8 percent and 87.2 percent of all AUM are held by clients suffering from at least one chronic illness

- Between 52.6 percent and 67.6 percent of all AUM are held by clients suffering from two or more chronic illnesses

- Between 14.1 percent and 32.2 percent of all AUM are held by clients suffering from cognitive impairment

- Between 22.8 percent and 36.7 percent of all AUM held by clients over age 65 are controlled by individuals suffering from cognitive impairment

These are not insignificant estimates. The average market correction results in a decline of about 10 percent to 15 percent of AUM. But financial markets always recover. By contrast, the onset of a chronic illness or cognitive decline is usually permanent.

What are the consequences for advisory firms not preparing their clients, or their firms, for health-related financial risks? We may already be seeing the results. Between 2018 and 2023, the S&P 500 grew at an annual compound growth rate of 12.4 percent. According to research by Cerulli, hybrid RIAs (12.9 percent) were the only type of advisory firms on aggregate to exceed that figure in the growth of their AUM. Wirehouses (8.6 percent), national and regional BDs (11.3 percent), and even independent RIAs (11.2 percent) failed to keep pace.7

We should not be surprised at these findings. Imagine a different type of firm that sells a service that 50 percent of its customers didn’t think met their main reason for purchasing that service. Wouldn’t you expect that service provider to eventually lose out to a competitor who did meet those customer needs? Moreover, history offers no shortage of warnings for what happens when industries fail to evolve alongside their aging customers. Think retail department stores or cable TV.

Perhaps most importantly, financial professional need to spend more time preparing their clients—and firms—from these health-related financial risks. For most clients, especially those over the age of 55, it is impossible to separate health risks from financial risks. For these older clients, these classes of risks are two sides of the same coin. Professionals who recognize this reality will not only be more successful at protecting their clients, they will be more successful at growing their business.

Endnotes

- Eisenberg, Richard. 2025, May 17. “This Is Generation X’s Biggest Retirement Worry—And It’s Not Money.” www.marketwatch.com/story/this-is-generation-xs-biggest-retirement-worry-and-its-not-money-7861035a.

- Edward Jones. 2021, June. “The Four Pillars of the New Retirement.” www.edwardjones.com/sites/default/files/acquiadam/2021-06/Four-Pillars-US-Report-June-2021.pdf.

- Merrill Lynch. 2013. “Americans’ Perspectives on New Retirement Realities and the Longevity Bonus.” https://agewave.com/wp-content/uploads/2016/07/2013-ML-AW-Americans-Perspectives-on-New-Retirement-Realities-and-the-Longevity-Bonus.pdf.

- U.S. Centers for Disease Control (CDC). 2024, July 12. “Fast Facts: Health and Economic Costs of Chronic Conditions.” www.cdc.gov/chronic-disease/data-research/facts-stats/index.html.

- Boersma, Peter, Lindsey Black, and Brian W. Ward. 2018. “Prevalence of Multiple Chronic Conditions Among U.S. Adults.” U.S. Centers for Disease Control (CDC). www.cdc.gov/pcd/issues/2020/20_0130.htm.

- Heye, Chris. 2022. “Examining the Prevalence of Diminished Capacity.” Journal of Financial Planning 35 (8): 62–66.

- Cerulli Associates. 2025, May 21. “Planning and Progress: The State of WealthTech 2025.” [Webinar].www.cerulli.com/webinars/webinar-planning-and-progress-the-state-of-wealthtech-2025.