Journal of Financial Planning: June 2013

For many years, the financial planning industry media have built up expectations of revenue inflows as baby boomers retire and realize they need professionals to help them manage their retirement funds. Financial planners, journalists, and consultants often discuss how the transition from retirement asset accumulation to distribution can create problems with traditional revenue models.

Consider this: retirement income planning can be highly time-consuming, but a planner’s or a planning firm’s revenue based on an assets-under-management model can decline when now-retired clients draw down assets. So how have planners reconciled this tension in practice? According to an FPA study, it may be by more widely embracing planning fees and clients consolidating more assets.

A Revenue Boost?

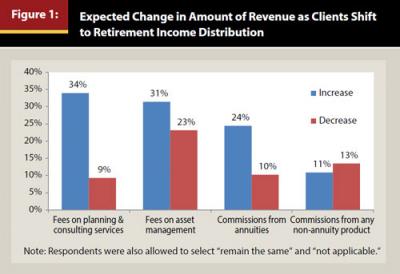

FPA’s 2012 Financial Adviser Retirement Income Planning Experiences, Strategies, and Recommendations study surveyed more than 440 financial planning professionals in July 2012. Planners were asked how they expect the amount of revenue they receive to change as clients transition from the asset accumulation phase to the distribution phase of retirement income planning. Although the majority of respondents do not expect revenue to change much, if at all, as clients transition into retirement, one-third expect the amount of revenue generated by fees to increase, and another 24 percent anticipate an increase in commissions from annuity sales (see Figure 1).

The largest firms—those with $2 million or more in annual revenue—are more likely to anticipate revenue generated from asset management fees to stay the same. However, firms with up to $1.99 million in annual revenue anticipate an increase in revenue from asset management fees as their baby boomer clients move into retirement.

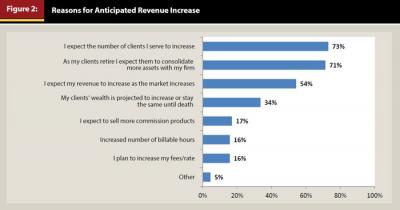

Planners who expect an increase in revenue were asked to indicate the reasons for the change. Nearly three-fourths of planners expect to increase scale with the number of clients served and the amount of assets managed for each client. About two-thirds of planners anticipate revenue to increase as the market increases, and one in six planners expect to increase fees or rates to achieve a higher level of revenue (see Figure 2).

Do You Have the Time and Resources?

Although the potential to boost revenue by bringing on more clients may exist (we’ve all heard the staggering number of baby boomers entering retirement each day: 10,000, according to the Pew Research Center), are planners prepared to grow their businesses? Do they have the time and resources to serve more clients?

Planners who responded to the 2012 FPA survey are working with a median of 65 client households in a financial planning/advice capacity. The 25th to 75th percentiles range from 32 to 140 households per respondent (not per firm).

Of these existing clients, half have received retirement income products, services, or advice in the past 12 months. In addition, 30 percent are retired, 10 percent are semi-retired (the client works part time and/or has a spouse still working), and 20 percent are expected to retire in the next five years. So most planners already have seen a significant percent of their client base retire and begin to draw down assets.

Additionally, half of the planners surveyed have seen at least one in five clients in a 12-month period make a significant change in retirement to account for unexpected expenses, market shifts, or other adjustments (see the Special Report in the December 2012 issue of the Journal of Financial Planning for more on this). In other words, the income distribution stage of retirement planning does not run on auto-pilot. At a minimum, planners should expect to help clients make significant adjustments to their plans or spending habits once every five years in addition to managing portfolios and monitoring the plans.

To increase the number of clients served, planners are going to need to increase scalability and free up time. Planners who expect revenue to increase or stay steady on an AUM model during the distribution phase should evaluate their time allocation and office efficiency.

Many planners may see an initial increase in revenue as clients consolidate assets at retirement. Past studies have found about two-thirds of clients consolidate more assets with their planner after receiving retirement income planning services, products, or advice from that planner.1 This initial bump needs to be evaluated and managed over time to ensure that planners do not end up with excessive work for the amount of cash flow in the later stages of the client retirement.

Pulling It All Together

Retiring baby boomers are creating demands and opportunities for planners. It is essential for planners to ensure their business structure, processes, and plans can support expectations. This is especially true with retirement income planning and revenue expectations. Once clients have retired, planners need to make sure the planner-client relationship works financially not only for clients, but also for them.

Some advice for planners: Make sure you have thought about how your revenue stream will change as clients retire. Be careful when making assumptions about changes in workload. Talk to planners who have worked with clients who have entered the income distribution phase to gauge how your expectations match up to reality. Then create a plan that accounts for the revenue you will need to guide your clients through their entire retirement so you can make sure you or your successor will be able to be there for clients when they will need you the most.

Rebecca King is a market research consultant specializing in the independent adviser market and the former director of the FPA Research Center. Contact her at Rebecca@RebeccaKing.com.

Endnote

- See previous FPA retirement studies from 2009–2011 available online at www.FPAnet.org/professionals/documentcenter/researchcenter/Find.aspx.