Journal of Financial Planning: October 2021

Phil Lubinski, CFP®, has spent over 30 years as a financial adviser, serving almost exclusively retirement income planning clients. He has trained thousands of advisers from around the country on his time-segmented retirement income strategy. After transitioning his practice, Phil co-founded IncomeConductor, a time-segmented retirement income software for financial advisers.

NOTE: Click on Table below for PDF version.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Much emphasis has been placed recently on the impact of taxes and the most tax-efficient order of asset liquidation for producing income in retirement. But the fact is, liquidation order primarily impacts high-net-worth clients and does not have a significant impact, if any, on mass affluent clients.

Before I address this issue, let’s set the definition of “mass affluent.” Equifax defines mass affluent as individuals with $100,000–$1 million of investible assets, while Nielsen defines this group as having income-producing assets between $250,000–$1 million.1 It has been my experience that most advisers’ clients fall into the mass affluent category. Personally, my retiring clients had an average of about $700,000 of investible assets when I sold my practice in 2014, which placed them squarely within this definition.

Taxes and Middle America

Since the inception of defined contribution plans and individual retirement accounts, Americans have been encouraged to max out their annual allowed contributions. Hence, most mass affluent baby boomers’ savings have gone into these tax-deferred vehicles. I found that about 75 percent of my clients’ investible assets were indeed in qualified accounts, e.g., 401(k)s, 403(b)s, 457s, and IRAs. If my mass affluent baby boomers represent the typical retiree and pre-retiree client that advisers are working with, then liquidation order is a moot issue as 75 percent of their assets will be taxed as ordinary income when withdrawn. Typically, my clients would want to use their nonqualified assets to provide a tax-free legacy to their heirs or as a surplus account to withdraw from when they had lump sum needs during retirement, e.g., new car purchases, travel expenses, or major home repairs.

Why then are so many advisers and academics obsessed with tax liquidation optimization strategies that typically would only apply to high-net-worth individuals, who typically would have multiple tax categories in their overall investment portfolio? According to DQYDJ research,2 only 6.25 percent of U.S. households in 2020 had more than $2 million of net worth (which includes their personal residence). Please do not misunderstand. I don’t mean to imply that tax planning should be ignored for the mass affluent, but most mass affluent clients’ tax planning strategies will focus on the use of Roth conversions and reverse mortgages, rather than tax liquidation order strategies.

Roth IRA Conversions

Since the main tax planning opportunity for the mass affluent is Roth IRA conversions, let’s look first at which clients would benefit most from a Roth IRA conversion:

- An individual or married couple who can generate income above their needs and remain in a low tax bracket. Some advisers refer to this approach as “filling up the low bracket.” An example of this would be a 65-year-old married couple who do not itemize. They could enjoy about $115,000 of gross annual income, which might vary depending on their Social Security benefits, and remain in a 12 percent federal tax bracket. If this married couple only needed $100,000 of gross annual income, they could convert $15,000 of their qualified money to a Roth IRA each year and still pay only 12 percent federal tax on the conversion amount, thus “filling up” their 12 percent bracket.

- An individual or married couple who have over-accumulated in qualified accounts and may face a situation where their RMDs at age 72 will force them into a higher marginal tax bracket and potentially expose them to Income-Related Monthly Adjustment Amount (IRMAA) surcharges on their Medicare Parts B and D premiums. By considering Roth IRA conversions now (even if they fall into a higher tax bracket), they potentially could avoid IRMAA surcharges for life.

- An individual or married couple who have over-accumulated in qualified accounts and want to leave a tax-favored inheritance. This could be accomplished by converting the qualified money targeted for the legacy to a Roth IRA or withdrawing those assets and using the after-tax proceeds to purchase a life insurance policy for the benefit of their heirs. In either situation, the retiree is pre-paying the tax liability for the benefit of their heirs.

- An overlooked yet significant reason for Roth IRA conversions is to eliminate the “tax penalty” of a surviving spouse. In many retirement situations today, the only change in income when the first spouse dies is a reduction in the Social Security income. It’s not uncommon to have a married couple filing jointly who are living comfortably within the 12 percent bracket. When the first spouse dies and there is little change in the total income to the surviving spouse, they could find themselves in a 22 percent bracket or higher. Additionally, the surviving spouse could be exposed to IRMAA surcharges that were not an issue when they filed jointly. One might argue that the surviving spouse does not need as much income as they did together, so just reduce the investment income taken. A problem arises if the investment income is mostly RMDs that can’t be lowered just because they are not needed.

There are two potential mistakes that advisers must be aware of when using Roth IRA conversion strategies:

- Miscalculating tax impact. The only thing more dangerous than trying to predict the future performance of the markets is trying to predict what Congress will do with tax brackets. Considering the tax legislation that is currently being discussed, I would not advise a Roth IRA conversion today at a 22 percent tax rate just to avoid a future tax of 25 percent. Let’s look at an example of just this situation where a retired couple wants to pay lower taxes today to save the higher taxes later. They might feel that in 20 years, they will need additional income to cover medical expenses, or they might be worried about longevity and want to have 10 more years of income to age 95, and they do not want to pay a higher tax on the extra withdrawals.

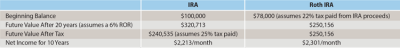

The chart above illustrates the future gross and net account values of the IRA and the Roth IRA after a 20-year investment period and the income that those accounts will produce over the subsequent 10 years of retirement.

At year 20, the Roth IRA account value is only $9,621 more than the IRA would be after taxes are paid. At a 3 percent inflation rate, the difference equals a present value (PV) of $5,326, which is a relatively small amount. The difference in monthly income these accounts would generate is even less impressive at $87 per month ($48 per month PV).

There is also the possibility that the tax brackets may be lower in 20 years. That may sound crazy, but we’ve seen this happen in the past. In 1970, we had 24 tax brackets ranging from 0 to 70 percent. No one was predicting lower taxes at the time, yet by the 1980s, there were 14 tax brackets ranging from 0 to 50 percent, which were significantly lower. Another consideration is if the $320,713 IRA is used to pay for long-term care, these expenses may be mostly deductible, and the retiree could pay little or no tax on the entire IRA balance.

That leads to the second potential mistake:

- Paying the conversion taxes from the proceeds. The true value of a Roth IRA conversion is to capture the full value of the IRA within the new Roth IRA account. If the client’s tax bracket remained 22 percent as in the example above, there is no tax benefit. Growing at a 6 percent annualized rate, the tax-free $78,000 Roth has the same value ($250,156) at the end of 20 years as the tax-deferred $100,000 IRA after deducting the 22 percent federal tax. To maximize the tax benefit of a Roth conversion, a client must have other assets that can be used to cover the tax liability at the time of conversion. It has been my experience that most mass affluent retirees do not have the amount of cash sitting on the sidelines required to pay the taxes incurred when converting a significant amount of IRA assets to a Roth IRA.

The exception to these mistakes could be when doing the Roth IRA conversion to avoid the surviving spouse tax penalty.

Reverse Mortgages

The second tax strategy that advisers use to generate tax-favored income for mass affluent retirees is reverse mortgages. This has become a very popular strategy in recent years as baby boomers retire without pensions and seek additional sources of income. Most reverse mortgages fall into three categories:

- Lump Sum

- Monthly Income

- Line of Credit

Regardless of which one (or combination) a retiree uses, the money is considered a tax-free loan, and the interest on the loan will compound at either a fixed or variable rate depending on which option the retiree selects. One nice feature is that the loan does not need to be repaid until six months after the surviving spouse vacates the residence. If a single retiree or the surviving spouse of a couple dies and the estate does not have enough assets to pay off the loan, the house must be sold. Another attractive feature is that should the house sell for less than the balance of the loan, neither the estate nor the heirs are responsible to pay the difference.

Despite this, many retirees consider reverse mortgages a last resort, probably due to the fear of losing their home or its value to their heirs. Nevertheless, advisers should consider home equity as a source of funds during retirement as home equity can represent a significant portion of a client’s total assets. In my personal practice, I recommended reverse mortgages primarily for one of the following reasons:

- To pay off the client’s home mortgage. By eliminating the principal and interest portion of the house payments, the client would need to draw less from their taxable accounts. Since the reverse mortgage is tax free, the elimination of the principal and interest payments could reduce their modified adjusted gross income enough to reduce the amount of their Social Security benefits that are taxable. For clients needing a higher monthly income, the reverse mortgage could potentially help them avoid IRMAA surcharges on their Medicare premiums.

- To fund the client’s “bucket list” items. Some of my retired clients did not have any heirs or charities they wanted to provide for after their deaths. A reverse mortgage provided them with a source of tax-free income that allowed them to do those extra trips and activities in the early years of their retirement while they were healthy and active.

- To fund long-term care (LTC) expenses. When creating a retirement income plan, advisers should always consider the expense related to LTC for one or both spouses. Although there are a variety of LTC insurance policies that individuals can buy, many mass affluent retirees cannot afford the premiums or have health conditions that prevent them from qualifying for LTC insurance. Nevertheless, according to the American Association for Long-Term Care Insurance,3 statistics show that the probability that a retiree will require LTC triples in the first year following the death of their spouse, and a reverse mortgage could be a good substitute for LTC insurance.

Reverse mortgages have many rules and requirements that must be carefully researched before being initiated, and there are probably more scenarios than the three I listed where they would be beneficial. Advisers and their clients should understand the terms and risks associated with these types of loans. Fortunately, that information is readily available today from objective sources such as the Federal Trade Commission Consumer Information4 website.

Conclusion

As advisers, we must choose the best way to communicate our value or “alpha” to retiring clients. As asset managers only, our value is quickly being eroded with the advent of robos and other direct-to-consumer platforms offering asset management guidance at little or no cost. And, although tax efficiency is something all retirees say they want based on media hype and marketing, meaningful tax liquidation order analysis is only beneficial to a small percentage of the total retiree market. Being a specialist in retirement income planning and a trusted source of financial guidance to retirees as they age will never be replaced with robos. Perhaps markets and tax laws have some predictability to them, but human emotional needs and behavior have none.

Endnotes

- Nielsen. 2012. “Affluence in America: A Financial View of the Mass Affluent.” https://oaaa.org/Portals/0/pdf/research/Mass-Affluence-in-America-Report%202012%20(1).pdf.

- DQYDJ. 2021, July 10. “How Many Millionaires Are There in America?” https://dqydj.com/how-many-millionaires-decamillionaires-america/.

- American Association for Long-Term Care Association. 2021. “Long-Term Care Insurance Facts - Data - Statistics - 2021 Reports.” www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2021.php#couples-2.

- Federal Trade Commission. n.d. “Reverse Mortgages.” www.consumer.ftc.gov/articles/0192-reverse-mortgages.