Journal of Financial Planning: December 2014

Bradley T. Klontz, Psy.D., CFP®, is a financial psychologist, associate professor at Kansas State University, and partner at Occidental Asset Management LLC. He is the author and editor of several books, including Mind Over Money, Facilitating Financial Health, and Financial Therapy: Theory, Research, & Practice.

Martin C. Seay, Ph.D., CFP®, is an assistant professor at Kansas State University. His career objective is to provide impactful research into consumer financial issues while educating ethical, thoughtful, and well-rounded financial planners. His research focuses on consumer borrowing decisions and how psychological characteristics inform financial behavior.

Paul Sullivan is the author of The Thin Green Line: The Money Secrets of the Super Wealthy and the Wealth Matters columnist for The New York Times.

Anthony Canale, CFP®, is a doctoral student at Kansas State University in the personal financial planning program. He is an adjunct faculty member at St. John’s University and serves as the 2014 President for the New York chapter of the Financial Planning Association.

Acknowledgements: The authors thank United Capital, Platinum Advisor Strategies, Intrinsic Wealth Counsel, and Envision Wealth Planning for their assistance with this research project.

Executive Summary

- Using a sample of financial planning clients, this paper investigated the financial psychology of high earners. For this study, high income was defined as individuals in the top 2.5 percent of earners in the United States ($154,000 or greater), with the comparison group reporting a median income of $80,000.

- When compared to other high-income financial planning clients, significant financial psychological differences were observed in the highest earners.

- Membership in the high earning group was associated with lower levels of money avoidance and money worship scripts, higher levels of money status scripts, higher levels of financial knowledge, more financial enabling behaviors, and a greater likelihood to attribute financial success to a fundamental drive to increase wealth.

- A deeper understanding of the financial psychology of high-income clients can help financial planners better serve this market niche, predict possible behavioral risks to those with high incomes and net worth, and help clients aspiring to increase their income and net worth through insights gleaned from this population.

This study sought to examine the psychology of wealth through a sample of financial planning clients, to see if and what psychological and behavioral factors predict high levels of income. It is hoped that insights gleaned from this study might be of service to financial planners who work with high-income clients, as well as those planners who are concerned about possible behavioral threats to their clients’ financial health. In addition, financial planners who work with individuals who are aspiring to grow their income and net worth might benefit from insight into how financially successful individuals think and behave differently.

The Impact of Personality Traits

Previous research has noted differences between higher income and lower income individuals on a number of psychological variables. For example, there is strong evidence of the predictive effect of personality traits on socioeconomic outcomes, including job performance, health, and academic achievement (Borghans, Duckworth, Heckman, and Ter Weel 2008; Chamorro-Premuzic, and Furnham 2003). This is true, in part, because some personality traits are more valued in certain occupations, such as conscientiousness, openness to experience, and emotional stability. As such, occupational sorting occurs based on personality (Mueller and Plug 2006) as individuals choose work and educational experiences based on qualities aligned with their personalities (Roberts, Kuncel, Shiner, Caspi, and Goldberg 2007). However, it is important to note that much of this previous research has been based on income diverse samples. Such studies have been unable to isolate factors that might differentiate the ultra-successful from the successful.

Personality traits have also been found to be predictive of other important life outcomes, such as mortality, divorce, and success at work (Roberts et al. 2007). It has been argued that the power of personality traits equals or exceeds the power of cognitive traits (including intelligence) in predicting schooling, occupational choice, income, and physical health (Heckman, Stixrud, and Urzua 2006).

Several specific personality traits have been tied to higher incomes and better economic outcomes. Conscientiousness, for example, which is defined as the tendency to be dependable, motivated, and to act with self-discipline, is associated with higher income (Heckman et al. 2006; Mueller and Plug 2006), entrepreneurial intention and success (Zhao, Seibert, and Lumpkin 2010), good job performance (Almlund, Duckworth, Heckman, and Kautz 2011), and academic success (Chamorro-Permuzic and Furnham 2003). Emotional stability, including one’s ability to control impulses and manage negative feelings, is also associated with higher income (Mueller and Plug 2006) and better job performance (Almlund et al. 2011; Gelissen and de Graaf 2006). Openness to a variety of experiences, independence, and creativity has also been found to be associated with higher levels of income (Mueller and Plug 2006).

Locus of control is another personality trait that has been linked to income. Locus of control refers to the extent to which someone sees their life outcomes as being determined by their actions. Individuals with an internal locus of control believe that their actions control life outcomes, while individuals with an external locus of control feel that their life outcomes are unrelated to their behaviors, unpredictable, under the control of others, or the result of chance or luck (Cohen, Rothbart, and Phillips 1976; Rotter 1975).

Research using diverse samples has demonstrated that an internal locus of control is associated with higher income and wealth (Zagorsky 2007), higher rates of reemployment after a job loss (Gallo, Endrass, Bradley, Hell, and Kasl 2003), and better spending control (Perry and Morris 2005). Having a strong sense of control over one’s life is linked to greater life satisfaction (Johnson and Krueger 2006). Higher self-esteem is also associated with higher levels of wealth and income (Zagorsky 2007).

Research has also linked money scripts to income and net worth. Money scripts are beliefs about money that are typically unconscious, often trans-generational, primarily developed in childhood, and a key driver of financial behaviors (Klontz and Klontz 2009). Four categories of money scripts have been identified, three of which are associated with lower income, lower net worth, and a host of self-destructive financial behaviors: (1) money avoidance; (2) money worship; and (3) money status (Klontz, Britt, Mentzer, and Klontz 2011; Klontz and Britt 2012). In contrast, money vigilant scripts, which include themes of frugality and anxiety about money, have been shown to be associated with higher income. These scripts appear to be a protective factor against destructive financial behaviors (Klontz et al. 2011; Klontz and Britt 2012).

Personality and income can also be influenced by childhood socioeconomic status (SES), financial knowledge, and education. Not surprisingly, SES in childhood is one of the most important contributors to adult financial success, educational attainment, longevity, and occupational success (Roberts et al. 2007). Researchers have noted that those who are raised in lower socioeconomic environments tend to be more impulsive, take more risks, and are quicker to experience temptation (Griskevicius et al. 2013). The opposite was found to be true of those who grew up in higher SES environments.

Education, occupational attainment, and income are not as critical to happiness as some may assume (De Fruyt, Van Leeuwen, Bagby, Rolland, and Rouillon 2006); however, these variables are associated with access to resources that can improve quality of life, including medical care, education, and social connections. The higher incomes associated with educational and occupational attainment may enable individuals to maintain life satisfaction during difficult times (Johnson and Krueger 2006).

The type of schooling children receive also differs based on family income. According to 2012 U.S. Census Bureau data, 16 percent of families with $75,000 or more in annual income enroll their children exclusively in private schools for kindergarten, elementary, and high school, while only 5 percent of children from families with lower incomes do so. Financial education, in particular, has a significant impact on financial outcomes (Perry and Morris 2005). Those with more financial knowledge are more likely to engage in recommended financial behaviors, such as paying bills on time and having emergency savings, and people may gain financial knowledge as they accumulate wealth, along with family experiences and economic socialization contributing to financial knowledge and behavior (Hilgert, Hogarth, and Beverly 2003).

Income and assets are often said to be objective assessments of environmental circumstances, and therefore, indicative of the potential to generate resources that contribute to life satisfaction (Johnson and Krueger 2006). The strongest predictor of financial satisfaction is the level of material desires one has, and his or her ability to afford them (Johnson and Krueger). As such, psychological perceptions about financial matters may be more important to life satisfaction than the actual financial matters themselves.

Research Question

Although a variety of personality and demographic factors have been found to be associated with income, net worth, financial satisfaction, and life satisfaction, little is known about how an individual’s financial psychology is related to income. Based on the literature previously discussed, the following research question was investigated: Is there an association between an individual’s financial psychological characteristics and their likelihood of being a high-income worker?

Methodology

Participants. The sample for this study was comprised of individuals recruited through several financial planning firms. The firms agreed to either send their clients an email inviting them to participate in a web survey of financial beliefs and behaviors, or in the case of larger firms, send the email invitation to their financial adviser associates, encouraging them to email the survey to their clients. A total of 351 complete responses representing full-time workers were received and used in this study.

Dependent variable. According to the 2012 Current Population Survey, the top 2.5 percent of individual earners in the United States had income of $152,000 or higher. Inflated to 2013 numbers (the time period in which the data for this study were collected), this suggests that individuals with personal incomes above $154,000 represented the top 2.5 percent of all earners in the United States. It is important to note that this dollar figure represents personal, as opposed to household, income. Consequently, this cut-off is lower than estimates used in similar work that relates to household income. Having achieved a high personal income, as defined by having a personal income at or above the $154,000 threshold, served as the dependent variable in the analyses.

Independent variables: Money scripts. The Klontz Money Script Inventory–Revised (KMSI–R) was used to assess money beliefs. In prior research, the four KMSI subscales have been shown to correlate with income, net worth, revolving credit, and are associated with a range of disordered money behaviors (Klontz and Britt, 2012; Klontz et al. 2011).

The subscales include money avoidance, which includes the tendency to believe that money is bad and a general dislike for “rich” people; money worship, which is the belief that more money will solve all of life’s problems and bring happiness; and money status, which is the tendency to link self-worth to net worth. In contrast, the fourth subscale, money vigilance, which is associated with frugality and savings, has been found to be a financial health protective factor.

The KMSI–R retains 32 of the original 51 KMSI items. Individual scale items were coded on a six-point Likert-type scale, where 1 = strongly disagree; 2 = disagree; 3 = disagree a little; 4 = agree a little; 5 = agree; and 6 = strongly agree. Responses were summed to form the overall scales. Cronbach’s alphas for the current study were: money avoidance = .84; money worship = .69; money status = .75; and money vigilance = .66.

Locus of control. Locus of control was measured using the External Locus of Control Scale (Perry and Morris 2005). Respondents were asked their level of agreement on seven items using a five-point Likert-type scale, where 1 = almost never; 2 = seldom; 3 = sometimes; 4 = often; and 5 = almost always. Items included such statements as: “How often do you feel…” (1) “There is really no way I can solve some of my problems;” (2) “I am being pushed around in life;” and (3) “I have little control over the things that happen to me.” Two items were reversed scored, with final scores ranging from 7 to 35, with higher scale scores indicating a tendency toward external locus of control. Acceptable reliability was found with a Cronbach’s alpha of .82.

Financial behaviors. Two scales of the Klontz Money Behavior Inventory (KMBI) (Klontz and Britt 2012; Klontz, Britt, Archuleta, and Klontz 2012) were used to assess money behaviors of interest in higher net worth populations. Specifically, the financial enabling and workaholism subscales were included. Conceptually, financial enablers have trouble refusing financial requests from friends and family members and often feel taken advantage of financially. Workaholics tend to have higher income, but they feel an irresistible urge to work and have trouble enjoying time away from work. According to Klontz et al. (2012), the internal consistency coefficient for both the financial enabling and workaholism scales is .87. Individual scale items were coded on a six-point Likert-type scale, where 1 = strongly disagree; 2 = disagree; 3 = disagree a little; 4 = agree a little; 5 = agree; and 6 = strongly agree. Cronbach’s alpha for the financial enabling and workaholism scales in this study was .82 and .77, respectively.

Wealth motivation. To investigate the wealth motivations of respondents, two questions were developed for this study to measure the extent to which participants agreed or disagreed with the following statements: “Much of my financial success has come about because of a commitment to follow my passions,” and “Much of my financial success has come about because of a fundamental drive to increase my wealth.” Responses were collected on a six-point Likert-type scale, where 1 = strongly disagree; 2 = disagree; 3 = disagree a little; 4 = agree a little; 5 = agree; and 6 = strongly agree.

Financial knowledge. With regard to financial knowledge, respondents were asked: “How would you rate your financial knowledge level compared to your friends?” Responses were measured on a 10-point scale, where 1 = lowest level and 10 = highest level.

Demographic characteristics. Socio-demographic characteristics of interest included: gender, age, marital status, education, and attendance in public or private high school. Additionally, self-reported subjective socioeconomic status in childhood was measured through the use of the MacArthur Scale of subjective SES (Adler, Epel, Castellazzo, and Ickovics 2000). On this 10-point scale, participants were asked to place themselves on a ladder representing the socioeconomic status of people in the United States based on money, education, and jobs, where 1 = the people who are the worst off and 10 = the people who are the best off. To measure subjective SES during childhood, the first sentence of the question was changed to: “Where on this ladder would you place your family during your growing up years?”

Statistical analysis. This research sought to investigate the association between an individual’s psychological characteristics and their likelihood of being a high-income earner. Consequently, a binary logistic regression was generated to estimate the likelihood of being a high-income earner based upon the aforementioned psychological constructs, controlling for socioeconomic characteristics.

Results

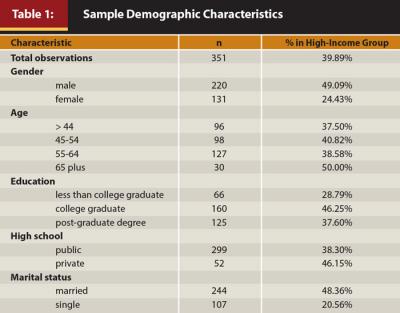

Sample characteristics. An overview of the sample demographic characteristics is found in Table 1. Approximately 40 percent of respondents were identified as being high-income individuals. Overall, respondents tended to have significantly higher self-reported income (mean of $203,334; median of $120,000) than the U.S. population average. The average and median income for high-income earners was found to be $382,628 and $250,000, respectively. The mean and median income for the remainder of the sample was $84,370 and $80,000, respectively. The total sample was skewed toward males (63 percent) and individuals between the ages of 45 and 64 (64 percent). The majority of the sample was Caucasian (94 percent), had at least a college education (81 percent), and reported being married (70 percent). The majority of the sample had attended a public high school (85 percent).

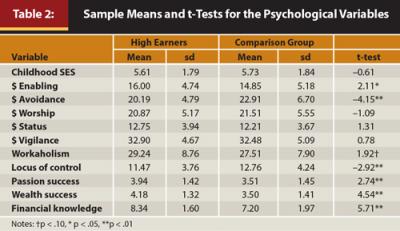

Descriptive statistics for the psycho-logical variables are found in Table 2.

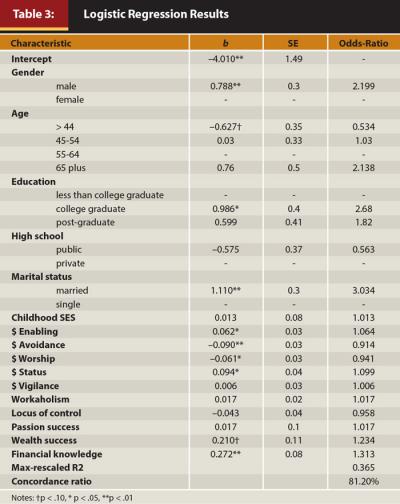

Logistic regression results. The results of the logistic regression analysis are found in Table 3. Overall, there is significant evidence that an individual’s psychology is associated with his or her propensity to be in the top 2.5 percent of earners. These differences were noted in a sample of relatively high-income earners, as compared to the overall population. Results, organized by psychological construct, are discussed below.

Money scripts. Money avoidance beliefs were negatively associated with inclusion in the high-income group. Specifically, a one unit increase in the money avoidance scale was associated with an 8.6 percent decrease in the odds of being in the high-income group, holding all else equal. Similarly, money worship scripts were negatively associated with the likelihood of being in the high-income group. A one unit increase on the money worship scale was associated with a 5.9 percent decrease in the odds of being in this group. Significant differences were also observed on the money status subscale. A one unit increase in the scale was associated with a 9.9 percent increase in the odds of belonging to the high-income group.

Financial behaviors. Financial enabling was positively associated with membership in the higher-income group. With this variable, a one unit increase in the scale was associated with a 6.4 percent increase in the odds of being in this group, holding all else equal. However, workaholism was not a significant predictor of inclusion in the top high-income group.

Locus of control. Both groups scored in the direction of internal locus of control, with high earners reporting slightly higher levels of internal locus of control. However, locus of control was not significantly associated with inclusion in the high-income group, after controlling for other factors.

Wealth motivation. Although no differences in the likelihood of being in the high-income group were noted by individuals that attributed their success to following their passion, a trend approaching statistical significance was observed for those who reported a fundamental drive to increase their wealth as their motivating factor (p = .06). Specifically, a one unit increase on this scale was associated with a 23.4 percent increase in the odds of being in the high-income group, holding all else equal.

Financial knowledge. A strong positive association was found between self-reported financial knowledge and the likelihood of being in the high-income group. Specifically, results indicated a 31.3 percent increase in the odds of being in the high-income group for every one unit increase in the scale.

Demographics. Several demographic variables were associated with inclusion in the high-income group. As may be expected, education was associated with high income. College graduates were more likely to be members of the high-income group, holding all else equal. Although the income measure used was personal income, being married was also found to be positively associated with income level. Similarly, age and gender were found to be associated with income. Females and those younger than age 44 were less likely to be in the high-income group. Lastly, attendance in public high school (versus private school) was unrelated with income status, as was self-reported childhood socioeconomic status.

Discussion

This study sought to examine high-income earners across a range of psychological variables. For this study, high income was defined as individuals in the top 2.5 percent of earners in the United States ($154,000 per year or greater). These individuals were compared to a group who reported a median income of $80,000. Results suggest that psychology factors may explain some of the gap between income earners.

Findings indicate that high earners may endorse different money beliefs than lower earners. Specifically, an increase in the money avoidance scripts scale was found to be associated with an 8.6 percent decrease in the odds that an individual was in the high-income group. As such, individuals endorsing beliefs that money is a corrupting influence, that rich people are greedy or get rich by taking advantage of others, that there is virtue in living with less money, or that they do not deserve money were less likely to be high earners. This result is supported by previous research.

The literature shows that individuals with low money avoidance scripts are less likely to sabotage their financial success, less likely to overspend or gamble compulsively, less likely to hoard possessions, and less likely to have trouble sticking to a budget (Klontz and Britt 2012). Interestingly, an increase in the money worship scripts scale was found to be associated with a 5.9 percent decrease in the odds of being in the high-income group. As such, respondents who were less likely to endorse beliefs such as, “more money will make you happier,” “money is power,” or “money buys freedom,” were more likely to report higher incomes. This suggests that there may be a happy medium between being money avoidant and being a money worshiper—two somewhat opposing scripts—that is associated with attaining higher incomes.

Money status scripts were strongly associated with inclusion in the high-income group, with a unit increase on the scale being associated with a 9.9 percent increase in the odds of being the high-income group. As such, individuals endorsing the beliefs that self-worth and net worth are intertwined, that success is defined by how much money they earn, and that money helps give their life meaning were more likely to have attained a high-income level. This is interesting, as prior research with a more diverse income sample linked money status scripts to lower socioeconomic status in childhood, lower income (Klontz et al. 2011), and greater risk of disordered money behaviors, including gambling disorder, hoarding disorder, and financial enabling (Klontz and Britt 2012). However, for members of the high-income group, the belief that one’s self-worth equals their net worth may serve to fuel their income aspirations. Similarly, attributing one’s financial success to a fundamental drive to increase one’s wealth was also marginally associated with inclusion in the high-income group.

With regard to workaholism, high earners reported more symptoms than the comparison group (mean scores of 29.24 and 27.51, respectively), although these differences were not statistically significant and no relationship was found in the regression model. Previous research has shown that workaholism tends to be associated with higher income, but also higher levels of revolving credit (Klontz et al. 2012). Although overindulgence in work can be associated with pay increases, praise from employers and colleagues, and job promotions (Sussman 2012), workaholics often isolate themselves from others, report lower levels of relationship and family life satisfaction, feel guilty when they are not working, have difficulty relaxing, have higher levels of worry and distress, report more health problems, and report lower levels of psychological well-being (Chamberlain and Zhang 2009; Clark, Lelchook, and Taylor 2010; Oates 1971; Scott, Moore, and Miceli 1997). As such, clients prone to workaholism might benefit from their adviser’s encouragement to maintain a healthy work-life balance.

Exhibiting financial enabling behaviors was also associated with inclusion in the high-income group, with a one unit increase in the scale being associated with a 6.4 percent increase in the odds of being in the high-income category. Klontz, Kahler, and Klontz (2008) defined financial enabling as an inability to refuse requests for money, often from family or friends. Klontz and Klontz (2009) referred to financial enabling as “an irrational need to give money to others, whether you can afford it or not, and even when it is not in the other’s long-term best interest” (pp. 187–188). They hypothesized that having more money than one’s family and/or friends can push someone out of their financial comfort zone, causing fear of social exclusion, which can lead to individuals giving money away out of a sense of anxiety or guilt, rather than using it to increase their net worth.

Klontz and Klontz (2009) also noted that financial enabling is seen when parents support adult children when they should be able to support themselves, often to the detriment of the parents’ financial health and the child’s self-efficacy and motivation. Previous research failed to find a connection between financial enabling and income, but did find financial enabling to be associated with higher revolving credit and lower net worth (Klontz et al. 2012). However, the study by Klontz and his associates was made up of a much more diverse sample, with 50 percent of the sample reporting income under $60,000 and more than 75 percent reporting income under $100,000.

Regardless of the motivations behind financial enabling behaviors in this high-income sample, financial enabling can put the financial health of high-income individuals at risk. As such, financial enabling ought to be an area of concern and consideration for financial planners. It should be noted that more research is needed to determine if the presence of financially enabling behaviors precedes attainment of high income or is a result of having achieved it.

Lastly, a strong association was found between self-reported financial knowledge and income level. Specifically, a one unit increase in self-reported financial knowledge was associated with a 31.3 percent increase in the odds of being in the high-income group. It is possible that higher financial knowledge levels have allowed these individuals to achieve greater income success, although this may be better investigated with an objective knowledge measure. Conversely, the attainment of financial success may have given these individuals more financial learning opportunities or inflated their self-perception of their knowledge level.

Although there are limits to this study—most notably the use of a convenience sample of financial planning clients—this paper provides a glance into the psychological characteristics and financial behaviors of high-income individuals who are not well understood but frequently served by financial planners. Future research could further explore the nature of these personality characteristics to see if each is consistently associated with future inclusion in higher socioeconomic groups, which is the goal for many clients and planners alike.

When personality traits are identified as having predictive value, interventions such as cognitive-behavioral strategies targeting beliefs, attitudes, and behaviors that are keeping a person from reaching his or her goals may be warranted. When limiting financial beliefs are identified, these beliefs can be changed (Klontz and Britt 2012; Klontz, Bivens, Klontz, Wada, and Kahler 2008).

There is also evidence to support the notion that psychological traits can change over time (Borghans et al. 2008) and can be altered by therapeutic interventions (De Fruyt et al. 2006). A deeper understanding of the financial psychology of high earners can help financial planners better serve this population and better help individuals aspiring to increase their income and net worth.

References

Adler, Nancy E., Elissa S. Epel, Grace Castellazzo, and Jeannette R. Ickovics. 2000. “Relationship of Subjective and Objective Social Status with Psychological and Physiological Functioning: Preliminary Data in Healthy, White Women.” Health Psychology 19 (6): 586–592.

Almlund, Mathilde, Angela Lee Duckworth, James J. Heckman, and Tim D. Kautz. 2011. “Personality Psychology and Economics.” Working Paper No. w16822. National Bureau of Economic Research.

Borghans, Lex, Angela Lee Duckworth, James J. Heckman, and Bas Ter Weel. 2008. “The Economics and Psychology of Personality Traits.” Journal of Human Resources 43 (4): 972–1059.

Chamberlain, Christine M. and Naijian Zhang. 2009. “Workaholism, Health, and Self-Acceptance.” Journal of Counseling and Development 87 (2): 159–169.

Chamorro-Premuzic, Tomas, and Adrian Furnham. 2003. “Personality Predicts Academic Performance: Evidence from Two Longitudinal University Samples.” Journal of Research in Personality 37 (4): 319–338.

Clark, Malissa A., Ariel M. Lelchook, and Marcie L. Taylor. 2010. “Beyond the Big Five: How Narcissism, Perfectionism, and Dispositional Affect Relate to Workaholism.” Personality and Individual Differences 48 (7): 786–791.

Cohen, Sheldon, Myron Rothbart, and Susan Phillips. 1976. “Locus of Control and the Generality of Learned Helplessness in Humans.” Journal of Personality and Social Psychology 34 (6): 1049–1056.

Current Population Survey. 2012. “Current Population Survey.” Retrieved from: www.bls.gov/cps.

De Fruyt, Filip, Karla Van Leeuwen, R. Michael Bagby, Jean-Pierre Rolland, and Frédéric Rouillon. 2006. “Assessing and Interpreting Personality Change and Continuity in Patients Treated for Major Depression.” Psychological Assessment 18 (1): 71–80.

Gallo, William T., Jerome Endrass, Elizabeth H. Bradley, Daniel Hell, and Stanislav V. Kasl. 2003. “The Influence of Internal Control on the Employment Status of German Workers.” Schmollers Jahrbuch 123 (1): 71–81.

Gelissen, John, and Paul M. de Graaf. 2006. “Personality, Social Background, and Occupational Career Success.” Social Science Research 35 (3): 702–726.

Griskevicius, Vladas, Joshua M. Ackerman, Stephanie M. Cantú, Andrew W. Delton, Theresa E. Robertson, Jeffry A. Simpson, Melissa Emery Thompson, and Joshua M. Tybur. 2013. “When the Economy Falters, Do People Spend or Save? Responses to Resource Scarcity Depend on Childhood Environments.” Psychological Science 24 (2): 197–205.

Heckman, James J., Jora Stixrud, and Sergio Urzua. 2006. “The Effects of Cognitive and Noncognitive Abilities on Labor Market Outcomes and Social Behavior.” Working Paper No. w12006. National Bureau of Economic Research.

Hilgert, Marianne A., Jeanne M. Hogarth, and Sondra G. Beverly. 2003. “Household Financial Management: The Connection between Knowledge and Behavior.” Federal Reserve Bulletin 89 (7): 309–322.

Johnson, Wendy, and Robert F. Krueger. 2006. “How Money Buys Happiness: Genetic and Environmental Processes Linking Finances and Life Satisfaction.” Journal of Personality and Social Psychology 90 (4): 680–691.

Klontz, Bradley T., Alex Bivens, Paul T. Klontz, Joni Wada, and Richard Kahler. 2008. “The Treatment of Disordered Money Behaviors: Results of an Open Clinical Trial. Psychological Services 5 (3): 295–308.

Klontz, Bradley T., and Sonya L Britt. 2012. “How Clients’ Money Scripts Predict Their Financial Behaviors.” Journal of Financial Planning 25 (11): 46–53.

Klontz, Bradley T., Sonya L. Britt, Kristy L. Archuleta, and Ted Klontz. 2012. “Disordered Money Behaviors: Development of the Klontz Money Behavior Inventory.” Journal of Financial Therapy 3 (1): 17–42.

Klontz, Bradley T., Sonya L. Britt, Jennifer Mentzer, and Ted Klontz. 2011. “Money Beliefs and Financial Behaviors: Development of the Klontz Money Script Inventory.” Journal of Financial Therapy 2 (1): 1–22.

Klontz, Bradley T., Richard Kahler, and Ted Klontz. 2008. Facilitating Financial Health: Tools for Financial Planners, Coaches, and Therapists. Erlanger, KY: The National Underwriter Co.

Klontz, Brad, and Ted Klontz. 2009. Mind Over Money: Overcoming the Money Disorders that Threaten our Financial Health. New York: Random House.

Mueller, Gerrit, and Erik Plug. 2006. “Estimating the Effect of Personality on Male and Female Earnings.” Industrial and Labor Relations Review 60 (1): 3–22.

Oates, Wayne E. 1971. Confessions of a Workaholic: The Facts about Work Addiction. Nashville, TN: World Publishing Co.

Perry, Vanessa G., and Marlene D. Morris. 2005. “Who is in Control? The Role of Self-perception, Knowledge, and Income in Explaining Consumer Financial Behavior.” Journal of Consumer Affairs 39 (2): 299–313.

Roberts, Brent W., Nathan R. Kuncel, Rebecca Shiner, Avshalom Caspi, and Lewis R. Goldberg. 2007. “The Power of Personality: The Comparative Validity of Personality Traits, Socioeconomic Status, and Cognitive Ability for Predicting Important Life Outcomes.” Perspectives on Psychological Science 2 (4): 313–345.

Rotter, Julian B. 1975. “Some Problems and Misconceptions Related to the Construct of Internal Versus External Control of Reinforcement.” Journal of Consulting and Clinical Psychology 43 (1): 56–67.

Scott, Kimberly S., Keirsten S. Moore, and Marcia P. Miceli. 1997. “An Exploration of the Meaning and Consequences of Workaholism.” Human Relations 50 (3): 287–314.

Sussman, Steven. 2012. “Workaholism: A Review.” Journal of Addiction Research and Therapy Suppl 6 (1): 4120.

Zagorsky, Jay L. 2007. “Do You Have to Be Smart to Be Rich? The Impact of IQ on Wealth, Income and Financial Distress.” Intelligence 35 (5): 489–501.

Zhao, Hao, Scott E. Seibert, and G. Thomas Lumpkin. 2010. “The Relationship of Personality to Entrepreneurial Intentions and Performance: A Meta-analytic Review.” Journal of Management 36 (2): 381–404.

Citation

Klontz, Bradley, Martin Seay, Paul Sullivan, and Anthony Canale. 2014. “The Psychology of Wealth: Psychological Factors Associated with High Income.” Journal of Financial Planning 27 (12) 46–53.