Journal of Financial Planning: December 2017

Julie A. Welch, CPA, CFP®, PFP, is the director of tax services and a shareholder with Meara Welch Browne P.C. in Leawood, Kansas.

Cara Smith, CPA, CFP®, is a senior tax manager with Meara Welch Browne P.C. in Leawood, Kansas.

Hurricanes Harvey, Irma, and Maria devastated much of Houston and the Texas Gulf Coast, Florida, and Puerto Rico during August and September. Some federal tax provisions can be used to help those affected recoup some of their losses, namely casualty loss deductions, and for those in federally declared disaster areas (qualified disaster areas), special extensions of time to comply with certain tax responsibilities. President Trump signed into law the Disaster Tax Relief and Airport and Airway Extension Act of 2017 on September 29, allowing even more federal tax benefits for hurricane victims.

Casualty losses, such as those arising from these recent natural disasters, must be sudden, unexpected, or unusual in nature. Fires, floods, thefts, hurricanes, and car accidents are examples of casualties. A casualty loss does not include any normal wear and tear on an asset that can cause damage to occur over time.

How to Claim a Casualty Loss

For individuals to claim a casualty loss on their federal income tax return, they must itemize deductions on Schedule A, Itemized Deductions. To determine the amount of the casualty loss, subtract any insurance money received (or the amount expected to be received from the insurance company) from the basis in the property. If one estimates an amount from insurance, but estimates too high or too low, an amended return can be filed. If one receives more insurance proceeds than estimated, the excess received can be included in income in the following year.

If property is not completely destroyed, the amount of the casualty loss is the lesser of the decrease in market value or the adjusted basis in the property. Generally, for non-business property, the basis is what was paid for the property plus any improvements (such as an addition). If the basis is more than the decrease in the value of the property, one can only deduct the decrease in the value of the property. Basically, if one is able to salvage their property, only the loss in value is deductible rather than the entire basis of the property.

For personal casualty losses, such as losses on a home or car, generally the amount of the loss that can be deducted must be more than $100 per occurrence and 10 percent of the adjusted gross income (AGI).

If the deductible loss is greater than one’s income, there may be a net operating loss (NOL). An individual does not have to have a business to incur an NOL; a large casualty loss can create one too. If one incurs an NOL due to a casualty loss, one can deduct that loss against income earned in a previous year and recoup taxes paid for that previous year. Special rules allow an NOL resulting from a qualified disaster loss to be carried back five years rather than the typical two years. This process allows refunds of taxes paid in prior years.

Business or income-producing property casualty losses are fully deductible and are not reduced by the $100 per occurrence or the 10 percent of AGI limitations that apply to personal casualty losses. Business casualty losses are losses on property used in a business, such as machinery and buildings.

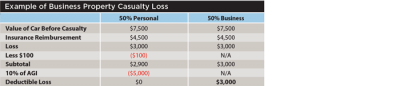

Example: Larry’s car was destroyed in Hurricane Harvey. He received $9,000 from the insurance company for the car he recently bought for $15,000. He used the car 50 percent for business. Larry has income for the year of $50,000. Larry's casualty loss deduction is $3,000 (see the table below).

Employee business casualty losses are treated as miscellaneous itemized deductions on Schedule A. Such losses must be added to other unreimbursed employee business expenses and most other miscellaneous itemized deductions and then reduced by 2 percent of AGI. Employee property is property used in performing services as an employee.

Exclude a Casualty Gain

If one receives more insurance proceeds than the basis in their property, there will be a casualty gain. If the damaged property was a person’s main home, generally the gain up to $250,000 ($500,000 if married filing jointly) can be excluded from income as if the home had been sold or exchanged.

To exclude a gain, the person generally must have owned and lived in the property as the main home for at least two years during the five-year period ending on the date it was destroyed (see IRS Publication 523). If the casualty gain on the home is more than the amount that can be excluded, the person can defer this gain by buying a new home within two years after the end of the year of the casualty. If the casualty was in a qualified disaster area, the person has four years after the end of the year of the casualty to purchase replacement property.

Sometimes an insurance company will reimburse for living expenses when one cannot use their home because of a casualty. To avoid paying tax on part of these reimbursements, one must show that what was spent on living expenses is more than what would normally be spent.

Keep Good Records

Good records are necessary to help substantiate the casualty loss taken on a federal tax return. This includes receipts for the cost of items and improvements, and pictures both before and after the casualty. Appraisals may even be helpful for certain items. If the original records are lost or destroyed, a loss can still be taken using other satisfactory evidence to support the amounts.

If damaged property is repaired, receipts for the cost of the clean-up and repair can be used as a measure of the decrease in market value caused by the disaster (as long as the repairs do not cause the property to be worth more than the value before the casualty).

If the loss is to a home, title companies and the mortgage lender could be contacted to obtain a copy of the original purchase paperwork, and the county assessor’s office could be contacted to get a split of the value between the land and the building structure. The mortgage company may have recent appraisals or an appraisal company can be contacted to provide information on comparable sales before the disaster to help establish the fair market value before the loss. For improvements to the property, the contractor could potentially provide duplicate statements related to the work.

Finally, if tax returns are lost, duplicate copies can be requested from the IRS using Form 4506. Indicating the request is related to a recent disaster, such as Hurricane Harvey, on the top of the form can expedite the processing of the request and waive the typical user fee for copies.

To reconstruct the cost of a vehicle, the car dealer could likely provide a copy of the contract to acquire the vehicle or a comparable sales figure for the particular make and model. Kelley Blue Book (kbb.com), National Automobile Dealers Association (nada.com), and Edmunds (Edmunds.com) are also good sources for fair market values.

The IRS suggests using old catalogs to help establish the cost of items destroyed or damaged. Bank and credit card records could also be used to help establish the cost of items. Additionally, thrift stores, newspaper classified ads, and online secondary markets can help establish the market value for similar items.

Amending a Prior Year Return

If one has a casualty loss from a qualified disaster, that person can choose to deduct the loss that year or deduct the loss in the previous year. Careful planning can increase the deduction. To qualify for this special disaster loss treatment, the area must be declared a federal disaster area. These areas are listed in the Internal Revenue Bulletin.

Generally, one must elect to amend the prior year return before the due date of the tax return for the year of the loss, usually April 15. Once made, this decision cannot be revoked unless done within 90 days.

Some factors to consider when deciding whether to amend the prior year return include:

Ability to get a refund more quickly. If the loss occurred in August 2017, amending the 2016 return should get a refund within 90 days of the date the amended return is filed. However, if the loss is deducted on a 2017 return filed April 15, 2018, generally the refund will not be received until late May 2018.

Difficulties computing the amount of the loss. The person may be unable to get the information to file an amended return for the prior year before it is too late to make the election.

Comparison of the income for the prior year and the current year. If one has significantly more income in the prior year, the personal casualty deduction will be less because only the loss over $100 and over 10 percent of the income is deductible. In determining which year to take the deduction, tax brackets should also be considered.one also needs to consider the tax rate brackets.

Other Federal Tax Assistance for Hurricane victims

The Internal Revenue Service (IRS) is providing relief to Hurricane Harvey and Irma victims in the form of extensions to file certain individual and business tax returns and make certain tax payments. This benefits individuals who had returns on extension due Oct. 15, 2017 and businesses whose returns were on extension until Sept. 15, 2017. Those affected have until Jan. 31, 2018 to file returns that were otherwise due in September and October 2017. The IRS also extended the due date to make estimated tax payments until Jan. 31, 2018 for those affected by the storms.

A variety of other tax deadlines qualify for relief, including the extension of time to file payroll and excise tax returns, employee benefit returns, and waiving late deposit penalties for federal payroll and excise tax deposits normally due the first 15 days of each disaster period (starting Aug. 23 for Hurricane Harvey, and Sept. 4 for Hurricane Irma).

The counties included in the federally declared disaster areas are automatically eligible for these extensions. Additionally, the IRS says it will work with those taxpayers who may not live in a federally declared disaster area but whose personal or business-related tax records are located in the affected area.

Relief workers. The extension benefits are also offered to any relief worker assisting in a covered disaster area, regardless of whether the individual is affiliated with a recognized government or philanthropic organization. Those taxpayers should call the IRS at (866) 562-5227 to request the extension. Taxpayers who reside in the affected area should automatically qualify for the additional time and relief. However, if penalty notices are received, taxpayers should call the number on the notice.

Retirement plans. 401(k)s and similar employer-sponsored retirement plans can make loans and hardship distributions to victims of the recent hurricanes and their families who live or work in disaster areas. As a result, participants have access to their retirement money more quickly with less red tape. However, the tax treatment of loans and distributions remains unchanged. Loans must generally be repaid over a maximum five-year period. Distributions will still be includible in income and generally subject to the 10 percent early withdrawal penalties unless another exception exists.

Donating leave time. Similar to relief provided after previous hurricanes (Katrina, Sandy, Matthew) and the Ebola outbreak in West Africa, the IRS has announced that employees who donate their vacation, sick, and personal leave will not be taxed the value of their leave as wage income. Employers will be able to deduct these payments they make directly to charitable organizations providing aid to hurricane victims as a business expense.

SBA relief. In response to the damage caused by Hurricanes Harvey, Irma, and Maria, the U.S. Small Business Administration (SBA) announced it will provide relief to certain borrowers within the counties designated as Federal disaster areas. The relief is in the form of an automatic 12-month deferral of interest and principal payments for SBA-serviced businesses. Those borrowers located in a county sharing a common border with a disaster county and adversely impacted due to the disaster are eligible to apply for a nine-month deferral of payments.

Foreign earned income. Regarding the foreign earned income exclusion for U.S. persons residing in Puerto Rico and the Virgin Islands, the IRS extended the 14-day grace period to 117 days for those displaced by Hurricane Maria. This allows affected taxpayers to continue to qualify as “bona fide residents” of either territory for the foreign earned income exclusion, even with a prolonged dislocation due to the hurricanes. The extension is effective starting Sept. 6 and extending to Dec. 31, 2017.

Disaster Tax Relief Act

The Disaster Tax Relief and Airport and Airway Extension Act of 2017 provides temporary tax relief to those affected by Hurricanes Harvey, Irma, and Maria. The new law eases the casualty loss rules, making it easier for those with losses to take deductions against taxes with the following provisions:

The new law eliminates the requirement that personal losses exceed 10 percent of AGI to qualify as a deduction for qualified disaster losses. Additionally, the $100 per-casualty floor is increased to $500.

Itemizing deductions is no longer required to take a qualified disaster loss deduction. The standard deduction is increased by the amount of the qualified disaster loss for those who do not itemize deductions.

Casualty loss additions to the standard deduction will also be allowed for Alternative Minimum Tax purposes.

The new law also eases access to retirement funds with new provisions, including relief from the 10 percent early withdrawal penalty for qualified hurricane distributions, and allowing taxpayers to spread out any income inclusion and tax resulting from hurricane withdrawals over a three-year period. In the event of re-contribution of withdrawals during the three-year period following the distributions, the taxpayer is treated as having made an eligible rollover distribution. Maximum loans that a participant or beneficiary can borrow from a qualified employer plan are increased from $50,000 to $100,000 for hurricane victims, and the requirement that a loan not exceed 50 percent of the account value is removed.

Additionally, those affected by hurricane disasters are given a longer repayment term by delaying the start of the first repayment for one year. The new law also allows for the re-contribution of plan withdrawals originally designated for home purchases and construction when the home contract was cancelled due to Harvey, Irma, or Maria.

AGI limitations on deductions of qualifying charitable contributions are temporarily suspended under the new law. Qualifying contributions must be paid during August 23, 2017 through December 31, 2017 and made to organizations providing relief efforts in the Hurricane disaster areas. The contributions must be substantiated with contemporaneous written acknowledgement that the donation is to be used for relief efforts. Also, to be effective, taxpayers must make an election with their 2017 tax return.

Businesses in the disaster areas may be eligible for up to a $2,400 credit per employee for qualified wages paid when the business was inoperable. The credit is equal to 40 percent of up to $6,000 of wages paid to an eligible employee during the time in which the employer is inoperable due to the storm(s).

Federal relief assistance is available for those affected by storms, floods, and other disasters— not just Hurricanes Harvey, Irma, and Maria. A complete list of federally declared disaster areas and related tax relief can be found on IRS.gov and searching “tax relief in disaster situations.”