Journal of Financial Planning: January 2026

NOTE: Please be aware that the audio version, created with Amazon Polly, may contain mispronunciations.

Danielle Andrus is the editor of the Journal of Financial Planning. She can be reached HERE.

NOTE: Click on the image below for a PDF version.

Financial planners know the value of being proactive about saving for financial objectives. Whether it’s building a nest egg for retirement or setting aside money for college, time is a key ingredient in getting clients to where they want to be. The One Big Beautiful Bill Act introduces some changes that reiterate the value of starting early when it comes to saving for school.

New Borrowing Limits Could Fuel Shift to Private Loans

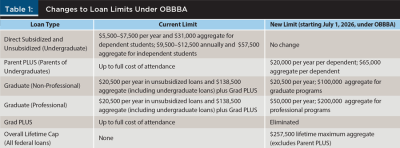

A key change planners need to account for in clients’ funding strategies is a new limit on how much can be borrowed, both annually and in the aggregate.

The College Board’s Trends in College Pricing and Student Aid 2025 (Ma et al. 2025) report shows federal loans are the largest source of aid for graduate students, accounting for 61 percent of total graduate student aid in the 2024–25 school year. By comparison, federal loans accounted for 23 percent of aid for undergraduates.

“Parent PLUS loans have been a bit of a fallback option for financing undergraduate education for students. Parent PLUS loans currently are able to cover up to the cost of attendance. However, beginning July 1, 2026, Parent PLUS loans will now be limited to $20,000 per year, up to $65,000 per student,” according to Krista Teegarden, team lead for the advanced planning group at Commonwealth Financial Network.

This will shift some people toward private loans, which may be more expensive with fewer options for repayment compared to federal loans, Teegarden points out. In the 2024–25 school year, about 14 percent of all student loans were nonfederal, including private loans as well as those issued by states and institutions (Ma et al. 2025).

“Unlike federal student loans, private student loans do not have access to public service loan forgiveness, taxable forgiveness, or flexibility in loan repayment options,” she says. “Students and parents will either need to think about saving more in advance or evaluating some of those private student loan options, which may mean some of the things that they were planning for with public service loan forgiveness may look a little bit different.”

Teegarden warns that families should be thoughtful about income changes in the years before they send a child to college. “One of the things that we’re seeing is not realizing that the FAFSA considers your income from your tax return two years back, so it’s important to watch your income two years before your child is getting ready for college, and try to avoid large increases to income during that time,” she notes.

She also points out that the FAFSA isn’t the only route to financial aid. Planners should educate their clients about the differences between the FAFSA and CSS Profile, especially if the student is considering a private university. The CSS Profile is used by hundreds of schools, mostly private institutions, to determine nonfederal aid for students. The profile only has to be completed once per award year, but information will be shared with each of the schools selected by the student. Schools may have different deadlines, so students and families need to be diligent about completing the form on time, according to the College Board (n.d.).

While all students looking for federal financial aid should file a FAFSA, they should also check www.cssprofile.org to see if any of the schools they’re considering also require the CSS Profile to grant institutional aid. The profile collects additional information that the FAFSA doesn’t, such as the number of students in a family and medical circumstances that might impact financial need.

Borrowing limits will also be determined based on enrollment status, with part-time students eligible for less aid than full-time students.

The loan limits instituted by OBBBA are more likely to impact older students than undergraduates, according to estimates by Jobs for the Future, a nonprofit that advocates for education and workforce reforms. Ethan Pollack (2025), senior director in the policy and advocacy practice at JFF, notes in a blog post that just 3 percent of undergraduate borrowers in the 2019–20 class borrowed more than $65,000 in Parent PLUS loans. However, about 38 percent of graduate borrowers in the same graduating class borrowed more than the new cap of $20,500 for nonprofessional students and $50,000 for professional students.

Emphasize Smart School Decisions

Steve Witter, CFP®, CSLP, is president of Bentham Wealth Advisors and owner of Student Loan Steve, where he supports students, parents, and financial professionals in student loan planning.

“A lot of families before went with the financial planning strategy of ‘get into the school and we’ll figure it out,’ and that’s not really going to work anymore,” says Witter. “Before, it didn’t matter. You’d get on an income-based plan and then get it forgiven later on. There was no real incentive to price shop once you borrowed a certain amount.”

He notes that parents are the people most impacted by the bill’s changes, particularly those who intend to use Parent PLUS loans.

“Parent PLUS borrowers are [most] impacted by this because of the loan limits and not being able to repay based on income. They’re the ones that are suffering the most with this, which leads to college choice and the cost aspect of it,” he says.

It may not always be possible, or even appropriate in the long term, to choose a major based solely on financial factors, but it’s important for planners to help clients find a way to set realistic expectations for their children so they can make good decisions. It may not even be the children who need to have their expectations adjusted.

“Undergrad loans always come back to the parents: either they saved ahead of time, they’re signing up for a Parent PLUS Loan, or they’re cosigning on a private loan,” Witter explains. “There’s no way of saying, ‘My kid’s got to take care of it.’”

Still, a lot of parents who provide financial support for their children in school will have a “handshake deal” with their kids, Witter says, where they take loans with the expectation that the student will one day contribute to pay it back. That doesn’t always play out.

“You can’t always refinance it to the kids name because they may not have the income,” he says. “That handshake deal gets tough with students who don’t have enough to pay back their parents.”

Prioritizing life goals and aligning them with financial strategies is a cornerstone of financial planning. Parents who put a lot of stock in a college education to the detriment of their own retirement planning need to think very carefully about private loans and potentially have frank and difficult conversations with their children.

“There’s a lot more risk to the parents getting in trouble with a private loan compared to the federal loan. If they’re not willing to have that discussion, limit the kids’ college choices and expenses that they’re funding; it’s going to come back to hurt the parent,” Witter says.

This will be especially critical for clients who are getting a late start in saving for education or who are eyeing expensive postsecondary degrees for themselves. Graduate students have a lifetime cap of $100,000, while students pursuing degrees in certain professions, such as medicine, dentistry, or law, may borrow up to $200,000.

Priority 1: Start Early

With the limits on how much of a student’s educations costs can be funded by loans, it’s more important than ever to start saving early. The workhorse of education funding, the 529 savings plan, has become more effective over the years as eligible expenses and spending limits have become more favorable. After 2017’s Tax Cuts and Jobs Act, parents can use these funds for K–12 tuition as well as college costs, and transfer funds from a 529 to an ABLE account without penalty. The SECURE Act of 2019 allows students to use up to $10,000 of 529 funds to pay down student loans, and the SECURE 2.0 Act of 2022 allows some 529 beneficiaries to roll unused funds into a Roth IRA, starting them on the path to another significant long-term saving goal.

While the implementation of the new FAFSA form was a little rocky, there are some benefits for students and their families, according to Commonwealth’s Teegarden.

“There have been some good things that came out of the FAFSA Simplification Act. One of my favorite things about that was planning with grandparent-owned 529 plans,” she says, noting that some types of untaxed income are no longer included in determining need, including financial support from grandparent-owned plans. “We used to have to get creative with strategy on grandparent-owned 529 plans.”

OBBBA increased the 529 withdrawal limit for K–12 expenses to $20,000 annually per beneficiary and expanded the list of qualifying expenses to include instructional materials, standardized test fees, and tutoring. Credential programs, like CFP® certification, are also eligible.

“These changes to 529 plans provide increased flexibility and options to use 529 plans, so those are all helpful to see, especially as we’re talking about what to do to save more for education expenses. Financial advisers can help bring to light the questions that clients may not be aware to ask or think about as they’re preparing for college,” Teegarden says.

Student Loans and Debt Forgiveness

After a slight decline in student debt in 2023, the total amount owed is again climbing, with over $1.8 trillion owed as of the second quarter of 2025, according to the Education Data Initiative (Hanson 2025). The average federal loan balance is over $39,000, and students who also have private debt have a total average balance of nearly $47,000.

“These new tax law changes have been a bit of a maze for existing students, trying to figure out what loan repayment plan to select or how [it works],” Teegarden notes. OBBBA eliminates some current repayment options, giving borrowers on new loans after July 1, 2026, two options, she explains.

“It’s going to be the new standard repayment plan, where payments are going to vary depending on the amount borrowed, and that’s going to range from 10 to 25 years, or the new RAP—the repayment assistance plan, which is a new income-driven repayment plan. In the RAP, the minimum payment plan is going to be based on your adjusted gross income, with payments that range as low as $10 up to 10 percent of your income once AGI reaches $100,000,” she explains. RAP payments will contribute to public service loan forgiveness (Andrade 2025).

Current income-driven repayment plans allow remaining balances to be forgiven after 20 or 25 years, depending on which of the four plans a borrower is on. Now, borrowers in a RAP will have 30 years before any remaining balance will be forgiven.

Students and families who turn to private loans to fill the gap between savings, federal loans, and other types of aid face more unforgiving repayment options.

“Federal student loans are unlike any other debt that a student or a parent will ever have in their life,” Witter said. “If you ever lose your job, you can’t just tell your mortgage company, ‘Oh, I lost my job, pause the payment for a year.’ [With a] federal loan, you can do that.”

Private loans are more similar to a mortgage or car loan, and borrowers will have to pay close attention to the terms of the loan, as each provider may have their own rules, Witter says. Private lenders will also look more closely at borrowers to see what kind of risk they’re taking on.

“They’re going to evaluate you on a one-on-one basis. They may see that you’re going to an expensive school to become a physical therapist that is only going to make $50,000 when you graduate,” Witter says. “You’re going to have people that aren’t going to be able to go to some of the programs they may want to go to, unless they come from a wealthier family that has the money set aside or cash flow.”

Conclusion

The cost of a college education has always been a factor in choosing which school to attend, but it may be a stricter limit for families in the future when they can’t fill a funding gap with a loan. Witter encourages planners to immerse themselves in the student loan market or work with a partner who understands it.

“As a financial adviser, you either have to devote a lot of time to it or devote no time to it and outsource to someone [who] does because the rules are constantly changing,” he says.

Commonwealth’s Teegarden recommends planners focus on long-term planning in conversations about education funding. She suggests planners encourage students to take their time before signing up for student loans.

“Ask that question: what is the potential income for this degree? How does this compare to the amount of student loans that will be taken? Taking that time to evaluate how loans may impact their future is crucial to avoid that debt trap,” she says.

References

Andrade, Jeffrey. 2025, July 18. “Federal Student Loan Program Provisions Effective Upon Enactment Under the One Big Beautiful Bill Act.” https://fsapartners.ed.gov/knowledge-center/library/dear-colleague-letters/2025–07–18/federal-student-loan-program-provisions-effective-upon-enactment-under-one-big-beautiful-bill-act.

College Board. n.d. “CSS Profile.” https://cssprofile.collegeboard.org/media/pdf/CSS-Profile_Student-Flyer.pdf.

Hanson, Melanie. 2025, August 8. “Student Loan Debt Statistics [2025]: Average + Total Debt.” Education Data Initiative. https://educationdata.org/student-loan-debt-statistics.

Ma, Jennifer, Matea Pender, and Xiaowen Hu. 2025. Trends in College Pricing and Student Aid 2025. College Board. https://research.collegeboard.org/media/pdf/Trends-in-College-Pricing-and-Student-Aid-2025-final_1.pdf.

Pollack, Ethan. 2025, August 27. “What Do OBBBA’s Tighter Borrowing Limits Mean for Students?” Jobs for the Future. www.jff.org/blog/what-do-obbbas-tighter-borrowing-limits-mean-for-students/.

Russell, Lauren C., Lei Yu, Michael J. Andrews. 2024. “Higher Education and Local Educational Attainment: Evidence from the Establishment of U.S. Colleges.” The Review of Economics and Statistics 106 (4): 1146–1156. https://doi.org/10.1162/rest_a_01214.

Zhang, Guangli, Jason Jabbari, Mathieu Despard, Xueying Mei, Yung Chun, and Stephen Roll. 2025, November 3. “College Is Still Worth It, Even with Student Debt, but We Can Do Better.” Brookings. www.brookings.edu/articles/college-is-still-worth-it-even-with-student-debt-but-we-can-do-better/.

Sidebars

Local Students Save More

While it feels like everything is more expensive these days, the cost to attend two-year and four-year public schools for local students has fallen 10 percent and 7 percent, respectively, over the last decade, according to the College Board (Ma et al. 2025). The tuition for a four-year public school for an in-state student was $11,950 in the 2025–26 school year, down from $12,810 in the 2015–16 school year.

“College is an exciting time, so students get excited. They see the school, the degree, and in my observations, students tend to focus on that short term and often forget to think about the long-term implication of the decisions that they’re making today,” Teegarden says. “Students sometimes jump headfirst into student loans as a way to cover cost without thinking about the potential income for that field of study. It’s a simple question to ask, but one that is overlooked.”

Paving the Way for Vulnerable Youth

Education is a powerful tool in reducing poverty. Individuals who complete some kind of postsecondary education earn an additional $8,000 per year, according to Brookings, even when accounting for debt (Zhang et al. 2025). Bachelor’s degree holders saw the greatest benefit, with a premium of nearly $12,850 compared to non-completers. The benefits don’t stop at individuals. Communities with a local college have 56 percent higher rates of degree attainment and higher employment in the private sector in industries with a high degree of human capital, according to a paper in the Review of Economics and Statistics (Russell et al. 2024).

The FAFSA Simplification Act included provisions that lower some barriers to higher education for homeless and vulnerable youth.

- Students who are an “unaccompanied homeless youth” or who are unaccompanied, self-supporting, and at risk of homelessness will be considered independent students and don’t need to provide parental income information when they file their FAFSA form. Unaccompanied youths don’t live with a parent or guardian, and self-supporting students pay for their own living expenses.

- Eligible students only have to answer a single question to determine their homelessness status.

- Officials who are authorized to confirm a student’s homelessness status include school district homeless liaisons, director-level staff or their designees at agencies that help people experiencing homelessness such as shelters and outreach programs, directors or their designees of programs funded by a TRIO or Gaining Early Awareness and Readiness for an Undergraduate Program grant, and financial aid administrators at institutions that have already made such a determination on behalf of the student.

- If students can’t provide a determination from these agencies, the financial aid administrator must make their own determination.

- Determinations must be made within 60 days of a student enrolling and must be carried forward to each subsequent award year.

- These rules apply even if a student effectively chose to be homeless because they were fleeing a violent or abusive home.

These measures make it easier to apply for aid, but homeless and at-risk students face all the same challenges in paying back student loans as peers who have parental support. Planners who provide pro bono support to vulnerable and low-income families and youths should familiarize themselves with these rules.