Journal of Financial Planning: January 2015

Much has been written about the surge of the “robo-adviser” and the impending doom it signals for the traditional financial adviser business model. Such press is giving many advisers pause: is this simply a short-term fad, or is something bigger happening? Advisers I’ve talked with are all over the spectrum in their outlooks, from “it’s not going to affect me at all” to an attitude of serious concern.

Like most things in life, the answer likely lies between the extremes. Let’s look at some of the facts surrounding this trend and how it stands to impact traditional financial advisers’ business models.

The Investment Manager Is Dead

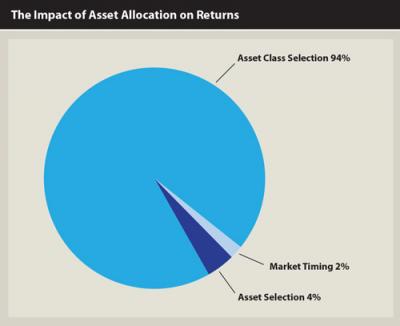

Although an active-versus-passive argument isn’t the focus of this article, investments have some important undertones in the robo-adviser surge. Study after study has shown that it is very difficult for anyone to beat the markets over a long period of time. Advisers familiar with the seminal Brinson, Hood, and Beebower study conducted in 1986 (“Determinants of Portfolio Performance” published in Financial Analysts Journal), recognize that any given portfolio’s returns are mostly a factor of asset allocation, not of asset selection or market timing.

Aside from the myriad of investment return-based studies, other industry trends have contributed to the rise of online advisory platforms. The rapid expansion of transparent investment products (many now without trading costs) has made it easier and cheaper than ever to buy tax-efficient investment vehicles. Pure technology advancements have played a critical part as well—namely, robust, readily available portfolio modeling/rebalancing software (scalable implementation) and the rise of the Internet and proliferation of mobile devices (scalable delivery). Together, these facts and trends tell us that investment management is ripe to be commoditized.

The struggle often seen in the early stages of commoditization can be characterized as the divergence of love and statistics—the old guard loves what they do/make, but the innovative disruptor can usually do it better, faster, or cheaper.

Many advisers love learning about and selecting individual investments; some even feel that the investment selection process is the core differentiator they bring to the table. Plus, investment selection is what they grew up doing and one of the things that attracted them to the business model. And there’s nothing wrong with that, at least not until it becomes a competitive disadvantage. The best “pure” robo-advisers today literally spend 5 cents per client per year managing and maintaining their portfolios (including trading costs and so on). As they’re structured today, most advisers would spend as much just reading the last sentence.

Planning for Differentiation, Guiding for Loyalty

For a moment, let’s assume that investment management is in the beginning stages of being commoditized. Given that, how should financial advisers best position themselves to thrive?

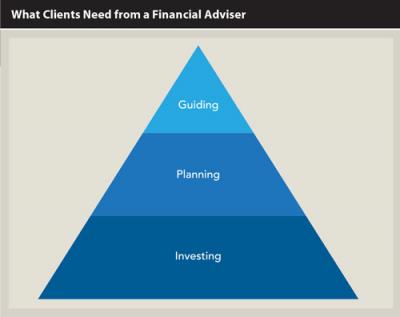

The good news is that many successful advisers are already doing it: offering financial planning and guidance/advice to clients. Whether they acknowledge it or not, almost all clients need more than just investment management (asset selection, asset allocation, rebalancing, and the like); they need a plan and someone to help choreograph how they’ll carry it out. And executing a solid financial plan goes way beyond a simple goal calculator—it balances art and science, emotions, and execution.

Most people would agree that, even with all our great technology advancements, life is busier and more complicated than it was 10 years ago. Is there any reason to think that it will be simpler 10 years from now? Clients’ lives will continue to get more complex, and the more complicated things become, the more difficult it will be for a computer program to address them. This is not because computers aren’t amazingly fast or good at handling tons of variables, but because, at present, they need human beings to program them to deal with life’s nuances.

Financial planning software tries its best to handle those intricate details of peoples’ financial lives, but even the most advanced software doesn’t cover everything—and it certainly doesn’t implement and monitor the plan for a client. It also doesn’t do a great job guiding a couple through an issue that they disagree on, or convincing a client who’s terrified of dying to get a will drafted.

If investment management is well on its way to being completely commoditized and true financial planning is not, then the key for financial advisers going forward is to ensure that planning and service are front and center in their business model. Will humans always maintain this lead over computers? At some point, “technological singularity”—when artificial intelligence exceeds human intellectual capacity and control—may also render financial planning a commodity, but that’s a problem we can worry about 15 years from now.

The Great Unbundling

Many products and services come bundled together; many don’t. Think about buying an iPhone and how odd it would feel to pay extra to use the camera. Yet, thousands of people pay for camera-based apps each day without blinking an eye. Microsoft could have built Microsoft Office into every computer with Windows installed, but it didn’t. Why not? While the game theory of pricing is outside the scope of this article, its basic principles are not.

Any company that is trying to compete with a commodity for a portion of its business will have to do two things:

- Offer the commodity at a competitive price

- Offer and charge for the value delivered beyond the commodity

In terms of offering the commoditized services, advisers will need to take a page from the robo-advisers’ book, leveraging investment management technologies in order to help scale the process. Another option on this front is to enlist a robo-adviser firm to handle your investment management process. (Think of this as a modern-day version of separately managed accounts.)

As far as offering value beyond the commodity, it’s important to note that investments are nothing more than a means to an end. Understanding the goal of the investments, how to get the client to stay invested, how to structure and protect assets, how to leverage Social Security strategies, how to meet legacy wishes—that’s where the human aspect of planning comes into play and where advisers outshine their computer counterparts.

Over the course of the next five years, I expect that this distinction will lead to a great unbundling of services in the financial advisory industry. Most advisers will continue to charge clients based on assets under management, but from a logistical and client perception standpoint, advisory services will need to be more clearly articulated, either in writing or in conversation, so that the breakdown looks something like this:

Investment management 0.25%

Financial planning and guidance 0.75%

Total fee 1.00%

Advisers who aren’t already segmenting services should start talking with clients about all the pieces they bring to the table, emphasizing the fact that investment management is a small portion of the whole. Advisers who already charge separate fees for planning are ahead of the curve, but to net the same revenue from any given client relationship in the future, they will likely need to increase their planning fees to offset the expected decrease in investment fees.

The “Device Advice Generation”

If history has shown us anything, it’s that those who are about to be disrupted by technology typically live in denial about the impact the impending change will have on them. For forward-thinking advisers, this presents a great opportunity, as many of their peers will invariably fall into this trap. Advisers who embrace and leverage technology to the fullest—so that clients don’t know where the adviser ends and the technology begins—will enjoy the best of both worlds, giving clients better service and driving costs down.

Systems such as model management/rebalancing software to scale the investment process, CRM/social media software to scale client mass communications, and interactive and easy-to-use planning software are now must-haves for financial advisers. But, as Disney likes to say, that’s the “backstage” technology.

The “front-stage” technology needs to shine even brighter, and offering an uber-robust portal that allows clients to view their accounts is quickly becoming table stakes. Soon, all of these portals will allow clients to self-service, to answer their own questions on their own time, and to play with what-if scenarios before collaborating with their adviser online. Furthermore, most of those features will need to be mobile device-enabled. The technology/mobile-first habits of millennials are certainly real, but studies have shown that older clients want this, too.

I refer to this impending change as adviser/technology convergence—or, more simply, creating a blended adviser experience. And although the pure robo-advisers will certainly have a place for some clients, the future for business- and technology-savvy financial advisers is brighter than ever.

Darren Tedesco is managing principal, innovation and strategy, at Commonwealth Financial Network®, member FINRA/SIPC, an independent broker-dealer–RIA.