Journal of Financial Planning: March 2024

Randy Gardner, J.D., L.L.M., CPA, CFP®, AEP (Distinguished), is a financial educator and founder of Goals Gap Planning LLC.

Julie Welch, CPA, PFS, CFP®, AEP (Distinguished), is the managing shareholder at Meara Welch Browne, P.C. Julie Welch and Randy Gardner are the authors of 101 Tax Saving Ideas (Eleventh Edition).

Creyton Vincent is a financial educator with the Gardner Foundation.

NOTE: Please be aware that the audio version, created with Amazon Polly, may contain mispronunciations.

JOIN THE DISCUSSION: Discuss this article with fellow FPA Members through FPA's Knowledge Circles.

FEEDBACK: If you have any questions or comments on this article, please contact the editor HERE.

Ten years ago, when clients asked about education planning, they were referring to setting aside funds for their own or their children’s college educations. Today, it could mean discussing strategies to reduce taxes for expenditures at any educational level, including pre-school; elementary, secondary, and college education; graduate school; continuing education; and adult learning/day care. This article addresses frequently asked questions related to tax-wise education planning during an individual’s lifetime.

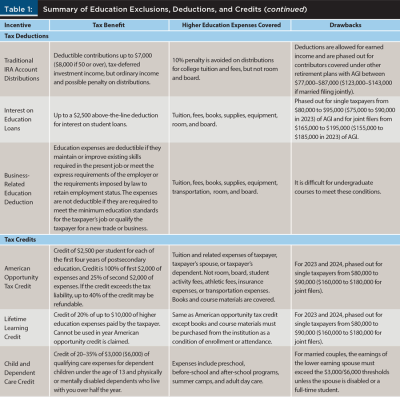

Tax planning is accomplished through five strategies: taking advantage of exclusions, deducting expenditures, claiming tax credits, reducing marginal tax rates by shifting income to others or investing in capital assets, and improving one’s filing status. The exclusion, deduction, and credit techniques are shown in Table 1. Filing status is not listed in the table but it can come into play. For example, married taxpayers who file separately are not eligible for the dependent care credit, the American opportunity tax credit, or the lifetime learning credit, but they can claim a $2,500 dependent care exclusion (half of the $5,000 maximum). These techniques are complicated by these types of details.

Answers to Clients’ Most Frequently Asked Questions

1. Newborns: We just had our first child. What planning should we be doing for their education?

The cost of raising a child is expensive. According to Northwestern Mutual (2023), the cost is $331,933 through age 18 or over $18,000 per year.

The cost of college is added to the pre-19 costs. According to the College Board’s 2023–2024 Survey of Colleges (Ma and Pender 2023), the annual tuition of four-year public, in-state tuition is $11,260 (plus $12,770 for room and board, if applicable), for a total of $24,030 per year. For four-year, private colleges, the annual tuition is $41,540 (plus $14,650 for room and board), for a total of $56,190 per year in today’s dollars. If we increase those figures at a 4 percent inflation rate and multiply for four years of school, the four-year cost of public school in 18 years is $194,721, and the four-year cost of private school is $455,323. Assuming an 8 percent rate of return in a Section 529 education account, we would need to contribute $5,199 per year to fund public school and $12,158 per year to pay for a private university.

To save for these costs, both a Coverdell education savings account and a Section 529 account take advantage of tax-free growth and contributions toward educational expenses. The tax advantages of these two accounts are the tax-free growth and tax-free distributions. If the client saves $12,158 per year between the two accounts for a private college, they will have contributed $145,896 (18 years × $12,158) and, if the accounts earn 8 percent, will have accumulated $455,323 in the accounts, meaning $309,427 ($455,323 – 145,896) of untaxed earnings will be used to pay for educational expenses.

The Coverdell education savings account contribution is limited to a non-deductible $2,000 per year, which grows tax-free. The main advantage of a Coverdell education savings account is tax-free distributions that can be used to pay for college tuition and room and board as well as elementary and secondary school expenses, including tuition, fees, academic tutoring, special-needs services, computers, and internet access fees. The drawbacks are: not everyone will be eligible to use the Coverdell education savings account because of the $95,000–$110,000 ($190,000–$220,000 for married filing jointly couples) phaseouts, and qualified education withdrawals will not be eligible for the college credits because of their tax-free source.

Section 529 qualified tuition plans and prepayment tuition plans can also be used for K–12 expenses, but K–12 distributions, if permitted by the plan, are limited to $10,000 of qualifying expenses per year. Qualifying post-secondary expenses include the costs of college, trade school, and graduate school. The SECURE 2.0 Act enhanced the benefit of 529 plans by allowing up to $35,000 of excess funds to be rolled over to the beneficiary’s Roth IRA if the 529 account has been open for at least 15 years.

Contributions to 529 accounts are subject to the rules in the state plan, state agency plan, and education institution plan where they are established and may be eligible for a state income tax deduction. Contributions are not limited by income phaseouts, but qualifying tax-free distributions may not be used to claim the college credits.

2. Pre-school Expenses: Can I Use Coverdell Education Savings Accounts and 529 Plans for Pre-school Education?

The short answer, currently, is no. However, that time may be coming. In 2021, President Joe Biden proposed in the American Families Plan the expansion of mandatory public education to include children over the age of two because of the numerous studies that have shown the benefits of pre-school education.

A two-earner couple filing jointly may currently use an employer-provided dependent care assistance plan to cover up to $5,000 of dependent care assistance. The $5,000 is not subject to income tax or payroll tax. Alternatively, the 20–35 percent child and dependent care credit is available for up to $3,000 of care for one dependent ($6,000 for two or more dependents) if you have AGI less than $200,000 ($400,00 if you are married filing jointly). The amount of the credit for families with over $43,000 of adjusted gross income (AGI) is $600 (20 percent × $3,000) for one child and $1,200 (20 percent × $6,000) for two or more children. The $3,000/$6,000 limitation is reduced by contributions to an employer’s dependent care assistance account.

Perhaps because these benefits are relatively low, clients do not use them to the extent they could. They are available for children under the age of 13. In other words, the credit could be claimed for sending a child to after-school care programs, tutoring/coaching programs, and day camps through the age of 13. These tax strategies are also available for mentally or physically disabled dependents over the age of 13 who live with the client for over half the year, such as elderly parents. For example, the expenses of an adult day care would qualify.

3. Education Deductions: Are My Payments for Private Elementary, Secondary, and Higher Education Expenses Eligible for a Deduction?

No. Even if the payments are made to a religious or educational charity, you are receiving your child’s education in return (a quid pro quo) and, thus, are not eligible for a charitable contribution deduction. If your child has special medical needs, payments to a school, including room and board if the school is a residential school, may be deductible as a medical expense.

Many private schools offer discounts or scholarships if the family has financial need, especially if multiple children from the same family are attending.

Prior to 2021, there was a $4,000 deduction for college tuition and fees, but that benefit was not extended by Congress and is no longer available.

4. Work and College Costs: If My Education Is Related to My Work, Can I Claim a Deduction for It or Can My Employer Pay the Costs as a Benefit to Me?

Classes that maintain or improve existing skills required in the present job or meet the express requirements of the employer, or the requirements imposed by law to retain employment status, can be deductible. Examples of deductible expenses include continuing education courses required of physicians, attorneys, and financial advisers.

However, if the classes are necessary to meet the minimum education standards for the taxpayer’s job, such as undergraduate accounting courses for a CPA or a CFP® exam review course, then they are not deductible. Furthermore, the costs of education courses are not deductible if they qualify the taxpayer for a new trade or business, such as law school courses taken to qualify the student to enter the legal profession. These courses are not deductible by an employee, employer, or self-employed individual.

An employer, including a parent, can offer an annual $5,250 educational assistance fringe benefit to its employees, creating a deduction for the employer and avoiding income and payroll taxes for the employee. The courses do not need to be job-related. Expenses that qualify for this reimbursement include tuition, books, supplies, equipment, and student loan payments (reimbursed before January 1, 2026).

The payment of an employee’s education expenses by an employer can be deductible by the employer and excluded from the employee’s income as a working condition fringe benefit if the courses taken are job related, such as MBA courses, and are not required to meet the minimum educational requirements for the employee’s job.

5. Scholarships: Are Scholarships Taxable?

Many parents dream that their child will receive a scholarship to attend college. Scholarships for tuition and fees generally are not included in the students’ income, but amounts received for room and board are taxable.

For the scholarship to be tax-free, the student must be a candidate for a degree at an educational institution that maintains a regular faculty, offers a curriculum, and has a regularly enrolled body of students. Thus, amounts received from the federal government, universities, and businesses are not taxable as long as the payments are aid to the student and not a payment to the student or their parents for services rendered to the payer. If the student receives a scholarship from the National Health Services Corps or the Armed Forces Scholarship Program, the scholarship is tax-free even if the student must provide services to receive the scholarship.

Parents can be the owners of companies and donors to charities that have scholarship programs as long as there are numerous individuals benefiting from the programs. If the business owner’s or charity founder’s children are the only recipients, the IRS will likely treat the scholarships as taxable.

If you have saved funds in a 529 plan for your child’s education but now you have excess funds in the 529 account since your child received scholarships, you have some options. First, you can transfer the funds in the 529 account to the beneficiary’s sibling or cousin. Second, you can transfer up to $35,000 to the beneficiary’s Roth IRA if the 529 account has been open for at least 15 years and certain other conditions apply. Third, while the income portion of any non-qualified distributions would be taxable, the 10 percent penalty will not apply on non-qualified withdrawals up to the amount of the tax-free scholarships.

6. College Credits: Can I Claim a Credit for Payments for College Tuition from the Proceeds of a Section 529 Account Withdrawal?

Generally not. The American opportunity tax credit and the lifetime learning credit rules prevent double dipping. Both of these options allow a tax credit for the payment of qualified expenses, including tuition and fees necessary for the enrollment or attendance of the parents or any of their dependents at a higher education institution. Room and board are not covered. If the tuition and fees are paid by a scholarship or from tax-free distributions from a Coverdell education savings account or Section 529 plan, or from the tax-free proceeds of the sale of U.S. Savings Bonds, then the credit will be disallowed. In addition, each of these credits are phased out if you are single with AGI between $80,000 and $90,000 or married filing jointly with AGI between $160,000 and $180,000.

The American opportunity tax credit is available for a student’s first four years of post-secondary education. Either the student or the parents may claim the credit. The maximum credit allowed for any year is 100 percent of the first $2,000 of qualified expenses plus 25 percent of the second $2,000 of qualified expenses. In other words, the maximum annual credit is $2,500 per student, and the maximum overall credit is $10,000 per student.

In other words, it is easy to claim both the benefits of tax-free deferral and the credit. The client just needs to be able to show that $4,000 paid for the student’s tuition did not come from the tax-free sources. Being able to claim the deferral plus the credit is really a recordkeeping and tracing issue.

7. Continuing Education Expenses: Can I Claim the Lifetime Learning Credit for My Professional Continuing Education Expenses?

Yes. The lifetime learning credit provides for a broader range of learners than the American opportunity tax credit. Full-time or part-time students at undergraduate, graduate, professional, or continuing education programs at a higher-education institution may use the lifetime learning credit. The credit provides a non-refundable credit equal to 20 percent of up to $10,000 of qualified expenses the student pays. This credit is per taxpayer return, not per student like the American opportunity tax credit. The credit is phased out if you are single with AGI between $80,000 and $90,000 or married filing jointly with AGI between $160,000 and $180,000.

You cannot claim both the American opportunity tax credit and lifetime learning credit for the same student in the same year.

If a self-employed professional paid $2,000 for continuing education, the professional might claim the $400 credit ($2,000 × 20 percent). However, they can probably reduce their taxes more by claiming the expenses as a business deduction, avoiding income taxes and the 15.3 percent self-employment tax. If they were in the 22 percent tax bracket, their tax benefit would be $746 ($2,000 × (.22 + .153)).

8. Student Loans: Does It Make Sense to Take Out a Student Loan to Attend College?

This question requires thought and analysis. Many families cannot afford to use the saving strategies mentioned so far. Thus, when the time for college enrollment arrives, the family faces the choice of not attending college or borrowing the funds needed to attend.

Let’s do the math. The average annual earnings of a high school graduate is $39,700 and the average earnings of a college graduate is $61,600 (National Center of Education Statistics 2022). The cost to attend a four-year public university is $24,030 per year and the cost to attend a private university is $56,190. Dividing the missed earnings of $158,800 ($39,700 × 4 years) and college costs $96,120 ($24,030 × 4 years) by the $21,900 ($61,600 – $39,700) of additional earnings for a college graduate results in a breakeven of 11.6 years (($158,800 + $96,120) / $21,900). In other words, 11.6 years after graduation, a college graduate has recovered the costs of college and foregone earnings. For a private college, the breakeven is 17.5 years ((158,800 + $224,760) / $21,900), assuming the private college did not offer higher financial aid to cover the higher costs.

This analysis suggests that college makes sense. In addition to higher annual earnings, college graduates have higher lifetime earnings, lower unemployment, and greater job satisfaction. However, a portion of the cost will be debt when they graduate. The average interest rate on student loans is 5 percent to 7 percent, depending on the type of loan; the average loan origination fee is 1 percent; and loan payments do not commence until after a full-time student graduates. The interest expense paid annually, up to $2,500, is an above-the-line tax deduction if the borrower’s AGI is below the phaseout range of $80,000–$95,000 ($165,000–$195,000 for a married filing jointly couple). Many students find that their high earnings and their high student loan debt ($2,500 deductible amount divided by a 5 percent interest rate equals $50,000) prevent them from claiming all of their interest payments as a deduction.

With regard to borrowing to attend college, students and their parents should proceed with caution. As of the third quarter of 2023, there was $1.74 trillion in student loan debt (Caporal 2023). The average loan balance was $37,465 and the average monthly payment was $337. Fifteen percent of borrowers were behind in their payments. The COVID-19 suspension of interest charges and loan payments ended in October 2023. These statistics suggest that borrowers are having difficulty paying back their loans and should consider lower-cost community colleges, working part-time while attending college, or continuing to live at home while they attend a local college.

At the same time, the borrowing environment is positive. Biden sympathizes with borrowers as he continues his effort to forgive student loans; the Department of Education has initiated a new SAVE program capping student loan payments based on a student’s post-graduation earnings and is making sure student loans are cancelled after 20 years of payments as promised. Additionally, the revised Free Application for Student Aid (FAFSA) form no longer counts the parents’ home equity and retirement accounts as a parental resource, making it easier for students to qualify for grants and loans.

Other strategies include paying off student loans from other sources. Up to $10,000 per child of Section 529 account funds can be used to pay off the student’s loans. Some parents pay off their own or children’s student loans by borrowing from their retirement accounts, taking penalty-free substantially equal periodic payments from individual retirement accounts, and using home equity loans. The itemized deduction for home equity loan interest expense is scheduled to return in 2026.

9. Claiming Multiple Benefits: Is There Any Way to Save Money for College That Provides a Deduction, Tax-Free Growth, and College Credits?

It would be great if there was an education savings account that had the characteristics of a health savings account where the owner could receive a deduction for contributions, benefit from tax-free growth in the account assets, and be able to make tax-free distributions for education. Such an account, however, does not currently exist.

Some taxpayers have used traditional and Roth IRAs to try to accomplish this result. For example, a parent might contribute to a traditional IRA and invest in assets that grow tax deferred. However, amounts withdrawn for education expenses are subject to income tax. If the participant is under age 59 1/2, they can still avoid the 10 percent penalty because the distributions are for the tuition and fees (not room and board) of the parents or their dependents. Approaching education funding in this manner also enables the participant to claim college credits for the tuition payments.

In 2024, the maximum contribution is $7,000 for an IRA plus an additional $1,000 if the participant is 50 or older. The deduction may be disallowed if the taxpayer is covered under a qualified retirement plan and the taxpayer’s AGI exceeds $87,000 ($143,000 if married filing jointly). To avoid this loss of deduction, the participant may instead use a Roth IRA. The phaseouts are higher at $161,000 for single individuals and $240,000 for married individuals, but they still pose a risk for the use of the strategy that Section 529 plans do not have. With the Roth IRA approach, the additional benefits are the tax-free return of the already-taxed contributions, avoidance of the 10 percent penalty under the age 59 1/2, and college tuition and fees exceptions.

These IRA strategies become “shifting of income to a lower tax bracket” strategy if the IRA is established by or for the child. If the child has earnings or can work for a parent for ten or so years prior to and during college, then money can be saved in the IRA and used to pay college expense during the student’s college years or pay off student loans after graduation when the student’s tax rates are low, minimizing the tax costs.

10. Irrevocable Trusts: Should I Establish an Irrevocable Trust to Pay for My Descendant’s College Expenses?

Prior to 1996 when Section 529 accounts became available, irrevocable trusts were frequently used to set aside money to pay college expenses for family members. In special situations, they are still used. The trust holds investments, including growth securities and real estate, that increase in value and produce little income. The grantor of the trust is able to add funds to the principal or sell assets to ensure funds are adequate to meet the educational needs of the beneficiaries, usually the grantor’s children and grandchildren. The disadvantages of using these trusts are: the cost of establishing the trust, annual tax filings, and the annual taxation of the trust income, if any, at the compressed tax rates of the trust or the annual taxation of the trust income to the beneficiaries at the parents’ tax rates because of the “Kiddie Tax.”

These trusts were often set up by grandparents. Often, the grandparents owned a large estate that was above the applicable exclusion amount ($13.61 million currently) and were looking for ways to decrease their estate tax exposure. Rather than setting up a trust, grandparents in today’s tax environment can avoid transfer taxes by prepaying tuition at a college they believe their descendants will attend, thereby removing the assets from their estate. They can also donate $90,000 ($18,000 annual gift tax exclusion × 5 years) to each grandchild’s 529 account. The grandparent must live for five years to qualify to use five gift tax annual exclusions in a single transfer. Another advantage is the 529 account established by a grandparent will not count as a parent or student resource for purposes of the FAFSA form. In other words, irrevocable education trusts remain an alternative, but Section 529 accounts are more beneficial and versatile.

While education planning presents complex challenges, understanding the tax implications and utilizing available strategies can significantly alleviate the financial burden. Consideration of various accounts, credits, and employer benefits is essential for comprehensive tax-wise education planning.

References

Caporal, Jack. 2023, December 19. “Student Loan Debt Statistics in 2023.” The Motley Fool. https://www.fool.com/research/student-loan-debt-statistics/.

Ma, Jennifer, and Matea Pender. 2023. “Trends in College Pricing and Student Aid 2023.” College Board. https://research.collegeboard.org/trends/college-pricing/highlights.

National Center for Education Statistics. 2022. Digest of Education Statistics. Table 502.30. https://nces.ed.gov/programs/digest/d22/tables/dt22_502.30.asp.

Northwestern Mutual. 2023, September 26. “How Much Does It Cost to Raise a Child?” www.northwesternmutual.com/life-and-money/how-much-does-it-cost-to-raise-a-child/.