Journal of Financial Planning: March 2023

David Y. Oh, J.D., L.L.M., managing director and trust counsel at Fiduciary Trust International, is a senior trusts and estates adviser with broad experience in estate planning and trust administration. He advises clients on matters including tax planning, tax compliance, wealth transfer techniques, and charitable strategies.

Note: Click on the image below for PDF version

Parents are often interested in saving for their children’s education but may not know where to start. There are various savings vehicles available, but not all offer the same benefits. One option, however, may be more compelling than the rest. Imagine a planning strategy that allows your clients to:

- Grow assets free of income tax.

- Make gifts over the annual gift tax exclusion with no gift tax.

- Avoid inclusion of the assets in the client’s estate for estate tax purposes.

- Retain the power to change their beneficiary.

- Control when, how, and how much of the gift the beneficiary can use.

- Retain investment control.

- Retain the power to reclaim the property.

Imagine clients also could implement the strategy with minimal costs or logistics. Does this sound too good to be true? It shouldn’t.

Section 529 college savings plans are well-known among financial planners as a means of tax-free college savings. Planners should also realize how 529 plans can be an estate planning panacea for clients concerned with passing wealth between generations.

Education Is a Primary Goal

For families with generational wealth, funding education is typically a top priority. Families recognize the role of education in their own success and well-being. Even families that question how much is too much and are concerned about the impact of wealth on their family typically don’t doubt the value of education.

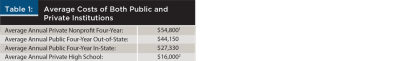

Yet funding education is not a nominal investment. Below are the average costs of both public and private institutions:

For parents or grandparents looking to fund education for multiple descendants, potentially spanning kindergarten through college and graduate school, the expense can be well into the millions. This puts an imperative on putting aside sufficient funds. It also spotlights the need to optimize those savings and have flexibility as descendants grow up.

Section 529 Plans

Congress created two types of qualified tuition plans under Internal Revenue Code (IRC) §529. One type, known as a “prepaid tuition plan,”3 allows a donor to purchase credits on behalf of a beneficiary so that educational expenses are waived. These accounts freeze education expenses to current tuition rates but are often limited to in-state residents and available to only certain states.

The more common type of plan, known as a “college savings account,”4 is what we colloquially refer to as a 529 plan. All 50 states have contracted with a financial institution to offer and manage their own respective plans. Each state has its own set of investment options that will vary, and fees will also differ, which may factor into the ultimate decision of selecting a plan.

Opening a 529 plan account can be as simple as going online to a financial institution and contributing after-tax dollars to the state-sponsored account. The cash is invested in a portfolio of mutual funds, which an account owner can adjust and reallocate over time. The account owner can be the person opening the account and contributing funds, or someone the initial contributor designates.

The account owner manages the savings plan. They have the power to: (1) designate the beneficiary, (2) change the beneficiary, (3) make distributions, and (4) receive distributions if there is no designated beneficiary. The account owner can be an individual, trust, or entity, as can the contributor. Once created, there can be multiple contributors to a single account. Each account, however, has its own designated beneficiary.5 The beneficiary must be an individual, but is not required to be a family member.

When a student eventually needs funds to attain their education, the account owner may make payments directly to eligible educational institutions. Otherwise, the account owner has the option to issue checks payable to both the designated beneficiary and the educational institution, or reimburse the beneficiary provided they produce receipts. Another possibility is to advance funds to a beneficiary so long as they certify that they will use them for qualified higher education expenses within a reasonable time and provide substantiation within 30 days.

Income Taxation and 529 Plans

Federal Income Tax

Assets in a 529 plan grow tax-free. Additionally, when distributions ultimately are made from the plan, there is no income tax due if the distributions are used to pay for qualified expenses.6 That includes tuition, fees, books, supplies, and equipment. For special needs students, qualified expenses also include services connected to enrollment or attendance. Supplies and equipment consist of computers, peripheral equipment, software, and internet access, among other items. Room and board constitute qualified higher education expenses if the student is enrolled with at least half of a full course load.

State Income Tax

More than 30 states offer a deduction or credit to their residents for contributions to their own state’s 529 plan. Contributors are free to deposit funds in plans from other states, but doing so may disqualify them from receiving a tax benefit. For example, Alabama will tax its own residents who receive distributions from out-of-state plans, but not distributions from plans that are in state.

Wealth Transfer Taxes and 529 Plans

The income tax benefits of 529 plans are generally known. However, the transfer tax benefits, options, and considerations may not be fully appreciated.

Federal Estate Tax

Typically, if a donor retains control over their gift, Sections 2036 and 2038 of the IRC would require inclusion of the value of that gift in the donor’s estate. These rules, however, do not apply to gifts to a 529 plan, despite the account owner retaining this power. Instead, a 529 plan is an asset of the designated beneficiary for estate tax purposes.

Federal Gift Tax

Transfers to a 529 plan are a completed gift7 and qualify for the annual gift tax exclusion. In addition, a contributor can front-load up to five years’ worth of annual exclusion gifts in a single year without gift tax liability. The gift is prorated over a five-year period and requires filing a gift tax return to elect the proration. If the donor’s death occurs within the five-year period, the unused annual exclusion amount is included in the donor’s estate.

For example, a parent can gift $85,000 in a single year to a child’s 529 plan ($17,000 annual gift tax exclusion for 2023 multiplied by five years). If they die in the fourth year, the final year’s prorated $17,000 would be included in their estate.

Federal Generation-Skipping Transfer (GST) Tax

Contributors who make gifts to their grandchildren through a 529 plan should keep in mind that the GST tax applies. Fortunately, the annual GST tax exclusion automatically applies to transfers that also qualify for the annual gift tax exclusion. Though not explicitly stated in the code or regulations, it is widely considered that the five-year front-loading rule available for gift tax purposes also applies to the GST tax.

Rolling Over a 529 Plan

One of the more attractive features of the 529 plan is that it can be rolled over to another beneficiary. But there are tax implications to consider prior to transfer. To avoid a taxable event for income tax purposes, an account owner must change the beneficiary to a “member of the family” of the initial beneficiary.8 This includes:

- Child or a descendant of a child

- Sibling or a stepsibling

- Parent or ancestor

- Stepparent

- Sibling of the parent

- Son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law

- First cousin

If the new beneficiary is a member of the family9 and within the same generation of the original beneficiary, a rollover also is exempt from gift tax. If those conditions are not met, the rollover is considered a taxable gift by the original beneficiary. This is true even though the original beneficiary has no decision-making power with respect to the transfer. A silver lining is that the original beneficiary may take advantage of the five-year front-loading rule.

Limits and Alternatives

In essence, the 529 plan functions as a specialized educational trust. Yet unlike most other types of specialized trusts, it does not require complex drafting and nuanced technical decisions. It also does not require legal fees.

All states have limits on contributions to their 529 plans. These are generally based on the cost of education within the state and range anywhere from $235,000 in Georgia and Mississippi, to $529,000 in California. Once a plan reaches its limit, no additional contributions can be made to the plan, though there is no penalty if a plan grows to levels beyond.

Families may consider Uniform Transfers to Minors Act (UTMA) accounts as an alternative to avoid these limits. But these accounts do not enjoy the same tax advantages as 529 plans, and the limits are likely more than sufficient for a single beneficiary’s education. In addition, if a family is concerned about having flexibility for funds to be used outside education, they can always fund other savings vehicles after 529 plan accounts have been established. Also, under the recently passed SECURE 2.0 Act of 2022, beneficiaries of a 529 plan will be able to roll over assets from their 529 account to a Roth IRA starting in 2024. [For more changes arising from the SECURE 2.0 Act, see page 41]. Conditions apply: The 529 plan must have been in existence for 15 years, contributions from the previous five years are ineligible, there is a $35,000 rollover maximum throughout the beneficiary’s lifetime, the beneficiary must have compensation, and the standard annual Roth IRA contribution limits apply (in 2023, $6,500 if under 50 and $7,500 if 50 or older).

Trust Ownership of 529 Savings Plans

Upon opening a 529 plan, it is important to ensure that there is proper succession to the account owner in case of incapacity or death. Most states make this as simple as filling out a form. If an account owner dies and does not have a successor, the 529 plan could be distributed to the account owner’s residuary beneficiaries. Another option to side-step the concern and potentially provide additional benefit is to name a trust as account owner.

As mentioned above, a trust is a permitted account owner of a 529 plan. Naming a trust as an account owner provides more control to the contributor with respect to future distributions. A trust instrument can set guidelines on how and when distributions are made in a more precise way, rather than simply trusting the account owner or their successor. Having a trust as an account owner also provides added creditor and spendthrift protection, as well as a contingency plan in case of incapacity.

Should a contributor name a trust as an account owner to a 529 plan, the trust does not automatically qualify for the annual gift tax exclusion, annual GST tax exclusion, or the five-year front-loading rule. As a result, contributors may consider gifting directly to a 529 plan that is being held by a trust.

529 Plans and Financial Aid

Schools take into account 529 plans when computing a student’s financial aid. If the account owner is a parent, the plan is deemed to be the parent’s asset in calculating the level of financial aid available, but it will not be considered a student asset when distributions are made. Alternatively, a 529 plan can be owned by a relative and the assets in the plan would not be counted toward the initial financial aid assessment. Future distributions, however, may be considered as the student’s assets, so families will have to compare which arrangement best fits their situation.

A Beneficial Multigenerational Planning Tool

For wealth transfer purposes, 529 plans allow clients to have their cake and eat it too. They can enjoy the tax benefits of an educational savings vehicle while retaining significant control over the assets. The longer runway a student has before they need to access funds from a 529 plan, the more the account can grow tax-free. For families concerned with multigenerational planning, the advantages, from income and wealth transfer tax standpoints, make it a powerful instrument to consider.

Endnotes

- See www.collegeboard.org.

- See www.educationdata.org.

- IRC §529(b)(1)(A)(i)

- IRC §529(b)(1)(A)(ii)

- Prop. Reg. §1.529-1(c)

- IRC §529(e)(3)

- IRC §529(c)(2)(A)(i)

- IRC §529(e)(2)

- IRC §529(c)(5)(B)