Next Generation Planner: February 2023

By Greg Sloan, CFP®, CEPA

Co-founder and CEO, Go Beyond

This article is an edited transcript of a presentation by the Financial Counseling community, supported in partnership with FPA and the Association for Financial Counseling and Planning Education: “Building Trust in a Remote World: Technology’s Role in the Counselor–Client Relationship.” Visit https://connect.onefpa.org/communities/allcommunities to learn more.

NOTE: Click on the images below for PDF versions.

Click here to read this article in the DIGITAL EDITION.

Maslow came up with his hierarchy of needs about 60 or 70 years ago. What he found was human beings all have the same desire for certain things. The very foundation is physiological; they need food, water, and rest. Moving up the hierarchy, they want safety, security, and having a roof over their head. Once they’ve gotten into this stability of life, they want to have relationships with other individuals: close friends, loved ones, family. Once you move beyond that, they want to start accomplishing things personally; they want to have a personal sense of self-esteem.

I’m going to talk about the last two needs, which is really where your role with the client comes into play. For many of us, myself included, we learned that the peak of Maslow’s hierarchy was something called self-actualization, which was defined as achieving your full potential in life. When you think about your role as a financial counselor, you are helping your clients to achieve [success]; through financial education, through financial decision making, possibly even investing, and possibly even purchasing financial products or guiding them on what kind of products to purchase. But it’s all based around this idea that they themselves want to reach a higher level of experience in life.

Maslow originally described this peak as something called self-actualization, but what many people don’t realize is that Maslow changed his mind before he died, and he said the peak of human experience goes beyond the self. In fact, it crosses into this area of what he calls “fulfillment”: having a sense of meaning and purpose in life. Maslow used the term “self-transcendence,” but the way I think of fulfillment is once you have personally achieved something in your life, you simply want to turn around and help someone else do the same. I would argue that many of you come from situations where you weren’t taught financial literacy. You may not have been aware of how to make good financial decisions earlier in life. You’ve come to the point of doing that for yourself, and now you want to help other individuals do the same. In other words, you want to have a sense of meaning and purpose by paying it forward and helping your fellow man. Your role as counselors is to help your clients get to the top of this hierarchy in having a more fulfilled life.

When I started in the industry, we focused on algorithms and spreadsheets. I started in 1995. I have an undergraduate degree in finance. I went back and got a master’s degree in finance, and I have a CERTIFIED FINANCIAL PLANNER™ designation, amongst a few other certifications. But most of what I focused on was the neocortex of your brain. In other words, how to help people make rational decisions. When you think about rational decisions, most times you’re thinking about mathematics. For example, if I show you that this loan has a better interest rate than that loan, then I can show you the math about why you should select Loan A versus Loan B. Much of what we do is still focused on this rational part of our brain. However, that is not all that the human mind needs to interact. It needs to become fulfilled and have a greater experience.

The middle part of our brain is what we call the limbic brain, and this is where emotion and motivation start to play a part. As you sit down with your clients, you will use questions like “How does that feel?” Feelings don’t come from the rational part of our brain; that comes from the emotional part of our brain. What would you like for your daughter or your son? What kind of experiences do you want to have in life?

When I started in 1995, behavioral finance and emotional intelligence were just not terms that were used much at all. And for me personally, it wasn’t until 15 years into my career, in 2010, when I made a bad financial decision myself that was very emotionally charged. That was the catalyst for me to say, “Wait a minute. We can’t just think about the rational part of our brain. We have to incorporate emotion, we have to incorporate these greater desires that we have as human beings, and then ultimately, we also have to understand the primal brain.” Some would call these instincts and urges that we have as human beings the lizard brain or the fight-or-flight [response]. What I learned in my 25 years of serving individuals was that they could make good decisions 90 percent of the time, but when a crisis came up, when stress rose, when someone lost their job, when some company was about to go under, when the stock market was too volatile, human beings would go back to this primal part of their brain and make fast decisions, and sometimes those decisions are very catastrophic. Think about a person who quits their job because they have a bad day. That is a financial decision that’s not commonly made with the rational part of the brain—that is made from these other two components.

My encouragement to you as counselors is to recognize that we have these three parts of our brain and that you have a sacred duty to make sure you’re understanding and communicating with all three parts of your client’s brain. That is going to improve the client experience, which is everything that we want you to come back to. This is so important that the Certified Financial Planning Board of Standards issued an edict [in 2021]. [Since] April 2022, they are requiring that all new CFP® [professionals] that go through the exam have to take a test on the subject of psychology, which they’ve categorized as improving coaching, emotional intelligence, and consulting. The CFP Board has been encouraging psychology since 2018, but it wasn’t until this year that they said, “That’s enough. This is no longer just something that we think is a ‘nice to have.’ We now believe it’s a ‘need to have.’” And the reason is because they recognize clients want more than just a relationship; they want tools, they want process, but they want coaching. They want you to walk beside them and help them become the best version of themselves. So everything that we’re talking about with fintech and machine learning and blockchain, it’s all leading us to this point, which is making sure you are doing what it takes to improve the client experience.

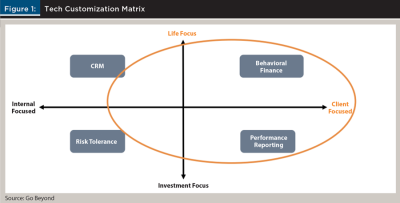

For many of you who are starting your career and are at the early stages, or even if you’re transitioning into a different type of service model, you have some decisions to make yourself. One of those decisions is where do you start? How do you put together a technology stack? How do you cobble together different fintech products, or “wealthtech” or “advisertech” products (as Michael Kitces calls them), and how do you put this together in such a way that you improve your client experience? There are so many different ways to start; you can start with a client relationship management system, performance reporting, cash flow modeling, risk tolerance assessment, digital marketing, banking behavior, etc. There are many different ways you can start this. I would argue that you should start putting together your tech stack based on your client profile and who you are serving.

Figure 1 displays a thought exercise. The Y axis has life focus at the top and investment focus below, which is generally the way the industry has evolved over the last 100 years. And then you have the internal-focus software and the external/client-focus software. I encourage you to think holistically, which I think many of you do. Focus on a client’s life as opposed to just their investments, or just those transactions, and definitely be on the client-centered side of things. That means you’re probably going to lean toward tools that have at their core behavioral finance and emotional intelligence; not just the rational part of your brain, but you are incorporating other components of how individuals make decisions. This is what I would suggest the sweet spot is. Nonetheless, you have to make a decision for yourself.

Michael Kitces has a solutions map at Nerd’s Eye View (www.kitces.com/fintechmap/), and he updates this solutions map every single month. It’s available to the public. You can go into the map, and you can click on any of the icons, and it’ll take you right to the technology solution.

Now I want to talk about how COVID-19 has changed what we’re doing as counselors. Just like 2001 with the World Trade Center towers coming down and the beginning of decentralization, to 2008 and the distrust [caused by the Great Recession], now we have COVID-19, and this is simply speeding up the adoption of digital technologies, according to a survey done in October [2020]. This is all across the board, but it’s even more so highlighted in the financial services industry. There’s an old saying that goes something like “change or die.” The reality is your consumers are looking for tools, they’re looking for an experience that they can come back to you and say, “Wow, I enjoy working with this person because it’s a great experience.” That’s what we all want as human beings, and that’s what I think you want to provide your clients as their counselors.

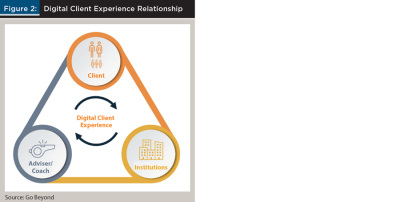

So how do you put together your tech stack? Focus on the digital client experience first. Figure 2 shows a simple diagram with three parties in this relationship.

Obviously, you have the clients up top—that is the most important. Then you have you as the counselor—I would encourage you to think of yourself, if you don’t already, as a counselor or coach. And then make sure that you have whatever institutions they are working with or that you believe are highly important to [clients] in mind. Don’t try to be all things to all people. You have an ideal client avatar or profile. Try to find a tech stack that is built around those individuals that are most attracted to your service model and that you’re most attracted to serving. Select tools that allow your clients to see more than just one segment of the value chain: more than just a portfolio manager, more than just a financial planner, more than just the insurance guy. Lastly, make sure that the tools you select do integrate smoothly with the institutions if you are registered or licensed. Make sure that they interact smoothly with your custodians or broker–dealers.

Ultimately, have in mind that this is always about the client experience. Advisers/counselors who can hold together the ideal digital-client experience will win the day.