Byrke Sestok, CFP®, is co-owner and financial planner at Rightirement Wealth Partners. He serves as chair of the OneFPA Advisory Council Executive Committee and president of FPA of Greater Hudson Valley. He also is a moderator for the FPA Tax and Estate Planning Knowledge Circle.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

In the Journal’s November 2019 issue, Luke Delorme, CFP®, presented valuable research on the tax alpha of 529 plans in his paper, “College Savers: What Is the Expected Tax Alpha of 529 Plans?” Delorme’s analysis will likely shape your future advice to clients regarding college savings.

As virtual financial planning gains market share, the likelihood planners will work with residents of more than one state will increase. As a result, the timing of Delorme’s research is prescient because the differing states’ tax rates play a significant role in determining whether to recommend a 529 plan to a client over a taxable investment account.

Net gain on investment should be a deciding factor when considering account type and structure for our clients. It seems clear (barring significant extenuating circumstances) that Indianans saving for a future college expense should select a 529 plan as the preferred vehicle because of the state’s significant tax credit, which drives a 10-year tax alpha of 4.16 percent on annual contributions of $3,000.

Conversely, eight states have no state income tax (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming) resulting in a tax alpha solely driven by federal capital gains tax treatment. The tax alpha of 529 plans utilized in the other 49 states that are not Indiana may influence your client advice.

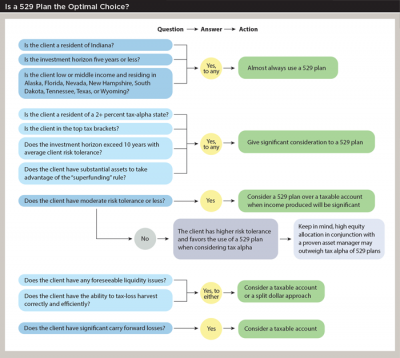

The goal of this column is to present a clean thought workflow to consider when advising on college savings in light of the research and commentary provided by Delorme.

Key Findings from the Research

When 529 plans emerged in 1996 it seemed a given that the tax-free treatment of gains on investment when proceeds are used for qualified secondary education expenses would vault 529 plans to the top of the list for this savings goal almost every time. However, it has become clearer over time that selecting a 529 plan for college savings may not be a snap decision.

In his research, Delorme found that the tax alpha of 529 plans declined over longer investment periods and suggested that investors who feel they can invest better than options inside a 529 plan may want to consider using taxable accounts. However, it is also common that increasing the timeline examined on average annual returns of many mutual funds and ETFs will show lower 10-year returns than three-year returns, for example. So, while the shrinking tax alpha is indisputable math, the real effect of that tax alpha compounded over time is still significant real dollars.

A significant finding is that tax alpha increases with increasing investment returns. This means that aggressive investors will find more value in 529 plans than conservative investors. What cannot be accurately measured is whether an aggressive investor investing in a 529 plan can do as well as he would in a taxable account because of the investment option limitations of 529 plans. Stock picking is off the table in 529 plans. A talented investor or stockbroker may have the skills to significantly beat the tax alpha of a 529 plan investment allocation of similar risk profile.

Of interest is the finding that a lump sum contribution to a 529 plan had a lower tax alpha than systematic contributions over the same time period; however, the gross dollar difference was larger. It’s my speculation, without having statistics to confirm, that the majority of 529 plan contributions are systematic or streaming contributions, versus sizable lump-sum contributions. It would likely require considerable wealth to take advantage of the full “superfunding” rule, as it relates to gift taxation, by contributing $75,000 per person for a single 529 plan beneficiary. Ultimately, it’s that gross dollar difference that pays tuition; not a percentage tax alpha.

Delorme raised two more points of consideration for choosing between a taxable account and a 529 plan. Some states have additional matching benefits for 529 plans, generally applicable to low- and middle-income households (for example, California, Colorado, Connecticut, Kansas, Louisiana, Maine, Maryland, Nevada, North Dakota, Tennessee, and West Virginia). Taxable accounts allow for tax-efficient loss harvesting.

Beyond the scope of Delorme’s work, a planner should also consider his or her role in shaping the client’s perception and understanding of risk-taking for this particular goal. Since the tax-alpha effect is enhanced with higher investment returns, consider pushing a client toward a more aggressive investment allocation if significant time exists until tuition will be paid. For many Americans, the concept of saving every dollar needed for a four-year school is daunting. Increased risk tolerance over a long enough timeline should result in a greater account balance in the future. When completing the full savings goal is not probable, the incremental increase in account balance over time is likely to be significantly helpful to the client.

Is a 529 Plan the Optimal Choice?

In light of Delorme’s work, a thought workflow can be developed when considering whether a 529 plan is an optimal choice for college savings. This workflow cannot assure that end results of college saving planning over time will prove to have been the best decision in hindsight; however, it should result in better collective advice for your college savers.

Here are considerations to factor in your thinking (see the graphic above for a visual of this workflow):

- Is the client a resident of Indiana? If yes, then almost always use a 529 plan.

- Is the client a resident of a 2.00+ tax-alpha state? If yes, give significant consideration to a 529 plan.

- Does the client have any foreseeable liquidity issues? If so, consider a taxable account or a split dollar approach.

- Higher client risk tolerance favors the use of a 529 plan when considering tax alpha. However, keep in mind that high equity allocation in conjunction with a proven asset manager may outweigh the tax alpha of 529 plans.

- Is the client in the top tax brackets? If yes, give significant consideration to a 529 plan.

- If a moderate risk tolerance or less exists, give consideration to a 529 plan over a taxable account when income produced will be significant.

- Does the investment horizon exceed 10 years with average client risk tolerance? If so, give significant consideration to a 529 plan.

- Is the investment horizon five years or less? If yes, almost always use a 529 plan because tax alpha is a higher percentage with shorter timelines.

- Does the client have substantial assets to take advantage of the “superfunding” rule? If yes, give significant consideration to a 529.

- Is the client low or middle income and residing in Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, or Wyoming? If so, then almost always use a 529 plan for extra credits in these states.

- Does the client have the ability to tax-loss harvest correctly and efficiently? If yes, consider a taxable account or a split dollar approach.

- Does the client have significant carry forward losses? If yes, consider a taxable account.

In summary, a decision that seems straightforward to invest in a 529 plan for college savings has significant nuances, and each client’s financial situation must be evaluated for residence state, risk tolerance, tax brackets and loss carries, investment horizon, current net worth, income level, and investment skill.

Outside of Indiana residents and top earners, there are very few straight-forward decisions about whether to invest in a 529 plan. When a client resides in a state that does not have an income tax, mathematically there is an advantage to a 529 plan, but the margin is small and better investment options outside of a 529 plan may negate the tax alpha.

As possible tax alpha climbs above 1 percent to 1.5 percent, the value of using a 529 plan climbs; however, it still may be a judgement call in this range because the real dollar gain isn’t impressive and may realistically be exceeded by excellent investment management in a taxable account. This deeper knowledge of the tax ramifications of 529 plans should help you better advise your clients on college savings.