Journal of Financial Planning; October 2014

Greg Geisler, Ph.D., is an associate professor of accounting at the University of Missouri–St. Louis, where he teaches a course on taxes and investments. His research interests include how taxes affect investment decisions of individuals. His work has been published in several journals, including Journal of Accountancy, Journal of Financial Service Professionals, and State Tax Notes.

David Hulse, Ph.D., is a faculty member in the Von Allmen School of Accountancy and the Martin School of Public Policy and Administration, both at the University of Kentucky. He has published tax-related articles in several journals and is a contributing author for a federal taxation textbook.

Executive Summary

- Many employers offer 401(k) plans that allow both traditional and Roth 401(k) contributions. It is common for employers to match some or all of their employees’ contributions.

- An employee who cannot afford to contribute enough to maximize the employer’s match can obtain a larger matching contribution by contributing to a traditional 401(k), because before-tax dollars contributed cost less than after-tax dollars contributed to a Roth 401(k).

- This advantage can make a traditional 401(k) more attractive than a Roth 401(k) in many circumstances. This can be true even if an employee’s current tax rate is lower than his or her tax rate will be in retirement.

- In contrast, for an employee who can afford to contribute enough to get the full employer match and pay the current tax related to a Roth 401(k), a traditional 401(k) is less advantageous than a Roth 401(k) if the current tax rate is lower than what the tax rate will be in retirement.

Many employees have the opportunity to contribute to 401(k) plans, but this opportunity has become more complicated in recent years as more employers have expanded their plans’ options to include Roth 401(k) accounts in addition to traditional 401(k) accounts.1 Several papers, including Geisler (2006), and Geisler and Stern (2014), have examined the Roth 401(k) versus traditional 401(k) choice. The typical recommendation from these studies has been to contribute to the Roth retirement account if the tax rate during retirement will be higher than the current tax rate, or contribute to the traditional type retirement account if the tax rate will be lower.2

An important aspect of 401(k) plans is that employers often match part or all of their employees’ contributions. Employers are motivated to match contributions for various reasons, including concerns for their employees’ retirement security and providing an incentive for non-highly compensated employees to contribute so the plan satisfies nondiscrimination tax law requirements.

While it is obvious that an employee should not overlook the availability of an employer match when deciding the amount to contribute to a 401(k) plan, it is less obvious that the match should not be overlooked when deciding whether to direct a contribution to a Roth or a traditional 401(k) account. This paper focuses on the effect of an employer match when making this latter decision.

The reason an employer’s match is relevant to this decision is that, an employee who cannot afford to contribute the amount needed to maximize the employer’s matching contribution can obtain a larger match by contributing to a traditional 401(k), because a dollar contributed to a traditional plan costs less on an after-tax basis than a dollar contributed to a Roth 401(k). Because the employee is not currently taxed on a traditional 401(k) contribution, but is currently taxed on a Roth 401(k) contribution, the employee can afford to contribute more to the former than the latter.3 This larger employee contribution generates a larger employer matching contribution, increasing the attractiveness of a traditional 401(k) relative to a Roth 401(k). The former is not necessarily better than the latter, but it is better in more circumstances than is commonly believed; for example, an advantage exists when the tax rate during retirement will be higher than the current tax rate.

This paper analyzes the Roth 401(k) versus traditional 401(k) contribution decision, taking into account employer matching contributions. This paper presents after-tax accumulation models for the two options, shows the break-even point where they are equivalent, and illustrates the models through numerical examples. The analysis here should help financial planners provide better advice by better understanding the effect that matching contributions have on the Roth versus traditional 401(k) decision.

Tax Treatment of Traditional and Roth 401(k)s

The amounts that employees elect to contribute to traditional 401(k) accounts are not currently taxed to the employee. This allows the employee to invest the full, before-tax amount. Any matching contributions the employer makes also are not currently taxed to the employee. The tax law allows an employee to contribute up to $17,500 in 2014 ($23,000 if age 50 or older), but employers typically limit their matching contributions to a smaller amount. Investment returns on the contributed amounts are not taxed as they are earned. When the employee receives distributions from the account during retirement, these are taxed in full because the employee has zero cost basis in the account. A 10 percent penalty also applies to distributions before the employee attains age 59½, but several exceptions exist, such as an employee’s death, disability, or a series of substantially equal periodic payments after separating from service with the employer. A 50 percent penalty applies to employees who do not receive required minimum distributions annually after attaining age 70½.

Roth 401(k) contributions have been allowed under tax law only since 2006. It was slow to be adopted, but more employers offering 401(k) plans have started to allow Roth 401(k) contributions. Unlike Roth IRAs, employees’ eligibility to make Roth 401(k) contributions is not eliminated if AGI is above a certain threshold. The amounts that employees elect to contribute to Roth 401(k) accounts are currently taxed to the employee. The employee thus invests after-tax dollars rather than before-tax dollars. Any employer matching contributions go to a traditional 401(k) and not to the Roth 401(k), even though the employee’s contributions are going to the Roth 401(k) (see IRS 2012). The employee is not currently taxed on the employer’s contribution. The contributed amounts’ investment returns are not taxed as they are earned.

Distributions from the Roth 401(k) are not taxed if the employee is at least 59½ years old and it has been at least five years since the beginning of the first taxable year for which the employee contributed to that employer’s Roth 401(k). This five-year requirement is similar, but not identical to, the five-year requirement for Roth IRA distributions to be tax free.

Minimum distribution requirements do apply for Roth 401(k) accounts when the employee attains age 70½, even though they do not for Roth IRAs. Distributions from the traditional 401(k), which occur because the employer’s matching contribution is required to go to it, are taxed in full, as previously mentioned.

Statistics on Roth 401(k) Usage

More than 90 percent of 401(k) plans include employer matching contributions, but many employees do not take advantage of this opportunity to the maximum extent possible.4 About one-quarter of employees with employers offering 401(k) plans do not contribute to an account. Among those who do contribute, the median employee contribution has traditionally been around 6 percent of compensation (salary and wages).

The most common employer matching formula is 50 percent of up to 6 percent of the employee’s compensation. However, employees may not maximize their employer’s matching contribution. This may be due, in part, to plans that automatically enroll new employees. About 50 percent of such plans have a default employee contribution rate of 3 percent of compensation. Consistent with this, Beshears, Choi, Laibson, and Madrian (2014) found that five of the 12 large companies they examined automatically enrolled new employees, but only one of the five had a default contribution rate that equaled the compensation percentage that would maximize the employer’s matching contribution. They did not report the percentage of employees contributing at a rate that does not obtain the maximum employer match, but it is likely that many employees at the other four companies did not contribute enough to obtain the maximum employer match.

About half of 401(k) plans allow designated Roth contributions, but the percentage of employees offered this alternative who choose the Roth option is low, but increasing (from 7 percent in 2007 to 11 percent in 2012). Interestingly, the percentage is higher for employees under age 30 than for older employees. Younger employees likely have current tax rates that are low relative to their future tax rates—a circumstance where a Roth 401(k) often is better than a traditional 401(k). Younger employees are also more likely to be new enrollees in a company’s 401(k) plan. Beshears et al. (2014) found that Roth 401(k) participation was higher for employees hired after a Roth 401(k) option was introduced in 2006 than for employees hired before it was introduced. The percentage of employees who choose the Roth option, when available, varies little with respect to income. These statistics suggest an opportunity for financial planners to better inform these employees about the relative advantages of Roth 401(k) versus traditional 401(k) accounts.

After-Tax Accumulation Models

Some employees must decide to contribute to a traditional 401(k) or a Roth 401(k). The models developed here specify the after-tax accumulation associated with each of these two choices—in other words, the amount the employee retains after liquidating the 401(k) at retirement and paying any income tax on its liquidation. Table 1 presents the variables and assumptions used in the models. Table 2 presents the two models. Several of the assumptions were made to simplify the analysis and avoid obscuring the effect of the employer’s matching contribution. Modifying the analysis to relax some of these assumptions and better tailor it to a particular set of circumstances would complicate the analysis without necessarily resulting in additional insight.

Traditional 401(k) contribution. In this analysis, the employee makes a before-tax contribution (BTC) to a traditional 401(k) account. The employer’s matching contribution will be BTC × m, making the total contribution BTC × (1 + m). The account’s assets grow at an R annual rate for n years. It was assumed that the employee will cash out the 401(k) as a lump-sum at this time and that this will occur when the employee is age 59½ or older.5 The entire amount of the distribution will be taxed at that year’s marginal tax rate. It can be shown that the employee’s after-tax accumulation will be:

BTC (1 + m) (1 + R)n (1 – tn) (1)

If the employer provides no matching contributions (m equals zero), this formula simplifies to be the same as the after-tax accumulation of a traditional IRA contribution, where the taxpayer is allowed to deduct the entire contribution amount.

Roth 401(k) contribution. In this scenario, the employee is taxed currently on the amount contributed to a Roth 401(k). As such, he or she can afford to contribute only BTC × (1 – t0). In other words, of the BTC amount the employee can currently afford to forego, BTC × t0 is paid as tax, and the remainder is contributed to the Roth 401(k). The employer’s matching contribution is BTC × (1 – t0) × m, which is less than the BTC × m matching contribution with a traditional 401(k) contribution. This matching contribution goes into a traditional 401(k), because employer contributions are not allowed to go into a Roth 401(k).

The amounts in the two 401(k) accounts grow at an R annual rate for n years, and the employee liquidates them as lump sums at the end of the n year period. Assuming the employee is at least 59½ years old at that time and meets the five-year requirement, none of the Roth 401(k) distribution is taxed. However, the entire balance of the traditional 401(k) is taxed. It can be shown that the employee’s after-tax accumulation will be:

BTC (1 – t0) (1 + R)n [1 + m(1 – tn)] (2)

If the employer provides no matching contributions (m equals zero), this formula simplifies to be the same as the after-tax accumulation of a Roth IRA contribution.

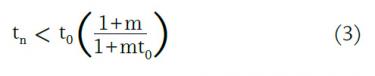

Break-even analysis. Comparing the two after-tax accumulation equations, it can be shown that the after-tax accumulation of a traditional 401(k) contribution is greater than that of a Roth 401(k) contribution when:

Note that the fraction in parentheses is greater than 1, because the current tax rate (t0) is less than 100 percent. This means that the traditional 401(k) will be the better choice for the employee when the future tax rate (tn) is less than or equal to the current tax rate, and it will sometimes be the better choice when tn is greater than t0. This latter result is contrary to the usual advice of choosing the Roth type account when the tax rate is expected to be higher at the end of the investment horizon. The reason is that, while the higher future tax rate disfavors the traditional 401(k), the larger employer match the employee obtains for a given BTC favors the traditional 401(k). Whether these two factors are a net advantage or disadvantage depends on the magnitudes of the current and future tax rates, as well as the employer’s matching rate.

Figure 1 presents graphs from equation 3. It depicts combinations of current and future tax rates for which traditional and Roth 401(k) contributions result in equal after-tax accumulations. When there is no employer match (the lowest of the three lines), the break-even analysis indicates the usual advice that it is better to contribute to a Roth 401(k) than to a traditional 401(k) when the tax rate is expected to increase.

If the employer does match contributions, the break-even future tax rate is higher than the current tax rate. Therefore, there is a range between this 0 percent match line and the line for the actual match rate, where it is better for the employee to contribute to a traditional 401(k) even though the usual advice would recommend contributing to a Roth 401(k). For example, if the current tax rate is 15 percent, a traditional 401(k) contribution is better when the future tax rate is less than 20.9 percent if the employer’s match rate is 50 percent (26.1 percent if the match rate is 100 percent).6 This 20.9 percent (and 26.1 percent) future tax rate is substantially greater than the 15 percent break-even future tax rate when the employer does not match employee contributions.

Numerical Examples

The following numerical examples illustrate the model. Table 3 summarizes the parameters for the examples and their outcomes. In all five examples, the employee’s BTC is $10,000, and his or her current tax rate is 25 percent. The employee’s choice is to contribute $10,000 to a traditional 401(k) or $7,500 ($10,000 × (1 – .25)) to a Roth 401(k). Example 2 is the same as Example 1, except for the employer’s matching rate. Similarly, Examples 3, 4, and 5 differ from Example 1 only with respect to the length of the investment horizon (n), the tax rate at the end of that horizon (tn), and the before-tax return on the 401(k)’s assets (R).

Example 1. In this example the employer’s match rate is 50 percent, the investment horizon is 20 years, the future tax rate is 30 percent, and the before-tax return on the 401(k)’s assets is 8 percent.

If the employee chooses to contribute $10,000 to a traditional 401(k), the employer’s matching contribution is $5,000 ($10,000 × .50). The $15,000 total contribution grows over 20 years to $69,914 ($15,000 × (1 + .08)20). The entire balance will be subject to the 30 percent tax rate applying at that time, resulting in $20,974 ($69,914 × .30) of tax. The employee’s after-tax accumulation from contributing to a traditional 401(k) thus is $48,940 ($69,914 – $20,974).

If the employee chooses to contribute $7,500 to a Roth 401(k), the employer’s matching contribution is $3,750 ($7,500 × 0.50), which is $1,250 less than when the employee chooses to contribute to a traditional 401(k). Recall that the employer cannot contribute to a Roth 401(k), so its $3,750 contribution is made to a traditional 401(k). At the end of the investment horizon, the Roth 401(k) grows to $34,957 ($7,500 × (1 + .08)20), and the traditional 401(k) grows to $17,479 ($3,750 × (1 + .08)20). Upon liquidation, the traditional 401(k) balance will be subject to the 30 percent tax rate at that time, but the Roth 401(k)’s balance will not be taxed. The employee’s after-tax accumulation is $47,192 ($34,957 + $17,479 – ($17,479 × .30)).

Note that this amount is $1,748 less than the $48,940 after-tax accumulation that results from the employee contributing to a traditional 401(k). As a result, the employee is better off with a traditional 401(k) contribution, even though the tax rate is expected to increase from 25 percent to 30 percent. The usual disadvantage of a traditional 401(k) with an increasing tax rate exists in this example, but it is outweighed by the benefit of the larger employer matching contribution. The post liquidation amount of the traditional 401(k) contribution made only by the employee is $32,627 ($10,000 × (1 + .08)20 × (1 – .30)), which is $2,330 less than the $34,957 post liquidation amount of the Roth 401(k) contribution. The $1,250 larger employer contribution resulting from a traditional 401(k) contribution has a post liquidation amount of $4,078 ($1,250 × (1 + .08)20 × (1 – .30)). The net advantage thus is $1,748 ($4,078 – $2,330).

In other circumstances, a Roth 401(k) contribution might provide a larger after-tax accumulation than a traditional 401(k) contribution. More specifically, if the future tax rate was higher than 33.33 percent, (that is, the break-even tn from applying equation 3 to Example 1), the disadvantage of the increased tax rate would outweigh the benefit of the larger employer contribution.

Example 2. All but one of the facts in this sample are the same as those in Example 1. The primary difference is the employer’s matching rate, which is 100 percent, instead of 50 percent. Because the employee can afford to contribute more before-tax dollars than after-tax dollars, the advantage of a traditional 401(k) contribution over a Roth 401(k) contribution should be greater than for Example 1. This intuition holds, as shown in Table 3, where the larger employer matching rate increases the after-tax accumulation for both types of contributions, but does so by $16,313 ($65,253 – $48,940) for the former, and $12,235 ($59,427 – $47,192) for the latter. The net advantage of contributing to the traditional instead of the Roth 401(k) increases from $1,748 to $5,826 (a $4,078 increase, which also equals $16,313 – $12,235).

Example 3. This example is based on the same facts as Example 1, except the investment horizon is 10 years, instead of 20 years. This means that the net advantage of a traditional 401(k) over a Roth 401(k) contribution should be less than in Example 1, because that net advantage has less time to grow.7 As shown in Table 3, results are consistent with this intuition. The net advantage is only $810 ($22,669 – $21,859) in Example 3, compared to $1,748 in Example 1. The shorter investment horizon decreases the after-tax accumulation for both types of contributions, but it does so by $26,271 ($22,669 – $48,940) for a traditional 401(k) contribution, and $25,333 ($21,859 – $47,192) for a Roth 401(k) contribution. The net advantage of contributing to the traditional instead of the Roth 401(k) decreases from $1,748 to $810 (a $938 decrease, which also equals $25,333 – $26,271).

Example 4. In this example, the facts differ from those for Example 1 in that the future tax rate is 35 percent, rather than 30 percent. This should decrease, and possibly reverse, the net advantage of a traditional 401(k) over a Roth 401(k) contribution, because the former’s future liquidation will be taxed more heavily. As shown in Table 3, this does occur ($46,318 after-tax accumulation for a Roth 401(k) contribution, versus $45,444 for a traditional 401(k) contribution). A traditional 401(k) contribution still has the advantage of obtaining a larger employer match ($5,000 versus $3,750), but this advantage is outweighed by the disadvantage of the higher tax rate at liquidation. Note that the 33.3 percent break-even future tax rate is the same as in Example 1, but the 35 percent future tax rate now is higher than the break-even rate. Note also that the Roth 401(k)’s after-tax accumulation decreases from Example 1 to Example 4. The employee’s portion of the contribution is not impacted by the higher future tax rate ($34,957 after-tax accumulation in both examples), but the employer’s portion is affected because it must go into a traditional 401(k).

Example 5. This example differs from Example 1 in that the annual, before-tax return on the 401(k)’s assets is 6 percent, rather than 8 percent. The net advantage of a traditional 401(k) over a Roth 401(k) contribution will grow more slowly, which reduces the traditional 401(k) contribution’s net advantage.8 This effect can be observed in Table 3, where the net advantage decreases from $1,748 to $1,203. The after-tax accumulations for both types of 401(k) contributions decrease, but it does so more for a traditional than for a Roth 401(k) contribution.

Other Relevant Factors

The model presented here omits several factors relevant to the Roth 401(k)-versus-traditional 401(k) decision, so that the insights regarding the effect of employer matching contributions are not obscured. This section briefly discusses some of these omitted factors and how they would affect the analysis if the model were modified to incorporate them.

Although the required minimum distributions (RMD) rules apply to both traditional and Roth 401(k) accounts, these rules are a relevant decision factor. An employee can roll over amounts from a Roth 401(k) to a Roth IRA tax free. The advantage is that RMD rules do not apply to Roth IRAs. To the extent RMDs compel the employee to receive distributions that he or she otherwise would not choose to receive, ignoring them makes a Roth 401(k) contribution appear to be less advantageous relative to a traditional 401(k) contribution.

The previous analyses were based on the assumption that the tax rate at the end of the investment horizon (tn) is known. In actuality, there can be substantial uncertainty about both future tax law changes and the level of a taxpayer’s future taxable income. One can test the sensitivity of the model’s results to both of these sources of tax rate uncertainty by varying the future tax rate. There is uncertainty about a traditional 401(k)’s future taxation but not about a Roth 401(k)’s future taxation. To the extent the employee prefers certainty to uncertainty, ignoring this tax rate risk makes a Roth 401(k) appear to be less advantageous relative to a traditional 401(k). Tax rate risk, however, may create an advantage for a traditional 401(k), because the employee obtains an option to convert the traditional 401(k) to a Roth 401(k) in the future. See Hulse (2003) for an analysis of this consideration in the context of traditional and Roth IRAs.

The analyses were also premised on the assumption that the employee will contribute the same after-tax amount, which means that the model compared a Roth 401(k) contribution to an appropriately larger traditional 401(k) contribution. It was further assumed that the employee invests the current tax savings arising from a traditional 401(k) contribution, and this invested amount grows and is available to cover some or all of the future tax liability arising from a traditional 401(k) distribution. The analyses could have been structured differently so that the employee consumes the current tax savings arising from a traditional 401(k) contribution, but such an analysis would be comparing dissimilar after-tax contributions. A financial planner can help an employee understand this distinction.

Conclusion

An important aspect of retirement planning for an employee is the 401(k) plan offered by an employer and employer matching contributions. A 401(k) account can help employees build sufficient retirement savings. The increasing availability of a Roth 401(k) in recent years has expanded employees’ options. The growth of Roth 401(k) plans also makes employees’ contribution decisions more complex, because they must decide the type of 401(k) account to use in addition to the amount to contribute.

The findings presented here help address this complexity by examining the effect of employer-matching contributions on an employee’s after-tax accumulation from contributing to a Roth 401(k), versus a traditional 401(k) account when he or she cannot afford to maximize the employer’s matching contribution. In such a situation, a traditional 401(k) contribution has an advantage over a Roth 401(k) contribution, because it yields a larger employer matching contribution.

Although an employer may match both types of contributions at the same rate, an employee can afford to contribute more dollars to a traditional 401(k) than to a Roth 401(k), because the before-tax dollars contributed to the traditional 401(k) are less costly on an after-tax basis than the after-tax dollars contributed to the Roth 401(k). This means that a traditional 401(k) can be more advantageous than a Roth 401(k) when the employee’s tax rate during retirement is expected to be higher than it is currently. This conclusion is contrary to the usual advice that a Roth type account should be used in this situation. However, a Roth 401(k) is the more advantageous alternative if the future tax rate is sufficiently higher than the current tax rate, given the employer’s matching contribution percentage.

Endnotes

- The analysis also applies to Roth versus traditional contributions to 403(b) plans.

- Some authors, including Campbell and Urban (2006), recommend contributing to a Roth type retirement account if the tax rate during retirement will be less than the current tax rate by only a few percentage points, because a taxpayer contributing the maximum amount allowed can contribute more after-tax dollars to a Roth type account than to a traditional type account.

- The analysis assumes that the employee anticipates the current tax savings from a traditional 401(k) contribution and increases the contribution by such savings. The employee thus effectively invests in the traditional 401(k) the tax savings from contributing to it. The invested tax savings grow and are available to cover some or all of the future income tax arising from liquidating the traditional 401(k). Note that the total amount the employee contributes to the traditional 401(k) is before taxes are considered, but it is after taxes are considered for a Roth 401(k) contribution. To have an apples-to-apples comparison, the employee thus makes an appropriately larger contribution to a traditional 401(k) than to a Roth 401(k).

- Statistics on 401(k) plans are from Deloitte’s 2012 Annual 401(k) Benchmarking Survey (www.iscebs.org/Resources/Surveys/Documents/401kbenchmarkingsurvey2012.pdf) and Vanguard’s How America Saves 2013 report (pressroom.vanguard.com/content/nonindexed/2013.06.03_How_America_Saves_2013.pdf).

- A lump-sum liquidation is assumed to avoid complicating the analysis by having to specify a pattern for a series of distributions. The employee is assumed to be at least 59½ years old so there will not be a 10 percent penalty for early distribution.

- Equation 3 was applied to obtain 20.9 percent and 26.1 percent.

- If there is a net disadvantage to contributing to a traditional 401(k) rather than a Roth 401(k), a shorter (longer) investment horizon will decrease (increase) this net disadvantage.

- If there is a net disadvantage to contributing to a traditional 401(k) rather than a Roth 401(k), a lower (higher) before-tax rate of return will decrease (increase) this net disadvantage.

References

Beshears, John, James J. Choi, David Laibson, and Brigitte C. Madrian. 2014. “Who Uses the Roth 401(k), and How Do They Use It?” National Bureau of Economic Research working paper.

Campbell, David J. and William R. Urban. 2006. “Roth 401(k) and Roth 403(b) Accounts: ‘Pay Me Now or Pay Me Later.’” Journal of Financial Service Professionals 60 (11): 79–88.

Geisler, Gregory G. 2006. “Ranking the Choices Between Retirement Savings, College Savings, Other Investing, and Paying off Debts.” Journal of Accountancy (9): 41–43.

Geisler, Gregory G., and Jerrold J. Stern. 2014. “Retirement Account Options When Beginning a Career.” Journal of Financial Service Professionals 68 (3): 45–50.

Hulse, David S. 2003. “Embedded Options and Tax Decisions: A Reconsideration of the Roth versus Traditional IRA Decision.” Journal of the American Taxation Association 25 (1): 39–52.

Internal Revenue Service. 2012. Designated Roth Accounts Under 401(k), 403(b), or Governmental 457(b) Plans (Publication 4530). www.irs.gov/pub/irs-pdf/p4530.pdf.

Citation

Geisler, Greg, and David Hulse. 2014. “Traditional Versus Roth 401(k) Contributions: The Effect of Employer Matches.” Journal of Financial Planning 27 (10) 54–60.