Journal of Financial Planning; June 2014

Mitch Anthony is the founder and president of Advisor Insights Inc. He is the author of several books, including From the Boiler Room to the Living Room, The New Retirementality, and Your Clients for Life. EMAIL author.

One of the most endemic existential enigmas for the modern retiree is trying to strike the perfect balance between vacation and vocation. Going from a life of all work and no play to a life of all play and no work is not the answer. If it were the answer, the majority of “retirees” (I use the term loosely; it might be the great oxymoron of our times) wouldn’t go back into the workplace—at least on a part-time basis—within their first year of retirement.

Clearly, they underestimated the benefits of working.

W-O-R-K is no longer a four-letter word. We are living in an age of Renaissance regarding the place of work in our lives. We are beginning to fully understand the virtues and benefits of being engaged in productive and affirming pursuits. Unfortunately for many workers entering their 60s, the drudgery of toiling in enervating careers has dulled this comprehension to the point that they are ready and willing to believe the mendacious mythology of the “play all day, Del Webb mirage in the desert.

Recently, while having breakfast in a Minneapolis eatery, I couldn’t help but overhear a conversation between two retired gentlemen. It was evident to any eavesdropper present that these men were intelligent, well-heeled, and by any standard “successfully” retired in America—except for one small annoyance: after a year on the sidelines, they were bored out of their skulls.

I heard one of them say to the other, “I’ve been talking to headhunters lately. I realized I’ve still got a lot to offer and I still love aspects of the game. These headhunters look at me and ask, ‘Why? You’ve got what everyone wants. You’ve cashed in. You’re successfully retired.’” He said to his breakfast mate, “They just don’t get it.” I decided this was my cue to insinuate myself into the conversation, and we had an illuminating chat about the overrated aspects of retirement.

I spend a lot of time speaking at conventions, and that translates to about 100 rides a year in limos driven by, in most cases, former retirees or partial retirees. I often ask about their former careers and their impetus and timing for coming back to work. For most it didn’t take long. When people wake up to the idea that they need to spread out going to the pharmacy and dry cleaners over a two-day period so they have something to “do” each day, they’ve reached a crossroads that will either propel them back into employment or send them spiraling into a state of decline.

In one of these conversations, a limo driver in Missouri told me: “I met with the same six guys every day for breakfast, and then we would go play golf. After about four months of this, we started looking at each other like, ‘Haven’t we had this conversation before?’ Within six months all of us were back to working at least part time."

An Unpredicted Work Trend

In a recent article in the New York Times titled, “An Aging Population Also Poses Opportunities for Retirement Careers,” Kerry Hannon postulated that as the population ages, jobs like massage therapist (the employment of massage therapists is projected to grow 23 percent by 2022) and others like senior fitness trainers, dietitians and nutritionists, personal assistants, handymen, drivers, and caterers who prepare meals for shut-ins are on the upswing.

An unpredicted work trend seems to be emerging where an aging population is spawning new fields of work for people ages 55 to 75 to care for and attend to those in their 80s and older. This trend should gain demographic momentum because, according to the Pew Research Center, the nation’s population of people age 65 and older is expected to more than double in the next three decades.

Hannon quotes Kevin Cahill, Ph.D., an economist with the Sloan Center on Aging and Work at Boston College, saying, “It’s no secret that retirement is a very diverse process for older Americans, with some combination of phased retirement and bridge jobs being the norm among older career workers.” According to Cahill, close to 60 percent of career workers take on a part-time job after exiting their main career. A trend within this trend is that many are migrating from waged or salaried employment toward self-employment.

An unexpected driver for those who want to be their own boss are jobs that target those who want to stay in their own homes, rather than move to an assisted living facility, or a nursing home. An AARP survey showed that nearly 90 percent of those over age 65 want to stay in their residence for as long as possible, and 80 percent are convinced that their current home is where they will always live. Perhaps you have noticed the recent proliferation of jobs and businesses being created that appeal to the healthier living crowd, and serving the aging-in-place population. Look for a grayer workforce to be attending to these markets.

Why Not You?

The recent collaborative report between the Boston College Center for Social Innovation and Encore.org, Been a Long Time Coming: Social Entrepreneurship In Later Life, talks about the increase in recent years in social entrepreneurship with the formerly retired. This trend has been aided in no small part by the efforts of Encore.org and its founder Marc Freedman. Encore.org has discovered a way to tap into the altruistic resources of those on the retirement sidelines in our culture. Spurred by a more compelling vision of what can be accomplished by retirees and the founding of The Purpose Prize, which has given away millions of dollars in grants to mature visionaries in the past few years, many are waking up to their true potential in this phase of life.

The collaborative report found that about one-third of social entrepreneurs had worked for nonprofits in their first careers, one-third had worked in the for-profit sector, but had long harbored a need to make a difference, and the last third had always devoted significant time in their lives (at least a half a day per week) to volunteer activities.

I find it interesting that as people begin to think about pursuing an encore career as a social entrepreneur, they initially will spend some time engaging in solitary thinking, some time discussing preliminary ideas with others, and some time pilot-testing prototypes in collaboration with other individuals/organizations. This was true with about three-quarters of those who had engaged in social betterment projects.

The question I would like to pose to the financial planning community is, “Why not you?” Why shouldn’t you be the person starting this conversation with clients regarding the investments of their intellect, experience, and soul capital into your local society? This is part of the retirement planning conversation of our present age.

Before writing this column, I sat down with my financial planner and showed him the conversation tool I’m about to introduce into the retirement dialogue that profiles clients on the existential and economic motivators toward work as they approach or have encountered retirement. I asked, “Can you use this?” He replied that he’s having more conversations about work in retirement than any other topic.

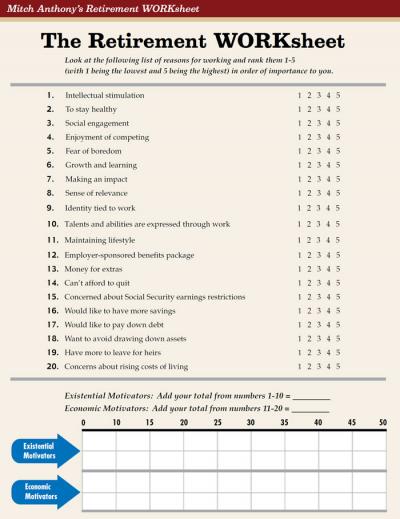

I’m encouraged to know that this conversation is happening organically and that planners are beginning to address it. To make the conversation easier, I would like to introduce a profile designed to accelerate the dialogue. It’s called the Retirement WORKsheet.

A thorough examination and dialogue around the motivators toward work is necessary in the age we live in. By filling out the Retirement WORKsheet, potential retirees can see how they personally weight their motivation in light of life-satisfaction and financial reality.

The verdict is in on the all-play lifestyle, and the majority is bored with the redundancy and aimlessness such a life offers. When people weigh in on the reasons for re-seeking some form of employment, the existential factors often trump the economic factors in importance—but they are both motivators that need to be culled out in today’s retirement planning discussions. For example, a 2009 FRC Consumer Retirement Income Planning Survey showed that for women, staying healthy was the No. 1 reason for seeking some re-employment in retirement.

Social Insecurity

One area in which retirees will need specific counseling is the annual earnings limits of Social Security. The fact that our government still maintains guidelines that serve as disincentives for mature workers illustrates the anachronistic nature of our policies around retirement. A person younger than full retirement age can only earn up to $15,120 without affecting their Social Security benefit. After that, $1 is deducted from their Social Security benefit for each $2 they earn above the limit. If you signed up for Social Security benefits worth $600 per month ($7,200 for the year) and earned $20,800 ($5,680 above the $15,120 limit), the Social Security Administration would withhold $2,840 of your benefit. I have listened to many retirees lament that they would work more and earn more, but they don’t like the idea of being penalized for working.

In the year that you turn your full retirement age, the earnings limit climbs to $40,080, after which $1 is deducted from your payment for every $3 you earn above the limit. And the earnings limit no longer applies once you reach the month you turn your full retirement age. Hopefully, sometime in the near future, these nonsensical shackles on working retirees will be removed altogether.

A financial planner called me last week and gave me a hearty laugh by sharing one of his female client’s definition of retirement: “Too much husband and not enough money.” By the way, I welcome all calls that lead to such great quote-ability!

As a kid I remember the line, “All work and no play makes Jack a dull boy” (popularized in the movie The Shining), but it turns out that the retirement reality is even more severe in that. “All play and no work makes Jack even duller."

Del Webb invented the terms “golden-ager” and “golden age” to lure American retirees into the playground existence his walled communities offered. We’ve learned over the past decade or two that the gold tarnishes quickly if it “does not shine in use”—to borrow on Tennyson’s imagery in Ullyses.

My comfort to the aimless, bored, disengaged, and those disenchanted with nothing but play is, you’re not alone. You’ve been sold a mirage. Play extracts its meaning from work. When you no longer have any meaningful and affirming engagement in your life, your playdates can quickly lose their luster. My advice to those in this place is, make your play more fun, and make your work more challenging.

As planners, you have a unique opportunity to encourage your clients to live a life of balance between vacation and vocation. Therein lies the true oasis of retirement.