Journal of Financial Planning: February 2025

Anne Jones is founder and partner of Artemis Partners (www.artemisdallas.com). She can be reached HERE.

NOTE: Click the image below for a PDF version.

Higher education costs have increased more than 170 percent over the last 40 years, according to BestColleges.1 Together with increased living expenses and inflation, the total expense of college has become cost prohibitive for young people wanting to attend a private or public university. Traditional educational savings plans—for example, 529 plans—are a great start in preparation for the expense of education. Permanent life insurance may be an appropriate product to complement these savings for some clients.

For the past several years, life insurance has evolved to provide additional benefits to a death benefit. It can be used as an investment tool to help provide liquidity for expenses like college tuition or room and board. This article will review the who, what, why, and how of using permanent life insurance as a solution for the rising costs of higher education.

What Is Permanent Life Insurance?

Permanent life insurance is a type of life insurance with an “investment feature,” or cash value component. The cash value portion of the policy grows tax free, and income and withdrawals can be taken by the owner tax free, while simultaneously maintaining a death benefit. Furthermore, when structured properly, the death benefit is tax free to the beneficiary.

Certain types of cash value permanent insurance allow the owner to control where the premium contributions are allocated. Additionally, the insurance type allows for flexibility with the timing of premium payments, and income or withdrawals are left to the discretion of the owner.

How to Use Life Insurance to Supplement Costs

Using life insurance as a solution for aiding the rising cost of education requires the re-engineering of a death benefit insurance design. Historically, low premiums are contributed for high death benefits. Treating insurance as an investment asset requires the opposite design: a low death benefit with healthy premium funding to increase the cash value component of the insurance.

Why Use Life Insurance

- Adding life insurance can help alleviate the stress and burden of wondering where the cash for education is going to come from.

- Obtaining an additional layer of financial security and liquidity, coupled with traditional education plans like 529 plans, can be a creative solution to fund educational expenses.

- Implementing a tool now with children younger in age can help combat the rising cost of education and student debt while also providing immediate cash for tuition, books, living, and other expenses.

Who Can Benefit

Insuring younger individuals, as young as age 1, is extremely cost effective, costing pennies on the dollar. Today, insuring a 1-year-old male for $1 million of death benefit costs a one-time contribution of approximately $31,000.

Parents insuring children have the opportunity to contribute, via gifts, small annual premiums and take advantage of the compounding annual returns until the child is ready for college.

Grandparents paying for grandchildren can provide tax-free gifts to the insurance policies to help ease the pain or premium fatigue growing families might feel during periods of inflation and the rising costs of living.

Case Study

Client Facts

Patriarch

• Personal: Age 32, male, married, one son, owner and entrepreneur

• Financial: Recent liquidity event, moderate risk tolerance, self-managed portfolio, high annual income

Son

• Personal: Age 1, life expectancy 85+ years

Client Goals

• Provide for educational and lifestyle expenses and leave children debt free

• Leverage wealth to provide opportunities for the next generation

• Satisfy the desire to provide for family

• Identify alternative tax deferral investment vehicles

Solution

A variable universal life (VUL) insurance policy is the recommended strategy for the patriarch’s goals. With purposeful design, this solution provides compounding tax-free annual returns, tax-free cash value growth, and tax-free income for future education expenses.

Policy Assumptions

Product: Variable universal life

Risk class: Juvenile, standard non-tobacco

Return assumption: 7 percent net

Death benefit: $1 million

What to Notice in this Case

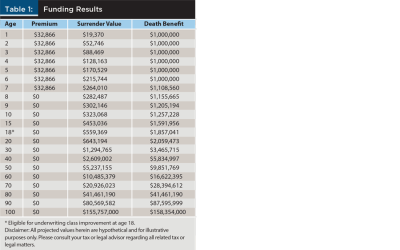

The total outlay for the client is $230,062. At age 18, the initial death benefit of $1 million increases to $1,857,041, and the cash value is $559,369 at the time when many people start college. At age 50, the cash value is $5,237,155 and the death benefit is $9,851,769, representing an IRR of 6.86 percent and 8.29 percent, respectively.

Conclusion

When you look 10 years ahead to 2035, public college tuition could easily reach $54,000, and private college tuition could reach $120,000 per year. Starting in 2035, a four-year college degree could cost upwards of $480,000. Life insurance is not the solution for everything, but it can be an efficient tool, when coupled with other educational savings vehicles, to provide peace of mind to parents and grandparents. Creating liquidity to support the education of our next generation is a wonderful gift anyone can give.

Endnote

- Bryant, Jessica, and John Boitnott. 2023, October 12. “Why Is College So Expensive? 5 Reasons.” BestColleges. www.bestcolleges.com/news/analysis/why-is-college-so-expensive/.