Next Generation Planner: January 2023

Tanya Staples, CFP®, is a professor of financial planning and a doctoral student at Kansas State University’s personal financial planning program. Tanya’s research interests are financial behaviors and well-being, retirement preparedness, and gender in the financial planning profession. Tanya has held the CFP® designation for more than 15 years and spent 10 years in pension and benefit consulting prior to taking on the position of professor. Tanya can be reached HERE.

Ashlyn Rollins-Koons is an investment professional practicing in Northern California and a doctoral student in Kansas State University’s personal financial planning program. Ashlyn’s research interests are in behavioral finance, religion and finance, natural disaster financial planning, and family financial socialization. Ashlyn can be reached HERE.

Kyle Lancett’s parents have used Marcel Pigott, CFP®, for more than 18 years as their financial planner. The Lancett family has been very pleased with Mr. Pigott’s knowledge and skill and are happy that he has agreed to meet with Kyle and his wife, Megan, as they know it can be difficult to find a good financial planner.

Kyle and Megan have not done any formal financial planning, but they have had many discussions with Kyle’s parents as to what they should and should not be doing with their money. In fact, it has begun to strain their relationship. Kyle and Megan are looking forward to meeting with Mr. Pigott, as they do have some financial concerns and goals they would like to address, especially as they recently found out they are expecting.

Kyle and Megan were married last year, and they purchased a fixer-upper on an acre of land soon thereafter, just outside of Marysville, California. Kyle is very handy and enjoys working on their home in his free time. Renovations are almost complete, except for the kitchen, which they expect to do over the next couple of months.

Kyle is a 30-year-old licensed mechanic (DOB: November 21, 1992) and owns a mechanic shop in Marysville with Megan’s brother, Zander. Megan is a 28-year-old registered nurse (DOB: April 26, 1994) who works full-time in the emergency department at the local hospital.

Kyle trained as a mechanic at the local community college where he met Zander. They opened their shop five years ago and worked out of the farm implement shed on Zander’s dad’s farm for two years. Three years ago, they incorporated their business, bought a building in town, and turned it into a shop. Both borrowed $100,000 each at a rate of 4 percent from their parents to buy the building. Kyle just started repaying the loan, and his monthly payments are $1,429. He intends to have the loan repaid within five years. The loan is paid through the business, and as a result, Kyle has reduced his income draw accordingly. This will continue until the loan is repaid.

Megan loves working in the emergency room at the local hospital. She started part-time six years ago as a triage nurse, but she switched to full-time four years ago. Megan works approximately 14 12-hour shifts each month.

Megan comes from a family of five. When Megan was six, her dad passed away from a heart attack at 44 years old.

Kyle is an only child. He was adopted as a baby and is very close to both of his parents. Both Kyle and Megan spend a lot of time with their families. It is not uncommon for them to see their families a couple of times each week.

Kyle and Megan started planning a family of their own, but they were not sure how long it would take to conceive. Kyle and Megan were surprised when they found out that they are expecting twins. They do not expect Megan to go full term, so she will likely have an earlier due date around 32–35 weeks gestation. Megan and Kyle are obviously very excited, but equally worried as they have no idea how much it will cost to support twins. They were relieved to find out that Megan will receive 70 percent of her salary for the first eight weeks of maternity leave, will be able to take up to four weeks pre-delivery, if need be, and she will use her remaining sick leave and paid time off for the remaining four weeks of her maternity leave. Given both their parents have already helped them so much financially, they are unwilling to ask for additional financial support when the twins arrive.

Although Megan loves her job and intended to return to work at the end of the 12-week leave, the prospect of twins has her and Kyle rethinking their options. Although they will have childcare help from their families, Kyle and Megan are wondering if they could afford to have one of them work part-time (a maximum of three days per week) for 26 weeks to ensure that Megan can fully recover and to provide time for them to adjust to parenthood.

Megan and Kyle are covered by CalPERS health program, and their portion of premiums is about $275 each month. Megan is also eligible for a $50,000 lump sum life insurance payout if she were to pass away, and a short- and long-term disability program through work, but she has yet to sign up. Her pension will vary according to her years of service and her retirement age. She does not currently have a 403(b), and while she knows the pension is a good long-term idea, she doesn’t believe they have the resources to contribute. Kyle and Zander’s business doesn’t offer any employee retirement or health benefits at present. They know this is something they will need to consider in the future but do not believe they have the resources to do that now.

Megan earns $78,000 per year while Kyle earns $58,000. Both expect their incomes to increase over time, but differently. Megan expects that, through contract negotiations, her salary will keep pace with long-term inflation. Kyle expects his income to remain flat until he has repaid the loan to his parents. Once the loan is repaid, his income will increase at a rate of 5 percent a year for about 10 years and keep pace with inflation thereafter.

Megan and Kyle made a 20 percent down payment when they purchased their home last year. They borrowed $300,000 for the purchase of their home. An additional $95,000 was borrowed for the renovation, in the form of a home equity line of credit (HELOC). The total amount they borrowed was $395,000, and they are making bi-weekly payments of $1,258. They chose a 25-year amortization period to ensure no negative impact on their cash flow. Their mortgage has a 4.59 percent interest rate, and the HELOC has a rate of prime plus 0.5 percent. They are wondering if they should pay down this amount faster once they have repaid Kyle’s parents.

Kyle and Megan worked part-time while in school and full-time each summer. They had additional financial support from their parents and, as such, have no student loans. They still feel like money is too tight each month. They each have an individual credit card as well as a joint card as a backup, and one for the house, but they are good at paying off the balances most months. Their budget indicates they spend more than they make some months, and they are worried that this does not position them well to start their family.

In addition to their mortgage, they pay $466 a month for their auto loan. Kyle drives one of the two vehicles that the business owns to and from work, as well as to transport clients.

Kyle and Megan love to spend their weekends from late spring to early fall at Lake Almanor. They do not have a cabin yet, although this is a shared life goal. If a cabin or mobile home became available, they would consider submitting an offer.

It is not uncommon for them to take either their boat, Sea-Doo, or both to the lake. Kyle purchased the boat when he graduated from college, and it will be paid off at the end of the year. He makes monthly payments of $360. The value of the boat is $23,000 with a 4 percent interest rate and a current fair market value of $14,820. Kyle and Megan jointly purchased the Sea-Doo the year before they bought the house and financed it over five years as well. They pay $253 per month toward the loan and the original value was $12,770, with a 4.5 percent interest rate, whereby the current fair market value is $9,000.

In the winter months, Megan and Kyle love to ski. This year their ski passes cost $620.

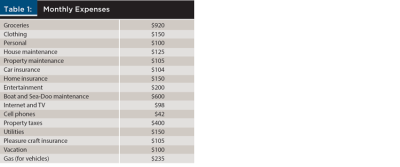

In preparation for their meeting with Mr. Pigott, Megan emailed the following information of their additional discretionary expenses from last month. This does not include the expenses listed already.

Megan and Kyle do not have many other additional assets. Their real estate agent told them that once the home was renovated, it would have a fair market value of approximately $485,000. They have typical household furnishings that are worth about $25,000, and they each opened a certificate of deposit (CD) at the insistence of Kyle’s parents just before they were married. They withdrew all the money out of their CDs to go on a honeymoon, but they kept up with the monthly deposits of $250 each. The current balance of each CD is $4,850. Kyle and Megan also have a joint banking account with a $1,250 balance that they use for their monthly expenses.

Kyle and Zander hope they can sell their business one day and that the sale proceeds will form part of their respective retirement plans. Zander estimates that their business is currently worth $620,000, including the building they purchased, but Kyle feels that this valuation is somewhat high. At present, the business is generating about $20,000 each year after expenses, of which Zander and Kyle have elected to reinvest in the business. Once the business loans are repaid, they expect the net revenue to increase to $50,000 per year. They both wish to draw more from the business and expect an annual net growth of 4–6 percent. Kyle estimates the value of the redundant assets to be $200,000 and goodwill to be worth $75,000.

Kyle and Megan would like to retire when Kyle is 60. Megan hopes to retire around the same time, ideally when she has about 30 years of service credits. Megan knows that she has a good pension plan, as many of her older colleagues have talked about its benefits. Megan would like to know more.

Kyle and Megan have no idea what they want to do in their retirement, nor do they know how much they might need. Their parents have encouraged them to save every cent, but both Kyle and Megan want to live now too. All Kyle and Megan know is that they love the outdoors and hope to see as much of North America as possible, doing what they love—cabin life and skiing.

Neither Megan nor Kyle have invested in the stock market, nor would they say they understand the investment process. They know they need to save more for the future, but with Megan’s pension and Kyle’s plan to sell the business and use the proceeds to fund their retirement, they were not sure how much they should save or what savings vehicle might be best.

Finally, both of their parents strongly encouraged them to meet with a lawyer and have a trust set up just after they were married. Kyle and Megan met with the lawyer and discussed the purpose of a trust for their future, but they never returned to finalize the details. Two years have since passed.

They hope Mr. Pigott can help them better understand how best to protect their growing family now and in the future.

Recommendations

Thinking through Kyle and Megan’s situation, what considerations should be made prior to any specific financial recommendations? Although it is not an exhaustive financial plan, tools for developing recommendations and suggestions are provided below.

Tools for Developing Recommendations

It is important to consider the clients’ goals and objectives, address their questions and concerns, and review any planning items that may have been missed. The easiest way to do this is to revisit the financial planning pyramid to ensure that their day-to-day financial management is stable and that they are protected in the event of a loss, injury, or illness. Also, be sure to consider the CFP Board’s financial planning process and the CFP® Principal Knowledge Topics when thinking about your recommendations. Another excellent planning tool is a NOISE analysis. As with many couples, we must consider their needs first.

A NOISE analysis reviews a client’s situation from the perspective of:

- Needs

- Opportunities

- Improvements

- Strengths

- Exceptions

Exceptions can be both positive or negative and do not fit in any one of the other listed categories. For example, Megan’s pension plan is an exception. Although they have not started to save formally for retirement, which is one of their biggest needs, there is some retirement funding already from the pension plan simply by the circumstance of employment.

These steps require critical analysis and help ensure rigor is applied to the planning process. Once these steps have been taken, planners can feel confident that they can move to other areas of the planning process without impacting their client’s immediate financial needs.

Financial Management

It is then critical to assess their current financial position. Draft and analyze their net worth and prepare a personal spending plan (cash flow) to determine the impact of maternity leave and the addition of twin babies.

This couple is young, in the accumulation stage of the lifecycle approach to planning, and they are acquiring assets and a significant amount of debt. A debt management strategy and the utilization of credit may provide for some consolidation or early repayment that would positively impact the spending plan. The first couple of years tend to be very expensive for new parents; therefore, it is advisable to supply Kyle and Megan with a projected cash flow that extends out a couple of years and provides for some alternative strategies. Kyle and Megan should immediately work toward funding their emergency savings. The addition of children increases planning risk and uncertainty, and, as planners, we need to help our clients prepare to manage that risk. Although this couple has significant life goals, to achieve those life goals, the creation of a stable financial foundation is the ultimate objective.

Risk Management

The next planning area that must be addressed is risk management. Kyle and Megan’s family will double in size, and it is imperative to insure against the risk of premature death or disability. This couple is young, with debt and dependents, so at a minimum, term insurance should be considered. Kyle’s family health history is unknown, and Megan’s father had significant health problems. Kyle and Megan should consider the role that critical illness and extended health and dental benefits might play.

Retirement, Estate, and College Planning

While Kyle and Megan are focused on their short-term needs and goals, it is still important for planners to have conversations with them about their future, including retirement and estate planning.

In terms of estate planning, there is a need for Megan and Kyle to revisit their wills, draft and finalize powers of attorney, declare guardianship for their children, and ensure appropriate beneficiary designations have been made. At the present time, their estate isn’t complex enough to warrant a trust.

To achieve their retirement goals, lower taxes, and offset the absence of a pension for Kyle, Megan should open a 403(b). As Kyle and Zander are small business owners, Kyle should consider self-employed retirement funding options such as SEP IRAs (tax deductions for business) or, as the business grows, they may wish to consider a 401(k) for the same purpose. Employer contributions would attract corporate tax deductions as well. It’s important to acknowledge the unique rules and limitations of each plan.

As Kyle and Megan move through the financial planning life cycle, they may wish to consider Roth contributions to their retirement plans for tax-free withdrawals later in life, assuming this is conducive to their financial situation. Finally, as it relates to their children, Megan and Kyle may also want to consider a 529 plan as a savings vehicle for their children’s education.

Advisers and planners must ensure that clients are involved in the financial decision-making process. Financial decisions should be made by clients that are guided by our advice and expertise.