Journal of Financial Planning: July 2022

Joseph Viggiani, CRPC, FBS, is a retirement planning consultant specializing in working with retirement plan participants across the country to facilitate financial health. He holds a master of business administration and has over 18 years of experience in the financial services industry.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Retirement readiness is the idea that one is financially prepared for the transition into the next stage of life. Traditional or “exterior” retirement planning provides great answers to the readiness question from a mechanical point of view (Klontz, Kahler, and Klontz 2016). This, however, only answers half of the question. Through principals of financial psychology, we can explore the other half of the answer: a client’s retirement readiness from a personal perspective. Not a set age, dollar amount, pressure from a spouse, or what a retirement adviser believes should be done. A perspective that focuses on the internal aspects of retirement readiness. The internal perspective or the “interior” is a focus on beliefs and emotions (Klontz, Kahler, and Klontz 2016). A perspective that must be addressed to truly help clients make one of the biggest decisions of their lives.

Lifestyle Change

A transition from work to retirement can affect identity and life purpose and may result in depression, especially if employment is a big part of the client’s identity (Osborne 2012). Consider a long-term client who just turned 67 and has worked in the same place for 20 years. His entire social structure revolves around waking up at the same time, going to the same place, communicating with the same people, and going home at the same time every day. This client has achieved a high level within the company and obtained the highest certifications in the field.

The client has been working toward 67 as a retirement goal for his entire working career. In recent meetings with the financial planner, a retirement plan had been created and agreed to. Savings and Social Security are more than enough to have made it easy to create investment income and an estate plan to cover all stated goals. The client is expected to walk into the office bright eyed and excited for the next stage in life, but it seems the opposite is taking place. The client, with a somber look, starts questioning the retirement plan that has been agreed to many times in past meetings. Trained to help and fix a client’s financial situation, the first reaction of the financial planner may be to reassess the plan to address any concerns regarding the investments or income planning. This solution, however, may prove to be inconsequential because perhaps the client is not questioning the financial retirement plan; they may be ambivalent about the transition and questioning the plan to justify continuing work.

In this scenario, or similar ones to it, the goal is not to influence retirement but rather help our clients discover their own internal motivations without guidance from outside factors. It does not matter what the financial planner believes the client should do; it only matters that the client is ready. Knowing how to help to address this ambivalence may be one of the most important aspects of retirement readiness.

Ambivalence

Ambivalence is a natural part of any change where the client both wants to change and does not want to change (Prochaska, Norcross, and Diclemente 2007). This is the core of what the financial planner should be able to help a potential retiree with on the “interior”; a self-discovery process that focuses on a client’s internal motivations for and against retiring. When helping a client decide whether they are ready to retire, one should be careful not to advise or direct. By doing so, the client may argue the other side of the advice, which will hinder the goal of the client to exploring internal motivations (Miller and Rollnick 2012). This external influence may be counterproductive to the goal of decreasing ambivalence and may actually increase resistance to suggestions (Klontz, Kahler, and Klontz 2016). Through raised awareness of internal motivations, the client will much better understand whether they are ready to retire from an internal point of view. One way to facilitate this self-discovery process is adapted through a technique focused on addressing ambivalence in an unbiased way called a decisional balance (Miller and Rose 2013).

Decisional Balance

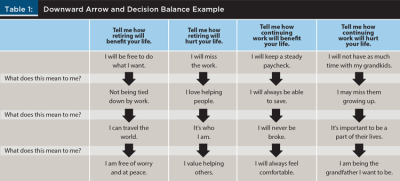

A decisional balance is an intervention used to resolve ambivalence when a facilitator wishes to remain neutral of the outcome (Miller and Rose 2013). It is a way of assessing the pros and cons of different aspects of change and will help the client focus on their own arguments for and against retirement. When applying this to retirement readiness, the decisional balance might sound like the following:

- Tell me how retiring will benefit your life.

- Tell me how retiring hurt your life.

- Tell me how continuing work will benefit your life.

- Tell me how continuing work will hurt your life.

To drill down further, the adviser should explore each answer deeper through a cognitive behavioral technique called the downward arrow. This technique is meant to help understand the beliefs, goals, and values behind the initial answers. It is a method of drilling down into an automatic thought to discover what belief, value, or goal is behind it (Wenzel 2012). An automatic thought is the first thing that comes to mind when thinking about a situation. This perspective will help the client understand not only if they are ready to retire but be in a better position to align the vision of ideal retirement with true values and beliefs, which will help to reduce ambivalence.

Table 1 is an example of the downward arrow incorporated into the decisional balance. Again, no advice is given at this point; rather, the objective is to have the client clarify, feel, and understand their ambivalence to find motivations in order to line up with the ideal retirement goals.

Using a decisional balance and downward arrow technique, financial planners can help clients address the natural ambivalence associated with the major change from working life to retirement life with a neutral point of view. Without influence or advice, this table may serve as an outline for how to help clients explore and find internal motivations with the goal of solving ambivalence when it comes to the question of retirement readiness. There is no greater expert than the client on their own life (Bannink 2010).

References

Bannink, Fredrike. 2010. 1001 Solution-Focused Questions: Handbook for Solution-Focused Interviewing. 2nd Revised ed. Norton Professional Books.

Klontz, Brad, Rick Kahler, and Ted Klontz. 2016. Facilitating Financial Health: Tools for Financial Planners, Coaches, and Therapists. 2nd ed. Cincinnati, OH: National Underwriter Company.

Miller, William R., and Gary S. Rose. 2013. “Motivational Interviewing and Decisional Balance: Contrasting Responses to Client Ambivalence.” Behavioural and Cognitive Psychotherapy 43 (2): 129–141.

Miller, William R., and Stephen Rollnick. 2012. Motivational Interviewing: Helping People Change. 3rd ed. The Guilford Press.

Osborne, John W. 2012. “Psychological Effects of the Transition to Retirement.” Canadian Journal of Counselling and Psychotherapy 46 (1): 45–58.

Prochaska, James O., John C. Norcross, and Carlo C. Diclemente. 2007. Changing for Good: A Revolutionary Six-Stage Program for Overcoming Bad Habits and Moving Your Life Positively Forward. HarperCollins.

Wenzel, Amy. 2012. “Modification of Core Beliefs in Cognitive Therapy.” Standard and Innovative Strategies in Cognitive Behavior Therapy. Edited by Irismar Reis de Oliveira.