Journal of Financial Planning: November 2019

Randy Gardner, J.D., LL.M., CPA, RLP®, CFP®, is the founder of Goals Gap Planning LLC, a faculty member at The American College, and an advice strategist for the Garrett Planning Network.

Julie Welch, CPA/PFS, CFP®, is the managing shareholder of Meara Welch Browne P.C., an accounting firm in Leawood, Kansas.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

Although tax filing season is just around the corner, there is still time for clients to reduce their taxes and avoid underpayment penalties. When we meet with our tax and financial planning clients during November and December for year-end tax planning, we focus on the following seven steps.

Step 1: Update Clients on Recent Developments

Tax law changes daily. We inform our clients of applicable developments throughout the year. This year, for example, you might mention:

-

The Treasury Department’s final regulations holding that federal charitable contributions must be reduced by state tax credits received based on the charitable contribution;

-

Revenue Ruling 2019-11, which contains four examples of the federal taxability of state income tax refunds in light of the $10,000 state and local taxation limitation; and

-

Revenue Procedure 2019-38, which sets out the details of the 250-hour safe harbor requirement for the net income from a real estate enterprise to be eligible for the qualified business income (QBI) deduction.

Step 2: Know the Client’s Situation and Broader Goals

Prior to the meeting, we review the client file. At the start of the meeting, we check with the client to see if there have been developments that affect their short- and long-term financial plans.

Step 3: Review the Prior Year’s Tax Return

We review the client’s prior year tax return and the planning we did at the end of the prior year, summarizing the benefits that resulted from the prior year’s planning meeting.

Step 4: Perform a Projection for the Current Year

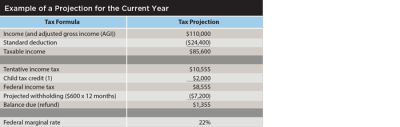

We request that the client bring their year-to-date statements from employers, business entities, banks, and brokers so we can project their income, tax liability, and federal and state tax payments. We verify that no other significant changes—such as bonuses or charitable contributions—will occur before the end of the year. Armed with this information, we calculate where the client currently stands using the quick and easy IRS withholding estimator or, if the situation is more complicated, the firm’s tax projection software.

Example: Sean and Emma are each 42 years old, married, and file a joint return. They each earn $55,000 ($110,000 total) and have a 15-year-old child. They own a home but only have $23,500 in itemized deductions, not enough to itemize. They are withholding $300 each ($600 per month) for federal tax per month.

Based on this projection (shown in the table below), Sean and Emma will owe money in April, and they may be under-withheld. They will only have 84 percent ($7,200/$8,555) of their anticipated tax liability paid before year-end. This amount may be adequate if their withholdings exceed 100 percent of the prior year’s tax liability (110 percent if their AGI was greater than $150,000). In other words, if they had $100,000 of AGI in 2018 and their total federal income tax was $7,000, then, with $7,200 of expected withholding, they meet the safe-harbor level and do not need to take corrective steps to avoid the underpayment penalty. They will owe $1,355 in April, but there will be no penalty.

However, if last year’s tax liability was $8,000 (93.5 percent of $8,555), Sean and Emma may prefer to use the 90 percent of projected tax liability safe harbor and increase their withholding by $500 to $7,700 (90 percent of $8,555). Note that Sean and Emma could make an estimated payment before the end of the year, but that would only reduce the penalty for the quarter in which it is paid, meaning they may be subject to penalties for earlier quarters in the year. Increased withholdings, whether from a paycheck or retirement plan distribution, are treated as spread throughout the year and avoid penalties in the earlier quarters.

Underpayment penalty clarification and planning opportunity. In 2018, many taxpayers were subject to underpayment penalties because they did not adjust their withholdings for the changes made by the Tax Cuts and Jobs Act. Bowing to Congressional pressure, the IRS issued Information Release 2019-55, which lowered the 2018 penalty threshold from 90 percent to 80 percent, providing relief to many taxpayers. It is not likely the IRS will again lower the threshold in 2019. So as you review your client’s 2018 tax return, check to see if an underpayment penalty was paid. You may use Form 843 to obtain a rebate of the penalty if your client paid over 80 percent of the projected tax liability through withholding and timely estimated tax payments.

Step 5: Consider Alternative Planning Strategies

The knee-jerk reaction when a client is under-withheld is to accept the tax liability as a given and pay the additional tax. Another possibility is to reduce the tax liability so that the amounts already paid in meet the threshold.

The table below outlines where the planning lines are. The items in bold represent the most beneficial planning points, while the italicized items are particularly relevant to clients who are 62 and older.

Continuing the Sean and Emma example, at $85,600 of taxable income, they are $6,650 ($85,600 – $78,950) into the 22 percent marginal tax rate bracket for married couples, and $6,850 ($85,600 – $78,750) from the zero tax rate bracket on dividends and capital gains (if applicable). By reducing their taxable income by $6,650, possibly through 401(k) contributions or IRA contributions, Sean and Emma can avoid the 10 percent (from 12 percent to 22 percent) increase in their marginal tax rate bracket, reduce their tax liability by $1,463 ($6,650 x 22%), avoid the underpayment penalty, and even get a refund of $108 ($1,463 – $1,355).

To avoid the underpayment penalty using the 90 percent safe harbor, they only need to decrease their income by $2,273 ((($8,555 x 90%) – $7,200)/0.22) or their tax by $555. They could accomplish this in a variety of ways, including deferring a bonus to the following year, bunching charitable contributions or medical expenses to exceed the standard deduction, or claiming credits for a dependent elderly parent or an older child’s college expenses. In short, strategies other than withholding more tax or making estimated payments are available to avoid the underpayment penalty.

Step 6: Ask about Upcoming Life Transitions

Possibilities of life transitions that could impact the client’s taxes include job changes, compensation and work benefits changes, retirement, real estate purchases, charitable pledges, children turning 17 or graduating from college. Numerous other life changes can significantly impact clients’ taxes as well.

Step 7: Discuss the Foreseeable Tax Policy Future

We discuss the long-term view of our tax system, particularly in light of pending bills in Congress and the upcoming elections. For example, we discuss the SECURE Act (which, as of early October was stalled in the Senate) and the impact it could have on stretching retirement distributions.

With regard to politics, if President Trump is re-elected, we will probably see more of the same, although he has mentioned payroll tax cuts and indexing the basis of assets to inflation. The Democratic candidates are talking about Medicare for all, free university tuition, and student loan debt relief funded by wealth taxes, reduced estate tax exemptions, and higher tax rates for the high income.

Given our federal deficit and debt situation, there is a good chance that taxes in general will increase in the future. Therefore, when we perform long-term strategic planning projections (such as for retirement) for our individual clients, we conservatively suggest using a blended rate 3 percentage points higher than the client’s current marginal income tax rates. About half of our clients agree to that assumption.

The autumn tax planning season offers financial planners the opportunity to show their value. Help clients achieve their long-term goals while helping them avoid underpayment penalties and reduce current income taxes.

Randy Gardner and Julie Welch are co-authors of the recently updated 101 Tax Saving Ideas (11th edition). To obtain a copy, email Julie HERE.