Journal of Financial Planning: November 2015

In 2006, Robert F. Hurley, a professor of management at Fordham University in New York, wrote a significant article on the topic of trust and communication. In “The Decision to Trust,” published in the September 2006 issue of Harvard Business Review, Hurley discussed the 10 factors related to whether people will trust.

Three of the factors relate to the individual and are the result of a complex mix of personality, culture, and experience (for instance, risk tolerance). Seven of the factors relate to the situation or the person to whom trust will (at least to some degree) be granted (for instance, whether the person being granted trust shows benevolent concern or is perceived as capable). In Hurley’s study, the bottom line is that people are more likely to trust when a majority of the 10 factors score high on the rating scale.

In his 2011 book, The Decision to Trust, Hurley explained how trust declined as a result of the 2008–2009 banking crisis and other negative news, and that only one-third of Americans surveyed at that time believed they could trust the government, big business, and large institutions. He explained how this new culture of cynicism and distrust creates many problems, and why it is almost impossible to manage an organization well if its people do not trust one another.

“High-performing, world-class companies are almost always high-trust environments,” Hurley said. “Without this elusive, important ingredient, companies cannot attract or retain top talent.”

The question is: what does this mean for financial advisers today? Is trust an issue, or is it, in fact, an opportunity?

Do We Have a Trust Problem?

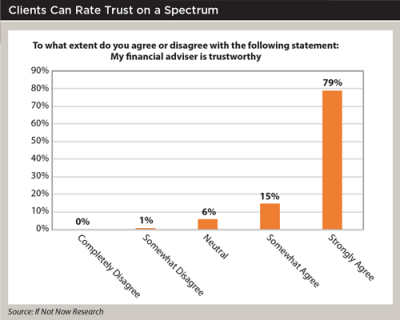

Earlier this year, If Not Now Research (led by Julie Littlechild, co-author of this article), examined the scope and impact of trust between clients and advisers through a survey of more than 1,000 clients of financial advisers across the country. The level of trust, researchers found, was very high. In fact, 90 percent of clients surveyed indicated they trust their adviser, 90 percent said they were loyal, and 89 percent said they were satisfied.

However, this level of trust does not, it turns out, extend to the financial services industry as a whole. The If Not Now Research Investor Study shows that only 7 percent of clients rate their level of trust in the industry as a 5 out of 5.

The substantial gap between trust in the industry and trust in the adviser can likely be explained by two phenomena—the Madoff effect and confirmation bias.

Regarding the Madoff effect, has extensive media coverage of individuals who have operated on the wrong side of the law put a downward pressure on trust in the industry? And when it comes to confirmation bias, do individuals seek out information that confirms their own preconceptions? Do they want to reinforce a decision they have already made?

Whatever the form of bias, if any exist at all, the facts seem clear; trust is not a problem for individual advisers, but nor is it a differentiator.

Can We Move the Needle on Trust?

This raises a more practical question: can we move the needle when it comes to trust, and should we bother to try? To explore this question, the clients surveyed earlier this year by If Not Now Research who indicated they trusted their adviser were broken into two groups—those who rated trust as a 4 out of 5 (moderate trust) and those who provided the highest rating of a 5 out of 5 (complete trust).

As you might expect, these two groups are quite similar on a wide range of factors, however five specific beliefs are substantially different. A review of these five things suggests that these are the things that drive trust, and are therefore fundamental to the adviser/client relationship and to the process of financial planning.

My adviser:

- takes the time to understand my financial needs and concerns

- fully understands my goals for the future

- gives me peace of mind

- clearly explains difficult financial concepts

- when making recommendations regarding our plan or portfolio, puts the needs of me and my family first

The gap between moderate and complete trust may be an issue of fact (an adviser is not doing some of these things,) or of communication (the client is not fully aware of what the adviser is doing). If we assume that all good advisers are doing these five things, then the lesson here is that in order to be seen as more trustworthy by our clients, we have to communicate our actions more effectively. We would wisely “assume less” (one way to do that is to gather client feedback more often) while also being more direct in explaining to clients exactly how we take action on these critical relationship dimensions.

The Impact of Trust

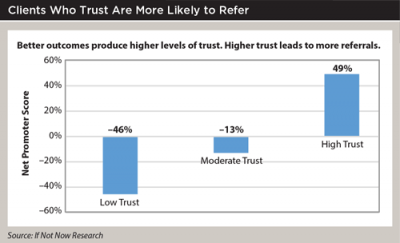

High trust is associated with a range of positive outcomes. From the client perspective, the positive benefits of high trust seem obvious, however there are clear business benefits as well; the higher the level of trust, the more likely a client is to refer.

Consider the net promoter score for three segments of clients based on trust. The net promoter score is a standardized metric that reflects a client’s perceived likelihood to refer. You’ll see from the bar graph on page 29 that a client’s net promoter score is directly related to his or her level of trust.

So how can we move people along the trust spectrum? As evidenced by the studies mentioned here, we can see that:

- People make a decision to trust, to one degree or another.

- To the extent that the client trusts the adviser, he or she is more likely to refer friends and family members.

- In order to be seen as more trustworthy by their clients, advisers need to communicate more effectively.

The interpersonal relationship between the adviser and the client is as fundamental to building and maintaining a practice as are all the technical skills needed to capably serve the client.

Communication Tips to Enhance Trust

Be predictable. Consistency drives trust. “Being capable does not build trust if the trustee is unpredictable,” Hurley writes in The Decision to Trust. “If predictability is low, then trusting is hard, because it is difficult to rely on someone when you can’t know with confidence what he is likely to do.

Integrity (honoring one’s word or practicing what one preaches) increases predictability. When someone with integrity tells you that she will do something, you have great confidence that her behavior will match her words. If for some reason a high-integrity person cannot honor her word, she will give you an explanation and an apology, and the problem will not recur.”

The reality is that our clients may begin to doubt our commitment to the relationship (or wonder if we really care) if we become unpredictable or fail to keep our word. Of course, just because someone does not follow a pattern (also known as “predictability”) does not necessarily mean that they are untrustworthy. But when too many doubts crop up, due to a pattern of missing deadlines and subsequently making excuses, the client may look for a more predictable business partner. Life is stressful enough—none of us want business partners who create mental confusion or ongoing concerns.

Assume less. One way to check your assumptions at the door is to gather feedback on an ongoing basis. By giving clients a voice in an objective and consistent way, you will not only actively demonstrate that you care (a key element of trust), but you can identify any lurking concerns that could potentially damage trust in the future. The basis of any good relationship is seeking to understand and truly know the other person.

Gathering ongoing client feedback doesn’t have to be difficult.

ActiFi Inc. is known for its systems that drive efficient and effective business operations for financial advisers and allied institutions. ActiFi’s CEO, Spenser Segal, and his team recently began offering a client engagement program designed to make the client feedback process easy. Segal said great advisers build getting feedback into their systems so that it is a recurring event. Predictable things are reassuring to clients, and build even more trust. “The process of taking that temperature of the client and to understand what they value and how they perceive what they are getting from the firm should be baked into your operating model,” says Segal.

Create rapport. The simplest way to establish trust is to create a sense of similarity and/or familiarity—sometimes known as rapport. Rapport, a close and harmonious relationship in which the people or groups concerned understand each other’s feelings or ideas and communicate well, can shift the direction of a potentially negative or adversarial conversation.

This is one reason why some of the most successful advisers in the industry make it a priority to host events away from the office and socialize with their best clients and strategic partners. They also make note of important events and client details in their CRM so that it is easy to remember and bring up that special anniversary, vacation, wedding, or charitable interest.

Some advisers are using intelligence solutions such as Infinata’s High Net Worth Insight coupled with LinkedIn to better understand their clients. Social media, including Facebook and Twitter, are also being used as a listening and engagement tool. Google News alerts can be used to monitor your best clients’ names and interests on the web. Grapevine6 can help you find relevant articles to share with prospects and clients to build high-trust relationships.

And here’s a quick tip for in-person meetings: find and emphasize something that will create a sense of kinship or affiliation. Similarities may include common values, membership in a defined group, and shared personality traits. Even if the commonality is not objectively meaningful, the sense of affinity and connection can be helpful in building trust.

Can You Be Confidently Relied On?

Hurley defines trust as “confident reliance on someone when you are in a position of vulnerability.” How many times have we read about, or experienced directly, that clients would rather talk about their sex lives than their financial affairs, or that they feel uncomfortable and vulnerable when discussing important money matters?

“Fortunately,” says Hurley, “fifty years of research in social psychology has shown that trust isn’t magically created. In fact, it’s not even that mysterious. When people choose to trust, they have gone through a decision-making process—one involving factors that can be identified, analyzed, and influenced.”

Trust is one way to measure the quality of a relationship. And moving clients along the trust spectrum through better communication is the key to a more profitable and satisfying financial advisory business.

Marie Swift is founder of Impact Communications Inc., a marketing and PR firm that has served independent advisers and allied institutions since 1993.

Julie Littlechild is founder of If Not Now Research, a firm that uses quantitative and qualitative research to help financial services firms understand the drivers of deeper engagement with clients and their teams.

Swift and Littlechild are founding partners of the 3rd Wave Collaborative (www.3rdWaveCollaborative.com), a consortium of industry leaders engaged in uncovering the new fundamentals in the profession of financial advice.