Journal of Financial Planning: July 2019

Randy Gardner, J.D., LL.M., CPA, RLP®, CFP®, is the founder of Goals Gap Planning LLC, delivering financial education to individuals and employer and professional groups.

Julie A. Welch, CPA, PFS, CFP®, is the director of tax services and a shareholder with Meara Welch Browne P.C. in Leawood, Kansas

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

Rhonda, an employee of Generous Corp., was shocked this past tax season to learn she is no longer itemizing deductions due the suspension of the deduction for miscellaneous itemized deductions. In 2017, she claimed $12,000 in deductions for unreimbursed work-related expenses for education, phone, internet, mileage, and professional dues, saving her federal and state taxes of $3,000 (30 percent tax rate x $10,000 ($12,000 less the 2 percent floor for miscellaneous deductions). She couldn’t claim these deductions at all in 2018.

Many employees found themselves in Rhonda’s situation this past year, but there is an alternative approach that can reduce both Rhonda’s and Generous Corp.’s taxes. Coordinating with her employer, Rhonda can reduce her taxable compensation by the amount of the unreimbursed expenses by treating them as a working condition fringe benefit.

Working Condition Fringe Benefits

A “working condition fringe benefit” is any property or service provided to an employee to the extent that, if the employee paid for the property or service, the amount paid would be allowable as a trade or business expense. Examples are any expenses that would be deductible as a business expense by a self-employed individual or business entity, including auto, travel, meals, education, technology, dues, subscriptions, and similar expenses. Working condition fringe benefits do not include: expenses allowed under a flexible spending arrangement (e.g., medical and dependent care expenses); production of income expenses (e.g., investment advisory fees and other investment-related expenses); and expenses that are limited or disallowed for businesses (e.g., entertainment expenses and 50 percent of the cost of meals).

Similar to employer-provided medical or life insurance benefits, working condition fringe benefits are excluded from the employee’s gross income for income tax purposes, not subject to employment taxes, yet deductible by the employer. By reducing the employee’s taxable pay for work-related expenses the employee would otherwise pay after-tax, the employer is: (1) increasing the employee’s after-tax cash flow; (2) reducing the FICA obligation of the employer; and (3) increasing the employee’s morale and commitment to the employer.

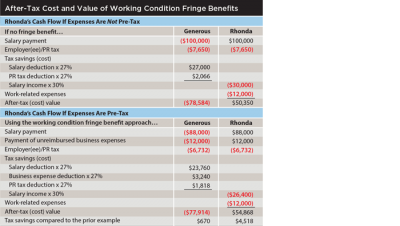

Example: Generous Corp. is negotiating its compensation arrangement with Rhonda. Her compensation is $100,000, and she has $12,000 of work-related expenses she would like to treat as a working condition fringe benefit. Generous’ marginal tax rate is 27 percent (21 percent federal plus 6 percent state), and Rhonda’s marginal tax rate is 30 percent (24 percent federal plus 6 percent state). The after-tax cost of this salary to Generous and the after-tax value of Rhonda’s pay are computed as shown in the table on page 30.

Treating Rhonda’s $12,000 of unreimbursed work-related expenses as a working condition fringe benefit decreased Generous’ after-tax cost of obtaining Rhonda’s services by $670 and increased Rhonda’s after-tax compensation by $4,518. Both parties benefited from viewing Rhonda’s pay as a total compensation package, which can be broken into taxable and nontaxable components based on the employee’s benefits-related spending. This approach to structuring compensation is often used by employers and their executive leadership.

Structuring the Arrangement as an Accountable Plan

For a cash reimbursement of work-related expenses to qualify as a working condition fringe benefit, the arrangement must be structured as an accountable plan. An accountable plan requires employees to meet all of the following requirements. Each employee must:

- Have paid or incurred deductible expenses while performing services as an employee;

- Adequately account to the employer for these expenses within a reasonable period of time; and

- Return any excess reimbursement or allowance within a reasonable period of time.

Reasonable advances. The arrangement under which money is advanced to employees must be reasonably calculated not to exceed the amount of anticipated expenses; and made within a reasonable period of time of the employee paying or incurring the expense.

Adequate accounting. If any expenses reimbursed under this arrangement are not substantiated, or to the extent an excess reimbursement is not returned within a reasonable period of time by an employee, the employer cannot treat any of the expenses as reimbursed under an accountable plan. The reimbursements are treated as compensation subject to income tax and payroll tax. The employees must provide documentary evidence of their travel, mileage, and other employee business expenses. This evidence should include items such as a statement of expenses, along with receipts, an account book, a day-planner, or similar record in which the employee entered each expense at or near the time the expense was incurred.

Excess reimbursements. The employee must return any excess reimbursement or other expense allowance to the employer within a reasonable period of time, which depends on the facts and circumstances. An excess reimbursement or allowance is any amount paid to an employee that is more than the business-related expenses for which the employee adequately accounted. Examples of reasonable periods of time from IRS Publication 463 include:

- An advance should not be paid more than 30 days before the time the employee pays or incurs the expense;

- Employees should adequately account for their expenses within 60 days after the expenses were paid or incurred;

- Employees should return any excess reimbursements within 120 days after the expenses were paid or incurred; and

- Employers should provide a periodic statement (at least quarterly) to their employees that asks them to either return excess reimbursements

or adequately account for outstanding expenses within 120 days of the date of the statement.

Example: Rhonda’s $12,000 of business-related expenses break down as follows:

Phone ($100 per month): $1,200

High-speed internet and Wi-Fi ($75 per month): $900

Mileage (3,000 business miles x 58 cents per mile for $145 per month): $1,740

MBA courses ($3,600 in January and $3,600 in August): $7,200

Professional dues and subscriptions (due in December): $960

Generous Corp. could reimburse these expenses monthly as they are incurred and substantiated with receipts and mileage logs, but administratively, Generous and Rhonda may prefer to reduce her taxable compensation by $1,000 per month based on an annual projection made during Rhonda’s annual performance review (see the table on page 31).

In this scenario, there are only two months (June and July) when reimbursements exceed cumulative actual expenses. Otherwise, Rhonda’s documented expenses exceed reimbursements. Although for these two months, the expenses are advanced more than 30 days in advance, the adequate accounting occurs within 60 days and there is no excess reimbursement 120 days after the advance. Given the facts and circumstances of the situation, this reimbursement arrangement will likely pass muster.

Pros and Cons of Fringe Benefit Plans

As illustrated by the previous example, employers may incur additional administrative expenses, but the time involved should not be significantly greater than a flexible spending account for medical and dependent care expenses and accounting for employee travel.

Some employers already reimburse all the work-related expenses of their employees. However, many do not, and establishing a working condition fringe benefit program offers the opportunity to increase the cash flows of the employee and the employer.

Some fringe benefit plans must be in writing, meaning possible legal costs.

Working condition fringe benefit plans may discriminate in favor of highly compensated employees, but some fringe benefit options cannot (e.g., group-term life insurance plans and employee discounts).

Many employees care mainly about maximizing their W-2 income and would not want to convert part of the income to nontaxable income, perhaps because they are concerned about qualifying for a home mortgage or they want to be able to be in a better bargaining position with a future employer.

Lowering the employee’s W-2 amount may also reduce the compensation considered for future Social Security benefits and for other fringe benefits, such as group-term life insurance protection and disability.

Numerous other opportunities to increase employee and employer cash flows using fringe benefit plans include: flexible spending accounts (dependent care and medical expenses); health, disability and long-term care insurance; group-term life insurance; meals and lodging for the convenience of the employer; on-premises athletic facilities; employee discounts; adoption assistance programs; and de minimis fringe benefits.

After the Tax Cuts and Jobs Act, many employees are no longer itemizing deductions because of the increased standard deduction, the state and local income tax limitations, and the suspension of the deduction for miscellaneous itemized deductions. Tax reform has created an environment where individual tax is based on gross income, not net income after deducting the expenses incurred to produce the income. To respond to this distortion of the definition of income, it may be mutually beneficial for employers and employees to think in terms of total compensation by designing compensation packages that take advantage of accountable plans and other fringe benefit options.