Journal of Financial Planning: August 2023

Penny Phillips is co-founder and president of Journey Strategic Wealth (www.journeyswadvisor.com), an RIA for independent financial advisers. Penny is a sought-after industry speaker and practice management expert who was recently named one of 23 people who will change wealth management in 2023 by Financial Planning magazine.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

NOTE: Click on the image below for a PDF version

“How do I grow my practice?” It’s a question advisers have been asking for decades—and for good reason. Industry statistics point to the fact that, over the last decade, advisory firms have grown because of the market and not because of new clients. The truth about “growth” in our industry is as follows:

- Most growth has come from market appreciation, not organic client acquisition.

- The industry is consolidating and, as a result, growth is concentrated among the larger firms ($1 billion or more in assets) because they have the most scale and resources.

- Referrals and introductions are still a leading way in which advisers acquire new clients, but digital and social marketing is absolutely necessary for long-term sustainable growth.

But what about the small subset of advisers who have in fact grown their practices and added new households and assets? What are they doing differently than every other firm? In this article, I focus on the activities, initiatives, and behaviors that drive net new growth in an advisory practice. As you review each section, consider what you can easily begin to implement into your practice. Consistent growth requires a complete commitment to focusing on revenue-generating actions and activities day in and day out.

Having the Right Mindset and Practice Structure

Before I dive into strategies and ideas, I want to note the following: through my work as an industry consultant and coach, and now as the president of an RIA aggregator, I have found that there are three very distinct attributes found among the fastest growing advisers in our industry:

- They believe fundamentally in the value of what they do and the service they provide. Thus, they never shy away from talking about their practice or “asking for the business.” They consider it their responsibility to educate others about the work that they do in order to serve more families.

- They embrace a “relentless prospector” mindset. They know that there is never an “off season” for needing financial guidance. Every conversation is an opportunity to talk about the problems they help clients solve (their mission) and the practice they are building (their vision). They are relentless about representing and promoting their own brand.

- They understand that the best use of their time is in working with clients and promoting the business to potential clients. They accept that they cannot be responsible for everything in the business and are committed to constantly creating capacity for themselves through outsourcing and hiring. At some point, they have completely gotten rid of the biggest time- and capacity-killing responsibilities in the organization; specifically, portfolio management and lower-tier client service.

Before you put together your growth plan for the year, it’s important to take the time to consider whether you even have the capacity to generate new (and higher margin) revenue. If you don’t, you’ll want to spend the next quarter identifying all the key decisions you need to make in order to create more capacity for yourself and any other revenue generator in the practice. Use the following questions as your guide:

- Where are the opportunities to systematize processes and workflows to create more time and capacity for me in any given week?

- Where are there opportunities to optimize my current team so that I am spending more of my time prospecting and working only with top relationships?

- What should we consider outsourcing or delegating to a vendor, partner, or third party?

- How can we be using technology or human capital better?

- If the goal is for me to only work with a select group of households and spend most of my time growing the practice, what decisions do I need to make now? How about over the next one to three years?

Understand the Client Better than Ever Before

You have likely built an “ideal client” profile for your practice at some point. Perhaps you listed the ideal client’s age range, income level, occupation, and family structure and maybe you then used that information to build out your website pages.

To compete in today’s marketplace, advisers need to take the ideal client profile exercise to the next level. First, they need to understand not just the demographic characteristics of their ideal client but the psychographic characteristics as well (i.e., where do your ideal clients spend their time? How do they make buying decisions? Who—or what—influences them?). Then advisers need to use this information to inform every single aspect of their marketing and client service including the way they communicate, the content they produce, the events they host, etc.

To get there, start by building out a new and improved ideal client profile. Here are three simple exercises that can help:

- List all of the questions that an ideal client might hypothetically ask themselves (or key stakeholders in their life) on a daily basis related to their finances, family, or future. For example, let’s assume your ideal client is a Gen X female executive with children. Her questions might include things like:

- Do I have enough saved to take care of my parents and put my kids through college?

- Are there ways I can have more impact with my money?

- This past year has made me realize I need a better work-life balance. How can I attain that without feeling guilty?

- Should I be talking to my parents about their estate?

- What’s going on with the real estate market right now?

- Does it make sense to look into private high schools for my kids?

- Why do I feel so burnt out? - List in bullet point format what a day in the life of an ideal client looks like. Be as specific as possible. Make sure to account for things like:

- Whether they work from home or commute

- Whether they have (and check) a self-directed account on apps like Robinhood

- Whether they are on social media and how often they use it

- How they spend their free time outside of work - List the money questions you help clients answer.

- How can I pay less in taxes?

- Do I have enough money for retirement?

- Am I invested in the “right stuff”?

- Am I saving enough money?

Once you have compiled all of this information, you can begin to immediately use it as your framework for weekly social media posts, monthly blogs, quarterly virtual client events, and for the new value-add services you introduce to clients in the coming year (e.g., tax planning or family financial planning).

Action Items for Relentless Prospecting

Through Introductions from Other Clients

Despite what the statistics tell us, most advisers will say that their practices continue to grow because of referrals from current clients. And while I don’t believe advisers should ask for referrals directly, I do believe that clients should constantly be reminded of the fact that you are in business and dedicated to serving more people like them.

Rather than asking everyone directly for a referral (a strategy that feels uncomfortable and doesn’t always work), advisers should focus on identifying the “influencers” in their book of business. These are the clients who love talking about all of the amazing service providers in their network: their dentist, their plumber, their real estate agent, etc. These are the people who tend to post on social media and leave Yelp and Google reviews. These are the people who would happily tell your story and introduce you to their friends.

Identify a handful of people each quarter who fit this profile and use very specific language with them that makes them feel important and gets them excited about the prospect of being part of growing something with you and having impact.

“We have space to take on five more households this quarter, but we have decided to only take on new households that are connected to a select group of our very best, ideal clients. You are one of those select few.”

Through Introductions from Centers of Influence

Advisers will either tell you they have a great COI in their network or they have a COI who they refer a lot of business to but get nothing in return. If the latter sounds familiar, schedule an intentional conversation with the COI you have been working with.

Be very direct about your intent (to grow your practice) and very intentional with your ask (what value can you provide to them and their clients to get them to refer business). I recommend advisers share a one pager with the potential COI that includes:

- A description of your ideal client.

- The specific services you provide.

- The challenges you help clients solve.

- A case study showing how you have helped clients achieve an outcome they were seeking.

In many cases, the COI is not referring business simply because they do not fully understand what the adviser does. When telling your story to COIs, either in a conversation or via a one pager you leave behind, make sure you are speaking in terms that are easily repeatable and that will resonate with people outside of our industry. In other words, instead of using terms like “comprehensive financial planning” or “holistic wealth management,” tell the COI something like:

“We help people who are about to sell a business save money in taxes and ultimately make sure the money they receive lasts for their retirement and their kids’ retirement.”

Through Unique Content

You may have heard the phrase “content is king.” Everywhere we turn it seems like there is a new adviser podcast, e-book, video, or blog post aimed at the same ideal client. Regardless of how saturated the market is, the truth is you have to be in the content game if you want to win the attention of new clients. There is a very technical reason for this: The more relevant content you create and post, whether it’s on your website or on social media, the more likely it is that your content will get in front of the right consumer. Social media platforms and search engines like Google are all underpinned by sophisticated algorithms. The more you post and create, the higher the likelihood that (1) your content will get shared by others, (2) your content will be recommended when someone searches a similar topic, and (3) your content will come up as a “top hit” on a search engine.

If you have never created content before, start by launching a blog or video series and sharing it with your current clients. If this feels daunting, refer back to your list of questions and client challenges. Commit to answering one of those questions each week in a short-form blog post or five-minute video. Send the content out to your clients, letting them know that this is a new series that you are launching. Ask them to share with others and provide feedback. Here are a few tips for amplifying the content you produce:

- Make sure you caption any videos you record and post on a YouTube channel or on your site.

- Use an email marketing service like Mailchimp or HubSpot.

- Share your content on your social channels as well.

- Include a hyperlink in your signature that connects to your social channels and to your blog, if you’re sharing it using a marketing email service.

You may want to consider hiring a marketing agency to help you with the most time-consuming aspects of this process including putting the email list together and getting the “newsletter” designed and edited. (This is money well spent, as advisers often need the most help with execution, not strategy.)

Through Social and Digital Prospecting

It goes without saying at this point that you need a modern-looking website and up-to-date profiles on the social channels that your ideal clients frequent. Regardless of how old your ideal clients are, chances are they are on social media and using search engines like Google.

Simply having a website or Facebook page is not enough, however. You need to make sure that your pages are search engine optimized (SEO) so that your website’s visibility is increased when someone searches for a service you offer. SEO has gotten trickier to manage, so I would recommend hiring a professional agency to help you manage your site, but there are several things you can do on your own, including using language that might closely match what someone would search for, and constantly posting and adding relevant content to your website.

While I am not a fan of direct messaging on social media, the truth is you must treat social media just like you would any other prospecting or networking forum: as a place to meet and engage with people and educate them on what you do. The advisers who have mastered the social media game do several things very effectively:

- Only spend their time on the channels that are most relevant to their target clients.

- Have built a network of ideal prospects and centers of influence, rather than a network of advisers and industry influencers.

- Consistently post, comment, and share on other people’s posts.

- Consistently post relevant content for their ideal clients.

- Use strategic opportunities to promote their businesses (e.g., offering a free “Open Office Hours” session for anyone in the tech industry who has questions about recent layoffs and what to do if they recently got laid off).

Through Branding and Networking

Regardless of how the industry is evolving, this is still very much a people business. And for many advisers, it’s still an in-person people business. Where do your ideal clients, and those who are connected to them, spend their time? Are they involved in charitable organizations? Do they spend their time in their communities, engaging in activities that involve their children?

Every quarter you should spend time with your team, or your coach, identifying where there are opportunities to build brand awareness within the communities of your ideal clients. Use the following questions as a guide:

- Where are there opportunities for you to personally represent your brand with clients and prospects present? An example might include sponsoring a table for a charitable function and attending alongside a few clients.

- Where are there opportunities to be positioned as a thought leader in front of ideal clients? An example might include donating a “financial planning engagement” as part of a raffle at your country club’s annual gala.

- Where are there opportunities to connect with others who have similar interests and fit your ideal profile? Examples might include joining a pickleball league in your community or golfing twice a week with different foursomes.

By Creating a Referable Experience

Most advisers who grow through client referrals will tell you that the referrals were unsolicited. In other words, these advisers are growing simply because they have created a referable practice.

Being referable is about more than just being exceptional at client service. It’s about curating an experience for people that is memorable enough to make a deep impression and impactful enough to share with others. If you consistently wow people with your emotional intelligence, attention to detail, and commitment to serving their unique needs, they will share their experience with others without you ever having to ask.

Here are some ways in which you could create referable experiences on a daily basis for clients and ensure that you are running a referable practice:

- Have a one-hour response policy. Even if you do not have an answer to something, or cannot get to a request, simply acknowledging receipt of an email or voicemail can go a long way in making someone feel heard and cared for.

- Surprise clients with thoughtful gifts and recognize milestones and occasions. Each month, choose five households to do something special for at random, or in recognition of a milestone. Here are two examples: send a handwritten card and cupcakes to a client who just hit a savings or net worth goal or send balloons and champagne to someone’s job on their last day of work before retirement.

- Make life easier for clients. Ask clients how they want information organized. Perhaps it would be easier for someone to receive printed documents rather than digital copies. Make notes of your client’s preferences in your CRM.

- Train your team to always go the extra mile. For example, if a client is trying to transfer an account, have someone on your team facilitate the call with them and the other firm rather than sending them the customer service number. When tax season comes around, help clients get organized and get their information over to their accountant.

Putting It Together and Executing Monthly

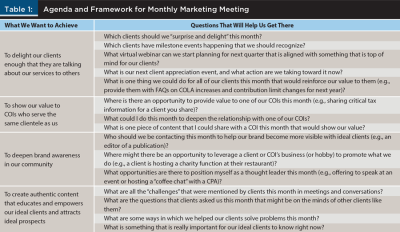

To ensure that you begin implementing these ideas right away, begin by setting a recurring monthly marketing meeting in your calendar. Each month, spend 60 to 90 minutes reflecting on what you want to achieve (i.e., how you actually want to drive growth) and planning out the activities that are going to drive success (i.e., each of the sections described in this article).

Use a table, like Table 1, as your framework and roadmap.

At the end of your meeting, you will have a list of action items to implement for the month that might look something like this:

- Address a different client challenge each week, in a post, on social media.

- Post a blog or article once a week on a timely topic that was recently in the news (e.g., the Fed’s rate pause and how it will impact clients’ wallets).

- Record one quick video on a piece of relevant financial planning information (e.g., increases to contribution limits for retirement accounts this year).

- Send out “surprise and delight” gifts to five clients randomly.

- Put together the content for your monthly newsletter.

- Set up a lunch or dinner with a trust and estate attorney.

- Send out a one pager to all your COIs on “how we are helping clients manage inflation.”

- Create a graphic that can be used by the charity event you’re sponsoring.

- Identify a theme and content for your next virtual webinar.

- Call venues and price out your next event.

- Send a weekly email with one entrepreneur-oriented financial planning tip.

- Record a quick video or audio clip on your phone, breaking down the news of the week, and send it every Friday afternoon or Monday morning.

- Conduct one interview a month with a successful entrepreneur client or COI, highlighting their journey to success. Send the recording out to your clients and position it as an “Entrepreneur of the Month” feature.

Once you get in the rhythm of planning and implementing every single month, you can almost guarantee that you’ll have built a successful organic growth engine within your practice.